Sri Lanka – Duty-Free shopping – Colombo Port City.

The Port City Colombo unveiled on 5th September 2024, its newest facility — the opportunity of ‘duty-free’ shopping with a dedicated new mall providing a never before shopping experience in the city of Colombo. The enabling legal provisions rooted in the Colombo Port City Economic Commission Act No. 11 of 2021 (“the Act”), with specific Regulation, No. 2381/24 issued on 22nd April 2024 (“the Regulations”).

The Regulations providing for, inter-alia eligibility criteria, permitted operations and benefits for duty free retail and mall business operations (the ‘Business’) in a designated duty-free zone within the financial district of the Port City.

ESSENTIAL ELIGIBILITY CRITERIA TO ENGAGE IN THE BUSINESS:

Be licensed as an ‘Authorized Person’ by the Colombo Port City Economic Commission (“the Commission”) – a company incorporated in Sri Lanka or registered as an offshore company in Sri Lanka, may apply to qualify as such, subject to other conditions as determined by the Commission based on the information contained in an application.

An applicant, on satisfying necessary criteria/conditions will be licensed as from the date on which an Order is published in the Government Gazette (“Effective Date”) naming such applicant as an Authorized Person.

OTHER REQUIREMENTS:

Duty Free RETAIL–

A minimum Investment of USD 5 million;

Demonstrate global experience in duty-free retail and offering a portfolio of high-end, luxury brands; and

Adopt the Commission’s passenger entry registration process and integrate with the Department of Immigration and Emigration for customer validation and also the supervision and oversight of the duty-free retail operation compliances of the Sri Lanka Customs.

Duty-Free MALL –

A Minimum Investment of USD 7 million; and

Adopt the Commission’s passenger entry registration process and integrate with the Department of Immigration and Emigration for customer validation.

EXEMPTIONS & INCENTIVES

A Business is entitled to exemptions from, or incentives from the Effective Date under, specified legislation to include the Inland Revenue Act, Value Added Tax Act, Finance Act, Excise (Special Provisions) Act, Customs Ordinance, Ports and Airports Development Levy Act, Sri Lanka Export Development Act, Betting and Gaming Levy Act, Termination of Employment of Workmen Act, Entertainment Tax Ordinance, Foreign Exchange Act, Casino Business (Regulation) Act.

Businesses that set up within a period of 3 years to end on 21st April 2027 are to qualify for the exemptions and incentives granted for a period of 20 years from the Effective Date.

PAYMENT CONDITIONS

A Business must necessarily use a digital payment system for transactions with Sri Lankan passport holders to include dual citizens and foreign passport holders domiciled in Sri Lanka by virtue of a Resident Visa.

SHOPPING DUTY FREE

Allowances and restrictions apply to categories and quantity of goods that may be purchased – provided in detail in the Regulations – Schedules I and II – attached.

A summary below –

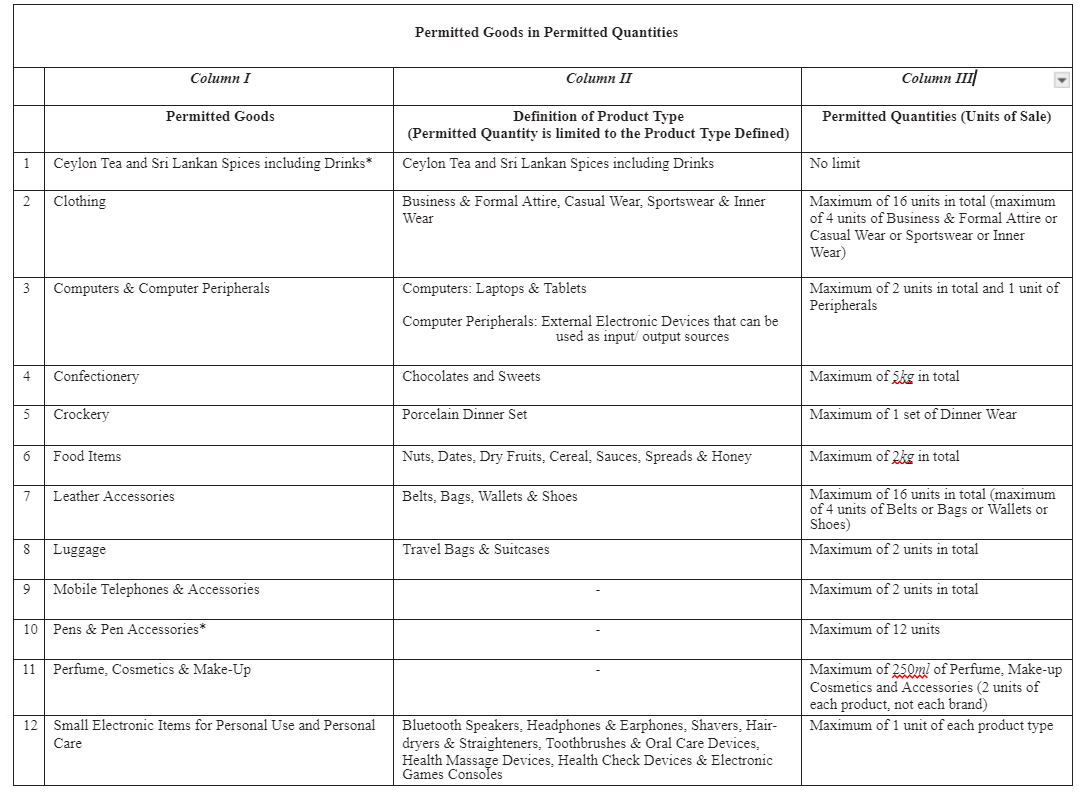

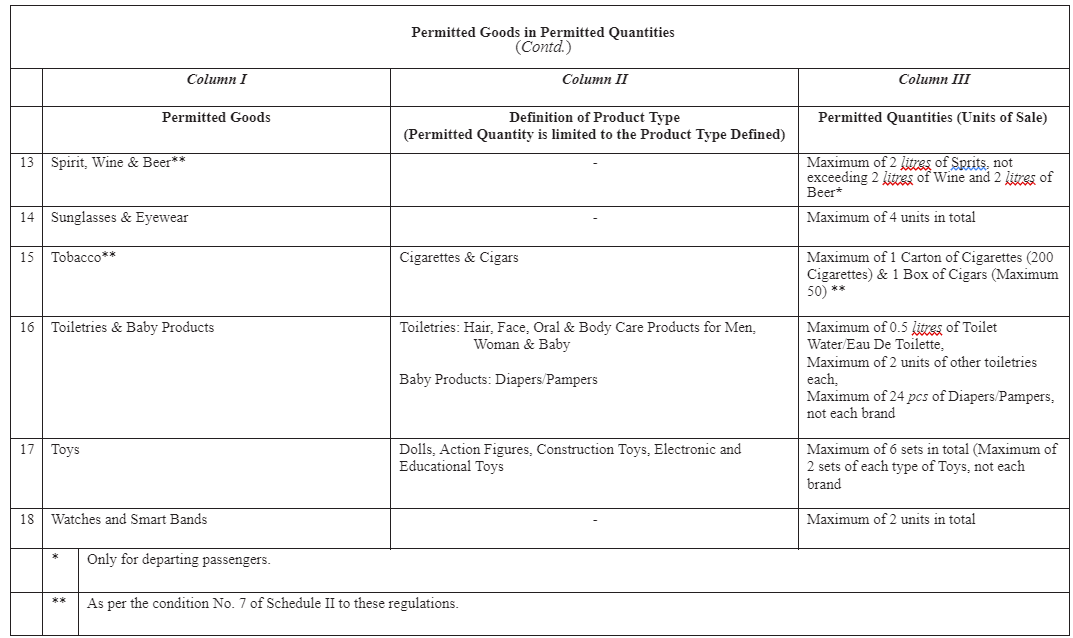

Permitted Goods and Quantities:

Permitted goods include a variety of items, such as Ceylon Tea and Sri Lankan spices, clothing, computers and peripherals, confectionery, crockery, food items, leather accessories, luggage, mobile phones, pens, perfumes, cosmetics, small electronic items, spirits, wine, beer, sunglasses, eyewear, tobacco, toiletries, baby products, toys, watches, and smart bands.

Each product has defined permitted quantities, such as, unlimited for tea and spices, a maximum of 16 units for clothing, a maximum of 2 units for computers, and 5 kg for confectionery. Spirits and wine, have quantity limitations tied to liters, while other products, such as pens, have a maximum unit limit.

Permitted Allowances:

Allowances are structured based on the category of customer and specific travel or residency, how and when purchases may be made and quantity limits. The allowances are also tied to specific regulatory requirements such as delivery locations and payment methods.

Sri Lankan Passport Holders and Foreign Residents Returning to Sri Lanka-

Sri Lankan passport holders, including dual citizens, and foreign passport holders with Sri Lankan Resident Visas, who return to the country with valid proof of arrival, are entitled to an annual duty-free allowance of USD 2,000 to be utilized within 04 days of their first date of arrival (FDOA) in Sri Lanka. No case payment maybe made.

Goods specified in Schedule I, purchased shall not be resold or exchanged in Sri Lanka.

Sri Lankan Passport Holders and Foreign Residents Traveling Abroad

Sri Lankan passport holders, including dual citizens, and foreign passport holders with Sri Lankan Resident Visas, intending to travel overseas are permitted to purchase goods with no prescribed annual limit on value of purchases; the goods maybe collected from the airport prior to departure.

Purchases are limited to the goods specified in Schedule I.

Tourists

Tourists arriving in Sri Lanka are not subject to an annual limit on the value of purchase of permitted goods. Purchased goods will require to be collected from the airport on departure, to ensure that the goods are for export purposes only and not for use within Sri Lanka.

Purchases are limited to the types and quantities specified in Schedule I.

Online Purchases (Non-Residents)

Persons residing outside of Sri Lanka may purchase permitted goods online with the purchased goods to be delivered to an address offshore.

The restriction ensuring that goods do not enter the Sri Lankan market.

Diplomats and Diplomatic Organizations

Diplomats and recognized diplomatic organizations operating in Sri Lanka, as approved by the Ministry of Foreign Affairs are exempt from most of the annual limits.

The permitted quantity limits for goods are as specified in Schedule I.

Additional general conditions

Customers, regardless of category must adhere to specific quantity limits for permitted goods and be purchased only for personal use and consumption and not for resale within Sri Lanka.

An unutilized allowance expires after 01 year from the customer’s FDOA in Sri Lanka.

Special rules apply to tobacco and alcohol purchases, with tobacco limited to departing customers aged 21 or older, while spirits, wine, and beer may only be purchased by customers aged 18 or older.

OVERSIGHT AND SUPERVISION

The operations of duty-free zones in the Port City will be under the supervision of Sri Lanka Customs, the Department of Immigration and Emigration and the Ministry of Foreign Affairs being the relevant State authorities for compliance and enforcement.

These Regulations, aim to establish the Colombo Port City duty-free zone as a hub for luxury retail, providing a highly controlled and exclusive shopping experience for tourists and authorized residents alike.

For businesses, this provides a structured pathway to tap into the growing market in the Port City, whilst benefiting from long-term incentives and exemptions.