13 May, 2017

On 31 March 2017, the land and buildings tax bill (the Draft Bill) was approved in principle by the National Legislative Assembly (NLA). This Draft Bill, which was prepared by the Council of State and approved by the Cabinet, is currently under the consideration of the responsible committee and will later be forwarded to the main assembly for final consideration. The Draft Bill is to replace existing house and land tax, as well as the local development tax under the Household and Land Tax Act B.E. 2475 and Local Land Development Tax Act B.E. 2508, which are currently collected by the local authorities and have criticized as being regressive and outdated. The Draft Bill is intended to decrease income disparity among taxpayers, improve and encourage land utilization, increase effectiveness in tax collection and increase public revenue.

A significant change is that the new land and buildings tax collected under the Draft Bill will be calculated on different basis from current house and land tax. The new land and buildings tax base is to be calculated on government appraised value, in contrast with the current house and land tax base which is calculated based on the yearly rent.

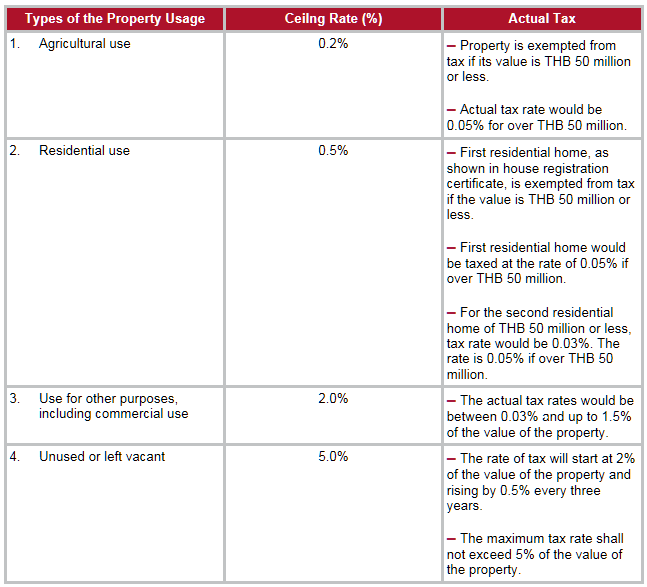

While the existing house and land tax has a single imposed tax rate of 12.5%, it is expected, according to the Draft Bill, that the new land and buildings tax rate will be different depending on type of the property usage as follows:

Please click on the image to enlarge.

Following the consideration by the responsible committee, the Draft Bill would then be further deliberated by the NLA for approximately 2 to 3 months. After which, provided that there are no further major comments or revisions, it should be announced in the Royal Gazette within this year. However, enforcement of the Draft Bill is expected to occur one year from the date of announcement.

As the new property tax regime looms ahead, land and property owners, developers, property managers and family business should now start early assessments of their tax exposures on their assets and commence with restructuring their asset portfolios.

For further information, please contact:

Duangkamon Amkaew, Partner, Baker McKenzie

duangkamon.amkaew@bakermckenzie.com