30 December, 2016

I. Regulations on share award plans which permit Vietnamese nationals to invest overseas

On 31 December 2015, the Government promulgated Decree No. 135/2015/ND-CP on offshore indirect investment (Decree No. 135). Decree No. 135, which took effect on 15 February 2016, confirms that an individual investor with Vietnamese nationality may indirectly invest offshore by participating in plans of awarded shares issued offshore by foreign entities for employees in Vietnam.

Thereafter, on 29 June 2016, the State Bank of Vietnam (SBV) issued Circular No. 10/2016/TT-NHNN (Circular No. 10) to guide the implementation of Decree No. 135. Circular No. 10, which took effect on 13 August 2016, is the very first legislation on stock award plans in Vietnam. Circular 10 provides that foreign companies can grant share awards and/or awards with rights to buy shares with preferential conditions to employees under share award plans.

Vietnamese employees participating in the plan have the right to:

- receive, own and sell shares abroad;

- receive, exercise and sell the rights to buy shares; and

- receive dividends and other lawful income (i.e. the amount of money derived from the sale of awarded shares, or the right to buy shares) through their employing entities

Under Circular No. 10, Vietnamese employers must submit a registration dossier to the SBV to obtain its certification before implementing the stock award plan in Vietnam. Vietnamese employees participating in the plan now can transfer money out of Vietnam to exercise stock options and can own foreign shares upon exercise of stock option or restricted stock units/ awards.

This represents a significant change in the remuneration of Vietnamese executives working at multi-national companies, and presents new opportunities for multi-national companies to recruit talent.

II. Consolidation and strengthened enforcement of occupational health and safety regulations

The Law on Occupational Hygiene and Safety No. 84/2015/QH13 adopted by the National Assembly on 25 June 2015 (Hygiene and Safety Law), came into effect on 1 July 2016. Previously health and safety regulations were set out in the Labor Code and numerous decrees. This new law consolidates all the regulations for the first time. To date, three decrees and five circulars implementing the new statute have also been released, so the law is set out in

far greater detail than before.

The following notable issues arise from the Hygiene and Safety Law:

- Labor accidents are given a broader definition than that specified in previous legislation. A labor accident is an accident which occurs in one of the following circumstances: (i) Labor accidents occurring at the workplace and during working hours; (ii) Labor accidents occurring outside the workplace or outside of working hours but while on an assignment from the employer; and (iii) Travelling between the employee’s residence and workplace within a reasonable period of time and on a reasonable route.

- Regulations on occupational safety and hygiene in labor outsourcing activities were for the first time provided in this law. The law requires a labor outsourcing contract to contain specific terms on occupational safety and hygiene. Furthermore, the law also sets out the rights and responsibilities of the parties for labor outsourcing activities.

- Employers must contribute to the unemployment insurance and occupational disease fund at a maximum of 1% of payroll used to contribute statutory social insurance premiums.

- Expenses incurred by an employer regarding its employees' health and safety are deductible for the calculation of Corporate Income Tax liability.

III. Amendment to the Labor Code

After three years of implementation, the Labour Code No. 10/2012/QH13 adopted by the National Assembly on 18 June 2012 (Labour Code) has improved the legal framework of labor and employment law in Vietnam. However, in the course of its implementation, problems have also been discovered. Employers, employees and other relevant parties have raised several issues and concerns. Furthermore, the revision of the Labour Code is necessary to implement Vietnam's commitments under international trade agreements it has recently signed, including the Trans-Pacific Partnership Agreement (TPP), and the European Union Vietnam Free Trade Agreement (EVFTA).

Therefore, the Government is revising the Labour Code, and the Ministry of Labour, Invalids and Social Affairs (MOLISA) has been assigned to prepare the first draft of the amendment. On 29 November 2016, the MOLISA issued a zero draft of the Law amending a number of articles of the Labour Code 2012 (Draft). Under the Draft, the changes to the current Labor Code are very extensive. Please contact us if you would like to have a copy of the Draft and/or the analysis of key changes of the Labor Code.

In terms of the revision process, the MOLISA will submit the first draft of the revised Labor Code to the Government

in January, 2017 and to the National Assembly by March 2017. Reforms are aimed to be completed by April, 2018.

IV. Increase of minimum wages

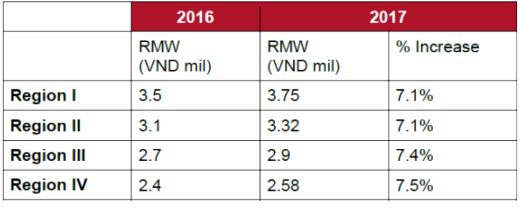

General Minimum Wage (GMW) will increase from VND1.21 million (in 2016) up to VND1.3 million effective 1 July 2017 while the Regional Minimum Wage (RMW) will increase by 7.1% to 7.5% (depending on the applicable region) from 1 January 2017 as below.

This means that the capped amounts for contributions to social, health and unemployment insurance will all increase. The capped salary used as the basis to calculate social insurance, health insurance and trade union fee contribution is 20 times of the new GMW. This means that the capped salary for these contributions will increase from the current amount of VND24.2 million to VND26 million. The capped salary used as the basis for unemployment insurance contribution is 20 times of the RMW. This will also represent a significant increase in labor costs. For example, the cap for Region I will be increased from VND70 million to VND75 million.

By 1 January 2018, foreign employees may also be required to contribute to social insurance, as well as employees with labor contracts for a term of one month or more.

V. Pilot program on electronic visa (e-visa)

On 22 November 2016, the National Assembly issued Resolution No. 30/2016/QH14 on the pilot program to grant electronic visas to foreigners who enter Vietnam. Under the Resolution, some important points of the pilot program as follows:

- Electronic visas for foreigners would be valid on a one-time entry basis with a duration not exceeding 30 days.

- Electronic visas are available to foreigners where the following three conditions are met: (i) the associated countries have diplomatic ties with Vietnam; (ii) granting the visa is consistent with the social and economic development policy and foreign affairs policy of Vietnam; and (iii) granting the visa does not impose any harm to national defense, security and order, social safety of Vietnam.

- Foreigners who: (i) have passports; and (ii) are not subject to any conditions of suspension from entry provided under the Law on Immigration of Vietnam shall be eligible to apply for electronic visas. After entering Vietnam, if these foreigners want to apply for a new visa, the immigration authorities shall proceed in accordance with Vietnamese immigration laws.

- The payment of application fees shall be conducted via bank account and shall not be returned in the case of an unsuccessful application.

- This pilot program commences on 1 February 2017 and will last for two years.

- The Government is responsible to set out the details of the relevant procedures for applying for e-visas.

For further information, please contact:

Thuy Hang Nguyen, Partner, Baker & McKenzie

thuyhang.nguyen@bakermckenzie.com