Background

On March 20, 2024, the Insurance Regulatory and Development Authority of India (“IRDAI”) notified the IRDAI (Registration, Capital Structure, Transfer of Shares and Amalgamation of Insurers) Regulations, 2024 (“Registration and Capital Regulations”), which consolidated and rationalised the regulatory framework applicable on an Indian insurer in aspects, including listing on a stock exchange pursuant to an initial public offer (“IPO”) that may consist of a fresh issue of equity shares or an offer for sale. Our detailed analysis on the other aspects of Registration and Capital Regulations can be found here.

The issue/ transfer of shares by an Indian insurer pursuant to an IPO was initially governed by the IRDAI (Issuance of Capital by Indian Insurance Companies transacting Life Insurance business) Regulations, 2015, and the IRDAI (Issuance of Capital by Indian Insurance Companies transacting other than Life Insurance business) Regulations, 2015, for life insurers and general insurers, respectively (collectively, the “Issuance of Capital Regulations”). The Issuance of Capital Regulations have been repealed by the Registration and Capital Regulations. Currently, the IRDAI-prescribed requirements for IPOs and listing of Indian insurers are covered under the Registration and Capital Regulations, read with the Master Circular on Registration, Capital Structure, Transfer of Shares and Amalgamation of Insurers, 2024, issued by the IRDAI on May 15, 2024 (“2024 Master Circular”).

In this blog, we have analysed the key changes to the regulatory framework applicable on listing of an Indian insurer, under the Registration and Capital Regulations, the impact of such changes on Indian insurers and whether these changes may encourage listing of Indian insurers on stock exchanges.

Salient Differences of the Registration and Capital Regulations vis-à-vis the Issuance of Capital Regulations

Under the Registration and Capital Regulations, the compliance requirements of an insurer for undertaking an IPO and listing on stock exchanges, have undergone extensive changes such that the IRDAI has minimal regulatory intervention in connection with the IPO. The key changes are discussed in detail below:

Listing of equity shares on stock exchanges recognised by International Financial Services Centres Authority (“IFSCA”)

Under the IFSCA (Issuance and Listing of Securities) Regulations, 2021 (“IFSCA Issuance and Listing Regulations”), an entity incorporated in India can list on stock exchanges recognised by the IFSCA.[1] Further, an insurance company registered with the IRDAI can undertake insurance in the International Financial Services Centre (GIFT City) if it is registered with the IFSCA.[2] For more details on the insurance landscape in IFSC, please see our analysis here.

However, previously, under the Issuance of Capital Regulations, an insurer could only undertake an IPO and list on stock exchanges recognised by the Securities and Exchange Board of India (“SEBI”) (viz., BSE Limited and National Stock Exchange of India Limited), pursuant to the SEBI (Issue of Capital and Disclosure Requirements) Regulations, 2018 (“SEBI ICDR Regulations”). Therefore, the IRDAI framework did not permit an insurer (registered with IRDAI and engaging in insurance business in India) to list its equity shares in stock exchanges recognised by the IFSCA.

Under the Registration and Capital Regulations, this restriction has been lifted since Regulation 29 of the Registration and Capital Regulations uses the inclusive term ‘financial sector regulator’, thereby allowing Indian insurers to list their equity shares on stock exchanges recognised by SEBI and the IFSCA. Therefore, the requirements prescribed under Regulation 29, read with the 2024 Master Circular will be applicable to insurers listing on stock exchanges recognised by the IFSCA as well, in the manner detailed below in paragraph 2.

Simplification of IRDAI Approval Requirement

The IRDAI, vide theRegistration and Capital Regulations, has done away with the requirement of seeking prior IRDAI approval for an IPO, and replaced it with the requirement to seek IRDAI approval under Section 6A(4) of the Insurance Act, 1938 (“Insurance Act”), only for the issue and/ or transfer of equity shares in excess of the specified thresholds, pursuant to the IPO. IRDAI approval is required to be sought in the format of Form IRDAI/ ToS (provided under the 2024 Master Circular), which is applicable for all other issuances and transfers in excess of the limits prescribed under Section 6A(4) of the Insurance Act. Further, in terms of the proviso to Regulation 29(5) of the Registration and Capital Regulations, the insurer is specifically exempted from providing transferee/ allottee details if such form is being filed in connection with IPO and listing.[3] Although the exposure draft of the Registration and Capital Regulations suggested that an insurer could approach the relevant financial sector regulator for filing the offer documents once an application seeking IRDAI approval under Section 6A(4) of the Insurance Act is made[4], in terms of Regulation 29(5) of the Registration and Capital Regulations, it is clear that prior IRDAI approval under Section 6A(4) of the Insurance Act is required before initiating any filings with the relevant financial sector regulator for listing.

These rationalisation measures provide substantial relaxation to insurers in comparison to the approval required under the erstwhile Issuance of Capital Regulations, which mandated prior IRDAI approval for IPO and required insurers to submit a host of information, along with applications such as detailed information on the insurer’s financial and solvency position, expenses of management and number of customer complaints and other business performance parameters. In addition, insurers were required to furnish declarations and undertaking on compliance with the Guidelines for Corporate Governance for insurers in India issued by the IRDAI on May 18, 2016 (“2016 CG Guidelines”), and compliance with Indian Insurance Companies (Foreign Investment) Rules, 2015 (“2015 FI Rules”).

Principle based approach vis-a-vis grounds of consideration to be adopted by IRDAI

The Registration and Capital Regulations prescribe principle-based regulations for seeking IRDAI approval for IPO and listing of an insurer. Thus, the checklist-based approach provided under the Issuance of Capital Regulations, has been replaced with a principle-based approach in the Registration and Capital Regulations.

The framework under the previous regime specified grounds for the IRDAI to consider while granting approval as discussed in detail in paragraph 2 above.[5] In any case, IRDAI already possesses such information of all insurers. Therefore, the benefit of omitting the list of grounds, that may be considered by the IRDAI for providing approval, is twofold:

- For the insurer: Insurers will be relieved as they no longer have to provide all the abovementioned information at the time of seeking IRDAI approval.

- For the IRDAI: IRDAI burden will be reduced as it won’t have to scrutinise each IPO application, prompting administrative efficiency, which in turn may improve the turnaround time for issuing the approval, which we expect to be approximately four weeks (as opposed to 8-10 weeks under the erstwhile regime). The IRDAI now retains complete discretion on the parameters to be assessed to provide approval to an insurer and can ask for only such information as it deems necessary for processing the application, rather than having to review bulky documentation for each application.

Lock-in applicable on allottee/ transferee in connection with IPO

The 2023 Master Circular provided that no lock-in would be applicable to entities investing in a listed insurance company. Further, the IRDAI had the power to waive-off lock-in for specific insurers to enable it to list, on a case-to-case basis. However, in the absence of the IRDAI granting such waiver, a peculiar inconsistency was created. It resulted in the equity shares allotted/ transferred, pursuant to an IPO, being subject to a lock-in period since the shares allotted/ transferred were of an unlisted insurance company on the date of allotment/ transfer and prior to the insurance company getting listed on the stock exchanges. Therefore, the exemption from lock-in applicable on listed insurers were not applicable on such shares on the date of allotment/ transfer pursuant to the IPO.

This anomaly has been rectified in the 2024 Master Circular, which categorically exempts equity shares allotted/ transferred in accordance with offer documents filed with the SEBI/ IFSCA in connection with the IPO. Further, the Registration and Capital Regulations reaffirm that lock-in will not be applicable for investment in listed insurers.[6]

Disclosure requirements in the DRHP

The Issuance of Capital Regulations prescribed elaborate disclosure requirements to be made in the offer document, in addition to those prescribed under the SEBI ICDR Regulations, including vis-à-vis specific risk factors, financial statements, information in relation to the issue and the issuer. Under the Registration and Capital Regulations, the IRDAI has not prescribed any disclosure requirements for offer document(s) to be filed in connection to the IPO, indicating that insurers will be guided by regulations issued by the concerned financial sector regulator (i.e., SEBI/ IFSCA) in this regard.

Procedure for listing:

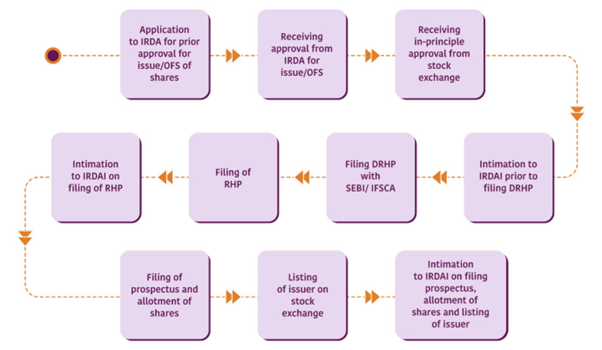

Presently, the steps to be undertaken by an Indian company, including an Indian insurer, in respect of an IPO and subsequent listing, is primarily governed by the SEBI ICDR Regulations (for listing on SEBI recognised stock exchanges) and the IFSCA Issuance and Listing Regulations (for listing on IFSCA recognised stock exchanges ). The IRDAI has supplemented this for Indian insurers through requirements provided under the Registration and Capital Regulations. The key ones are:

- Approval from IRDAI before approaching SEBI or the IFSCA for issuing/ transferring equity shares pursuant to an IPO;

- IRDAI to be intimated at least 15 days prior to filing of the offer document with SEBI/ IFSCA; and

- IRDAI to be intimated regarding all subsequent developments in connection with the IPO and listing of the insurer.

The key actions to be sequentially undertaken in relation to an IPO and listing by an Indian insurer are set out below.

Concluding Remarks

The IRDAI has adopted a principle-based approach, in line with the mandate of the Regulation Review Committee, formed for the purpose of revising the applicable regulatory framework, such that the process of IPO approval and listing of an insurer is substantially rationalised and relaxed. The new streamlined regulatory framework also helps to reduce the burden on both, the regulator and the regulated entity in terms of ensuring/ assessing compliances. Further, it is commendable that the new Regulations have increased the avenues available to Indian insurers to raise capital by enabling listing on IFSCA recognised stock exchanges.

The current regulatory regime provides soft-incentives to insurers to list, in the form of simplified application process, no lock-in on shares, deemed approval for transfer of up to five percent, reduced minimum promoter holding requirement and a streamlined listing approval process. Better standards of corporate governance and creating a roadmap for insurers to become less promoter-dependent appear to be the objective behind nudging insurers to undertake initial public offerings. Subject to market conditions and strategic interests of joint venture partners of insurance companies, it is likely that Indian insurers will favourably consider the idea of going public in the foreseeable future.

[1] Regulation 6 of the IFSCA (Issuance and Listing of Securities) Regulations, 2021.

[2] Regulation 5 of the IFSCA (Registration of Insurance Business) Regulations, 2021.

[3] Regulation 29(5) of the Registration and Capital Regulations states:

“The insurer shall have obtained prior approval for transfer of shares for offer for sale and/or fresh issuance of shares, as may be required vide section 6A of the Act read with Regulation 21 of these regulations:

Provided that the submission of the details of transferee shall not be mandatory.”

[4] Regulation 28(5) of the exposure draft of the Registration and Capital Regulations provided as follows:

“The insurer shall seek approval for transfer of shares for offer for sale and/or fresh issuance of shares, as may be required vide section 6A of the Act read with Regulation 19 of these Regulations.

Provided that the submission of the details of transferee shall not be mandatory.”

[5] Regulation 5 of the Issuance of Capital Regulations.

[6] Regulation 8(1) of the Registration and Capital Regulations states:

“Equity shares of an insurer having its shares listed on any stock exchange(s) recognized in India shall not be subject to lock-in.”