27 January 2021

Transactions by special purpose acquisition companies, or SPACs, exploded in 2020, resulting in a 320% increase in the number of SPAC initial public offerings (IPOs) compared to 2019. SPACs have been around for 15 years and now are established as a legitimate alternative to a traditional merger or IPO. This is due in part to an evolution of the SPAC vehicle, which now offers enhanced investor protections and positions sophisticated managers as “sponsor teams” that guide the company through both the SPAC IPO and the de-SPAC process, as further described below. SPAC prevalence is set to continue through 2021, with a significant number of both SPAC and de-SPAC transactions already in the pipeline.

A SPAC is a public, NYSE- or Nasdaq-listed acquisition vehicle through which a sponsor team raises a pool of cash in an IPO and places that cash in a trust, to be used solely to acquire an operating target company. The SPAC is required by its charter to complete that initial business combination — or “de-SPAC” transaction — typically within 24 months, or liquidate and return the gross proceeds raised in the IPO to the public shareholders.

The popularity of SPACs can be attributed to various factors, including highly regarded sponsor teams, their unique investment structure, a better understanding by the market of the SPAC structure, the well-established complementary private investment in the public equity (PIPE) financing market, and the potential attractiveness for target companies of the subsequent acquisition as compared to a traditional IPO or M&A transaction. SPAC activity has significantly accelerated as investors seek attractive opportunities and as companies seek to partner with these best-in-class sponsor teams and exert more control over valuation and share price, including to mitigate some of the market volatility risks associated with a traditional IPO.

SPAC activity has significantly accelerated as investors seek attractive opportunities and as companies seek to partner with these best-in-class sponsor teams and exert more control over valuation and share price.

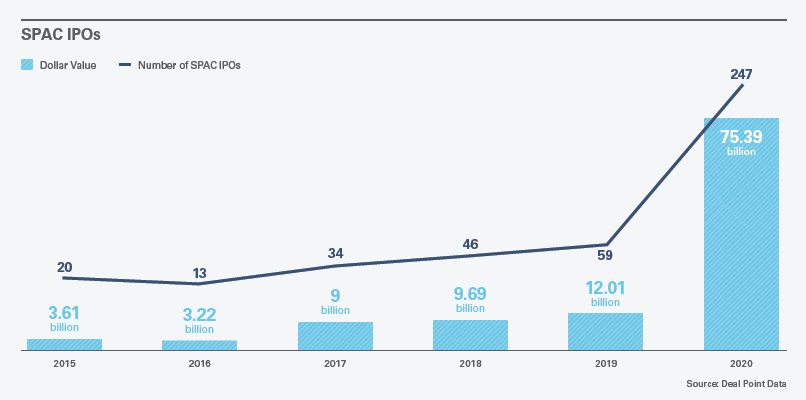

According to the research firm Deal Point Data, a record 247 SPAC IPOs were completed in 2020, raising total gross proceeds of approximately $75 billion, or 53% of the total number of offers and 48% of the overall IPO market by value. At the other end of the SPAC life cycle, a record $56 billion of de-SPAC transactions were announced in 2020. These figures represent a massive 320% increase in the number of SPAC IPOs, nearly a 525% increase in gross IPO proceeds and a 23% increase in the number of de-SPAC transactions, as compared to 2019, which itself was a banner year for SPACs. In 2019, there were 59 SPAC IPOs, raising approximately $12 billion of gross SPAC IPO proceeds. As shown below, the 2020 volume eclipsed the prior five years combined.

Please click on the image to enlarge.

Best-in-Class Sponsor Team

The SPAC is in essence its sponsor team — its founders, management and directors — and markets itself based on that team and what it can bring to a potential target. Today’s SPACs are backed by accomplished teams that have extensive proprietary deal sourcing networks, experience as M&A dealmakers and demonstrated track records of success in value creation. Many SPAC sponsors in the market today are, or expect to be, serial SPAC sponsors. The importance of partnering with a quality sponsor team has been illustrated by recent Securities and Exchange Commission (SEC) comments requiring SPACs to disclose if members of their management teams have previously been involved in a SPAC that performed poorly. From the target’s perspective, choosing the right SPAC partner is critical, as picking a poorly perceived or inexperienced sponsor team could result in failure of the SPAC.

Unique Investment Structure

The SPAC investment structure is unique in that it allows public shareholders to invest alongside the sponsor team, but with downside protection. In its IPO, a SPAC typically offers units, consisting of a share of common stock and a fraction of a warrant, at $10 per share. A shareholder that prefers to exit prior to the initial business combination can sell its units in the market or choose to have its shares redeemed for its pro rata portion of cash from the IPO that is being held in the trust. This mitigates the risk to the investor of the sponsor team selecting a poor acquisition target. A shareholder that prefers to remain an investor after the initial business combination can enjoy the potential upside of continuing to hold the shares and warrants. For investors (including nontraditional SPAC investors) looking for a cash management or investment alternative, a SPAC can be an attractive option because of downside protection and the potential for significant upside, and the ability to leverage their investment.

Transparency and Understanding of Sponsor Promote Structures

The structure of the sponsor promote has received increasing attention, including by the SEC Division of Corporation Finance. In late December 2020, the SEC issued guidelines related to disclosures in SPAC IPOs and de-SPAC transactions, specifically with respect to conflicts of interest and the nature of the sponsor team’s economic interests in the SPAC. (See our December 29, 2020, client alert, “SEC Staff Issues CF Disclosure Guidance on Conflicts of Interest and Special Purpose Acquisition Companies.”) Generally speaking, at the time of the SPAC IPO, the sponsor receives shares (known as “founder shares” or the “promote”) for $25,000 that are equivalent to 20% of the SPAC’s post-IPO common share capital. The dilutive impact of these shares has contributed, in part, to the historical view that de-SPAC transactions can be more expensive from the seller’s perspective than a traditional IPO. In response, some sponsors have used alternative promote structures to align incentives and distinguish themselves, with the goal of making their SPACs more attractive to IPO investors and potential target companies. In its simplest form, they achieve this by subjecting a portion of the founder shares to an “earn-out” construct, with these shares vesting only if certain post-closing trading price targets are achieved. In a more extreme example, one SPAC chose to forgo founder shares altogether. Regardless of the approach they choose, SPACs should be transparent in order to promote understanding and confidence in their structure, including among nontraditional SPAC investors.

Complementary PIPE Financings

As SPACs undertake increasingly larger de-SPAC transactions, the importance of complementary PIPE financings, and their size, has increased. By way of illustration, in 2020, the largest-ever de-SPAC PIPE transaction of $2.6 billion was announced, which was twice the size of the prior record PIPE raise announced in late 2019. In addition, it has become more common for the amount of proceeds raised in the PIPE to exceed that raised in the SPAC IPO. The well-established PIPE financing market provides numerous benefits. These include allowing SPACs to raise additional cash proceeds for the initial business combination, showing that key investors support the initial business combination, backstopping minimum cash conditions required to consummate the initial business combination (given the potential for uncertain levels of redemptions), providing upfront liquidity to the target’s shareholders, and optimizing the cash and capital structure of the target as a newly public company. A particular advantage of a de-SPAC PIPE financing is that, unlike the proceeds raised in the SPAC IPO, the PIPE proceeds may be raised without the parallel sponsor promote. As a result, a smaller IPO, combined with a larger de-SPAC PIPE, can be more attractive to a potential target and public shareholders than a larger IPO with a smaller or no de-SPAC PIPE.

Alternative to Traditional IPO or M&A Transaction

SPACs have clearly established themselves as legitimate and, in many cases, preferred alternatives to a traditional IPO or M&A transaction for target companies seeking liquidity. For sponsors or investors considering an exit for a portfolio company, founders or investors in a pre-IPO company, or a strategic seeking to sell a business, a de-SPAC transaction is now routinely considered in addition to, or as a dual track alongside, a traditional IPO, strategic acquisition or other extraordinary transaction. While both a de-SPAC transaction and a traditional IPO result in a public company, the former can bring unique advantages.

A de-SPAC transaction can provide for price discovery between the SPAC target and SPAC sponsor, which can help drive higher and more certain target valuations. Compared to a traditional IPO, where valuations are derived from roadshow meetings with potential investors, investment bank guidance, initial financing rounds and comparable company offerings, de-SPAC negotiations provide an opportunity to determine, negotiate and lock in the value of the target at the beginning of the process (at signing) without being subject to pricing fluctuations and similar market risk at the very end of the process (at the actual public offering). Further, in a de-SPAC transaction, the parties are able to leverage mechanics more common to an M&A transaction, such as earn-outs, to resolve differences in price, which they would not be able to effectively implement in a traditional IPO. The flexibility to negotiate within the confines of an acquisition agreement provides additional areas of compromise to ensure that all parties can maximize value and get comfortable with a partner with whom they will be working closely for an extensive period of time after the closing.

A de-SPAC transaction also has the potential to move more efficiently than a traditional IPO process if the target is well prepared to present itself as a public company. The SPAC target must be ready with all of its required disclosures, including audited financial statements, similar to (and in some cases more extensive than) those that would be required in a traditional IPO. The target also will need best practices in place to comply with the rules and regulations governing public companies, including internal controls, public company stock exchange rules and governance requirements. Another consideration as it relates to public readiness, and different from a traditional IPO, is the necessity for the target company, under applicable law and customary practice, to publicly disclose projections in connection with the de-SPAC transaction. In a de-SPAC transaction, unlike in a traditional IPO, targets must be prepared for heightened scrutiny relating to these publicly disclosed projections and the target company’s ability to achieve them in the future. All of this preparation requires cost and infrastructure investments at an early stage but can provide a target with maximum flexibility and potentially make it more attractive to a SPAC buyer.

A target company aiming for a potential de-SPAC transaction should engage early with both its experienced counsel and accountants to navigate these requirements.

For further information, please contact:

Jonathan Stone, Partner, Skadden

jonathan.sstone@skadden.com