10 January, 2018

I. Labor Costs to Rise in 2018

Labor costs in 2018 for businesses in Vietnam are expected to rise as a result of (i) the increase of minimum salaries set out by the Government, including both General Minimum Salary and Regional Minimum Salary, and (ii) the application of a social insurance scheme for two additional groups of employees, namely employees working under labor contracts from one (1) full month to under three (3) months and foreign employees working in Vietnam. Particularly:

1. Increase of Minimum Salaries

1.1. Regional Minimum Salary to increase from 1 January 2018

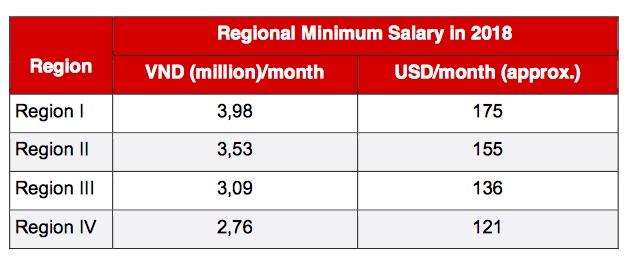

According to the recent Decree No. 141/2017/ND-CP dated 7 December 2017, the new Regional Minimum Salary (“RMS”) in 2018 will be effective from 1 January 2018 and be applied as follows:

Please click on the table to enlarge.

This increment followed the National Wage Council's proposal and remained unchanged from the draft Decree issued by the Ministry of Labor, Invalids and Social Affairs ("MOLISA"), as mentioned in our Monthly Labor and Employment Law Update in June and July 2017 and in October 2017, respectively.

By law, the RMS is generally the minimum monthly salary level applicable to employees who perform the simplest work. The RMS is also used to determine a cap premium in calculating unemployment insurance contributions for both employers and employees. Specifically, the salary which is used to calculate the unemployment insurance contribution premiums is capped at 20 times the RMS.

Therefore, labor costs will be increased accordingly (i.e., increase of RMS is applicable to employees and unemployment insurance contribution premiums).

1.2. General Minimum Salary to increase from 1 July 2018

In mid-November, the National Assembly approved the Resolution on State Budget Estimate for 2018, with the decision to increase the General Minimum Salary ("GMS" or aka basic salary as mentioned in the law, or "lương cơ sở" in Vietnamese) from VND1,300,000/month to VND1,390,000/month (approx. USD61/month) from 01 July 2018. Following this approval of the National

Assembly, a formal decree will be issued by the Government to make this GMS officially applicable.

For the private sector, the GMS is used as the basis to determine a cap premium in calculating social and health insurance contributions for both employers and employees, and other statutory contributions (e.g. trade union fees). Particularly, the salary used to calculate social and health insurance and trade union fees contribution premiums is capped at 20 times the GMS (i.e., VND27,800,000, approx. USD1,220).

The increase of the GMS will, therefore, result in an increase of labor costs for businesses.

2. Application of Compulsory Social Insurance Scheme to Two Additional Groups of Employees from 1 January 2018

Additionally, from 1 January 2018, compulsory social insurance will also apply to two additional groups of employees, namely:

(i) Employees working under labor contracts with a term of between full one (1) month and under three (3) months; and

(ii) Foreign employees working in Vietnam.

Although the application of the compulsory social insurance scheme to foreign employees working in Vietnam will be effective from 1 January 2018, to date there has been no adopted legislation to guide the application. We will keep you further updated when guiding legislation on social insurance applicable to foreign employees working in Vietnam is officially issued and when there is any regulations come into force which may effect businesses’ labor cost.

II. Technical Guidance from Social Insurance Authorities

The social insurance authorities of Hanoi and Ho Chi Minh City have recently issued a number of guiding regulations on various procedures related to social, health and unemployment insurance ("SHUI"), including:

Official Letter No. 2055/BXH-QLT dated 2 October 2017 by Ho Chi Minh City Social Insurance guiding the dossiers of retroactive collection of SHUI and occupational accident and disease insurance contributions. In the event of retroactive collection under a competent authority’s inspection conclusion or administrative sanction decision, employers must submit an electronic dossier in accordance with the template found in Form No. 601 enclosed with a scanned copy of the inspection conclusion or decision.

Official Letter No. 2424/BHXH-CST dated 20 November 2017 by Ho Chi Minh City Social Insurance on extension of health insurance cards according to social insurance codes in 2018. Under this Official Letter, from 1 December 2017, Ho Chi Minh City Social Insurance shall extend and print new health insurance cards for the year of 2018 according to the social insurance codes of all participants who have been granted codes.

For social insurance participants who have yet to be granted social insurance codes, employers are required to add their information into the List of participants yet to receive social insurance codes (Form MS1) and the Application of Participation and Amendment of Participants' Information (Form TK1-TS) for social insurance authority to complete the synchronization of social insurance codes and print new health insurance cards for them before 31 December 2017.

A social insurance code is a unique identifier issued to an individual, recording the process of his/her SHUI contributions and other entitled benefits, and is linked to the household data on the residential database of Vietnam Social Insurance.

For further information, please contact:

Thuy Hang Nguyen, Partner, Baker & McKenzie

thuyhang.nguyen@bakermckenzie.com