27 July, 2017

The Thai Government has been trying to appropriately conceptualize an e-commerce tax to efficiently capture the percentage of revenue generated by the e-commerce sector which has seen large volume and strong growth recently. Prior to e-commerce, tax collection has relied solely on principles based on the physical presence of the taxpayer and conventional sources of income, thus making the e-commerce tax issue a controversial one across the globe.

Recently, the Thai Revenue Department has published the main concepts of its draft e-commerce tax law on its website (without publishing the draft law in full) and has offered an online comment survey form in order to gauge the private sector's view.

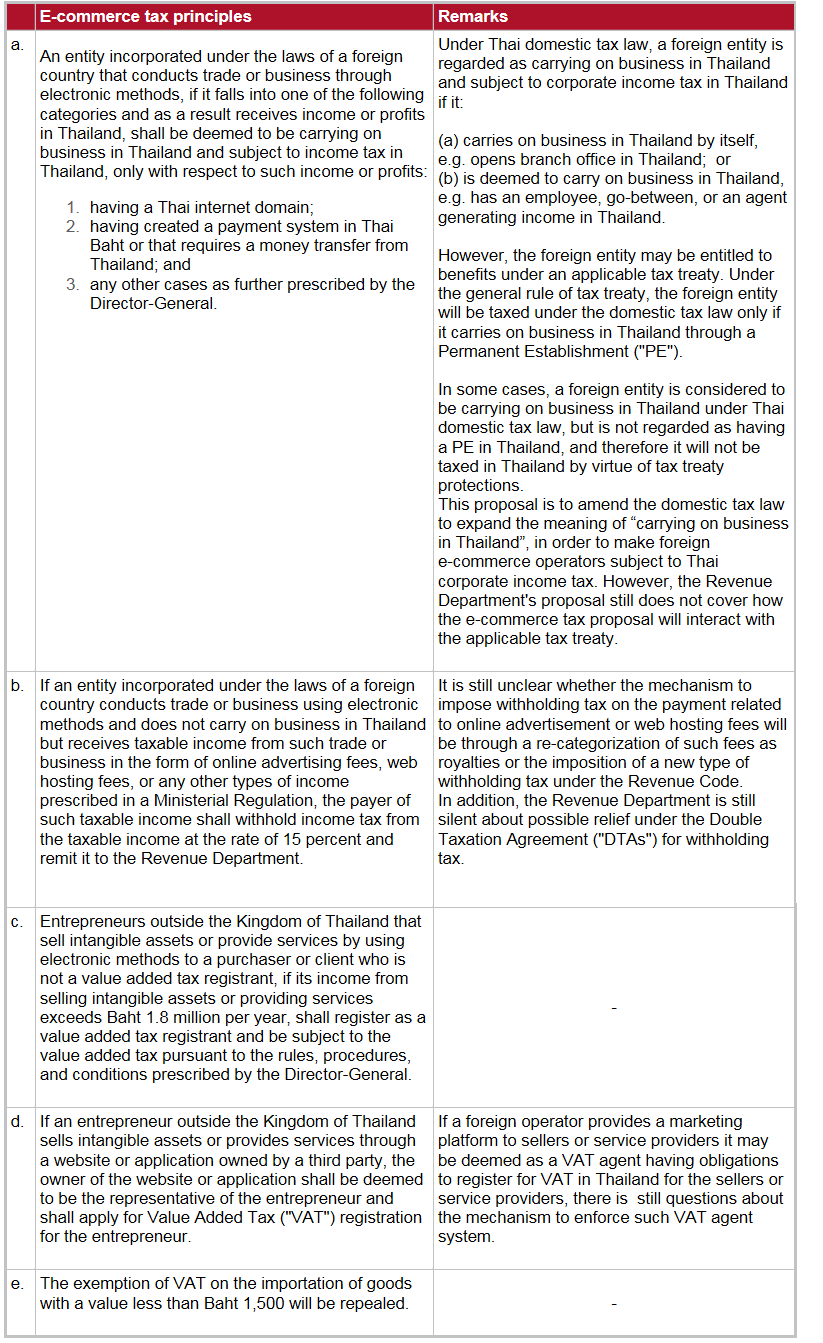

The Revenue Department's e-commerce tax main principles as published by the Revenue Department

The Revenue Department is now allowing the private sector to express its views on the draft e-commerce tax law on its website until 11 July 2017. The Revenue Department expects to propose a draft of the e-commerce tax law to the Cabinet for consideration by the end of July and it is expected that the legislation will take effect by the end of this year. After the Revenue Department has gathered the public's comments on the e-commerce tax law, we hope to see that the e-commerce tax law develops more clarity and practicality.

Click here for the link to public hearing.

For further information, please contact:

Aek Tantisattamo Partner, Baker McKenzie

aek.tantisattamo@bakermckenzie.com