The China Securities Regulatory Commission (“CSRC“) have twice solicited for public comment on the “Measures for the Supervision and Administration of Derivatives Trading” (“Derivatives Measures“), on March 17, 2023, and on November 17, 2023. Chapter 3 of the Derivatives Measures responds to the misuse of derivative transaction for violations and the circumvention of regulations in practice, and prohibits such activities. In particular, Article 19 in Chapter 3 prohibits the use of derivative transaction to circumvent restrictions on share reduction and lock-up rules. Article 21 prohibits derivative operating institutions from engaging in derivative transaction with shareholders holding more than five percent of a listed company’s shares, and the actual controllers, directors, supervisors, senior management personnel, or shareholders whose shares are subject to lock-up or reduction restrictions, using the listed company’s stock as the underlying assets in the contract. In the Drafting Statement of the second solicitation for public comments, the CSRC emphasized its plan to prohibit illegal securities and futures market activities and the circumvention of regulations by means of derivative transaction through Chapter 3 of the Derivatives Measures, aiming to fill any regulatory gaps.

On March 17, 2023, shortly after the first solicitation for public comment on the Derivatives Measures, the CSRC initiated an investigation into a case involving the actual controller of a listed company using derivative transaction to circumvent reduction restrictions and engage in private placement arbitrage. On April 30, 2024, the CSRC issued significant fines to the concerned securities broker and its clients. Although the CSRC’s punishment in this case was targeted at the actual controller’s circumvention of share reduction restrictions, the determination that the purpose of the derivative transaction arrangements was to circumvent regulations stemmed from the “see-through” principle. This indicates that although the formal issuance of the Derivatives Measures is still pending, the CSRC can apply the “see-through” principle to determine the trading purpose of derivative transactions and penalize the parties involved for circumventing the lock-up period regulations.

This article provides a brief analysis and summary of the case. We advise that foreign institutional investors pay attention to this significant regulatory development.

Case Summary (Main Content Only):

Key Parties Involved:

WZL: A natural person, and the actual controller of a listed company (“ZHTB”)

HHW: A natural person, and a friend of WZL

X Investment Company: An investment company controlled by WZL

Fund No. 1: A private fund controlled by HHW

HYC: A natural person, the executor of the private placement arbitrage scheme and responsible for liaising with A and B

A: A subsidiary of a futures company which is also a wholly-owned subsidiary of B

B: A securities company

C: Another securities company

Case Briefing (as disclosed in the CSRC Penalty):

1. The Proposal of a Private Placement Arbitrage Scheme by A to WZL

In July 2022, ZHTB’s application for a non-public issuance of A-shares was approved by the CSRC. From July to August 2022, A proposed a private placement long-short arbitrage scheme to WZL. According to A’s proposal, WZL could achieve the so-called private placement long-short arbitrage through over-the-counter (OTC) derivative trading, allowing for early settlement of the relevant transactions and realizing profits without waiting for the six-month lock-up period applicable to private placement subscribers. This meant that the invested funds and returns could be recovered in a month or so.

2. Joint Implementation of the Private Placement Arbitrage Scheme

From September 2022 to February 2023, the parties jointly implemented the scheme.

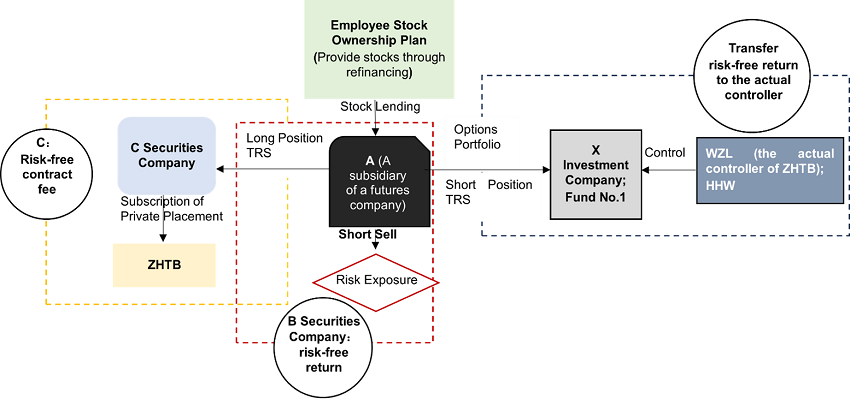

In September 2022, WZL decided to proceed with the private placement arbitrage scheme by directing ZHTB’s employee stock ownership plan to lend shares and conduct OTC derivative transactions with A in the name of X Investment Company. HYC executed the arbitrage scheme and liaised with A and B.

From September 2022 to February 2023, WZL, HYC, A and B discussed the private placement stock borrowing and lending arbitrage business. They agreed that ZHTB’s employee stock ownership plan would lend 88 million ZHTB shares through stock refinancing. A would designate four private fund product accounts for the stock borrowing and lending hedging of ZHTB shares, and B would formulate the stock borrowing and lending plan.

In November 2022, A had preliminary discussions with C about a total return swap (TRS) linked to ZHTB’s non-public issuance of shares.

In December 2022, A internally approved an application for OTC derivative transactions linked to approximately 88 million shares of ZHTB’s non-public issuance. That month, a report from A to B was internally approved regarding “ an application for A to conduct OTC options with the investment company linked to restricted shares of ZHTB with a notional principal of RMB 600 million”.

In February 2023, due to insufficient subscription funds from X Investment Company, WZL suggested his friend HHW join the private placement stock lending arbitrage transaction of ZHTB to fully utilize the stock lending quota. HHW participated and conducted OTC derivative transactions with A in the name of Fund No. 1.

From February 8 to February 10, 2023, C, after internal approval, included ZHTB stock in the derivative business candidate list and completed the company seal approval process for ZHTB’s non-public issuance subscription documents. On February 10, 2023, C participated in the first round of pricing for ZHTB’s non-public issuance according to A’s instructed price and subscription amount. The issuance price determined on that day was RMB 5.92 per share.

On February 16, 2023, C signed a share subscription agreement for ZHTB’s non-public issuance of shares and reached a long position TRS agreement with A linked to ZHTB stock. This was for the notional principal of RMB 532 million, corresponding to 89.8649 million shares, fully margined by A. On the same day, X Investment Company reached a vanilla options portfolio contract with A linked to ZHTB stock, with a notional principal of RMB 426 million, corresponding to 71.9595 million shares; Fund No. 1 reached a vanilla options portfolio contract with A linked to ZHTB stock, with a notional principal of RMB 89.0398 million, corresponding to 15.0405 million shares.

From February 6 to February 20, 2023, X Investment Company reached a short position TRS linked to ZHTB stock with A, with an opening position of 71.9595 million shares, corresponding to a notional principal of RMB 548 million. From February 10 to February 20, 2023, Fund No. 1 reached multiple short position TRS with A, with an opening position of 15.0405 million shares, corresponding to a notional principal of RMB 114 million.

From February 6 to February 14, 2023, ZHTB’s employee stock ownership plan distributed 88 million ZHTB shares to four private fund product accounts according to A’s designated path, with the lending period extended to September 2023 through renewals and refinancing.

From February 13 to February 21, 2023, the four private fund product accounts sold 88 million ZHTB shares through stock lending, with an average selling price of approximately RMB 7.63 per share and a transaction amount of around RMB 671 million.

WZL did not inform the listed company of his actual participation in the non-public issuance through these transaction arrangements. On February 24 and March 3, 2023, ZHTB announced the issuance report for the private placement of A-shares, stating that there was no direct or indirect participation by the issuer’s actual controller in the subscription of this issuance.

3. Closing and Settlement of the Private Placement Arbitrage

On March 9, 2023, ZHTB announced the listing of the non-publicly issued shares, with a lock-up period from March 9, 2023, to September 8, 2023. From March 17 to April 6, 2023, X Investment Company and Fund No. 1 applied to Company A for early termination of all long vanilla option contracts and short TRS contracts. Company A closed the relevant positions and settled the amounts.

4. CSRC’s Determination and Penalties

WZL and HHW were found to have participated in the private placement through derivative transactions, selling shares short at market price, locking in the price difference in advance between the discounted price of the private placement shares and the market price, and circumventing the lock-up period regulations in a disguised legitimate form. Company A was found to have proposed the arbitrage scheme, suggested the deal structure and provided leveraged capital support for WZL and HHW in violation of the restrictive stock transfer regulations. Company B was found to have knowingly provided stock lending services to facilitate the private placement arbitrage. Company C, by subscribing to ZHTB’s private placement shares in its name according to A’s pricing instructions, objectively helped A and its clients (WZL and HHW) obtain stock gains, thereby enabling an arbitrage in a private placement deal.

The CSRC decisions were:

(1) Confiscation of Illegal Gains: Total confiscation amount: RMB 77,531,959.84 ; WZL: RMB 60,637,954.37; HHW: RMB 14,193,879.43; B securities company: RMB 1,910,680.83; C securities company: RMB 789,445.21;

(2) Fines for Joint Violation of Restrictive Regulations on Stock Transfers: Total fine: RMB 120 million. Respective proportion of fines: WZL: 50%; Company A: 30%; Company B: 15%; Company C: 4.5%, HYC: 0.5%;

(3) Additional Fines for Violating Restrictive Transfer Regulations: Total fine: RMB 35 million. Respective proportion of fines: WZL: 30%; Company A: 30%; HHW: 20%; Company B: 15%; Company C: 4.5%, HYC: 0.5%.

(4) Fines for Information Disclosure Violation by WZL: RMB 2 million.

Takeaways of This Case – Our Observations From A Foreign Institutional Investor Perspective

- The Key is to ensure compliance with derivative transaction purposes. Before concluding derivative transactions, investors should assess the legality and compliance of the entire deal structure to ensure that the reasons for the derivative transactions are legitimate and compliant.

- The CSRC exercises discretion in determining the purpose of the derivative transactions under the “see-through” principle. Investors should be aware that regardless of whether the Derivatives Measures are formally implemented, the CSRC will apply the “see-through” principle to supervise and regulate derivative transactions. The CSRC could determine the purpose of the transactions based on the substance of the overall arrangement, regardless of the complexity of the structure or the number of parties involved. In this case, X Investment Company and Fund No. 1 were identified as controlled by WZL and HHW respectively, but the penalty decision did not disclose much detail of this determination, including how the CSRC identified the control relationships. This indicates that the CSRC may consider all the relevant facts and evidence to determine the control relationships when investigating and judging the case, but may not elaborate on this in the penalty decision.

- There might be an expansion of the scope of the prohibitive regulations. Investors should monitor and be mindful of the applicable prohibitive or restrictive rules and regulations. From a strictly legal perspective, the prohibitive or restrictive provisions should be limited to those existing in laws or administrative regulations, but we note that Chapter 3 of the Derivatives Measures expands the scope of the prohibitive provisions. Behavior that intentionally bypasses or circumvents regulations using derivative transaction could fall under the prohibitions listed in Chapter 3 of the Derivatives Measures. Investors should stay informed of the PRC prohibitive or restrictive rules and regulations, regardless of their level of legal authority.

- Securities broker’s solicitation and the arrangement of deals does not necessarily reduce or exempt a client’s liability and they may bear joint liability with their clients. The fact that a securities broker proposes a deal to a client (investor) does not reduce or exempt the client from liability. CSRC penalties could be imposed not only on the investor but also the securities brokers and the related parties, with fines apportioned according to the degree of fault.

- The CSRC intends to impose large penalty amounts to alert the entire market. Since the implementation of the amended Securities Law in 2019, the CSRC has significantly increased penalties. Monetary penalties from the CSRC includes not only the confiscation of illegal gains but also fines. Even if there are no illegal gains or the illegal gains are insignificant, the CSRC could use its discretion to decide the total fine amount based on the severity of the violation.