Introduction

Financial technology, or mainly known as Fintech has been a booming industry ever since the strike of Covid-19 when contactless transactions were the only means of dealing. It has become more convenient for every one of every age as everything is mostly one tap away. However, with how simple Fintech has become it can very easily get out of hand without proper supervision. Hence come into play the regulations governing financial technology. Different countries regulate on different playbooks.

This seven part series will highlight Fintech Regulations in several countries within Asia Pacific, namely:

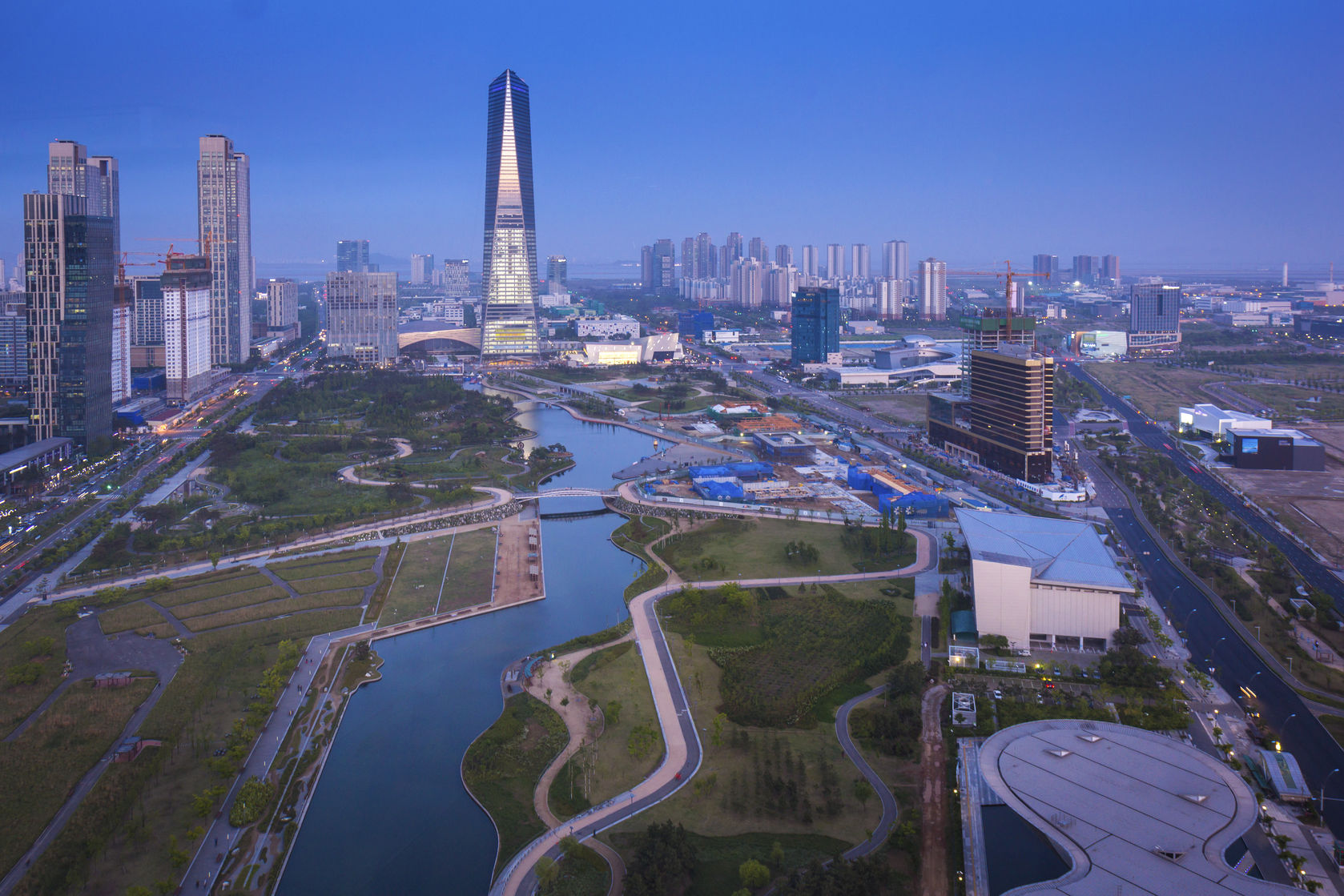

Series: South Korea

South Korea

Regulatory Authorities: FSC and FSS

South Korea’s fintech landscape is primarily governed by two regulatory bodies: the Financial Services Commission (FSC) and the Financial Supervisory Service (FSS). While the FSC is responsible for formulating financial policies, the FSS acts as its enforcement arm, overseeing and inspecting financial institutions to ensure compliance.

Fundamental Regulations

Electronic Financial Transactions Act (EFTA)

At the core of South Korea’s fintech regulatory framework lies the Electronic Financial Transactions Act (EFTA). This legislation governs electronic money transfers, payments, and various other electronic financial transactions. Prominent South Korean simple payment platforms such as Toss, Kakao Pay, and Naver Pay operate under the umbrella of this law. Businesses involved in issuing and managing electronic prepayment means for money remittance and payment gateway services must register with the FSC under the EFTA.

Act on Special Cases concerning the Establishment and Operation of Internet-only Banks

In 2018, South Korea introduced the Act on Special Cases concerning the Establishment and Operation of Internet-only Banks, which took effect in 2019. This law provides special provisions for internet-only banks, relaxing minimum capital requirements and stockholding limits for non-financial investors. However, it also reinforces certain restrictions on credit extension for large shareholders and borrowers.

Financial Innovation Act

The Special Act on Support for Financial Innovation, also known as the Financial Innovation Act, represents a recent milestone in South Korea’s fintech regulatory landscape. This act established a financial regulatory sandbox program aimed at exempting promising fintech businesses from existing regulations to foster innovative financial services. Under this framework, fintech companies can receive exemptions from regulatory measures for a specified period, further encouraging innovation in the sector.

Sector-Specific Regulations

Virtual Asset Regulations

South Korea has taken significant steps to regulate the virtual asset industry. The Amended Specified Financial Information Act, which came into effect in March 2021, mandates that virtual asset businesses register with the Korea Financial Intelligence Unit (KFIU). This act also establishes various regulations relating to anti-money laundering and countering the financing of terrorism (AML/CFT) measures, providing an official regulatory framework for the virtual asset industry.

Other Regulatory Regimes

Personal Data Protection

Fintech businesses in South Korea must navigate the complexities of personal data protection regulations. The Personal Information Protection Act (PIPA) applies to the processing of personal data in information and communications services, while the Credit Information Act applies to personal data processing in financial services. Given that fintech often straddles both realms, companies must comply with both sets of regulations.

Cybersecurity

While South Korea lacks specific cybersecurity laws for fintech businesses, the PIPA and the Credit Information Act mandate that fintech companies implement robust security measures to protect personal data and credit information. These measures encompass access restrictions, encryption, protection against malicious software, and more.

Anti-Money Laundering

Since July 1, 2019, electronic financial business operators, including many fintech businesses, must comply with anti-money laundering (AML) obligations under the Electronic Financial Transactions Act. These obligations include Know Your Customer (KYC) and Customer Due Diligence (CDD) requirements. Moreover, an amendment to the AML Act now extends AML requirements to virtual asset service providers (VASPs), further enhancing the AML regulatory framework in South Korea.

P2P Lending

The Online Investment-linked Finance Act, which took effect in August 2020, introduces regulations governing peer-to-peer (P2P) lending. This legislation addresses P2P business registration, sales practices, and consumer protection, aiming to bolster investor protection and promote growth in the P2P lending sector.

Conclusion

In conclusion, South Korea’s fintech regulatory landscape is multifaceted, covering a broad range of aspects to ensure the sustainable growth of the industry. As the fintech sector continues to evolve and innovate, the South Korean government remains committed to striking a balance between fostering innovation and safeguarding consumers and the financial system. This commitment positions South Korea as a promising hub for fintech innovation in the Asia-Pacific region.