Initial Public Offerings In Malaysia: What Companies Need To Know.

Introduction

“Going public” – when a private company wishes to sell shares to the investors in the public for the first time, it undergoes an Initial Public Offering (“IPO”) process in order to transition from a privately-owned establishment to a publicly-operated entity. For a company to offer IPOs, corporate lawyers must be appointed along with an investment bank to underwrite the offer. The actual sale of the shares is generally offered by the stock exchange or by regulators.[1] In Malaysia, the Securities Commission Malaysia (“SC”) is in charge of approving IPO applications in accordance with securities laws. Whereas Bursa Malaysia is the main stock exchange that regulates and sets out the procedure for listing. According to Malaysian law, it is a requirement under Section 58 of the Capital Markets and Services Act 2007 (“CMSA 2007”) for businesses seeking to engage in IPO to obtain a valid Capital Market Services License (“CMSL”) from the SC.[2]

The Current Market in 2025

Bursa Malaysia’s target of 60 listings for 2025 started on track with Malaysia leading Southeast Asia’s IPO performance in the opening half of the year. Deloitte reported an approximate 48% year on year increase in the amount of listings, with values raised by approximately 109% to US$940 million and a total IPO market capitalisation by approximately 165% to US$4.04 billion.[3]

Notably, Oriental Kopi Holdings, which listed on 23 January 2025 via the ACE Market on Bursa Malaysia,[4] began with its public portion of the IPO being oversubscribed over 60 times, along with an estimated market capitalisation of RM880 million upon listing, 20 times its financial year (“FY”) 2024 earnings. This may be partly due to their highly attractive FY2024 net profit margin of 15.6%. Additionally, Malacca Securities notes new outlets generally receive a payback period within 10 to 12 months of opening.[5]

However, in the month of March, there was a decline in share prices for newly listed companies such as Saliran Group BHD, which suffered from a 22.2% closing share price of 21 cent compared to its IPO price of 27 cent on 13th of March 2025.[6] This decline may be due to weak investor sentiment caused by United States President Donald Trump’s tariffs, amongst other challenges. Stephen Bates, partner and head of deal advisory in KPMG Singapore notes that “New tariffs, the ongoing US-China trade decoupling and supply chain disruptions create IPO delays and valuation challenges.”[7] The unpredictability of the market due to trade tensions and an unstable geopolitical environment may cause difficulties for companies to prepare for an IPO. Specifically, it may discourage smaller businesses in less established markets to list.

Nevertheless, many remain positive as Malaysia has grounded itself as the 12th easiest place to establish a business according to the World Bank.[8] Despite uncertain market conditions, structured listing frameworks provided by Bursa Malaysia along with strong regulations and government incentives to provide opportunities for smaller businesses through the Access, Certainty, Efficiency (“ACE”) Market and Leading Entrepreneur Accelerator Platform (“LEAP”) Market has curbed these challenges, keeping Malaysia in the lead within the region’s IPO market.

As Mohd Afzanizam Abdul Rashid, from Bank Muamalat Malaysia Berhad affirmed:

“While the market condition is part of the consideration for the IPO, there are also other factors such as capital structure, ownership goals, corporate readiness, strategic goals and regulatory environment.”[9]

The 3 Markets

There are three listing platforms offered by Bursa Malaysia: Main Market, ACE Market and the LEAP Market.[10]

a. Main Market

For established companies that have achieved the minimum profit track record or minimum size based on market capitalisation measures or have the right to establish an infrastructure project.

Issuers intending to list on this market are required to fulfil any one of the following tests:

(i) Profit Test[11]

- Three to five full financials years of consistent profit with at least a RM20 million combined after-tax profit with the recent financial year of at least RM6 million; and

- Issuer or corporation in the group contributing the single largest after-tax profits in the last three full financial years must have been operating in the same core business throughout at least the last three to five financial years.

(ii) Market Capitalisation Test[12]

- Upon listing, the applicant’s ordinary shares must have a total market capitalisation of at least RM500 million based on the issue or offer price as stated in the prospectus and the enlarged issued share capital; and

- The issuer or corporation within the group representing the core business must have been incorporated and generated operating revenue for at least one full financial year based on audited financial statements prior to submission to the SC.

(iii) Infrastructure Project Corporation Test[13]

- The right to build and operate an infrastructure project, whether located in Malaysia or outside Malaysia with project costs of not less than RM500 million;

- A government/state agency in or outside Malaysia must award a concession/licence for the project, with a remaining concession/licence period of at least fifteen years from the date of SC submission; and

- If the applicant satisfies the Profit Test requirements, the SC may consider the listing proposal by an applicant with a shorter remaining concession/licence period.

b. ACE Market

A Sponsor-led market aimed at companies with strong growth prospects. Bursa Malaysia essentially relies on a principal adviser who acts as a Sponsor to determine whether a company’s business prospects are suitable for listing on the ACE Market.[14] Therefore, Sponsors are responsible for assessing the suitability of prospective issuers by considering factors such as their business outlook, corporate governance, and the effectiveness of their internal controls.

Unlike the Main Market, it has no minimum operating track record or profit requirement. However, companies listed on the ACE Market can eventually transfer to the Main Market provided they achieve the profit track record required for the Main Market.[15]

ACE Market Listing Requirements include:[16]

- visible growth prospects and timeline for the foreseeable future;

- efficient leadership team consisting of directors and manager;

- strict compliance to the relevant regulations through adequate systems, procedures, policies, rules and resources;

- a risk management system to control the company’s business and growth schemes; and

- good corporate governance and track record with no conflict of interest situation within the company.

c. LEAP Market

Advisor-driven market for small to medium sized companies that allows a greater access to raise funds in the capital market. It is accessible only to sophisticated investors, namely accredited investors or high net-worth individuals and is subject to the LEAP Market Listing Requirements, along with the CMSA 2007.

Like the ACE Market, it has no minimum operating track record or profit requirement.

The Listing Process

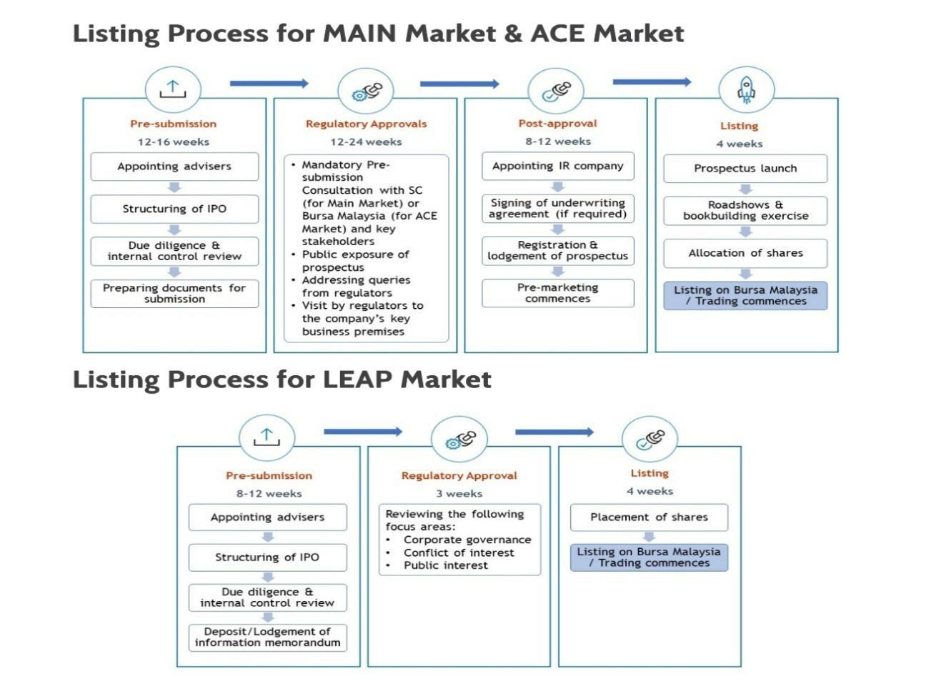

The listing process will generally take four to twelve months, depending on the size and complexity of the listing scheme. Upon approval, a company will have six months to complete the IPO exercise. The timeline of the listing process for each market is illustrated below:[17]

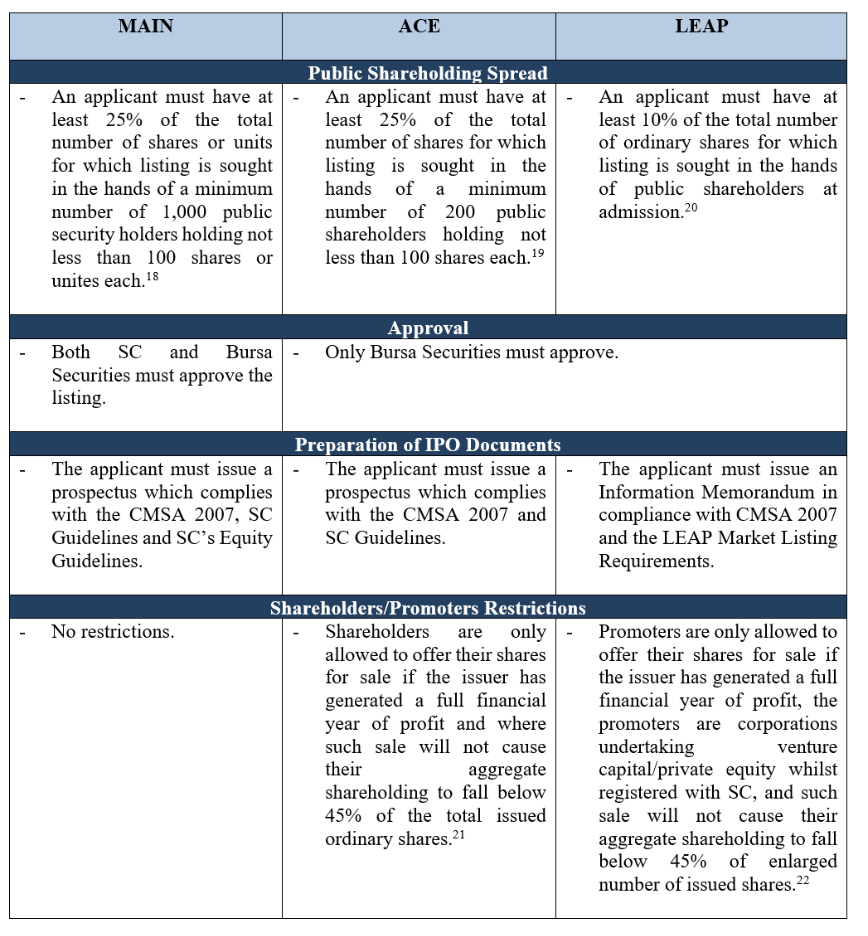

Key Distinctions between the 3 Markets

To List or Not to List?

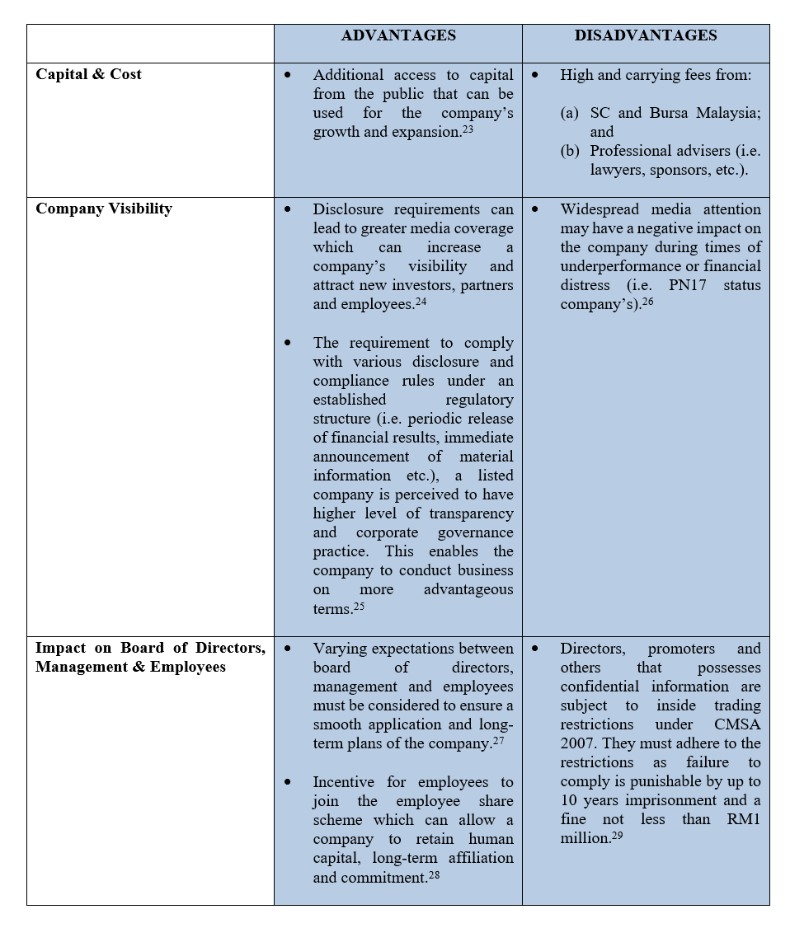

Proper planning must be undertaken before a company puts themself on the market. It is necessary to consider both the potential benefits and drawbacks from listing such as:

Parties in a Listing Exercise

The path to listing is undoubtedly a complex trajectory, therefore the listing issuer must engage with market advisers to curb these challenges. In a listing exercise, a Due Diligence Working Group (“DDWG”) will be formed and led by the Principal Adviser/Lead Adviser/Sponsor/Approved Adviser.[30] The additional members that make up the DDWG are the Legal Advisors/Lawyers, Accountants, Independent Property Valuers, Independent Business and Market Researchers, Issuing House and the Public Relations Company, who all provide various support in order to facilitate the listing process.[31]

For instance, the Legal Advisors draft all necessary legal documents such as the legal due diligence report and undertake the legal due diligence and verification exercise on the information provided i.e. Prospectus and/or Information Memorandum to ensure that all disclosures are accurate, not misleading and free of material omissions.[32] On the other hand, the Accountants will prepare the Accountant’s Report for inclusion in the Prospectus and undertake due diligence in relation to the financial information provided.[33]

Conclusion

Malaysia’s IPO process and market environment are well-regulated, offering tailored listing options – Main Market, ACE Market, and LEAP Market – that accommodate companies at various stages of growth. Despite facing challenges and a volatile market climate, Malaysia remains resolute in its ambition to achieve 60 public listings by 2025. This underscores the importance for companies to carefully weigh both the benefits and risks of going public, while emphasising the need for thorough preparation and strict compliance with regulatory requirements to ensure a successful IPO.

For further information, please contact:

Gavin Chan Zi Jian, Azmi & Associates

gavin.chan@azmilaw.com

- Bursa Malaysia, ‘Glossary of Stock Market Terminologies’ (2025) https://www.bursamalaysia.com/reference/insights/market_terminologies/glossary_of_stock_market_terminologies#:~:text=An%20initial%20public%20offering%20(IPO,are%20also%20sold%20as%20IPOs. accessed 12 August 2025.

- CMSA 2007, s 58.

- Xinhua, ‘Malaysia leads Southeast Asia IPO performance in first half of year’ (2025) https://selangorjournal.my/2025/07/malaysia-leads-southeast-asia-ipo-performance-in-first-half-of-year/#:~:text=The%20firm%20said%20in%20a,by%20approximately%20165%20per%20cent accessed 12 August 2025.

- Justin Lim, ‘ACE Market-bound Oriental Kopi to raise RM184 mil, sets IPO price at 44 sen’ (2025) https://theedgemalaysia.com/node/739927 accessed 12 August 2025.

- Lee Weng Khuen and Luqman Amin, ‘IPO Watch: Oriental Kopi’s listing – the talk of the town’ (2025) https://theedgemalaysia.com/node/741785 accessed 12 August 2025.

- Yap Yan Qing, ‘Weak sentiment puts damper on Malaysian IPO market after strong start’ (2025) https://theedgemalaysia.com/node/749905 accessed 12 August 2025.

- Ranamita Chakraborty, ‘South-east Asia’s IPO market shows signs of revival after subdued H1’ (2025) https://www.businesstimes.com.sg/international/asean/south-east-asias-ipo-market-shows-signs-revival-after-subdued-h1 accessed 12 August 2025.

- World Bank Group, ‘Ease of Doing Business rankings, 2020’ (2025) https://archive.doingbusiness.org/en/rankings accessed 12 August 2025.

- Daljit Dhesi, ‘IPO market expected to improve in 2H25’ (2025) https://www.thestar.com.my/business/business-news/2025/07/28/ipo-market-expected-to-improve-in-2h25 accessed 12 August 2025.

- Bursa Malaysia, ‘Going Public, A Practical Guide to Listing on Bursa Malaysia, 2020’ (2020) https://www.bursamalaysia.com/sites/5d809dcf39fba22790cad230/assets/5ea8ea6339fba25885eecafa/Going_public_guide_2020.pdf accessed 12 August 2025.

- Paragraph 5.02(a), Part II of the Equity Guidelines.

- Paragraph 5.02(b), Part II of the Equity Guidelines.

- Paragraph 5.02(c), Part II of the Equity Guidelines.

- Ibid (n10).

- Chapter 3A, Part B, Paragraph 3A.02, of the ACE Market Listing Requirements.

- Chapter 4, Part D, Paragraph 4.07(2), of the ACE Market Listing Requirements.

- Bursa Malaysia, ‘Listing Process’ (2025) https://www.bursamalaysia.com/listing/get_listed/listing_process accessed 12 August 2025.

- Chapter 3, Part B, Paragraph 3.06(1), of the Main Market Listing Requirements.

- Chapter 3, Part B, Paragraph 3.10(1), of the ACE Market Listing Requirements.

- Chapter 3, Part A, Paragraph 3.03, of the LEAP Market Listing Requirements.

- Chapter 3, Part C, Paragraph 3.19(1), of the ACE Market Listing Requirements.

- Chapter 3, Part B, Paragraphs 3.05 and 3.07, of the LEAP Market Listing Requirements.

- Ibid (n10).

- Ibid.

- Ibid.

- John Lai, ‘KNM shares to be suspended pending material announcement’ (2025) https://theedgemalaysia.com/node/745999 accessed 12 August 2025.

- Ibid (n10).

- Ibid.

- CMSA 2007, s 188(4).

- Bursa Malaysia, ‘List of approved Advisers/Sponsors’ (2025) https://www.bursamalaysia.com/listing/get_listed/list_of_approved_continuing_advisers_for_leap accessed 12 August 2025.

- Ibid (n10).

- Ibid.

- Ibid.