12 July, 2017

What is GST?

India is gearing up for the biggest tax reform since independence.The implementation of the Goods and Service Tax ("GST") will subsume host of levies, including excise, service tax and value added tax ("VAT"). It will be a uniform market for seamless transfer of goods and services and it will lead to an amalgamation of the current multi‐layered tax structure of Central and Sales taxes into a single line of taxation. Over 150 countries have already implemented GST in various forms in line with their increasing economic and societal needs. India too, is preparing itself to take this big step towards the complete over haul of the indirect tax structure. The GST Bill was officially introduced in 2014 as "The Constitution (One Hundred and Twenty‐Second Amendment) Bill, 2014" and it is proposed to be implemented from 1st July, 2017.

GST is a kind of tax imposed on manufacturing, sale and usage of goods and services. It is applied on services and goods at a national level with the purpose of achieving overall economic growth. India has proposed to adopt a dual GST model which means that taxation will be administered by both the Union and State Governments. This dual system is diagrammatically represented below:

Please click on the image to enlarge

GST will be applicable on "supply of goods or services" as against the present concept of tax on the manufacture of goods or on sale of goods or on provision of services. GST will be based on the principle of destination based consumption taxation as against the present principle of origin based taxation.

GST is proposed to replace the following taxes currently levied and collected by the Centre:

(a) Central Excise Duty;

(b) Duties of Excise (Medicinal and Toilet Preparations);

(c) Additional Duties of Excise (Goods of Special Importance);

(d) Additional Duties of Excise (Textiles and Textile Products);

(e) Additional Duties of Customs;

(f) Special Additional Duty of Customs;

(g) Service Tax;

(h) Cesses and surcharges insofar as they relate to supply of goods or services.

State taxes that will be subsumed within the GST are:

(a) State VAT;

(b) CST;

(c) Purchase Tax;

(d) Luxury Tax;

(e) Entry Tax (All forms);

(f) Entertainment Tax (except those levied by the local bodies);

(g) Taxes on advertisements;

(h) Taxes on lotteries, betting and gambling;

(i) State cesses and surcharges insofar as they relate to supply of goods or services.

Applicability and tax structure

GST will be applicable on the 'supply' of goods and/or services to any person or entity in India. The term 'supply' refers to sale, transfer, barter, exchange, license, rental, lease or disposal of goods and services.

There will be a four‐tier GST tax structure i.e. 5%, 12%, 18% and 28%. While major goods and services are covered under the tax bracket of 12% and 18%, the rate of tax for essential items will be as low as 5% and that for luxury and de‐merits goods will be as high as 28%.

Point of Taxation

Earliest of the following

Please click on the table to enlarge.

Components

There are two components of GST: (i) Central GST ("CGST"); and (ii) State GST ("SGST"). Both the Centre and States will be simultaneously levying GST across the value chain. Tax will be levied on every supply of goods and services. The Centre will levy and collect CGST and the States will levy and collect the SGST on all transactions within a State. For the purpose of Central GST, input tax credit will be made available for discharging the

CGST liability on the output at each stage. Similarly, the credit of State GST paid on inputs will be allowed for paying the SGST on output However, no cross utilization of credit will be permitted.

Input Tax Credit ("ITC")

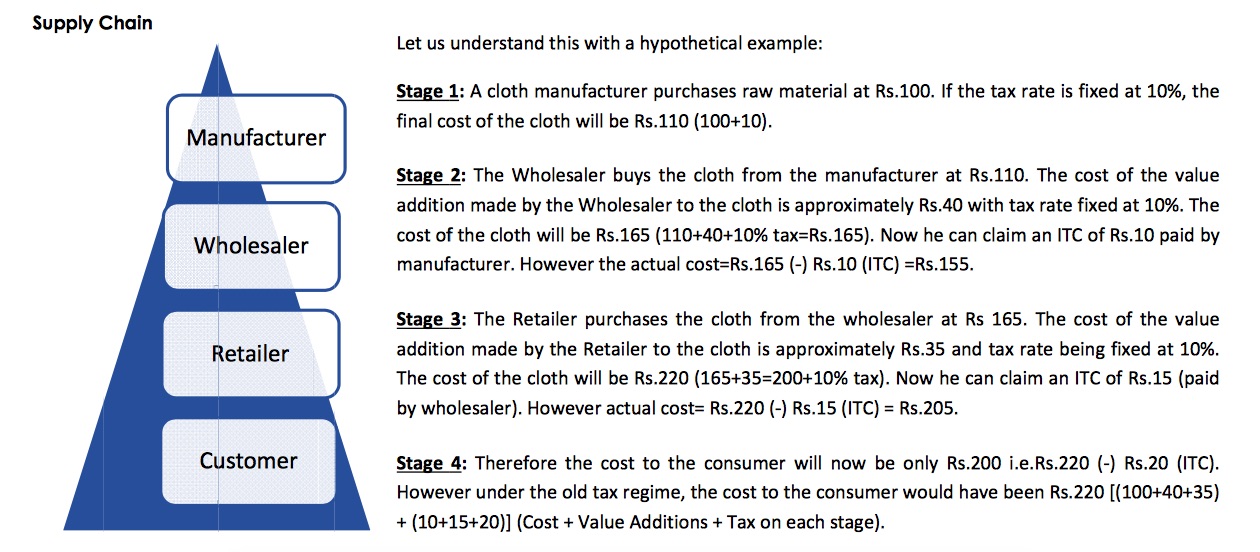

ITC means at the time of paying tax on output, a manufacturer, supplier, agent, e‐commerce operator, aggregator or any of the aforementioned persons can reduce the tax they have already paid on inputs viz. purchases. The concept of ITC is explained in the diagram below:

Please click on the image to enlarge.

Implication of GST to certain major Industries/ sectors

Logistics: Logistics players in India have been maintaining multiple warehouses across states to avoid Central Sales Tax ("CST") levy and state entry taxes. On the onset of GST, India will become one single market wherein goods can move freely inter‐state without any levy. This will further bring warehouse consolidation across the country and will witness mega logistic hubs and high investments in infrastructure wherein 100% Foreign Direct Investment has already been allowed. As an outcome of GST, warehouse operators and e‐ commerce players have already shown interest in setting up their warehouses at strategic locations.

Contrarily, with the introduction of e‐way bills framework, a new document is to be generated at every level of trans‐shipment of an article, which will result into increased compliance for this sector.

Manufacturers: Due to availability of ITC to the manufacturers there are less restrictions in claiming set‐offs in the taxes paid, resulting in reduction of cost of the goods or services supplied. Exports will now be cheaper due to refund of taxes to a considerable extent. However, GST will lead to increased compliance requirements.

Textile: GST is likely to encompass various taxes like luxury tax, octroi, entry tax, etc. which would lower the manufacturing cost of a product. ITC will provide a considerable boost for promoting the export of textile products.

FMCG: GST aims at keeping the mass consumption low. Products like milk, cereals and grains are exempt from GST and other products like tea, coffee, edible oil and sugar will attract only 5% of tax. This will benefit companies like Nestle. Further, products like soaps, toothpaste, hair oil, malted beverage which were taxed at the rate of 24% are now proposed to be taxed at 18% under GST. Companies like HUL, Colgate, Dabur, Emami, Bajaj Corp would profit under the GST regime. On the other hand items like detergent, shampoo, instant coffee will be expensive due to increased tax rates.

Consumer Durables: Under the proposed GST regime, consumers are likely to pay an additional price of 3‐4% on consumer durable products such as washing machines, air‐conditioners, TVs, refrigerators, and ceiling fans, etc. as the tax rate is projected to increase from the current 18% to 28%. Such an anticipated price hike has resulted in many companies providing competitive offers on consumer durables prior to the kick‐start date of the enforcement of GST.

Entertainment: The rate of tax for movie tickets differs from state to state. In the state of Maharashtra entertainment tax is levied at the rate of 40% however after the introduction of GST the tax is proposed at 28% resulting in the reduction in the cost of movie tickets benefiting the common man. Multiplexes will now be able to avail ITC.

Automobile: In the current tax structure taxes like excise, CST, National Calamity Contingent Duty and state VAT aggregates to 28.31% which is proposed to be reduced under GST regime which follows only a single line of taxation. Also, cars will now become cheaper due to a standard rate of tax i.e. 28% plus a cess of 1% on small cars, 3% on large cars and 15% on luxury cars which would, regardless of the cess, be lower than the current rate of tax.

Insurance: There are three kinds of major life insurance policies i.e. term insurance, ULIPS and Endowments ‐ each having a different applicability of service tax as per the current structure. After implementation of GST, the insurance sector would face a major implication as it will witness a hike of 3% from the current rate of tax. The standard rate of GST proposed for the insurance sector is 18% which is higher than the current rate of 15%. Both the existing and the new policyholders will have to bear the additional cost resulting into an increased expenditure.

Our View

With the introduction of GST a bundle of indirect taxes will be either replaced or subsumed within a single line of taxation, leading to clarity and transparency in the Indian tax laws. It will remove the cascading effect on taxes. It is speculated that the prices of goods and services will reduce due to the implementation of ITC thus reducing the burden on the end customers. GST will thus play a major role in offering a helping hand towards the contribution in the growth of the economy in India. Conversely, GST will also result in increase in prices of daily commodities and general services. While the introduction of the GST structure will lead to consolidation of taxes on one hand, it will also lead to discrimination in tax rates within a particular sector, consequently resulting in certain commodities/services becoming more expensive than the other.

.jpg)

.jpg)