18 August, 2018

A look at ipso facto clauses from a comparative perspective, an update on developments in the Singapore debt restructuring market and DIP/rescue finance considerations.

What is covered in this briefing note?

Ipso facto clauses – ipso facto clauses and the statutory restriction thereof from a comparative perspective, in light of the recent change in law in this respect in Australia where new legislation has introduced a statutory restriction on the effectiveness of ipso facto clauses for certain types of contracts.

Distressed debt market update – a market update (since our last update on 21 May 2018 which can be accessed here) on developments in the Singapore debt restructuring market, including commentary on:

- I.M. Skaugen – first foreign company to apply in Singapore for protection under the new Singapore s.211B scheme of arrangement regime; and

- Hyflux – a well-known Singapore water treatment company has made it publically known that it will be seeking to take advantage of the recently enacted DIP / rescue finance regime.

- DIP finance considerations – key considerations from the perspective of debtors, creditors and potential providers of DIP / rescue finance.

Rescue philosophy versus freedom of contract – each legal system must strike what it considers to be the fair balance …”

What is an ipso facto clause?

An ipso facto clause is a provision included in many medium to long term commercial contracts that allows one party to terminate a contract in the event of an insolvency or potential insolvency of the other contracting party – for example if one party enters into discussions with its creditors to restructure its debts. An ipso facto clause applies "by the very fact" of such event regardless of whether such counterparty has otherwise breached any contractual terms.

Rationale for ipso facto clauses

Broadly speaking the rationale for including an ipso facto clause in your contract is that if your counterparty is (or is likely to become) insolvent then this amounts to an anticipatory breach of contract because it will become beyond the control of such insolvent party to continue to perform. In such circumstances it is considered by many contractual counterparties as imprudent at best and commercially disastrous at worst not to terminate or otherwise amend the terms of such contractual relations. A key argument in favour of recognising ipso facto clauses is that it would be unfair and disruptive for an innocent party to continue to be bound to a contract with an insolvent counterparty who is unable to perform its obligations and to prevent the former from cutting its losses by terminating.

Rationale for imposing a statutory restriction on ipso facto clauses

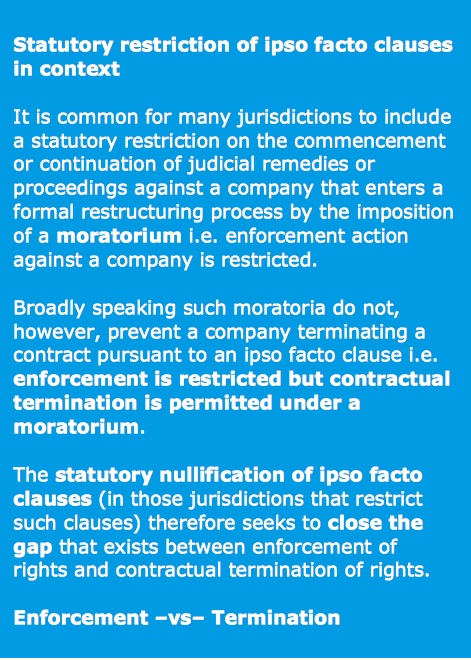

The main argument for imposing a statutory restriction on the effectiveness of ipso facto clauses is that allowing termination of key commercial contracts can pre-determine the fate of a company in financial distress and ultimately undermine the ability of such company to be saved as a going concern given that such contracts, in many cases, comprise the main assets of the company. As a result of the rescue philosophy in corporate restructuring (an approach that is gaining ascendancy internationally) a number of legal systems, most notably the US, introduced legislation designed to legally restrict or statutorily nullify the effectiveness of ipso facto clauses.

A comparative overview

The below is a broad overview of the status of ipso facto clauses in different jurisdictions and some commentary on the same.

|

Jurisdiction Ipso facto clause effective?

|

|

England Yes, under English law a contracting party can rely on an ipso facto clause. In the English courts freedom of contract is generally regarded as a fundamental principle and will in most instances be conclusive. There are certain narrowly defined instances where the common law anti-deprivation rule may prohibit the effectiveness of an ipso facto clause but such circumstances are very limited. |

|

US No, such clauses, in certain circumstances, are ineffective pursuant to US Bankruptcy Code Chapter 11 – Section 365(c). |

|

Hong Kong Yes, similar to the English position, under Hong Kong law a contracting party can rely on an ipso facto clause. Freedom of contract is generally regarded as a fundamental principle and will, in most instances, be conclusive. Neither the Companies Ordinance (Cap 622) nor the Companies (Winding-up and Miscellaneous Provisions) Ordinance (Cap 32) contain any limit on the effectiveness or operation of an ipso facto clause in an insolvency situation. |

|

Singapore Yes, again similar to the English position. It is worth noting that the Singapore Government did consider but ultimately decided against introducing a statutory restriction on the effectiveness of ipso facto clauses during the review process that culminated in the enhancements to the Singapore restructuring law that came into force on 23 May 2017. |

|

Australia No (since 1 July 2018), the Treasury Laws Amendment (2017 Enterprise Incentives No. 2) Act 2017 amended the Corporations Act 2001 to impose a "stay" on the enforcement of ipso facto clauses in new contracts (and of any provision in a new contract that is, in substance, an ipso facto clause) in certain circumstances. |

Distressed debt market update

I.M. Skaugen

first foreign company to apply in Singapore for protection under the new Singapore s.211B scheme of arrangement regime

On 28 June 2018, 102 year old Oslo listed Norway gas carrier company, I.M. Skaugen SE, and its Singaporean subsidiaries (collectively the "IMS Scheme Companies") successfully obtained a 3 month scheme moratorium.

The scheme moratorium bars creditors of the IMS Scheme Companies from threatening court proceedings or from bringing enforcement proceedings against any property of the IMS Scheme Companies in Singapore. The scheme moratorium will also have extra-territorial effect and restricts the commencement or continuation of court proceedings and arbitrations seated outside Singapore started by certain named parties.

This time period will allow the IMS Scheme Companies to complete their business transformation and focus on ongoing discussions with strategic investors.

The scheme moratorium was obtained with the assistance of, amongst others, Virtus Law LLP (part of the Stephenson Harwood (Singapore) Alliance).

Hyflux

well-known Singapore water treatment company has made it publicly known that it will be seeking to take advantage of the recently enacted DIP / rescue finance regime

Hyflux made an application on 22 May 2018 to restructure its business and liabilities through a scheme of arrangement citing cash flow difficulties arising from "prolonged weakness" in the local power market. On 19 June 2018, the company was granted a six month moratorium by the High Court. Hyflux subsequently released a public statement that it would pay all debts incurred post-filing of its scheme application (i.e. that it would perform all contractual obligations post-filing which is likely an attempt to mitigate potential claims by its counterparties for repudiatory breach of contract).

It has since signed non-disclosure agreements and shared information memoranda comprising a general overview of the company's situation, financial information and potential funding needs with 22 potential rescue financiers with a view towards shortlisting suitable candidates for negotiating a S$200 million rescue finance package. The company has set a deadline of 3 August 2018 for potential rescue financiers to indicate interest.

Following finalisation of the rescue financing package, Hyflux is expected to make an application under the new DIP / rescue finance legislation to give effect to its terms (e.g. for the granting of any super priority required by the rescue financiers).

“Super-priority for rescue financing…aid[s] in the financial rehabilitation of enterprises and the availability of such tools makes Singapore an attractive place for distressed businesses in need of restructuring.”

Justice Kannan Ramesh

DIP finance considerations

Key considerations from the perspective of debtors, creditors and potential providers of DIP / rescue finance include:

- Indubitable equivalent – what is it and in what circumstances will the Courts permit priming security?

- Valuations – the determination of what amounts to 'adequate protection' is often contentious with the

- issue of valuations at the heart of such disputes.

- Existing creditors – do existing creditors get to vote on the DIP finance?

- Roll-ups – the ability to roll-up existing unsecured debt into the new secured debt.

- Defensive DIP – what do existing secured lenders who wish to provide DIP financing need to know to protect their interests?

- Cross collateralisation – similar to roll-ups, it brings all lending made the DIP financier (including lending made prior to the DIP finance application) under the protection of the secured DIP financing.

- Subordination Agreements – are junior creditors contractually restricted from offering DIP finance?

- Universal liens – what is the impact of the universal floating charge?

- Cash collateral – what is the treatment of cash collateral?

- DIP financing terms – what are the key considerations and negotiation points?

- Re Attilan – what is the effect of the Re Attilan judgment on the likely development of DIP finance in Singapore?

- Safe harbours – what happens if there is an appeal to a Court order for DIP finance?

For information on the:

- changes to the Singapore scheme of arrangement regime please refer to here.

- DIP / rescue finance please refer to here.

For further information, please contact:

Lauren Tang, Partner, Stephenson Harwood (Singapore) Alliance

lauren.tang@shlegalworld.com

.jpg)