27 July, 2017

Existing treatment of IPPs and geothermal projects

Current regulation of IPPs

Historically, Indonesian independent power producers (IPPs) have enjoyed a large decree of regulatory freedom as compared to their investor counterparts in the mining and oil and gas sectors. The "regulation" of what IPPs can and cannot do was largely found within the confines of power purchase agreements (PPAs) signed with the Indonesian state-owned power utility PT PLN (Persero) (PLN).

These PPAs traditionally have only sought to impose restrictions or approval requirements on the corporate actions of IPP companies through obligations regarding changes in shareholding. Typically, these contractual requirements imposed on IPPs by PLN related to retention of ownership of shares in IPP companies. In essence, PLN's philosophy was that if an investor participated as a "Sponsor" in a PLN procurement process to be awarded the project (eg, a tender run by PLN for a coal fired project, or a direct appointment process for a hydro power project), then that investor should remain committed to the project for a minimum period of time to ensure that the project was constructed and put into reliable operation, and not simply look to flip the project. So to implement this philosophy, the PPAs have typically provided that:

No changes in shareholding in the IPP are permitted prior to commercial operation of the project.

During the first five years after the commencement of commercial operation, initial Sponsors could sell down part of their interest, but had to retain some minimum shareholding (eg, a common formulation would provide that a sell down is permitted, but the

Sponsor must retain a minimum 25% shareholding)

However, despite these restrictions, the PPAs would always give PLN an overriding right to grant approval for changes in shareholding at any time where PLN took the view that the requested change in shareholding was in the interests of the continuation of the project.

It is also important to note that after an early lock-in period, investors were free to monetize their investment.

Aside from contractual restrictions associated with changes in shareholding, neither the PPAs nor the power sector regulations imposed any other restrictions on corporate actions of IPP companies (such as changes in board members).

Earlier framework for Geothermal License holders (including Geothermal IPPs)

The issue on transfer of shares in geothermal license (commonly referred to as IPB) holders is a subject that is touched upon by the existing geothermal regulatory framework. The 2014 Geothermal Law provides that an IPB holder can only transfer its shares on the Indonesia Stock Exchange after exploration is concluded.

While this provision clearly does identify a specific instance when a transfer is permissible, it is not clear as to whether transfers other than in this specific instance are in fact permitted. For example, is a private transfer of shares in an IPB holder permitted at any time without Ministry approval? Despite this lack of clarity, the Ministry has over the past couple of years granted its approval to private share transfers in IPB holders (even during or prior to exploration period).

However, under the pre-existing framework, there is no restriction for the change of directors and commissioners in geothermal license holders.

What's new

On 14 July, the Minister of Energy and Mineral Resources issued Regulation No. 42 of 2017 on Supervision on Business Activities in Energy and Mineral Resources Sector (Reg. 42), which seeks to regulate two corporate actions of IPP companies (namely holders of electricity generation licences, known by their Indonesian acronym IUPTL) and IPB holders, namely: (i) transfers of shares in IPP companies and IPB holders; and (ii) changes in board members in those companies.

Transfer of shares

Any transfer of shares in an IUPTL holder (ie, a license for the supply of electricity for public interest, which is the license that an IPP requires to carry on business) or an IPB holder requires approval by the Minister of Energy and Mineral Resources.

In the case of an IUPTL holder, a transfer can only be carried out if:

- the power plant has reached commercial operations

- the transfer is being made to an entity that is more than 90% owned by the transferring Sponsor

Reg. 42 also states that for the affiliate transfer option, the affiliate must be a direct 90% owned subsidiary of the transferring Sponsor.

The regulation provides an extensive list of documents that must be submitted with the request for approval, including an explanation of the reason for the share transfer, approval by the buyer of power (ie, PLN, in a typical IPP project) as well as past tax returns, and financial statements of the transferee. The Minister is required to issue approval or rejection within 14 business days (for power projects) or 10 business days (for geothermal projects). There are no "deemed approval" mechanisms if no response is received within the prescribed period. In practice, therefore, the 14-business-day period may be more of a guideline than a rule.

For IPB holders, Reg. 42 only states that the transfer of shares must be done in accordance with prevailing laws and regulations (namely the relatively unclear provision of the 2014 Geothermal Law) with prior approval from the Minister of Energy and Mineral Resources. For the purpose of obtaining the approval, Reg. 42 requires the IPB holder to submit similar documents to those required for a change of shareholder in an IUPTL holder, with the additional of evidence of payment of the latest deadrents, production fees and production bonus (if the company has already achieved commercial operation). Accordingly, the fact that Reg. 42 does provide a mechanism for Minister approval, and this list of requirements that needs to be fulfilled does relate to documents relevant to a private (ie, non-stock market) transfer, this does support the view that the correct interpretation of the 2014 Geothermal Law is to allow for private (ie, non-stock market) transfers.

Curiously, although the 2014 Geothermal Law clearly contemplates a transfer of shares through the stock market, Reg. 42 does not contain a mechanism for dealing with approvals of share transfers in a publicly listed IPB holder (ie, it would be unworkable if the Minister were required to approve a change in daily trading of shares in a listed company that held an IPB). It would appear that for geothermal companies that hold both an IPB and an IUPTL wanting to change shareholders, there is a need to make two applications for approval.

Change of board of directors / commissioners

Holders of IUPTLs must first obtain the approval of the Minister of Energy and Mineral Resources before making any changes to their board of directors or commissioners.

As with the share transfer approval process, there is a requirement for submission of a number of administrative documents, including the recommendation of the buyer of power (ie, PLN for a typical IPP) and the past income tax returns of the incoming Director/Commissioner. Again, the Minister must notify its approval or rejection within 14 business days.

For IPB holders, similar approval is required, except that:

- The approval process is slightly shorter, ie, 10 business days.

- There is no requirement on the recommendation from the buyer of power.

- The company must provide specific details on the reason for such change in board members.

We set out below some of the implications of these new requirements.

Key implications

Which projects are caught?

Reg. 42 applies to all holders of IUPTL, whether those projects are already existing or are to be awarded in the future.

Typically, IPPs are granted a temporary IUPTL (issued under the title of IUPTL Sementara) at the time of signing of a PPA, and the permanent IUPTL is granted following financial close (and on occasion, closer to the time of commercial operation). So a question arises as to whether these new restrictions only apply to holders of an IUPTL (ie, the permanent IUPTL), or whether it also applies to IUPTL Sementara. Our view is that the restrictions apply to both forms of IUPTL (ie, whether temporary or permanent).

For IPB holders, Reg. 42 similarly applies to all existing IPB holders and all future holders of IPB. It does not apply to geothermal projects that are based on the old Joint Operation Contract structure and other forms of non-IPB concessions (eg, Kuasa Pengusahaan Sumber Daya Panas Bumi).

Block on lenders security enforcement

Except where the transfer is to a >90% affiliate (which is permitted at any time, subject to the Minister's approval), a share transfer in the IPP company can only occur after the commercial operation date of the power plant is achieved. Even after commercial operation, the change of shareholding is only permitted with the Minister's approval.

For IPP projects, project financiers invariably take security over all of the shares in the IPP company, such that if a default occurs under the financing agreements, lenders can step in and sell the shares in the IPP company to new Sponsors.

However, Reg. 42 contains no carve-out for project lenders enforcing security. Accordingly:

- If the project goes into default during the construction period, the lenders are not permitted to exercise the share pledge security they will hold over the shares in the IPP, as a change of shareholding is not permitted.

- If the project goes into default during the operation period, the lenders will only be able to enforce their security over the IPP's shares if the Minister so approves.

For this reason, we would expect that project lenders will insist without exception on a two-tiered shareholding structure in all IPPs, such that if a default occurs, lenders can enforce share security at the holding company level without having to transfer any shares in the IPP itself. This workaround does comply with the regulation, as the regulation only restricts transfers of shares in the IUPTL holder (ie, the direct shares in the IPP company itself).

Affiliate exception only applies to direct subsidiaries

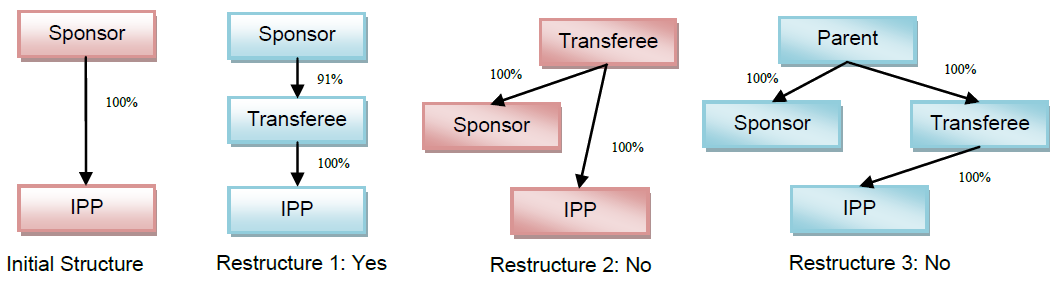

The transfer exception given for affiliate transfers are only where the transfer is to a >90% affiliate that is directly owned by the transferring Sponsor.

That is, the affiliate transferee cannot be a parent of the Sponsor nor an entity under common control with the Sponsor, as shown below in the following possible affiliate ownership structures:

Please click on the image to enlarge.

PLN approval required for change in shareholding

An approval letter from PLN must be submitted to the Minister for a change in shareholding of the IPP company. Accordingly, Sponsors will need to obtain the approval of PLN prior to approaching the Minister.

The vast majority of the existing PPAs signed had provided for the Sponsors to be free to sell their shareholding in the IPP after the initial lock-in period (ie. typically the fifth anniversary of commercial operation). However the effect of these new requirements is to give PLN (and of course the Minister) a project-life long right of approval over changes in shareholders.

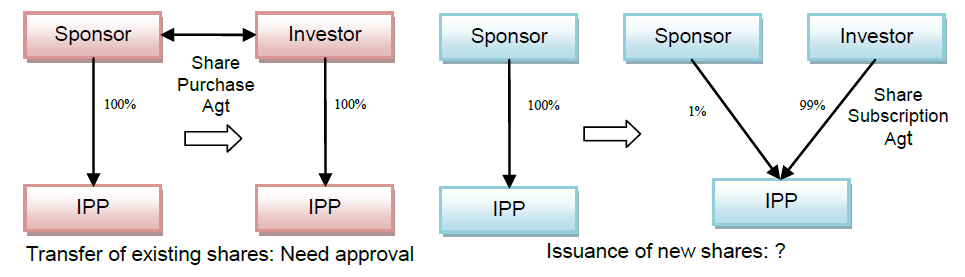

Transfer of shares vs issuance of new shares

The wording used in Reg. 42 is to restrict "transfers of shares of IUPTL holders." It therefore raises the question of whether a change in shareholding effected through an issuance of new shares by the IUPTL holder (without any transfer of existing shares) falls foul of the regulation or not.

Clearly if the issuance of new shares was not intended to be caught by the regulation, there would be a very simple workaround to the restriction (ie, sell 99% of the IPP company by issuing new shares, instead of transferring existing shares).

Requirements for tax documents

For both the change in shareholding and change in board approval process, the documents required to be submitted include a reference to the Indonesian tax file number of the transferee (in case of share transfer) or director/commissioner (in the case of a change in board) and Indonesian tax filings for the past two years.

Clearly for foreign companies and for non-resident foreign directors or commissioners, they will not hold Indonesian tax documentation (as they are not Indonesian tax resident).

The requirement for two years of records means that newly incorporated companies (which would not have two years of audited financial statements or tax filings) cannot be put forward as the transferee. Certainly for the affiliate transfer (which is often done for corporate or tax structuring reasons), the transferee entity is often a newly established company.

It is hoped that the Ministry takes a pragmatic view on these requirements (eg, if a company can show that it has paid its taxes in its home country then that would suffice, where the company has only been newly established, no requirements for tax filings or financial statements, etc.).

Approval of electricity purchasers

Both the change of shareholding approval and the change in board member approval require supporting documents from the "buyer of electricity." While a change in shareholding is a relatively infrequent event in the life of an IPP, changes in board members happen far more regularly. As these requirements for PLN to give a recommendation for a change in board member apply to all power projects, PLN should expect to be inundated with such requests down to the smallest of projects (eg, a 500kW micro-hydro project). Reg. 42 does not prescribe any time limit for PLN providing its approval, nor sets any real criteria for when approval will be given or withheld, and hence there are concerns that there may be delays in PLN issuing these approvals.

While the approval/recommendation requirement is clear for a traditional IPP (ie, PLN as the sole buyer of electricity should give the approval/recommendation), the position is less clear for integrated IUPTL holders for distribution areas (ie, companies that have been granted their own business area (wilayah usaha) where they supply power to many customers). In the case, for example of an IUPTL holder that supplies an industrial park housing 20 customers – is it required to obtain a recommendation from each of its 20 customers in order to change its board members? Taking an even more illogical scenario: PT PLN Batam itself is the holder of an IUPTL to supply consumers in Batam, and PT PLN Batam supplies thousands of customers throughout Batam. On its face, the regulation would require PT PLN Batam to obtain approval from its customers. We again would expect that the Ministry would drop this requirement where the IUPTL holder has multiple customers. The Ministry has stated in its official announcement launching the regulation that Reg. 42 does not cover changes in the boards of State-owned/Regional Government-owned companies (such as PLN). However there is no express exemption for these Government entities built into the regulation, and for PLN subsidiaries such as PT PLN Batam, albeit that they are 100% ultimately owned by Government, as those subsidiaries are not companies more than 50% directly owned by the Government, they are not "State-owned companies" as defined by the State-owned companies legislation. However as a matter of practice we would expect the Ministry to disapply the new approval procedures to PLN and its subsidiaries.

Conclusion

Reg. 42 itself covers not only IPPs and geothermal companies, but also mining and oil and gas entities. These types of approval regimes for corporate actions in the mining sector (and to a lesser extent the oil and gas sector) have been relatively long-standing features of those industries, largely driven by the constitutional requirement for the state to manage Indonesia's natural resources. In that respect, Reg. 42 is nothing particularly new as it relates to resource sectors. That geothermal companies are brought under a similar regime is also not unexpected, as geothermal energy is similarly another important natural resource of the country in much the same way as coal or oil and gas.

However, to bring power generation projects under this same regime is somewhat unexpected. The Ministry has officially stated that that the desire of the government to throw its net over the power sector has been driven largely by the Constitutional Court's reasoning in last year's challenge brought against the 2009 Electricity Law (see our previous article here). In the court's reasoning, private sector investment in the power sector is constitutional, provided there is state control. Clearly, the government is taking the view that they should exercise the same types of "state control" over power companies as they have over mining companies. The government has always controlled the two key fundamentals of an IPP, namely, the licence to operate (as an IPP cannot operate without an IUPTL issued by government) and the revenue that the IPP enjoys (as the government must approve the IPP tariffs). So even without the new controls imposed by Reg. 42, the government has always, and continues to, exercise significant control over IPPs.

Regardless of its justification, the regulation is now in force. Lenders particularly will have to look closely at the corporate structures of IPPs to ensure that they can continue to enjoy effective security over the project. Sponsors will now need to consider at a very early stage possible future plans to bring in equity partners, and ensure their structures allow for such eventualities.

Like many regulations, the rules and requirements appear to be very rigid and may not neatly fit or apply to all situations, so it is hoped that the Ministry adopts a pragmatic view with regard to its implementation. Of course only time will tell.

.jpg)