20 March, 2018

While China has continuously opened up its domestic capital market to foreign participation over the past decades, its commodity futures market has for a long time remained relatively inaccessible to international investors. However, with the upcoming launch of crude oil futures trading on the Shanghai International Energy Exchange (INE) on 26 March 2018, international investors can for the first time trade commodity futures directly in the PRC without the need to obtain any prior approval or quota from PRC regulators.

We believe that this marks a major step forward in China's liberalization of the PRC commodity futures market. In connection with this, we have prepared this client briefing to explain:

(1) the trading channels through which foreign investors and brokers can participate in futures trading on INE,

(2) the clearing methods and structure adopted by INE,

(3) the key eligibility requirements for foreign participants on INE and

(4) other material issues which foreign futures investors should consider.

TRADING CHANNELS AVAILABLE FOR FOREIGN PARTICIPANTS ON INE

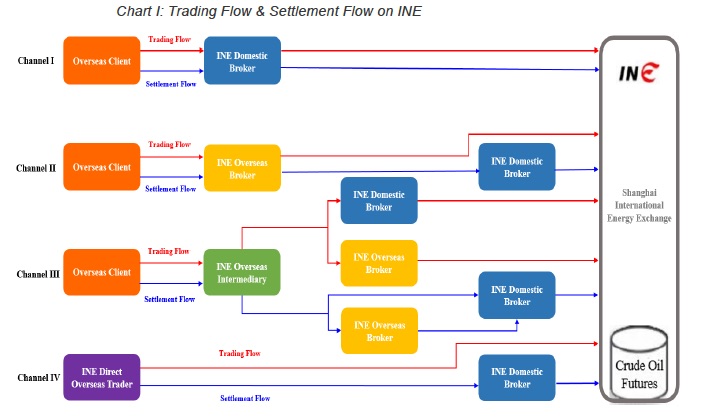

Foreign investors may engage in crude oil futures trading on INE via one of the following four channels:

(1) Channel I: a foreign investor appointing a domestic futures brokerage company which is an INE member (INE Domestic Broker) to trade crude oil futures on INE on its behalf;

(2) Channel II: a foreign investor appointing a qualified INE foreign brokerage institution (INE Overseas Broker) to trade crude oil futures on INE on its behalf;

(3) Channel III: a foreign investor appointing a qualified INE foreign intermediary institution (INE Overseas Intermediary), which will in turn appoint an INE Domestic Broker or INE Overseas Broker to trade crude oil futures on INE on its behalf; and

(4) Channel IV: a foreign investor which has applied to become a direct foreign trader with INE (INE Direct Overseas Trader) and which directly trades crude oil futures on INE.

Trading by a foreign investor on INE will be conducted through sending trading orders to the INE electronic trading system under the unique trade code assigned to the investor.

Applying for trading code

Prior to trading on INE, a foreign investor must apply for a unique trading code from INE. All crude oil futures trading carried out by such foreign investor will be recorded under the same INE trading code.

A foreign investor who trades under Channels I, II or III above (Overseas Client) must open a futures trading account with the relevant INE Domestic Broker, INE Overseas Broker or INE Overseas Intermediary, as the case may be. The Overseas Client must apply for its trading code as part of its account opening process. The trading code application will be further submitted by INE Domestic Broker, INE Overseas Broker or INE Overseas Intermediary, as applicable, to INE for review. The China Futures Market Monitoring Center will be responsible for the distribution and management of trading codes for each Overseas Client. While one Overseas Client may open different futures trading accounts with different INE Domestic Brokers, INE Overseas Brokers or INE Overseas Intermediaries, it must use the same trading code irrespective of who it appoints for crude oil futures trading.

An INE Direct Overseas Trader may directly apply to INE for its trading code.

For domestic asset management type institutions, such as securities companies, asset management companies, banks or other financial institutions that are subject to the relevant asset segregation requirements under PRC law, INE rules in principle allow them to apply for different trading codes in respect of different asset portfolios, so that trades carried out by different portfolios managed by the same institution on INE will not be aggregated. However, it is not entirely clear, under the current INE rules, whether a foreign asset manager could apply for separate trading codes for different asset portfolios managed by such foreign asset manager with INE.

Routing trading orders

Similar to the other four domestic futures exchanges, INE has also adopted a centralized auction trading mechanism to generate prices of crude oil futures. Trading orders of investors including foreign investors will be automatically matched by the electronic trading system of INE based on INE trading rules, normally in the order of price-time priority. It is contemplated under INE's trading rules that a market maker system may be established in the future.

INE Domestic Brokers, INE Overseas Brokers and INE Direct Overseas Traders may apply for trading seats on INE. A trading seat gives access through which an INE Domestic Broker, INE Overseas Broker or INE Direct Overseas Trader could directly place orders with INE's electronic trading system for matching and execution. Overseas Clients may place trading orders with their INE Domestic Broker, INE Overseas Broker or INE Overseas Intermediary (in this latter case, the order must be further passed on to an INE Domestic Broker or INE Overseas Broker). INE Domestic Broker or INE Overseas Broker who receives the trading orders from the Overseas Clients (or INE Overseas Intermediary) will verify the funds and positions of the Overseas Client and then further submit the order in a timely manner to INE for bidding. All trading orders must be matched through INE trading system and cannot be handled off exchange.

Once trading orders are matched, the trade is concluded. INE will return an execution report of the trading results. The transaction data recorded in INE system will be the conclusive record for all trading activities.

Clearing methods on INE

Settlement of INE transactions by a foreign participant shall be carried out using the clearing channels described below.

Clearing channels

INE adopts a centralized multi-layer daily netting clearing system. Upon closure of the market on each trading day, INE will calculate the net income or payment that each INE clearing participating member (INE Clearing Member) is entitled to receive or needs to pay on behalf of its clients. The calculation will be based on the settlement prices of the crude oil futures contract published by INE electronic trading system, the positions held by the clients of each INE Clearing Member and the relevant fees payable by the investors (such as commissions and taxes).

INE will act as a central counterparty (CCP) with respect to each trade. INE adopts a principal-to-principal model clearing system, i.e. INE only settles with INE Clearing Members, and INE Clearing Members in turn settle with their respective clients, either an Overseas Client, INE Overseas Broker, INE Overseas Intermediary or INE Direct Overseas Trader. If the clients of INE Clearing Member is an INE Overseas Broker or INE Overseas Intermediary, upon settlement with INE Clearing Member, INE Overseas Broker or INE Overseas Intermediary must further settle with their respective Overseas Clients.

Under the current INE clearing rules, only INE Domestic Brokers may act as INE Clearing Members. In order to clear crude oil futures contracts that have been traded, the relevant Overseas Client, INE Overseas Broker, INE Overseas Intermediary and INE Direct Overseas Trader must engage an INE Domestic Broker as its clearing agent. We set out the settlement flow corresponding to each trading channel below:

Please click on the image to enlarge.

Account set-up

Clearing between INE and INE Clearing Members, as well as clearing between INE Clearing Members and their clients are effected through the relevant domestic accounts opened with INE qualified futures margin deposit banks, which must be commercial banks incorporated in the PRC (INE FMDBs).

Margin for crude oil futures contract trading can only be deposited in domestic accounts opened with one of INE FMDBs. The account opened by INE with an INE FMDB is called a Designated Clearing Account. INE Clearing Members must open a Special Margin Account with INE FMDBs. Clients of INE Clearing Members, either an Overseas Client, INE Overseas Broker, INE Overseas Intermediary or INE Direct Overseas Trader, must open a Special Futures Clearing Account with INE FMDBs. 2

Clearing between INE and an INE Clearing Member must be effected through cash movement between INE's Designated Clearing Account and INE Clearing Member's Special Margin Account. Clearing between an INE Clearing Member and its clearing client (either an Overseas Client, INE Overseas Broker, INE Overseas Intermediary or INE Direct Overseas Trader) must be effected via cash movement between INE Clearing Member's Special Margin Account and such client's Special Futures Clearing Account. 3 Clearing between an INE Overseas Broker or INE Overseas Intermediary and their own Overseas Clients must be effected via cash movement between INE Overseas Broker or INE Overseas Intermediary's Special Futures Clearing Account and such Overseas Client's offshore account.

INE Clearing Members must set up an internal ledger for each of its clearing clients to record margin deposits and withdrawals, profits and losses, and transaction fees in relation to the client's crude oil futures trading. Likewise, INE Overseas Broker and INE Overseas Intermediary must set up their own internal ledgers to record the relevant trading and clearing information of their Overseas Clients.

Please click on the image to enlarge.

Key eligibility requirements applicable to foreign participants on INE

All foreign traders and brokers who participate in crude oil futures trading on INE must satisfy certain qualification requirements. We set out below a chart summarizing the key eligibility requirements applicable to different types of foreign participants on INE.

|

Category of Foreign Participants on INE |

Key Eligibility Requirements |

|---|---|

|

Overseas Client (institutions)4 |

has records of no less than 10 executed orders and of more than 10 days of simulated futures trading on domestic futures exchanges; or has records of more than 10 executed orders within the past three years on any of the domestic futures exchanges; or has records of more than 10 executed orders within the past three years on any of the overseas futures exchanges regulated by a competent futures regulatory authority that has entered into a memorandum of understanding on regulatory cooperation with CSRC; and has a balance of no less than RMB1 million (or equivalent in foreign currency) in its margin account at least five business days before applying for the trading code.

|

|

Overseas Client (individuals) |

has records of more than 10 executed orders and of more than 10 days of simulated futures trading on domestic futures exchanges; or has set up accounts on any domestic futures exchange or any overseas futures exchange regulated by a futures regulatory authority that has entered into a memorandum of

|

|

understanding on regulatory cooperation with CSRC, with records of more than 10 executed futures trading orders on any of such exchanges within the past three years; and has a balance of no less than RMB 500,000 (or equivalent in foreign currency) in its margin account at least five business days before applying for the trading code.

|

|

|

INE Overseas Broker5 |

was incorporated overseas and is holding a futures brokerage license from its domicile country (region); the futures regulatory authority in its domicile country (region) has entered into a memorandum of understanding on regulatory cooperation with CSRC; has a net capital of no less than RMB30 million (or equivalent in foreign currency); has a business operation record of more than two consecutive years; and has authorized a business organization or representative institution that has been validly existing in the PRC for no less than one year as its designated contact institution, and has appointed a senior manager or staff with good credibility within such business organization or representative institution as its designated contact person.

|

|

INE Overseas Intermediary |

is a financial institution legally incorporated and licensed for intermediary business by overseas competent authorities; is regulated and supervised by the competent futures regulatory authority in its domicile country (region), which has entered into a memorandum of understanding on regulatory cooperation with CSRC; has a net capital of no less than RMB30 million (or equivalent in foreign currency); and has a business operation record of more than two consecutive years.

|

|

INE Overseas Direct Trader |

was incorporated offshore; has a net capital or net assets of no less than RMB 10 million (or equivalent in foreign currency); and has authorized a business organization or representative institution that has been validly existing in the PRC for no less than one year as its designated contact institution, and has appointed a senior manager or staff with good credibility within such business organization or representative institution as its designated contact person.

|

Other material issues

Margin system

INE has put in place a trading margin system with respect to crude oil futures trading.

The trading margin (ranging from 5% to 20% of the contract value) applies to each standard crude oil futures contact that is purchased.

According to INE clearing rules, the margins which an INE Clearing Member directly charges its client must not be less than the standard specified by INE. These rules expressly provide that the ownership of the margin posted by a participant belongs to such participant.

It is also worthwhile to note that the clearing currency of INE is Renminbi. In addition to Renminbi, foreign currencies (though currently only USD is accepted), standard warrants and treasury bonds may also be provided as margin.

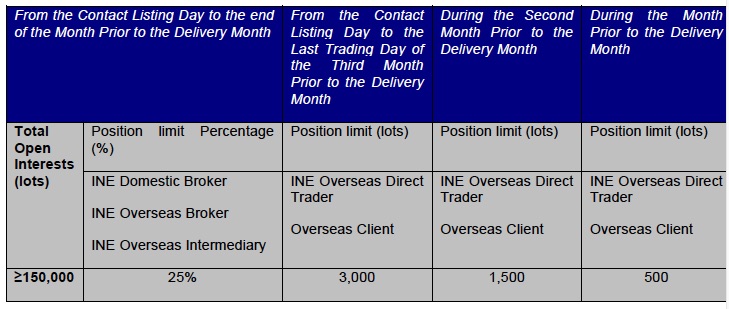

Position limit

Similar to the futures contracts traded on other domestic futures exchanges, INE imposes a position holding limit on traders and brokers on INE. Details of the position limit rules are set out below:

Please click on the table to enlarge.

It should be noted that for any hedging activity carried out on INE, the relevant investors (including foreign participants) shall apply for hedging quota(s) from INE in advance. In addition, investors who carry out arbitrage trading on INE can apply to INE for arbitrage quota(s) to meet its arbitrage needs. Where the positions of the futures contracts held by the relevant investor exceeds its hedging quota(s) and/or arbitrage quota(s) approved by INE, such investor must adjust its futures position so as to remedy the breach by the end of the first trading session of the next trading day.

Algorithmic trading

Algorithmic trading is permissible on INE so long as a pre-filing has been made. In addition, INE trading rules provide that if the trading orders sent by foreign traders or brokers (which adopt algorithmic trading methods) might influence the safety of INE's system or disrupt the trading orders on INE, INE may impose trading restrictions on such foreign traders or brokers.

Bankruptcy of INE and relevant market participants

INE trading and clearing rules provide important guidance on the consequences arising from the bankruptcy of any relevant parties involved in crude oil futures trading.

In the event where an INE Clearing Member enters into bankruptcy proceedings, INE may still carry out a net clearing of all the outstanding contracts held by such INE Clearing Member. Likewise, if INE is taken over or enters into bankruptcy proceedings due to insolvency, INE Clearing Members are entitled to terminate all the outstanding contracts on INE and perform a net clearing with INE.

When an INE FMDB or INE designated delivery warehouse enters into bankruptcy proceedings, the margins deposited in such INE FMDB and the relevant commodities stored in such INE designated delivery warehouse will not form part of the bankruptcy estate of INE FMDB or INE designated delivery warehouse, and will not be subject to any freezing or attachment order.

Tax

According to the relevant regulations promulgated by the State Administration of Taxation, the physical delivery of crude oil futures traded on INE in the PRC customs special supervision areas will be exempted from VAT. That said, it is not clear whether foreign investors and brokers will be able to enjoy exemption from income tax (as applicable under the QFII/RQFII and the Stock Connect regimes) in connection with crude oil futures trading on INE.

Conclusion

The ability of foreign investors to trade crude oil futures in China marks a historical step in the opening-up of the PRC commodity futures market. The availability of RMB-denominated crude oil futures contracts for international trading will not only enhance China's position in the international crude oil market, but will also promote the use of RMB in global trading, hence accelerating the process of RMB internationalization. On 2 February 2018, CSRC announced iron ore futures, which will be listed on Dalian Commodity Exchange, to be the second futures product available for international trading. It is anticipated that the success of crude oil futures trading and iron ore futures trading in the PRC will prompt China to make more futures products available for international trading in the time to come.

1 INE is an international board of futures trading which was approved in 2013 by the China Securities Regulatory Commission (CSRC) and incorporated in the China (Shanghai) Pilot Free Trade Zone.

2 Overseas Clients who appoint INE Overseas Brokers or INE Overseas Intermediaries to trade crude oil futures must settle with such INE Overseas Brokers or INE Overseas Intermediaries. Hence they do not need to open domestic accounts (i.e. Special Futures Clearing Account) with INE FMDBs.

INE Overseas Intermediaries who choose to go through INE Overseas Brokers to conduct crude oil futures trading for their Overseas Clients must settle with INE Overseas Brokers. Hence, such INE Overseas Intermediaries do not need to open domestic accounts (i.e. Special Futures Clearing Account) with INE FMDBs.

3 Foreign traders and brokers are allowed to use either RMB or foreign exchange funds to participate in crude oil futures trading on INE. Designated Clearing Account, Special Margin Account and Special Futures Clearing Account may be settled in RMB or foreign exchange.

4 Eligibility requirements of an Overseas Client are reviewed and verified by its account opening institution.

5 Besides satisfaction of the relevant qualification requirements in this chart, in order to become an INE Overseas Broker, INE Overseas Intermediary or INE Overseas Direct Trader, prior application must be made with INE and is subject to the review and approval of INE.

For further information, please contact:

Terry Yang, Partner, Clifford Chance

terry.yang@cliffordchance.com

.jpg)