3 May, 2018

Summary

On 26 April 2018, the Monetary Authority of Singapore (“ MAS”) issued a consultation paper (the “ Consultation Paper”) on proposed guidelines on individual accountability and conduct (the “ Guidelines”). If implemented as proposed, these Guidelines will enhance the regulatory scrutiny of senior managers and other individuals of financial institutions (“ FIs”) in Singapore and (in certain cases) their affiliates in Singapore and overseas. The Guidelines are aimed at enhancing the accountability and conduct of key individuals at FIs, and as such, will have practical implications for the governance, employment, and operational control arrangements of FIs.

The proposals also confirm that the MAS’ regulatory policy on individual accountability and conduct is broadly aligned with that of regulators in other major jurisdictions where similar regimes have been introduced, such as the United Kingdom and Hong Kong.

The consultation closes on 25 May 2018, and the Guidelines are targeted to be issued in Q4 2018.

This note provides an overview of the MAS’ proposals and their key implications for FIs. Implications for your business In preparation for the Guidelines, FIs may consider taking the following practical steps:

Participate in the public consultation process: If there are any aspects of the Guidelines which may pose concern or appear unduly onerous, or (conversely) areas in which the MAS should introduce additional requirements, corresponding feedback should be provided to the MAS.

Analyse practical implications: FIs may wish to consider identifying individuals in their organisations who are likely to be within scope of the Guidelines. Additional policies and procedures may need to be adopted (e.g. management responsibility maps and individual responsibility statements), and contractual documents may need to be amended (e.g. senior management employment contracts may need to reflect responsibilities and undertakings arising from the Guidelines). FIs should also consider whether achieving the outcomes in the Guidelines may be assisted by adopting a general corporate governance framework signed off by the Board.

Conduct a gap analysis: FIs may wish to conduct a comparison between their existing governance and oversight arrangements and the MAS’ proposals to identify gaps and consider whether pre-emptive remedial action is feasible.

Internal communication and training: FIs should communicate with and train employees to ensure they are aware of the obligations imposed on the firm and the standards of conduct they must adhere to. The requirement for accountability and sound conduct should be visibly propagated and endorsed by senior management.

Overview of Proposals

Rationale for the Guidelines

The MAS has made clear its approach to fostering appropriate culture and conduct in the financial services industry. In

particular, the MAS would take a three-pronged approach, consisting of the following:

i. working with industry players and stakeholders to promote a culture of trust and ethical behaviour in the financial sector;

ii. monitoring and assessing FIs’ culture and conduct as part of the MAS’ supervisory process; and

iii. taking supervisory or enforcement actions against FIs and individuals where lapses in risk management, misconduct, regulatory breaches, or offences have occurred.

The proposed Guidelines fall within the first prong of the MAS’ approach. The Guidelines do not introduce a standalone

framework for senior management responsibility, but rather, supplement existing rules in this area and focus on entrenching the right mindset and behaviour within FIs.

Scope and content of the Guidelines

The Guidelines would apply to a wide range of FIs, including (among others) banks, capital markets intermediaries, insurers

and financial advisers1. For locally-incorporated banks and insurers, the Guidelines would apply on a group basis.

The purpose of the Guidelines is to:

i. promote the responsibility of senior managers;

ii. strengthen the oversight of employees in material risk functions (“MRFs”); and

iii. embed standards of proper conduct among all employees.

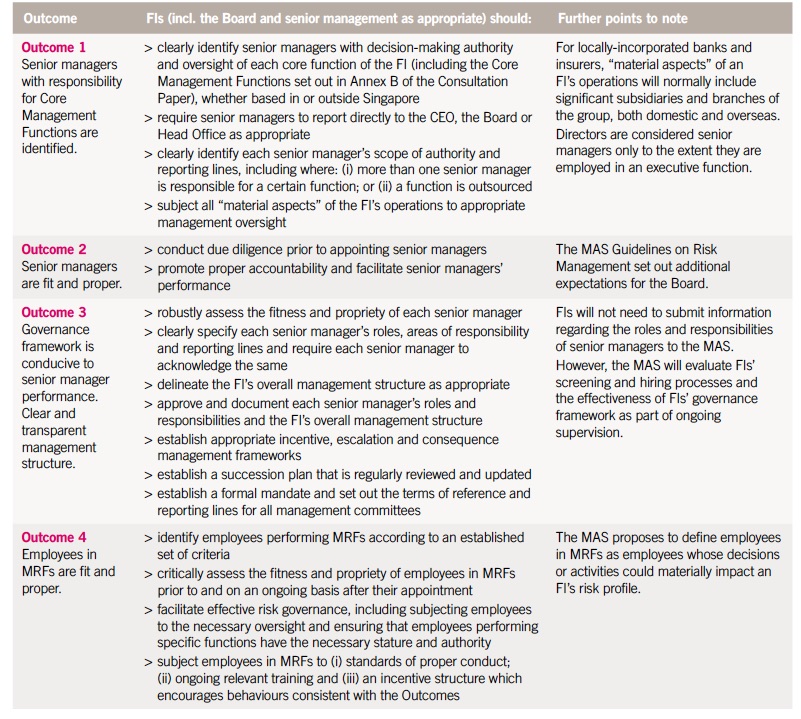

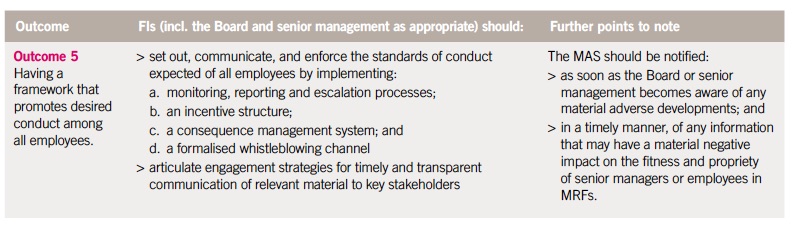

To achieve these objectives, the Guidelines focus on five key outcomes (summarised below), some of which formalise the MAS’ existing regulatory expectations. FIs will have the flexibility to achieve the outcomes in accordance with their organisational structure, business model and context.

Commentary

The above proposals represent a significant move by the MAS to clarify its expectations of the conduct of an FI’s key individuals. The Guidelines provide detailed benchmarks for governance and senior management accountability at FIs, and are a reminder of the importance the MAS attaches to culture within FIs.

While the MAS’ proposals partly reflect a desire for alignment with similar regimes in other jurisdictions, they are most likely also prompted by events in Singapore itself. The MAS has in the past taken enforcement action against individuals and FIs in respect of shortcomings in senior management conduct, with recent noteworthy examples of such action occurring during the MAS’ 1MDBrelated investigation. It is therefore unsurprising that the MAS confirms it will take enforcement action against FIs that fail to adhere to the Guidelines.

For FIs, the Guidelines present an opportunity to adopt or enhance arrangements that are designed to ensure sound culture and conduct. While this will give rise to an additional compliance burden for FIs, it will likely benefit the financial services industry, notably by heightening customer confidence, future-proofing against misconduct within FIs, and strengthening effective risk management within FIs.

1 More particularly, the Guidelines will apply to (i) banks licensed under the Banking Act (Cap. 19); merchant banks approved under the Monetary Authority of Singapore Act (Cap. 186); finance companies licensed under the Finance Companies Act (Cap. 108); insurers licensed under the Insurance Act (Cap. 142) (“IA”); foreign insurers operating in Singapore under a foreign insurer scheme established under section 35B of the IA; approved exchanges under the Securities and Futures Act (Cap. 289) (“SFA”); approved clearing houses under the SFA; approved holding companies under the SFA; holders of a capital markets services licence under the SFA; financial advisers licensed under the Financial Advisers Act (Cap. 110); and trust companies licensed under the Trust Companies Act (Cap. 186).

For further information, please contact:

Peiying Chua, Linklaters

peiying.chua@linklaters.com