27 April, 2017

The Stamp Duties (Amendment) Act 2017 was passed in Parliament on 10 March 2017 and takes effect from 11 March 2017.

The Stamp Duties (Amendment) Act 2017 made two key changes to Singapore's stamp duty regime.

(a) First, the duty point for transactions relating to the transfer of stock and shares is advanced to the time that the contract or agreement is executed, instead of the time at which the share transfer form is executed. Among other things, this will materially affect all mergers and acquisitions (M&A) involving Singapore shares.

(b) Second, it introduced the Additional Conveyance Duty (ACD), which is a new stamp duty to be levied on acquisitions and disposals of equity interests in residential Property-Holding Entities (PHEs). This change may potentially affect anyone who acquires or disposes of shares in an entity which directly or indirectly holds Singapore residential properties.

We discuss these changes below.

1. Duty point for the transfers of stock and shares

Prior to the amendment, section 22(1) of the Stamp Duties Act (Cap. 312) (SDA) provided for certain contracts and agreements for sale to be chargeable as "conveyances on sale". An exception was provided for in section 22(1)(b) for certain contracts and agreements, including those for the sale of stock and shares. In other words, the relevant duty point for a sale of stock or shares would be at the time of execution of the share transfer form. In the case of scripless shares where no transfer instrument is executed, no duty was payable.

The recent amendment removed the exception for contracts and agreements for the sale of stock and shares in section 22(1). The effect of the amendment is that contracts and agreements for the sale of stock and shares – and not the share transfer forms to be executed later – will now be chargeable as "conveyances on sale".

Therefore, with effect from 11 March 2017, the duty point for contracts and agreements for the sale of stock and shares is effectively moved up to the time of execution of the said contract or agreement.

How will this affect you: The change will have a timing and cost impact on M&As involving shares of private companies. Should the signing and the closing of a transaction occur on different days, stamp duty may be triggered upfront on signing, and not at closing. Where an agreement has been executed and duly stamped, but the deal for some reason does not close, parties may possibly consider whether and how the cost of the stamp duty paid upfront could be allocated.

For M&A involving scripless shares, this will likely have a significant cost impact. Prior to the change, only transfer instruments for the sale of shares were chargeable with stamp duty. The share purchase agreement itself would not be subject to duty. As there was no transfer instrument to be executed for a transfer of scripless shares, there was typically no stamp duty applicable. Under the new rule, contracts and agreements for the sale of scripless shares would be chargeable to duty. Its effect is that going forward, transfers of scripless shares will be subject to stamp duty unless no document is executed.

While this change does not affect the conditions for stamp duty relief under sections 15 and 15A of the SDA, parties should be adequately advised on timing issues as these would depend on the nature and content of the documents executed.

2. Introduction of ACD on PHEs

In the Second Reading of the Stamp Duties (Amendment) Bill 2017, the Minister for Finance announced that the new ACD was introduced to address the stamp duty rate differential between the direct buying and selling of residential properties and the indirect buying and selling of residential properties through PHEs.

Under current laws, the acquisition of equity interests in companies attracts stamp duty at a rate of 0.2%. However, the acquisition of residential properties in Singapore is subject to much higher duties, including Buyer’s Stamp Duty of 1% to 3%, and potentially both Additional Buyer’s Stamp Duty of up to 15% and Seller’s Stamp Duty.

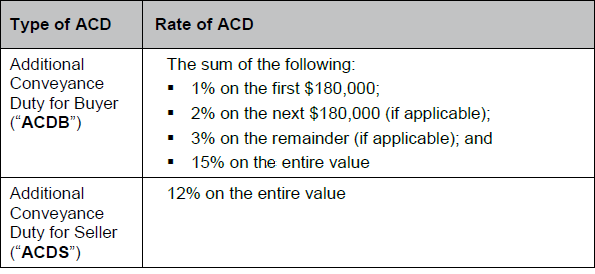

The ACD is levied at the following rates on the market value of the residential properties directly or indirectly owned by the target, and is pro-rated based on the percentage of equity interest that is acquired or disposed of:

Please click on the table to enlarge.

The ACD applies in addition to the prevailing stamp duty of 0.2% for the acquisition of equity interests in companies. However, do note that the ACD will not apply in respect of the transfer of scripless shares, where no document is executed.

How will this affect you: Following the amendment to section 22(1) discussed above, parties to share transfers involving PHEs should note that going forward, the duty point for any ACD and the usual 0.2% stamp duty for share transfers is at the time the relevant contract or agreement is executed.

While the concept of "Significant Owner" means that retail investors will not be caught by the new rules, we highlight that the ACD rules may potentially affect wealth planning structures, residential real estate developers, and REITs that hold interests in residential properties.

It is noted that the stamp duty relief provisions in sections 15(1) and 15A(1) of the SDA do not apply to the ACD. In particular, section 15(1)(a) grants relief from stamp duty where equity interests are transferred in an intra-group transfer as part of a scheme for the reconstruction or amalgamation of companies. This creates substantial additional duties for groups of companies seeking to reconstruct or amalgamate their entities.

Interestingly with the ACD, a stamp duty differential has now been created in favour of the direct purchase of residential properties. This is because ACD is imposed on top of the 0.2% stamp duty for share transfers. The ACDB also includes a component that appears to be aligned with the highest Additional Buyer's Stamp Duty rate at 15% (the rate that applies to foreigners and entities). This component of ACDB applies at a flat rate of 15%, regardless of the profile of the buyer.

The details of the ACD are discussed below.

A. What are PHEs

PHEs are entities whose primary tangible assets are residential properties in Singapore, and include companies, property trusts, and partnerships. There are two types of PHEs:

(a) Type 1 PHE: a target entity whose market value of residential properties owned is at least 50% of the value of its total tangible assets.

(b) Type 2 PHE: a target entity which directly or indirectly has 50% or more beneficial interest in a Type 1 PHE ("related entities"), and where the total sum of the market value of residential properties beneficially owned is 50% or more of the value of the gross total tangible assets.

B. Scope of the ACD

The ACD is levied on qualifying acquisitions and disposals of equity interests in PHEs acquired on or after 11 March 2017.

(a) Qualifying Acquisitions are subject to ACDB

An acquisition of equity interest in a PHE is a qualifying acquisition where a buyer, with its associates, is a Significant Owner of the PHE before the acquisition of the relevant equity interest, or becomes one after the acquisition.

Documents executed in respect of qualifying acquisitions are subject to ACDB, payable by the buyer, at the rates above.

(b) Qualifying Disposals are subject to ACDS

A disposal of equity interest in a PHE is a qualifying disposal where made after a seller, with its associates, has become a Significant Owner of the PHE and the relevant equity interest is disposed of within 3 years of its acquisition (assessed on a first-in-first-out basis).

Documents executed in respect of qualifying disposals are subject to ACDS, payable by the seller at a flat rate of 12%. The ACDS on sale will apply until the seller has completely disposed of all equity interest in that PHE.

C. Who is a Significant Owner

A Significant Owner refers to an individual or an entity who beneficially owns at least 50% equity interest or voting power in a residential PHE, including that held by its associates. Associates in the case of an entity include a parent company, subsidiary, and other subsidiaries of its holding company. In the case of individuals, associates include family members.

A broad anti-avoidance provision has been introduced in section 23C of the SDA for the ACD. Under this provision, instruments effecting certain arrangements may in certain circumstances be regarded as conveyances chargeable with ACD.

For further information, please contact:

Eugene Lim, Partner, Baker & McKenzie.Wong & Leow

eugene.lim@bakermckenzie.com