11 April, 2019

A significant number of Australian and New Zealand companies accessed the US capital markets in 2018. We have identified 83 US debt and equity offers that were completed by Australian and New Zealand companies in 2018, with a median amount raised of US$175 million.

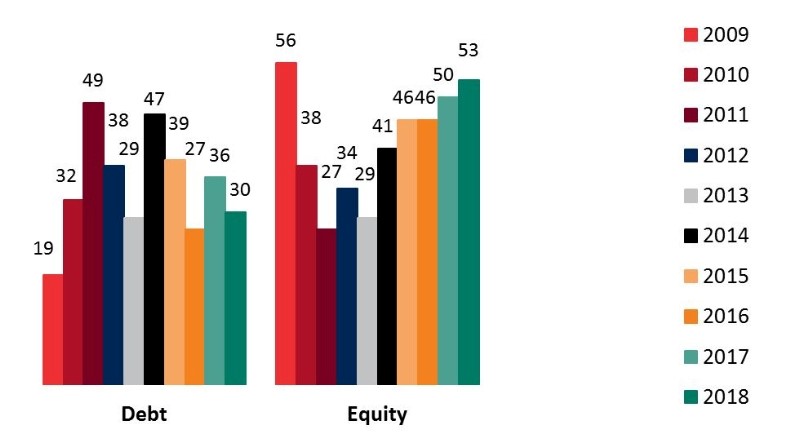

The following graph shows the number of debt and equity offers completed by Australian and New Zealand companies in the United States over the past ten years:

The number of US debt deals decreased 16% from 2017 to 2018 as the number of investment grade and high yield bonds offers under Rule 144A fell significantly, partially offset by an increase in USPP issuances from 19 in 2017 to 24 in 2018 (including 8 companies that raised A$ as well as US$ in the USPP market). It is interesting to note that a few Australian issuers that had previously accessed the 144A markets instead accessed the Australian and Asian debt markets in 2018, including to repay their US$ bonds.

The number of equity offers (excluding block trades) in 2018 was the highest since the GFC in 2009 as more issuers raising less than $50 million include a US tranche. The number of secondary offers increased slightly from 48 in 2017 to 49 in 2018 while the number of Australian IPOs that included a US tranche in compliance with Rule 144A increased from nil in 2017 to 2 in 2018. While the number of SEC-registered equity offers remained the same at 2, two private placements of ordinary shares in 2018 included registration rights.

Other offshore equity markets continue to be important. Based upon transactions that we worked on as International Counsel, more than 150 Australian and New Zealand issuers tapped Asian and European institutional equity investors in 2018.

Click here to download a chart that lists the US debt and equity offers completed by Australian and New Zealand companies in 2018.

For further information, please contact:

Andrew Reilly, Partner, Baker & McKenzie

andrew.reilly@bakermckenzie.com