7 November, 2017

Recent developments

The Ministry of Planning and Investment (MPI) is drafting a decree to regulate investment in innovative start-ups (Draft Decree), which is expected to create a legal framework for funding start-ups as well as policies to promote and support this type of investment activity in Vietnam. The first draft of this new decree is now open for public comments on the MPI’s website.

In particular, the Draft Decree (i) stipulates the investment vehicles (i.e. venture capital funds and venture capital firms) that can provide funding to start-ups and (ii) sets out conditions to establish and operate a venture capital fund or a venture capital firm.

We set out the key points of the Draft Decree below.

Two Investment Vehicles for Venture Capital Funding

Under the Draft Decree, venture capital funding can take the form of one of the following investment vehicles:

i. Venture capital funds (VC Funds); or

ii. Venture capital firms (VC Firms)

VC Funds and VC Firms are defined as funds and companies that are established for the purpose of making investments in innovative start-ups. Both investment vehicles will be entitled to preferential treatment in terms of corporate income tax in accordance with the law on corporate income tax.

Both local and foreign investors are allowed to contribute capital into VC Funds and VC Firms. No foreign ownership limitation is currently imposed on VC Funds and VC Firms. However, the Draft Decree generally provides that "VC Funds and VC Firms having foreign investors must, during its course of investment, comply with relevant laws on foreign ownership limitation." This requirement suggests that VC Funds or VC Firms which are majority owned by foreign investors may be subject to certain market access restrictions/conditions if the target start-up operates in protected sectors.

Qualified Investors

In order to invest in a VC Fund or a VC Firm, investors must meet the following financial requirements (thereafter they will be considered a Qualified Investor):

i. For individuals:

have an average annual income of at least VND200 million (approximately US$8,800) in the two most recent years; or

have total assets (including his/her spouse's assets) after deducting all liabilities (including his/her spouse's liabilities) of at least VND500 million (approximately US$22,000).

ii. For institutional investors: have total assets of at least VND1 billion (approximately US$44,000) recorded in their latest financial statement.

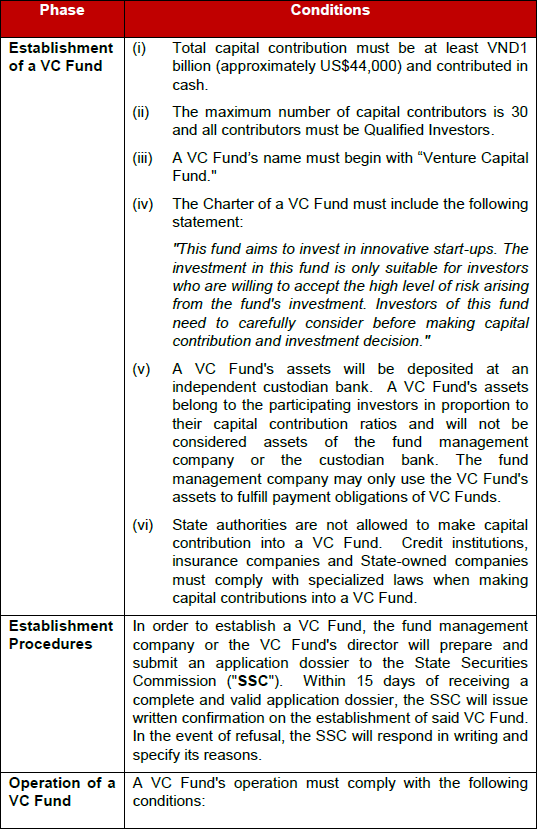

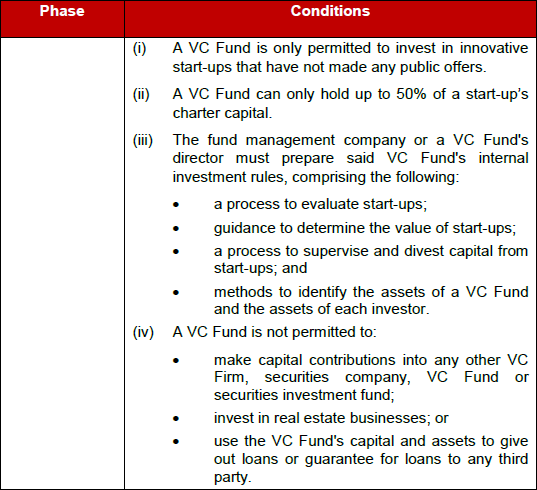

VC Funds – Conditions for establishment and operation

VC Funds are subject to the following establishment and operation conditions:

Please click on the tables to enlarge.

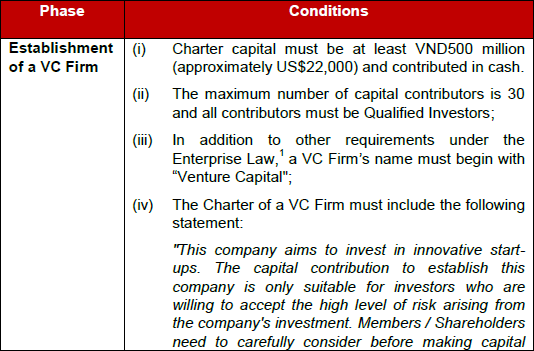

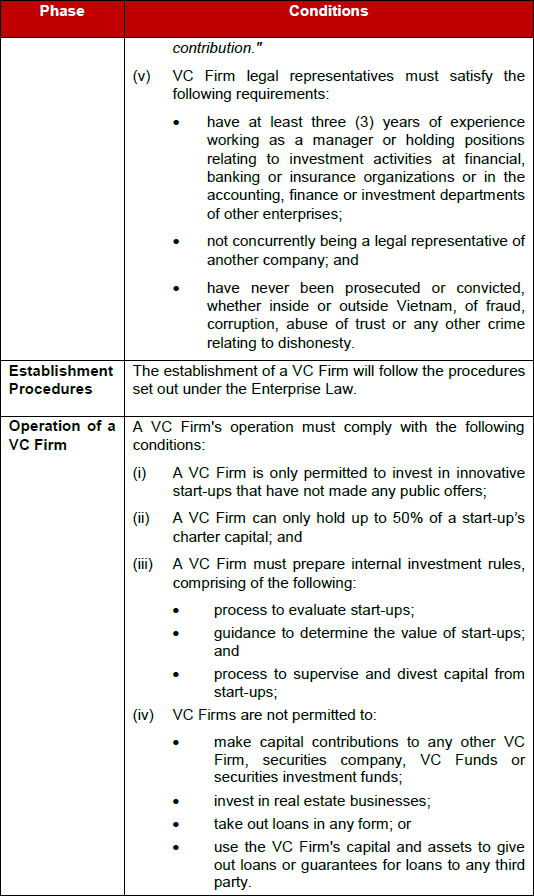

C Firms – Conditions for establishment and operation

VC Firms are subject to the following establishment and operation conditions:

Please click on the tables to enlarge.

Right to transfer

Investors of a VC Fund have the right to freely transfer capital contributions to a third party provided that (i) the transferee is a Qualified Investor and (ii) after the transfer, the VC Fund still maintains and satisfies all establishment conditions. Within 15 days after closing the transaction, the fund management company or the VC Fund's director must submit the following documents to the SSC:

I. notification on the transfer of capital contribution, specifying the information of the relevant parties, the ownership ratio of each party (before and after closing) and the value of the transaction; and

ii. a copy of the transfer agreement between the parties as certified by the fund management company or the VC Fund's director.

As for VC Firms, this Draft Decree is silent on the investors' right to transfer. In our view, VC Firm investors should be entitled to all the rights of members/shareholders as stipulated in the Enterprise Law, including the right to transfer their equity interests. The conditions and procedures for such transfer will, in such a case, follow the Enterprise Law and other laws on investment (if applicable).

For further information, please contact:

Thanh Son Dang, Partner, Baker McKenzie

thanhson.dang@bakermckenzie.com