7 December, 2016

The Insolvency and Bankruptcy Code, 2016 (the "Insolvency Code, 2016") had received the assent of the President of India on May 28, 2016. Since then, there have been discussions among the stakeholders with respect to its implementation and its repercussions on the interested parties, including corporates and individuals.

There have been certain material developments around the Insolvency Code, 2016 in last few days wherein the major

provisions relating to the Insolvency Code, 2016 have been brought into force.

To start with, the provisions relating to the setting up of the Insolvency Professional Agencies ("IPA") and Insolvency

Professional ("IP") got notified. In this respect, the Insolvency and Bankruptcy Board of India ("IBBI"), vide a notification dated

November 21, 2016, has notified the Insolvency and Bankruptcy Board of India (Insolvency Professional Agencies) Regulations, 2016 and the Insolvency and Bankruptcy Board of India (Model Bye-Laws and Governing Board of Insolvency Professional Agencies) Regulations, 2016 which inter alia govern the procedure of registration of IPA with IBBI and mandates the IPA to adopt bye-laws, respectively. The IBBI has also notified the Insolvency and Bankruptcy Board of India (Insolvency Professional) Regulations, 2016, by way of a notification dated November 23, 2016, which inter alia provide for the procedure of appointment and registration of IP. Presently, several IPs and three IPAs namely, Indian Institute of Insolvency Professionals of ICAI, New Delhi, ICSI Insolvency Professionals Agency, New Delhi and Insolvency Professional Agency of ICAI, New Delhi, have been registered.

In the initial phase, the provisions relating to the insolvency process of the company, limited liability partnership ("LLP") and other body corporate have been notified. However, provisions relating to liquidation process, voluntary liquidation and fast track corporate insolvency process for the corporate person have not been notified as yet – which we expect to get notified in near future. In the later phase, provisions relating to bankruptcy process for individuals and partnership firms will get notified.

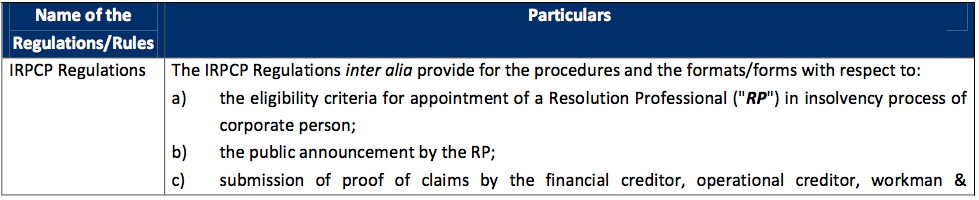

In respect to the insolvency process for corporate persons, the IBBI has, vide a notification dated November 30, 2016, also notified the Insolvency and Bankruptcy Board of India (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 ("IRPCP Regulations, 2016"), which have come into effect from December 01, 2016.

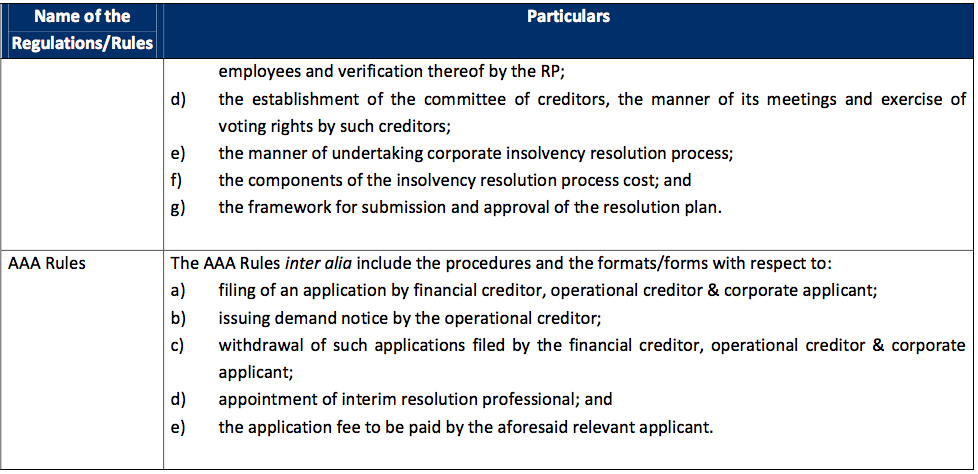

In order to initiate any process for insolvency resolution, an applicant is required to file an application with the Adjudicating Authority under the Insolvency Code, 2016 and therefore, the Ministry of Corporate Affairs ("MCA") has come up with the Insolvency and Bankruptcy (Application to Adjudicating Authority) Rules, 2016 ("AAA Rules, 2016"), which duly provide for such filings related framework.

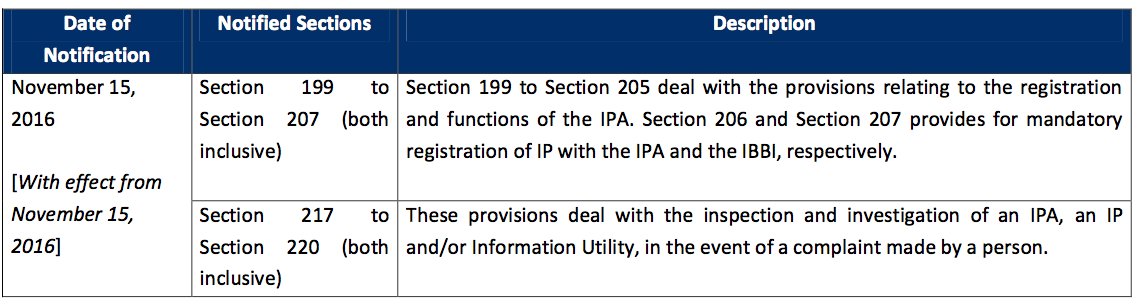

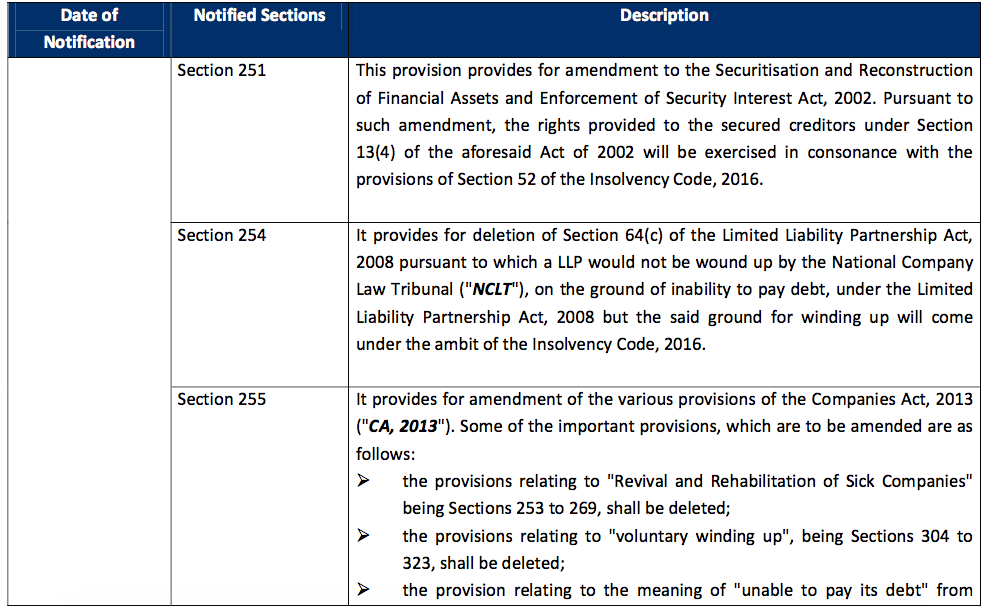

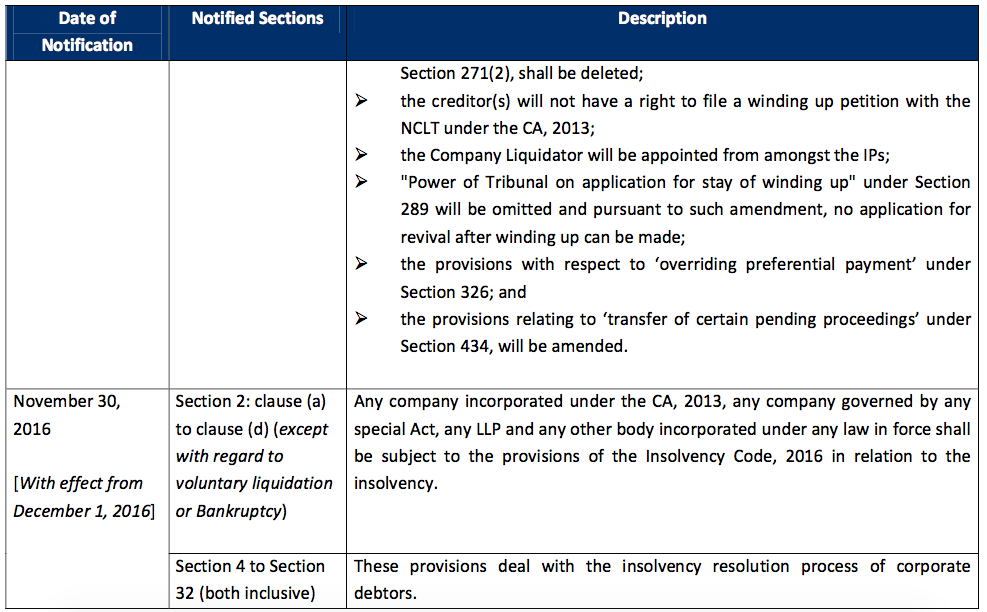

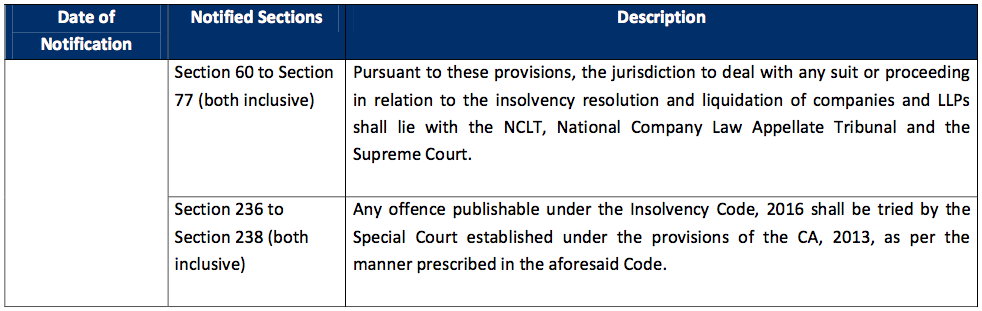

For ease of reference, we have set out herein below the important provisions of the Insolvency Code, 2016, which have been notified and brought into force:

please click on the images to enlarge

In addition to the aforesaid important provisions of the Insolvency Code, 2016, we have also set out herein below the

important regulations and rules, of the IRPCP Regulations, 2016 and the AAA Rules, 2016, respectively.

Our View:

With the enforcement of Sick Industrial Companies (Special Provisions) Repeal Act, 2003 with effect from December 1, 2016, all kinds of proceedings pending before the Board for Industrial and Financial Reconstruction and Appellate Authority for Industrial and Financial Reconstruction have been abated and the concerned parties involved in such matters are required to

take necessary steps by making an application to NCLT within 180 days from date of the aforesaid notification.

IBBI has been acting proactively for enforcing the provisions of the Insolvency Code, 2016 and has brought into force many operative provisions of the Insolvency Code, 2016 and regulations thereof. It is pertinent to note that the insolvency process provides for strict time line of 180 days from the date of admission of application (which is extendable up to 90 days) within which the lengthy insolvency resolution process needs to be completed, failing which, the corporate person will face liquidation. However, there are currently several logistical issues such as lack of members and infrastructure at NCLT level.

Further, the framework of "information utility" has also not been set up as yet. Due to aforesaid issues and various other practical difficulties, it will be interesting to see whether the strict time line can be adhered to.

Since any creditor having a minimum default amount of Rs.1,00,000 against a corporate debtor may approach the NCLT for initiation of insolvency resolution process and on the other hand, a corporate debtor, being one of the Corporate Applicant, may also apply for insolvency resolution process, in order to take the benefit of the moratorium, we envisage that NCLT may be flooded with such applications from the creditors as well as the corporate debtors.

Prem Rajani, Partner, Rajani Associates

prem@rajaniassociates.net

.jpg)