31 October, 2017

The Ministry of Trade (MOT) recently issued Minister of Trade Regulation No. 63/M-DAG/PER/8/2017 (Regulation 63) which is an amendment to the Minister of Trade Regulation No. 82/M-DAG/PER/12/016 on Provisions of Import of Iron or Steel, Alloy Steel and Their Derivative Products (Regulation 82).

Regulation 63 was issued to increase the effectiveness of the implementation of the import of iron or steel, alloy steel and their derivative products (herein after referred to as Products). By eliminating some of the administrative and technical requirements for importing Products, Regulation 63 is expected to cut the import barriers/restrictions under the previous regime.

For instance, Regulation 63 provides that the inspection of the fulfillment of import requirements of the Products will be performed after the imported Products pass the customs area. Under the previous regulation, the inspection was carried out before the imported goods entered the customs area. Further, Regulation 63 provides that a Surveyor Report is not considered as customs supporting document, which it was under Regulation 82.

The above provisions are some of the key highlights of Regulation 63. We will further elaborate on the differences between Regulation 63 and the previous regulations, the impact on importer and the issues that may arise from the new regulation as below.

What's New Under Regulation 63

(i) Post Clearance Inspection

Regulation 63 stipulates that inspection of the fulfillment of import requirements of the Products is performed after the Products pass through the customs area. An importer must obtain a Goods Release Order from the Directorate General of Customs and Excise (DGCE) in order to be inspected.

The inspection will be done by the Directorate General of Foreign Trade of Ministry of Trade, the Directorate General of Consumer Protection and Trade of the Ministry of Trade and/or an Independent Surveyor. The inspection will be performed in a warehouse or storage area before the Products can be used. If the importer uses the imported Products before the Products have been inspected, the importer may be imposed with an administrative sanction, ie, revocation of the Import Approval (Persetujuan Impor/PI).

The application for the inspection must be submitted by the importer in writing to the Director of Import, along with:

- Proof of possession of importer's warehouse or storage

- Import Declaration (Pemberitahuan Impor Barang/PIB) for Products that will be used

- Import Approval

- Surveyor's Report

- Goods Release Order issued by DGCE

The Director of Import will issue the Approval on the Use of the Products which have been imported no later than three days after the receipt of a complete and correct application.

(ii) Additional Classification of the Products That Are Not Subject to Provisions of Import of Iron or Steel, Alloy Steel and Their Derivative Products

Regulation 63 stipulates the following provisions:

- consignment goods that are imported through an airplane postal provider with a value not exceeding FOB USD 1,500; and

- imported goods that weigh less than one ton

are not subject to Regulation 63 jo. Regulation 82, which means that the importer is not required to have an import approval to import those type of products.

However, the Director of Import of the Ministry of Trade confirmed that the imported Products still need to pass the verification and inspection process.

(iii) A Surveyor Report is not Deemed as Customs Supporting/Complementary Documents

Under Regulation 63, a Surveyor Report is not deemed as customs supporting documents, whereas the previous regulation said it was. Although a Surveyor Report is not required for customs clearance, an importer still need to have a Surveyor Report to be attached on the inspection application. Failure to do so may cause the Importer cannot use the imported Products.

(iv) API-P Holder Company That is Excluded to Have an Import Approval

Under Regulation 63, an API-P holder company may import Products without obtaining an import approval (of iron and steel) provided that the imported Products are used as complementary goods, test market goods or goods for after-sales service.

However, the importer is still required to have another import approval considering that the imported Products are used as complementary goods, test market goods or goods for after-sales service, which is mandated by Minister of Trade Regulation No. 118/M-DAG/PER/12/2015 on Provisions of Complementary Goods, Test Market Goods and Goods for After-Sales Service.

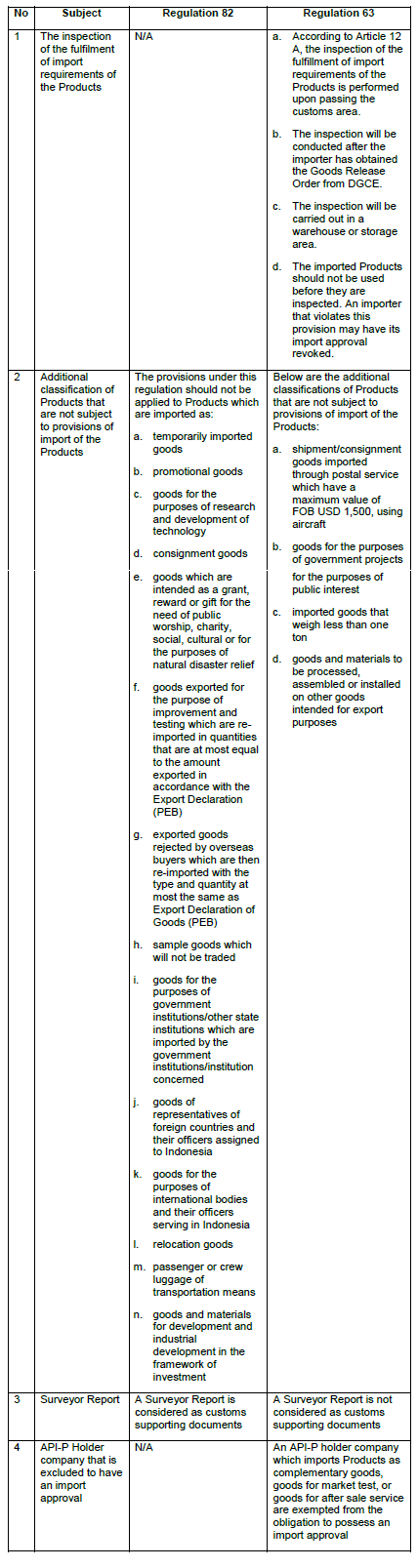

Please see table below for the key changes in Regulation 63

Please click on the table to enlarge.

Issue That May Arise

We believe that the implementation of Regulation 63 will make the import process easier for the importers. However, we think there will be issues with the implementation of Regulation 63, eg, the inspection that should be conducted in a warehouse or storage before the imported Products can be used.

If the inspection process is delayed for any reason, it may lead to piling up of the imported Products in the warehouse or storage and may result in longer lead time. It is also important to note that the importer should find a way to prevent the accumulation of the imported goods in its warehouse and/or storage area considering that the inspection will be carried out in its warehouse/storage area before the Products can be used in Indonesia.

For further information, please contact:

.jpg)