18 June, 2015

More For Less.

A shareholder of Vietnamese joint stock company (JSC) will be able to generally control the company with a simple majority of 51%, unlike the statutory minimum of 65% currently. This change, set out in the new Enterprise Law effective from July 2015, comes at the same time as other favorable M&A regulations for foreign investors who seek to buy stakes in Vietnamese companies. The new regulations are expected to support the continued uptrend in M&A activity in Vietnam.

Voting Thresholds In A Shareholding Company

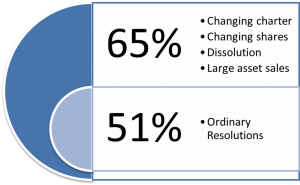

Under the new Enterprise Law, the statutory voting thresholds for a JSC’s general meeting of shareholders (GMS) will be lower:

- Quorum: 51% of voting shares (old law: 65%)

- 65% of the votes for special resolutions (old law: 75%)

- 51% of the votes for all other shareholder resolutions (old law: 65%)

A foreign investor will be able to generally control a JSC with only a 51% stake. It was impossible to do so in the past, absent voting preference shares or other voting arrangements of limited enforceability.

On the other hand, investors who relied on minority stakes (e.g., 25% or 35%) to block GMS resolutions should be alerted. They risk losing their “veto right,” if the company amends their voting thresholds to 65% and 51%.

The current cap for foreign investment into publicly-listed companies still stands at 49% (lower for financial institutions etc.). Those caps have long been expected to change to spur the stock market. However, raising the cap to say 65% would theoretically open the door to hostile takeovers of publicly-listed companies by foreign investors under the new law.

Voting Thresholds In A Limited Liability Company

Unlike in a JSC, 51% does not constitute a majority required for decisions in a limited liability company with multiple members (MLLC) under the current and the new Enterprise Law.

Statutory voting thresholds for members’ council resolutions in an MLLC:

- 75% for special resolutions

- 65% for ordinary resolutions

Note that in single-member limited liabilities companies, the above thresholds don’t matter, because there is only one investor. So long as there is no members’ council, most decisions can be unanimously made by the owner or chairperson.

Time To Amend Charters

As under the current law, the voting thresholds must be reflected in the company’s charter to become effective.

Investors interested in applying the new lower voting thresholds will need to reach consensus with other shareholders according to the decision-making rules contained in the relevant existing charters. In the vast majority of cases this means the GMS will still have to pass a special resolution with the current minimum required votes (at least 75%).

New investors should always check the target company’s constitutional documents with the help of competent legal counsel, before negotiating amendments and before closing deals.

For further information, please contact:

Giles T. Cooper, Partner, Duane Morris

gtcooper@duanemorris.com

Manfred Otto, Duane Morris

motto@duanemorris.com