The year 2024 saw 105 public takeovers implemented through the tender offer route under the Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations, 2011 (Takeover Regulations). The number of takeovers were 24% higher than the number of takeovers in CY23 (85 in all). The aggregate transaction size (i.e. the aggregate size of the underlying negotiated deal and tender offer) of the takeovers announced in CY24 was INR 705.89 billion, i.e. 158% higher than that of the takeovers announced in CY23 (i.e. INR 274.27 billion). Primarily, the deal activity in CY24 was driven by domestic strategic acquirers. Foreigners executed 11 deals in this space, which was substantially higher than in CY23 (being 3).

While the Indian (stock markets) indices reached a record high in September 2024, the buyers and sellers were able to bridge their valuation expectations to consummate their deals, often agreed at prices below the prevailing market price. In CY24, Indian conglomerates were active in the M&A space, with acquisitions or mergers of companies within the same sector or allied sectors, viz. the Tata Group’s merger of Air India and Vistara airlines; the Adani Groups’ (through Ambuja Cements and ACC) acquisition of cement companies, namely Orient Cement and Penna Cement, and its entry into the EPC business through the acquisition of ITD Cementation and PSP Projects; the Bosch Group’s acquisition of Johnson Controls-Hitachi Air Conditioning; and Coforge’s acquisition of Cigniti Technologies. Some conglomerates also streamlined operations by demerging their businesses into separate verticals for business efficiency – ITC’s demerger of its hotels business; Tata Motor’s demerger of its commercial vehicles segment; and Vedanta’s demerger into six (6) independent entities. Some exits by Indian conglomerates included Adani Group’s complete exit from its joint venture Adani Wilmar, which was one of the largest deals in the FMCG sector.

The Indian IPO market saw heavy activity in CY24, where the volume of Indian IPOs (332 IPOs) trumped the global markets. The country also witnessed the largest Indian IPO by Hyundai Motors India. Many PE players took the opportunity to exit their long-term investments in listed Indian companies through IPOs and public market sales, whereas others took the opportunity to enter new investments through direct PE-to-PE acquisitions. While PE players did not launch many takeovers in the listed space because of very high valuation expectations, given the stock market performance, we expect them to launch a higher number of takeovers when these prices settle, given their overall interest in publicly traded companies.

In this blog, we have focused on the key highlights of CY24. We will also be releasing a detailed report shortly, analysing CY24 deal activities and comparing it to the deal activities of CY22 and CY23. The report will have greater details of public takeover activity of CY24 than the ones covered in this blog post.

Analysis of sector-wise activity

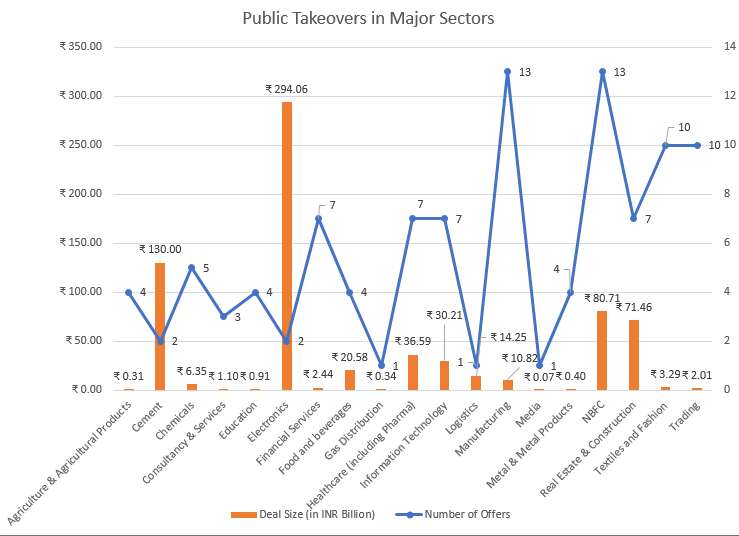

In value terms, the electronic sector saw the largest takeover at an aggregate deal size of INR 294.06 billion, followed by INR 130 billion in the cement sector, and INR 80.71 billion in the NBFC sector. In number terms, NBFC and manufacturing sectors saw the highest number of deals at thirteen (13) each, followed by ten (10) in textiles and fashion sector; and seven (7) each in the following sectors: real estate and construction, IT, healthcare (including pharma) and financial services sectors. In CY24, the five biggest takeovers by value were for companies operating in the following sectors: (i) Electronic sector – acquisition of Johnson Controls-Hitachi Air Conditioning India Limited by Bosch Group; (ii) Cement sector – acquisition of The India Cements Limited by Aditya Birla Group; (iii) NBFC sector – acquisition of Aavas Financiers Limited by CVC Capital; (iv) Cement sector – acquisition of Orient Cement Limited by Adani Group; and (v) Real estate and construction sector – acquisition of ITD Cementation India Limited by Adani Group. These five deals made up for 78.27% of the aggregate transaction value of all deals in CY24.

The following graph shows in number and value terms the offers in major sectors in CY24:

CY24 versus CY23

| Calendar year | 2024 | 2023 |

| Number of takeovers | 105 | 85 |

| Completed tender offers (tender offers that were launched and completed in the same calendar year) | 65 | 47 |

| Number of direct tender offers | 100 | 85 |

| Number of indirect tender offers | 5 | 0 |

| Number of tender offers made due to breach of 5 per cent creeping acquisition limit | 5 | 5 |

| Total deal value | INR 705.89 billion | INR 273.64 billion |

| Number of deals in the NBFC sector | 13 | 16 |

| Number of deals where underlying transaction was closed (whole or in part) before closure of the tender offer | 15 | 9 |

Other significant highlights of CY24

- Pricing analysis: Takeover Regulations do not mandate fixing the deal price. However, these mandate the minimum price the acquirer needs to offer public shareholders. In CY24: (i) in 87 takeovers, the price offered to public shareholders was higher than the 60 day VWAP (for frequently traded shares) or the fair value (for infrequently traded shares) (Minimum Price); (ii) in 15 takeovers, the price offered was the same as the Minimum Price; (iii) in 57 takeovers, the negotiated deal price was higher than the Minimum Price; (iv) in 10 takeovers, the negotiated deal price was equal to the Minimum Price; and (v) in 31 takeovers, the negotiated deal price was lower than the Minimum Price.

- Deal size analysis: The biggest deal by value was the acquisition of Johnson Controls-Hitachi Air Conditioning India Limited by Bosch Group for INR 294.05 billion approximately, and the smallest was for the acquisition of Supra Industrial Resources Limited, for INR 7.16 lakh, approximately. The other large acquisitions were – The India Cements Limited (INR 70.97 billion, approx.), Aavas Financiers Limited (INR 70.89 billion, approx.), Orient Cement Limited (INR 59.03 billion, approx.) and ITD Cementation India Limited (INR 57.58 billion, approx.).

- Deal activity during the year: The first half of CY24 saw the announcement of smaller deals, whereas the second half saw an uptick in “large-deal” activity and the number of deals. The number of takeovers (56) announced during the second half of CY24 was higher than in the first half of CY24 (49) and the aggregate value of deals announced in the second half of CY24 (INR 632.09 billion) was substantially higher than in the first half of CY24 (INR 73.80 billion).

- Foreign vs. Indian acquirers: Non-residents announced eleven (11) public takeovers in CY24. The aggregate value of such deals was INR 464.83 billion, which constituted 65.85% of the aggregate value of all takeovers in CY24. The aggregate value of deals announced by non-residents in CY24 was higher than in CY23 (by 384%).

- Time taken by SEBI to clear DLOF: In CY24, SEBI took an average of 81 days to issue observations on DLOFs, with the longest being 158 days and the shortest being 40 days. The average time taken by SEBI to clear the tender offers in CY24 was higher than the time taken in CY23.

- Offer by financial investor: CY24 saw four takeovers announced by a PE/ financial investors, i.e. for the acquisition of (i) Aavas Financiers Limited (NBFC sector) by CVC Capital Partners; (ii) Sanofi Consumer Healthcare India Limited (healthcare sector) by CD&R Group; (iii) Windsor Machines Limited (manufacturing sector) by Plutus Investments and Holdings; and (iv) Agro Tech Foods Limited (food and food processing sector) by Samara Capital.

- Two Tender Offers in the Same Year for LKP Finance Limited: Muffin Green Finance and Mr. Kapil Garg launched the first deal to buy LKP Finance in February 2024. However, the acquisition could not proceed as the RBI returned the application for change of control due to the existence of more than one NBFC in the acquirer group. In August 2024, Hindon Mercantile Limited and Mr. Kapil Garg launched a second attempt to acquire LKP Finance.

- Voting Rights of Preference Shares in Indian Radiators Limited: The acquirer had held cumulative redeemable preference shares of the target company before the underlying transaction. As the target company failed to pay dividend on these preference shares, in accordance with Section 47(2) of the Companies Act, 2013, voting rights had accrued to the acquirer. However, since the acquirer had failed to file the required reports under Regulation 10(7) of the Takeover Regulations, it was considered as an open-offer trigger, which required the acquirer to pay additional interest on the offer price.

- Composite Offer for Manphool Exports Limited: The acquirer launched a composite offer (i.e., tender offer with a delisting offer) to acquire the control of Manphool Exports and delist the company from the Calcutta Stock Exchange – the sole stock exchange where this company is still listed.

Year 2025

M&A activity in CY25 is likely to continue being robust and focus on energy transition and electrification, healthcare (including pharmaceuticals), infrastructure, fintech, and IT (largely AI driven). Indian conglomerates will continue their spree of horizontal and vertical integration, spurring M&A activity in the coming year.

Fund raising and IPOs are expected to continue their strong showing in CY25, with companies gearing up for their IPO, such as Reliance Jio, which is expected to be the largest Indian IPO. We expect increasing number of PE players using this opportunity to exit their long-term investments through these IPOs or subsequent market sales.

In line with the rising trend of NPAs in retail and micro-finance loans for Indian banks being put up for sale, IndusInd Bank has put up INR 1,573 crore worth of NPAs in its MFI loan portfolio for sale. We also expect an uptick in stress assets related M&A in CY25.