10 August, 2017

Please click on the image to enlarge.

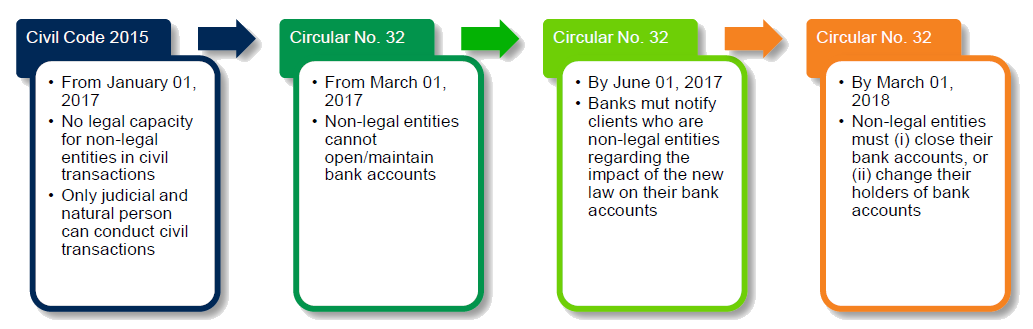

Non-legal entities no longer have legal capacity for purposes of civil transactions Law

No. 91/2015/QH13 on the Civil Code was adopted by the National Assembly on 24 November 2015, and entered into force 1 January 2017 (Civil Code 2015). The Civil Code 2015 only provides for the legal capacity of legal entities (judicial persons) and individuals (natural persons) in civil transactions. Accordingly, Civil Code 2015 omits the legal capacity of non-legal entities to conduct any civil transaction. Among other things, this means many thousands of non-legal entities, including representative offices, business associations, branches of offshore enterprises, offices of foreign contractors and NGO offices, may no longer be able to engage in any civil transaction as a party to such transactions.

Non-legal entities can no longer open/maintain bank account

The State Bank of Vietnam (SBV) has adopted the new, more limited approach of the Civil Code 2015 on legal capacity. An example is in Circular No. 32/2016/TT-NHNN dated 26 December 2016 (Circular No. 32), which amends Circular No. 23/2014/TT-NHNN dated 19 August 2014 on the guidelines for the opening and maintaining of current accounts at payment services providers. Circular No. 32 came into effect from 1 March 2017. As stipulated in Article 4 of Circular No. 32, non-legal entities are not allowed to open and maintain a bank account in their own capacity. This means all non-legal entities must either change the account holders, or close their bank accounts.

Options for non-legal entities and their existing bank accounts

Specifically, the SBV requires that, by 1 March 2018, in accordance with the instructions of their banks, non-legal entities must either (i) close their current bank accounts, or (ii) change their current bank accounts to the form of an individual bank account or a shared bank account with a legal entity (such as the parent company).

The SBV also requires that as of 1 June 2017, banks and foreign bank branches had to review their client portfolios and then inform and assist their non-legal entity clients regarding the impact of the new regulations on their clients' bank accounts. The banking community has been reluctant to follow through on these requirements pending clarification of the many technical complications such a huge undertaking involves. For example, while guidelines have been provided for head offices of representative offices to authorize an account holder to open and maintain a bank account on its behalf, no guidelines have yet been agreed for business associations, NGOs, etc.

For further information, please contact:

Frederick Burke, Partner, Baker McKenzie

frederick.burke@bakermckenzie.com