After many months of escalating recession speculation, financial markets have had it with all this recession talk and are ready to embrace a new narrative. That is the main takeaway from the rally in markets to start the year, which has put the S&P 500 back within 12% of its all-time high hit in a bubbly 2021 despite recent recession worries, slowing earnings growth and sharply higher interest rates. Who can blame markets for getting antsy?

For all the mounting concerns about an economic downturn after months of aggressive Fed tightening, there is scant evidence that a recession is impending. Early reads on economic data and corporate earnings for 4Q22 reflect slowing growth but little to suggest a contraction soon to follow. The advance estimate of real GDP growth in 4Q22 was 2.9%, certainly not a hot print but hardly anemic either and a tad higher than expected. 1 The labor market remains incredibly resilient by most measures. Consumer spending has slowed from unsustainably high rates of growth but remains healthy, and the 2022 holiday season (October-December) was a solid one (+6.2% YOY) despite the business media’s misplaced trashing of December retail sales, which ignored several pull-forward factors of holiday sales into October and November this year.

Only the housing market and related construction sector confronts a year that seems recession-like. Skeptics will argue that Fed actions to date take time to course through the veins of the economy, much like a time-release medication, and therefore conditions today may not reflect what is to come. Optimists will point to a domestic economy that has mostly withstood more than six months of steady Fed actions to slow it without inducing harsh or crippling effects so far, while inflation has probably peaked. They see a finish line in sight towards year-end, and a soft-landing scenario that seems more likely today than it did a few months ago. The recession debate is livelier today than at any point since late 2021 when the Fed preannounced its intention to tighten monetary policy in 2022. Curiously, the ranks of optimists vs. pessimists seem to fall neatly into a couple of distinct camps.

The pessimist camp consists mostly of corporate CEOs and economists. Approximately two-thirds of economists at major banks recently polled by Bloomberg 2 believe that a recession will occur at some point in 2023, compared to just 30% in June 2022 and 15% one year ago. It’s hard to appreciate how rare it is to have such a large percentage of economists making a recession call even with their reputed penchant for pessimism. In “normal times” a consensus recession probability forecast rarely ever exceeds 20%. These polled economists also forecast real U.S. GDP growth of just 0.5% in 2023, an exceptionally weak projection for the year.

Corporate CEOs have also joined the ranks of the downers since early 2022. The Conference Board’s Measure of CEO Confidence™ has plummeted to 43 in 1Q23 from 83 a year earlier,3 and is now nearly identical to CEO confidence levels in the pandemic-stricken period of 2Q20-3Q20. Nearly 93% of respondents now say they are preparing for a U.S. recession in the next 12-18 months, though 85% of respondents expect it will be a brief and shallow downturn. Approximately 55% of respondents said economic conditions had deteriorated in the previous six months while only 16% said general business conditions had improved in that time. Looking ahead, just 18% said that general business conditions would improve in the next six months while 48% expected conditions to worsen. Respondents were slightly more upbeat about prospects for their respective industries than the economy generally. CEO confidence readings in February marked an improvement compared to the deep pessimism of the 4Q22 survey results—which registered the lowest CEO confidence reading since the 2008 global financial crisis—but still reflected considerable concerns coming from the senior-most executive group with the best visibility into their end-markets and general business conditions, and who tend to be vigilant, steely-eyed realists rather than cheerleaders. Ignore them at your own risk.

At the other end of the spectrum are sell-side analysts and equity investors, who increasingly sense that the inflation problem will be tackled without tanking the economy. A few months ago, robust economic readings would have caused financial markets to sell-off, as strong reads suggested that Fed tightening would continue until these data points softened. But with inflation now subsiding, though still well above acceptable levels, that premise is less certain, and rate hikes will certainly moderate in the months ahead, provided that easing inflation trends continue even if economic activity remains hotter than the Fed would like. Markets rallied modestly in reaction to the stronger-than-expected advance GDP report for 4Q22, whereas months earlier, market reaction to key reads indicating economic resilience likely would have been negative in anticipation of a continued aggressive Fed response.

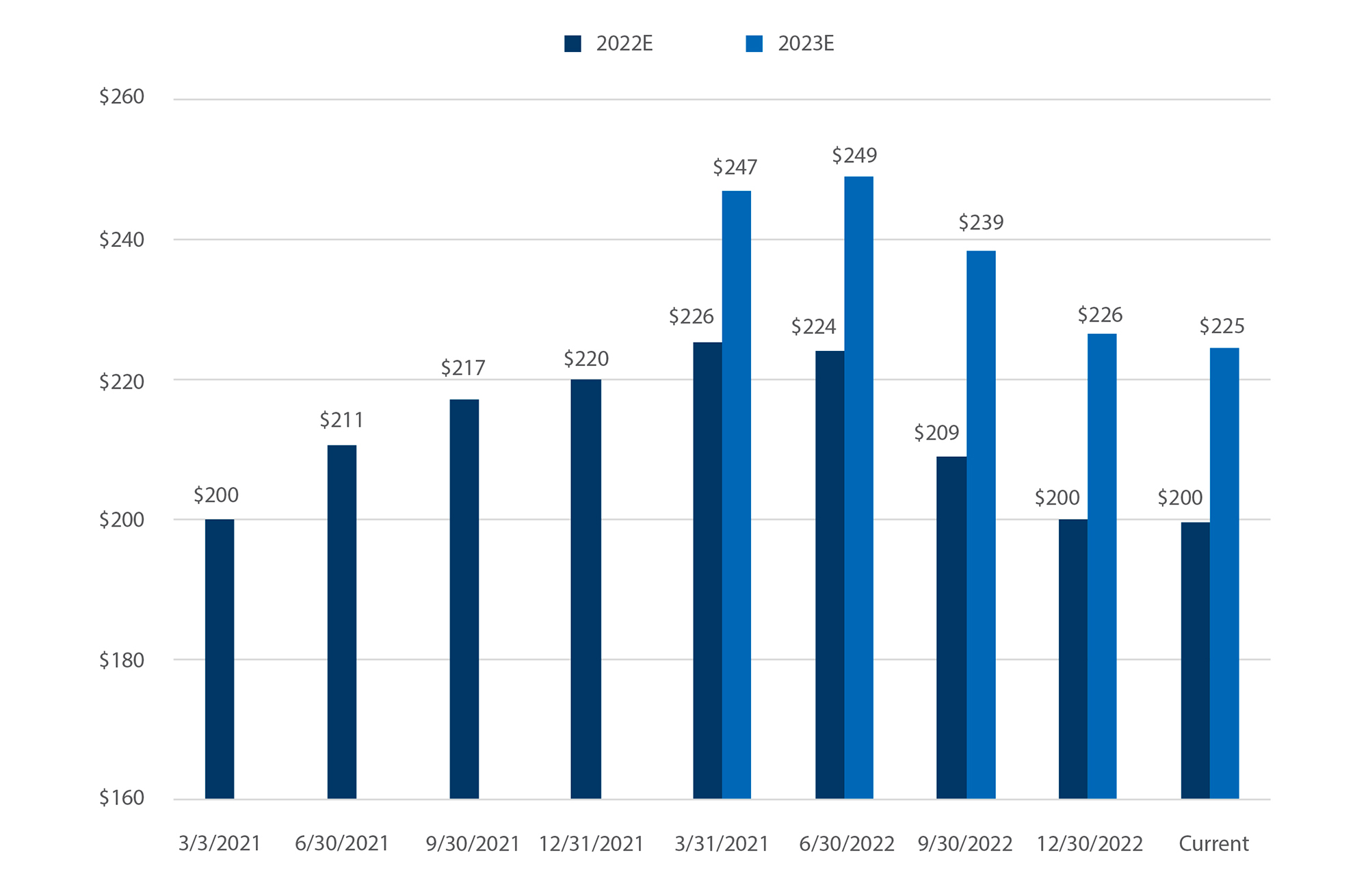

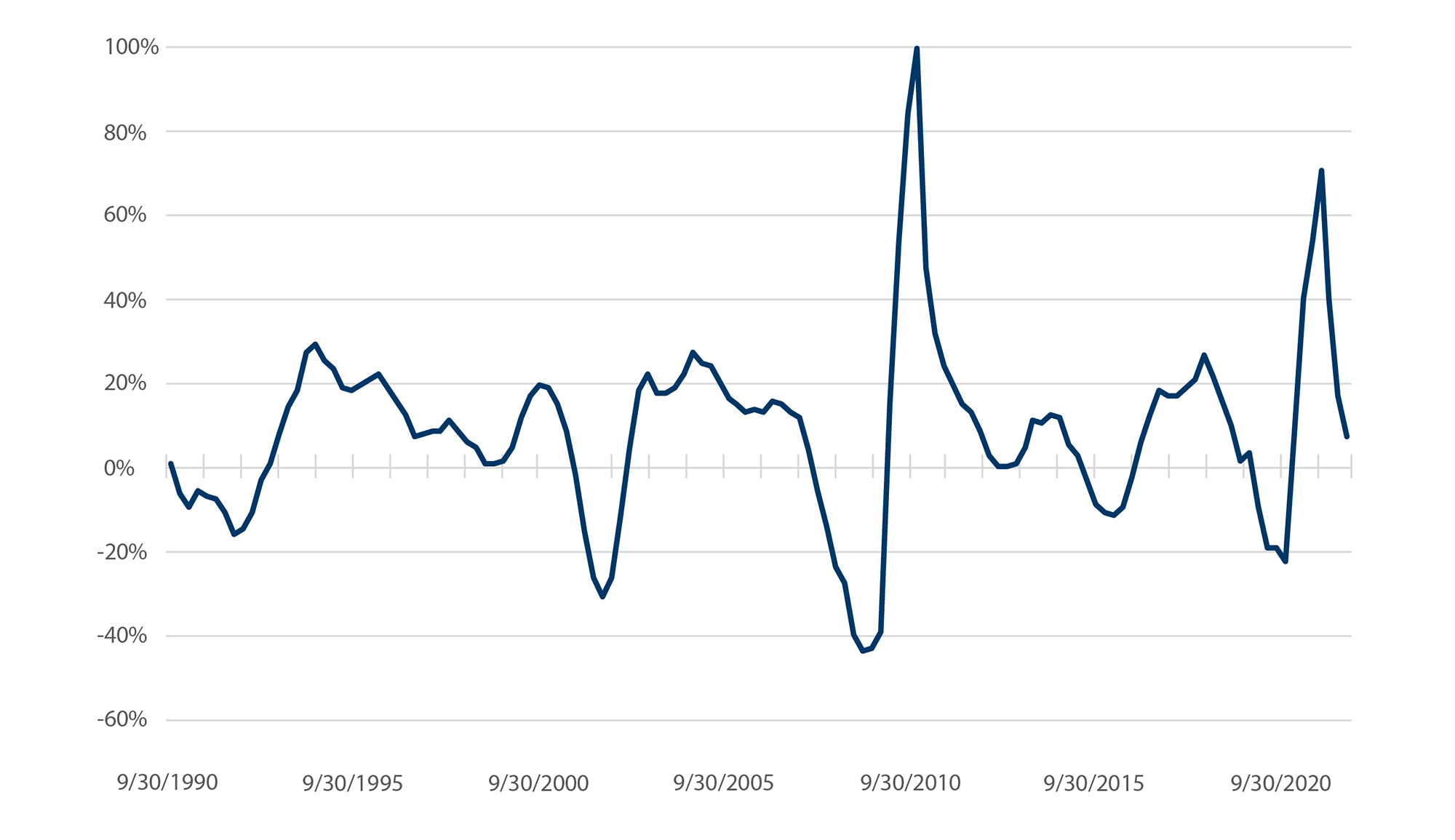

Earnings estimates for 2023 from sell-side analysts don’t reflect an expectation of recession. While EPS estimates for the S&P 500 in 2022 and 2023 continue to get trimmed, these revisions are modest in the context of a prospective downturn, with the current 2023 EPS estimate getting cut by just 10% from its mid-2022 peak (Exhibit 1). Moreover, 2023 EPS is expected to increase by 12.5% compared to 2022 EPS ($225 vs. $200), hardly the stuff of recessions. In fact, during the previous four recessions, EPS declines (YOY) for the S&P 500 have ranged from 16% to 42%, including the two outlier-downturns in 2009 and 2020. S&P 500 earnings declines in the previous two “normal” recessions of 1991 and 2001 were 16% and 30%, respectively (Exhibit 2). Current EPS estimates for 2023 would be indicative of a healthy year for corporate earnings growth. Are equity analysts and investors blithely ignoring the prospect of an earnings recession in 2023, or are they simply rejecting such a scenario? It’s hard to know, but keep in mind that this cohort is notorious for its “glass half-full” outlook, especially in recent years.

A recent Bloomberg article4 indicated that a “recession fatigue” rally by markets in the weeks preceding the start of a recession is not a new thing and can be clearly identified in the leadup to previous recessions — a last hurrah of sorts before reality set in. Such rallies proved to be a false “all clear” signal that reflected investors’ impatience with a drawn-out recession narrative rather than errant forecasts of a downturn. The author documented average S&P 500 market performance in the months preceding the five recessions from 1980-2009 and the results revealed a distinct pattern: Equity markets slumped in the months prior to an economic downturn as growing recession sentiment induced selloffs but then mustered a respectable rally in the weeks prior to recession, as investors grew weary of recession speculation that hadn’t materialized, only to surrender those gains and considerably more once the onset of recession began.

Overall, there is a wide divide between those who inhabit the inner depths of Corporate America and make the gritty calls, and those who interact with it from a safer distance. The divergence of opinion between the suit & tie and sweater-vest crowds is impacting restructuring market prospects as well. As we mentioned last month, market-driven indicators of restructuring activity are not anticipating default levels consistent with a recession in 2023, meaning that corporate credit markets likewise don’t expect a recession despite the spike in yields since mid-2022. In essence, it comes down to this: Who are you going to believe — the suits or the sweater-vests? Because a year from now, one of them will have been very wrong.

Exhibit 1 – S&P 500 EPS Consensus Estimates

Source: S&P 500 Earnings and Estimate Report, S&P Dow Jones Indices, January 20, 2023

Exhibit 2 – S&P 500 EPS

Source: Source: S&P 500 Earnings and Estimate Report, S&P Dow Jones Indices, January 20, 2023

For further information, please contact:

Michael C. Eisenband, FTI Consulting

michael.eisenband@fticonsulting.com

Footnotes:

1: Bureau of Economic Analysis, January 26, 2023. Article.

2: Vince Golle and Kyungjin Yoo, “Economists Place 70% Chance for US Recession in 2023,”Bloomberg, December 20, 2022. Article.

3: SCEO Confidence Picked Up in Q1, but CEOs Remain Pessimistic,” The Conference Board Inc. February 9, 2023. Article.

4: Jonathan Levin, “Don’t Get Disoriented by Recession-Talk Fatigue,” Bloomberg, January 23, 2023. Article.