24 April, 2018

On 28 March 2018, the Monetary Authority of Singapore (MAS) published its response to feedback (MAS Feedback) received on its proposed amendments to the OTC derivatives contract reporting regime, the proposed amendments of which were set out in MAS' previous Consultation Paper on the Proposed Amendments to the Securities & Futures (Reporting of Derivatives Contracts) Regulations dated 18 January 2016.

The OTC derivatives reporting regime are set out in Part VIA of the Securities and Futures Act, Cap 289 (SFA) and the Securities and Futures (Reporting of Derivatives Contracts) Regulations 2013 (SF(RDC)R).

The feedback confirms the amendments which will be implemented. A summary of the amendments is set out below.

Reporting of Commodity and Equity Derivatives Contracts

The reporting obligations for OTC commodity and equity derivative contracts will commence from 1 October 2018 (starting with banks and merchant banks).

With respect to commodity derivatives, the amended SF(RDC)R clarifies that contracts that are entered into to fulfill the needs of day-to-day operations of a business and intended for physical settlement are excluded from the reporting regime. Spot contracts are similarly excluded from the reporting regime as they do not fall within the definition of "derivative contracts". Commodity derivatives that are entered into for the purpose of hedging financial risks are subject to the reporting regime.

With respect to equity derivatives, the amended SF(RDC)R clarifies that debentures, shares, units in business trusts and units in collective investment schemes are excluded from the reporting regime, but derivatives of units in collective investment schemes and business trusts will be subject to the equity derivatives reporting regime.

Information to be Reported

Information to be reported with respect to equity derivatives and commodity derivatives are set out in Parts V and VI of the First Schedule to the SF(RDC)R respectively.

Additionally, from 1 October 2018, the booking location and trader location will need to be reported for all classes of derivative contracts as set out in Part IA of the SF(RDC)R. "Booking location" and "trader location" are intended to correspond with the definitions of "booked in Singapore" and "traded in Singapore" under regulation 2 of the SF(RDC)R.

MAS has agreed to defer the implementation of collateral reporting at this stage and will reassess the implementation of collateral reporting when there is further international guidance in this area.

Reporting Obligations and Exemptions for Non-banks Financial Institutions

The MAS has also introduced a few exemptions from the reporting obligations which are applicable to non-bank financial institutions. These exemptions have come into effect as of 1 April 2018.

Approved trustees and licensed trust companies

Approved trustees under Section 289 of the SFA are exempt from the derivatives reporting obligations. Similarly, licensed trust companies in Singapore who could otherwise be subject to the reporting obligations as a significant derivatives holder will also be exempt from the derivatives reporting obligations. These exemptions are set out in regulation 10(2A) of the SF(RDC)R.

Capital markets services (CMS) licence holders

CMS licence holders will also be exempt from the reporting obligations under the following circumstances:

- Where the counterparty to the derivative contract (to which the CMS licence holder is a party or has entered into the contract as an agent of a party to the contract) is a retail investor (i.e. non accredited or institutional investor). This exemption does not apply to other specified persons who are subject to reporting obligations (including banks and insurance companies) – see regulation 10A(4)(a) of the SF(RDC)R; or

- The aggregate gross notional amount of specified derivative contracts to which the CMS licence holder is a party, which are booked in Singapore or traded in Singapore for the year ending on the last day of a quarter, does not exceed S$ 5 billion for the most recent completed quarter and for each of the three consecutive quarters immediately preceding that quarter. Trades with counterparties who are retail investors do not need to be counted for the purpose of the S$ 5 billion threshold – see regulation 10A(4)(b) of the SF(RDC)R.

The existing relief for CMS licence holders in fund management or real estate investment trust management with managed assets of less than S$ 8 billion will continue to be in force, but only for a year. This relief which was previously promulgated under regulation 3 of the Securities and Futures (Reporting of Derivative Contracts) (Exemption) Regulations 2014 (now repealed) is now contained in regulation 10B of the SF(RDC)R.

Subsidiaries of banks incorporated in Singapore and licensed insurers

Subsidiaries of banks incorporated in Singapore and insurers licensed in Singapore will be exempt from the reporting obligations where the aggregate gross notional amount of specified derivative contracts to which such subsidiary or insurer is a party and which are booked in Singapore or traded in Singapore, for the year ending on the last day of a quarter, does not exceed S$ 5 billion for the most recent completed quarter and for each of the three consecutive quarters immediately preceding that quarter.

Implementation Timeline

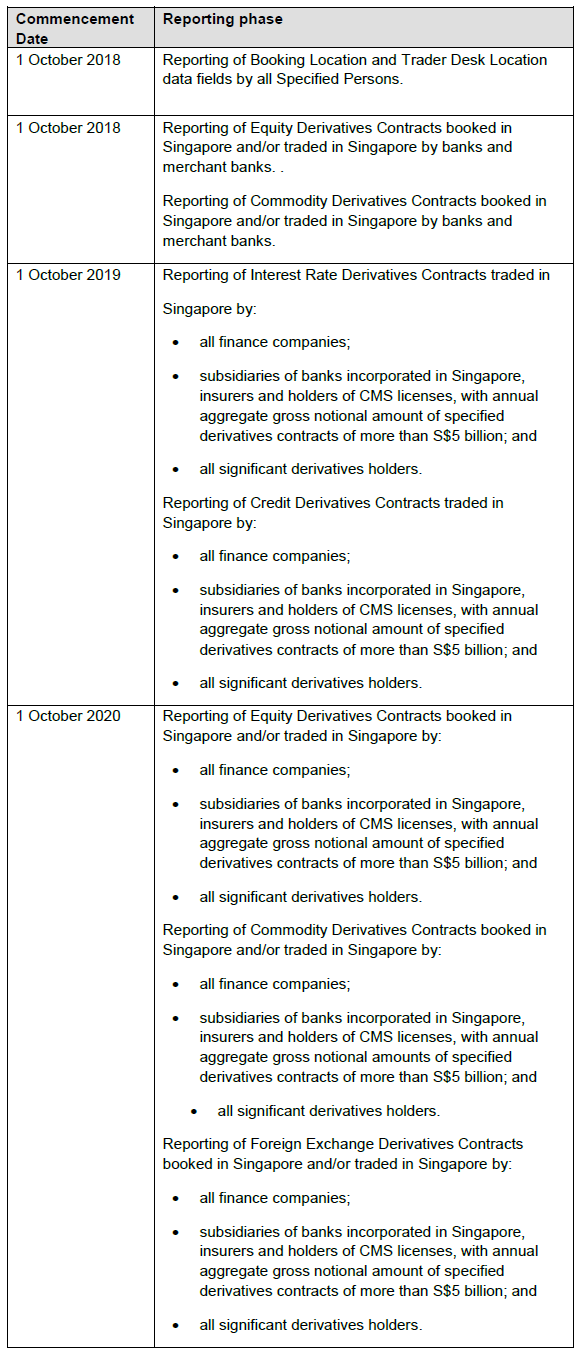

An overview of the commencement dates for the various reporting obligations is set out below, which is taken from paragraph 5.3 of the MAS Feedback.

For further information, please contact:

Stephanie Magnus, Principal, Baker & McKenzie.Wong & Leow

stephanie.magnus@bakermckenzie.com