10 January, 2018

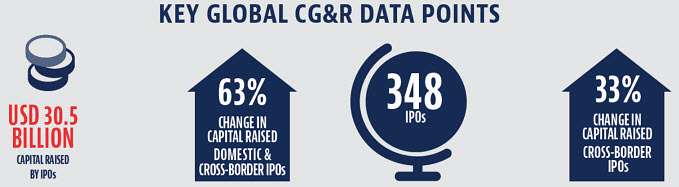

Baker McKenzie has just released the full year 2017 edition of the Cross-Border IPO Index. The report includes analysis of cross-border and domestic IPOs in 2017, including a review of all stock exchanges and sectors from a global and regional perspective. This year, the report also focuses on the Consumer Goods & Retail (CG&R) sector. Figures show that the steady progress of the CG&R sector over the last few years has seen the number of issues globally more than double since 2013. A total of 348 IPOs raising USD 30b were recorded in 2017 – significantly more than the 250 IPOs and USD 18b raised in 2016.

Listings in Asia Pacific have led the resurgence in this sector in 2017. China remains the top domicile nation of listing companies, which raised USD 7.8b worth of capital. This is not surprising given the increasing strength of the Chinese consumer, the size of the market and the rise of online shopping in China. Although companies in the US raised just USD 4.3b, this figure is still an improvement of 44% on 2016 value.

"The rise of IPOs in the Consumer Goods & Retail sector can be attributed in part to the sector’s continued strong performance, notwithstanding changing consumer demands and the increased role technology plays in the industry." Alyssa Gallot-Auberger – Global Chair of Consumer Goods & Retail Industry Group

Other CG&R highlights from the report include:

- In terms of stock exchanges, the New York Stock Exchange, Shanghai Stock Exchange and Euronext markets were the most popular destinations, all raising over USD 2b in total. Despite having the most number of deals at 45, the Hong Kong Stock Exchange was ranked only fifth in terms of capital raised. The New York Stock Exchange saw the biggest value of CG&R cross-border IPOs at USD 1.7b for ten listings.

- Brazilian wholesale hypermarket Atacadao SA's listing on B3 was the sector's biggest in value terms, raising a total of USD 1.4b. Atacadao is a subsidiary of the French retailing giant The Carrefour Group and despite pricing its IPO at the bottom of its expected price range, it is still the largest in Brazil in the last few years.

- Cross-border IPOs in the CG&R sector climbed sharply in 2017, both in terms of activity, which increased 88% to 47, and in deal value which rose 34% to USD 3.5b. While there was year-on-year improvement, total capital raised has yet to see 2014 levels when USD 9.2b was reached.

You may access the full report here. To download the CG&R infographic, please click here.

For further information, please contact:

Koen V. Vanhaerents, Partner, Baker & McKenzie

koen.vanhaerents@bakermckenzie.com