18 August, 2018

From 15 August 2018, the Office of the Securities and Exchange Commission (the "SEC") will be implementing new rules on securities/derivatives holding reports under Section 59 of the Securities and Exchange Act which generally requires directors, executives and certain disclosing persons of listed companies to report their (and their related persons') securities and derivatives holding activities to the SEC.

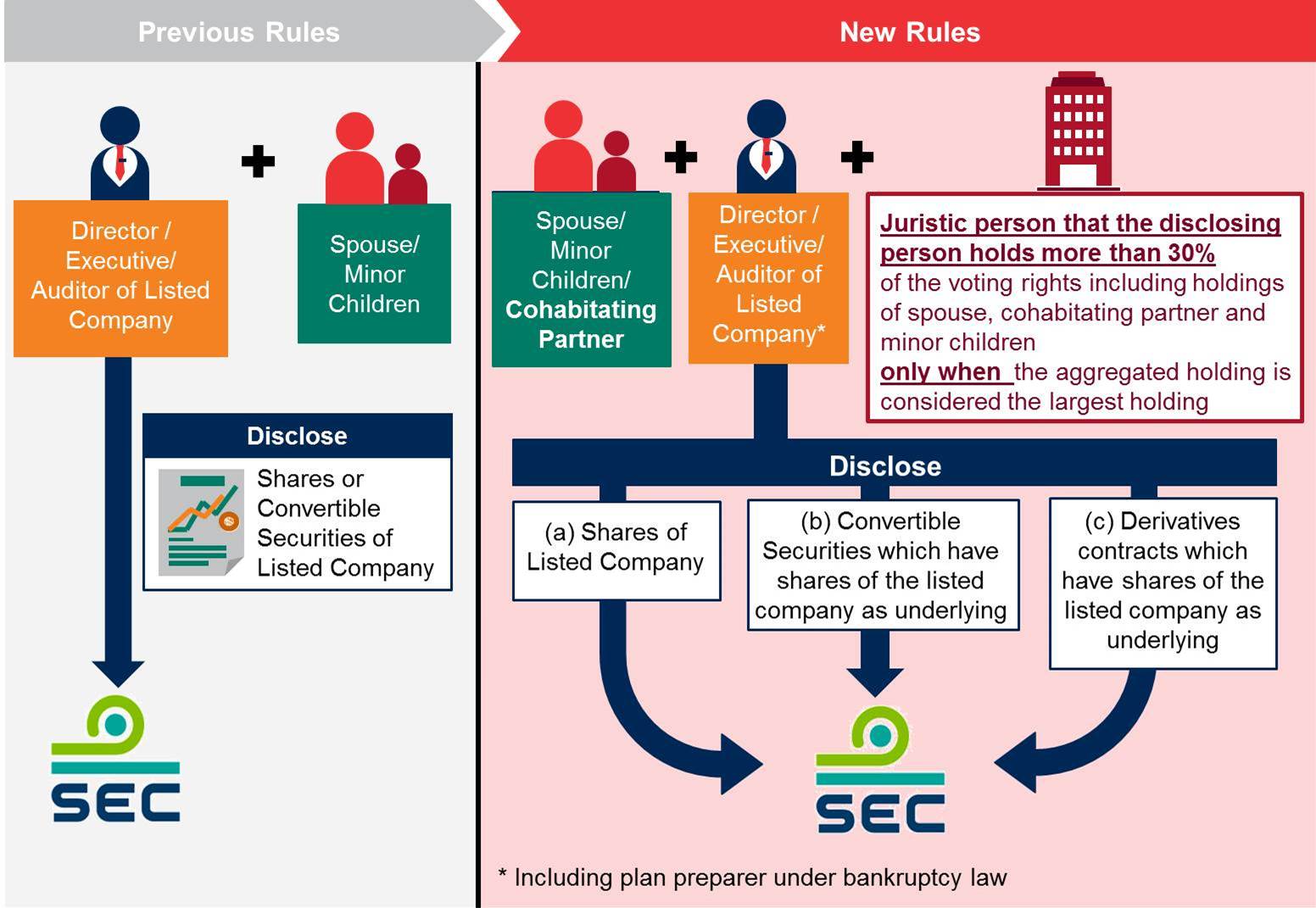

These new rules will be expanded from the previous rules to cover: (i) more types of disclosing persons; (ii) more entities for aggregate calculations; (iii) more types of disclosing products; and (iv) a longer reporting period.

I. What has changed?

Please click on the image to enlarge.

The new rules specify that not only are directors, executives, and auditors of listed companies required to report dispositions or acquisitions by themselves and their spouses and minor children, but that they are also required to report the holding activities of their cohabitating partners and juristic persons in which the disclosing person holds more than 30 percent of the voting rights, including holdings by their spouse, cohabitating partner and minor children if the aggregated holding is considered to be the largest holding.

The products required to be disclosed are shares in listed companies; convertible securities¹ which have shares of the listed company as underlying assets; and derivatives contracts which have shares of the listed company as underlying assets.

Exemptions include acquisitions or dispositions of securities in accordance with the proportion of the existing shareholding; stock dividends; exercise of convertible securities; acquisitions or dispositions from inheritance; Employee Stock Option Plans; Employee Joint Investment Programs; securities lending and borrowing with a licensed business operator or securities depository center; and acquisitions or dispositions with a custodian holding securities on behalf of the disclosing person and other related persons.

Under these rules, disclosing persons who do not have any changes to their holdings are not required to submit a report.

II. When and how to report?

Seven business days from acquisition or disposition if the listed company has notified the SEC of the names of directors and executives whose names were in the SEC database before the acquisition or disposition.

Three business days from acquisition or disposition for other cases.

This is a change to the previous regulations where the reporting period was set at three business days.

The disclosing person would be able to submit the report through the electronic system provided by the SEC.

III. Cessation of need to report

When the listed securities held by the disclosing person and other related persons has been delisted from the Stock Exchange of Thailand.

For further information, please contact:

Theppachol Kosol, Partner, Baker & McKenzie

theppachol.kosol@bakermckenzie.com

¹ Convertible securities means securities with any of the following features:

(1) providing rights to securitize debt repayment into shares of the listed company;

(2) providing rights to the securities holders to purchase shares of the listed company; or

(3) providing rights to receive a return which have the price or return of shares of the listed company as underlying assets.

.jpg)