Background

This note serves as an update on recent legal developments in the Indonesian geothermal market as it enters its next phase of development under the 2014 Geothermal Law (Law No 21/2014) (“2014 Geothermal Law”). The attached schedules provide further details on the 2014 Geothermal Law as well as other commercial issues in the Indonesian geothermal market.

Geothermal Energy In Indonesia

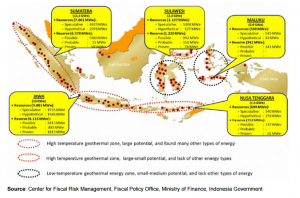

Indonesia is located on the Pacific Ring of Fire, and is estimated to possess 40% of the world’s geothermal reserves. However, only an estimated 4% of Indonesia’s geothermal capacity potential is being tapped. On the other hand, demand for electricity in Indonesia is increasing at a rate of 7% per year.1

(Click to enlarge)

Indonesia is still largely reliant on traditional sources of power such as coal, natural gas and oil to meet most of its energy needs, and has been taking steps so as to fully optimise the range of energy sources available, especially renewable energy.

In 2010, the Second Fast Track Power Program (“Program”) was established pursuant to Presidential Decree No 4/2010, with the goal of rapidly constructing power plants to meet the increasing demand for electricity. Unlike the First Fast Track Power Program which concentrated mostly on coal-based power plants, the Program’s List of Accelerated Projects of the Power Generation Development using Renewable Energy, Coal, and Gas and Related Transmission (“List”) includes more projects which tap on renewable energy sources including hydro power, wind power, solar power and geothermal power. Please refer to Annex 1 for an indication of some of the geothermal projects in the List.

The Indonesian government has set clear targets in respect of its energy diversification – it is aiming to allocate 20% of its energy sources to renewable resources by 2025, and to reduce carbon emissions by at least 26% by 20202 . The development of geothermal energy under the Program would aid the achievement of both goals and the Joko Widodo government has announced plans to triple geothermal power output within the next five years3.

International Support

Indonesia’s drive to promote green energy has received strong international support. Amongst others:

(a) Indonesia has historically had strong ties with New Zealand in developing geothermal energy. A general cooperation agreement covering areas such as geothermal energy training, regulation and technical assistance was signed in 2012, formalising the relationship4 . Joko Widodo has also recently proposed forging an investment partnership with New Zealand for geothermal projects5 .

(b) Indonesia has received an estimated USD,332.5m from the USA, under the auspices of the Green Prosperity Project, to help increase household income and reduce greenhouse emissions by promoting renewable energy. The Green Prosperity Project broadly comprises of funding (through the Green Prosperity Facility), participatory land-use planning, technical assistance and capacity building.6

(c) Indonesia is a beneficiary of the Low Carbon Programme of the UK Department for International Development. The programme focuses on promoting structural changes such as institutional reform, design and implementation of policies and frameworks, capacity building and investment stimulation, that will encourage the development of green energy7 .

(d) Indonesia’s geothermal development has been supported by Japan via the Japan Bank for International Cooperation which has provided loans for the Japanese developers of the landmark Sarulla power plant. The USD1.6 billion 330 MW Sarulla power plant will be the world’s largest geothermal plant when completed in 20188 .

Geothermal Market And The 2014 Geothermal Law

The geothermal market in Indonesia can be viewed through the interaction of various stakeholders on both the legal and commercial fields. Broadly speaking, the 2014 Geothermal Law has helped to improve the regime under the 2003 Geothermal Law (Law No 27/2003) (“2003 Geothermal Law”), in particular the legal field.

Legal Field

The 2014 Geothermal Law was promulgated, with the goals of being more “industry-friendly”, reducing existing barriers and liberalizing the use of geothermal energy for power purposes.

Under the 2003 Geothermal Law, geothermal activities were regarded as “mining activities”, and mining activities were forbidden to be carried out in conservation forest areas pursuant to Law No 41/1999 regarding Forestry (as amended by Law No 19/2004). This was a formidable stumbling block for the development of the geothermal industry as forested areas represent a significant proportion of geothermal areas in Indonesia.

The 2014 Geothermal Law has sought to tackle this issue head-on by declassifying geothermal activities as “mining activities”. Other key changes to the 2003 Geothermal Law include the distinction between direct utilization activities and indirect utilization activities and the centralization of government authority for indirect utilization activities. Please see Schedules 1 to 3 for further details.

Whether the 2014 Geothermal Law will prove to be a boost to the geothermal energy sector remains to be seen but the general thrust towards cutting down the legal barriers against the development of geothermal energy is laudable.

Commercial Field

The 2014 Geothermal Law mandates that the price to be paid for geothermal energy generated from indirect utilization activities must be determined with consideration given to “economic cost”. Geothermal projects are generally characterized by their high upfront costs and lengthy development of thegeothermal work field (“Work Area”) (roughly 7 to 10 years). These features translate into significant exploration and offtake risks, and this injunction may be seen as aiming to tackle commercial concerns about the perceived low profitability of geothermal projects. Whilst the precise mechanism for determining such price has yet to be announced, given that the 2014 Geothermal Law now formally directs the Indonesian government to consider the high costs of geothermal energy development, there is a possibility that the internal rate of return may be increased.

In addition, it should be noted that the Indonesian government has taken steps to mitigate the exploration and offtake risks when undertaking a geothermal project such as:

(a) establishing a Geothermal Fund Facility (“GFF”) to provide loans for data acquisition for exploration;

(b) offering guarantees on PT Perusahaan Listrik Negara (Persero) (“PLN”)’s performance of its contractual obligations via the Indonesia Infrastructure Guarantee Fund (PT Penjaminan Infrastruktur Indonesia (Persero)) (“IIGF”) and Business Viability Guarantee Letter (“BVGL”);

(c) adjusting the tariff regime to make it more attractive to developers;

(d) allowing tariff escalation; and

(e) providing tax incentives.

Please see Schedule 4 for further details on the aforementioned measures.

Stakeholders

PLN is a government-owned entity that enjoys a monopoly over electricity distribution. PLN develops its own geothermal power plants and also purchases electric power or geothermal steam under power purchase agreements (“PPAs”) (sometimes referred to in geothermal projects as “energy sales contracts” or “ESCs”) with government-owned power producers like PT Pertamina (Persero) (“Pertamina”) and PT Geo Dipa Energy (“Geo Dipa”), and independent power producers (“IPPs”). Under the terms of the PPAs, the power producers generate and supply electricity to PLN at an agreed tariff for an agreed period.

As the supply of electricity is an issue of national importance, PLNʼs activities are supported by other government stakeholders.

Firstly, PLN is a recipient of long-standing subsidies from the Indonesian government, thus affirming its financial viability and operational soundness9 . The subsidies also allow PLN to set consumer electricity tariffs below cost recovery levels and increase electricity affordability to a wider section of the population. PLN also from time to time receives capital injections from the government (the most recent capital injection being IDR5 trillion (USD 416m) in February 2015)10, thus providing it with the necessary financial resources to develop the energy market.

Secondly, PLN’s financial standing is enhanced by guarantees provided from the Ministry of Finance and the IIGF. These guarantees seek to guarantee PLN’s performance of its payment obligations under the PPA, and thus decrease the offtake risks of geothermal developers (especially IPPs), making geothermal projects more attractive.

Notwithstanding the support that PLN has received, its various roles as a commercial entity, a provider of social good (namely power) and a promoter of the geothermal sector can sometimes be difficult to balance. For example, lowering the tariffs payable to IPPs would help PLN to keep consumer electricity costs low, but such lower tariffs would then represent a commercial barrier to geothermal developers.

Further, PLNʼs interests are not always aligned with the other government stakeholders. Even though PLN and Pertamina/Geo Dipa are government-owned, historically this has not prevented vigorous tariff negotiations between PLN and Pertamina/Geo Dipa from taking place. Similarly, PLN is not able to fully rely on the Ministry of Finance to provide guarantees as the general fiscal policy of the Ministry of Finance directs it to control its exposure and by extension, the exposure of the IIGF. Hence, the Ministry of Finance will generally not guarantee PLN unless absolutely necessary.

Negotiating the various stakeholder concerns and interests remains a key issue for the development of the geothermal sector, although this problem has been somewhat alleviated due to the current trend towards centralization. Please see Schedule 2 (Authority) for further details.

Future Developments

- Since the 2014 Geothermal Law has been promulgated, new contracts have been awarded to Sumitomo11 and Alstom12 to construct geothermal power stations/plants in Indonesia.

- Starting from 2015, Pertamina Geothermal Energy (“PGE”) plans to operate at least one new geothermal plant per year. PGE’s geothermal plants of PLTP Ulubelu Unit 3, PLTP Lumut Balai, and PLTP Lahendong-5 are expected to commence operation by next year13 .

- The Asian Development Bank (“ADB”) is understood to be considering the financing of the exploration of several geothermal projects in Indonesia, via its Clean Technology Fund (“CTF”).The CTF generally provides financing alongside project finance loans and the ADB’s potential plans may be seen as a step to provide greater support for private geothermal developers during the exploration phase when the risks are generally the highest14 .

Upcoming projects The Ministry of Energy and Mineral Resources (“MEMR”) has prioritized the tender of Work Areas which are on the List. Please refer to Annex 1 for further details.

Based on a press release by the Directorate General of New Renewable Energy and Energy Conservation (“DG NREEC”) dated 26 January 2015, the Indonesian government intends to tender 25 Work Areas from the List in the next three years, out of which 5 to 7 will be tendered out in 2015, including:

(a) Danau Ranau (with capacity up to 110 MW) and Gunung Lawu (with capacity up to 165 MW) which the MEMR is planning to tender out in April 2015;

(b) Simbolon Samosir in North Sumatra with capacity up to 110 MW;

(c) Gunung Endut with capacity up to 40 MW in Banten;

(d) Ijen in East Java with capacity up to 110 MW in East Java;

(e) Rantau Dadap with capacity up to 220 MW in North Sumatra; and

(f) Iyang Argopuro in East Java with capacity up to 55 MW. Please also note the following updates on existing Work Areas:

(a) Gunung Ciremai (capacity of 150 MW) − PT Jasa Daya Chevron (“Chevron”) was previously awarded this Work Area on 2012. Chevron has recently returned the award and the Indonesian government is now considering re-tendering the Gunung Ciremai Work Area; and

(b) Kepahiang (capacity of 110 MW) − The tender process for this Work Area (previously conducted by the provincial government) has been suspended and will be handed over to the central government to conduct in accordance with the 2014 Geothermal Law.

Schedule 1 − Utilization Under The 2014 Geothermal Law

Under the 2003 Geothermal Law, there was only one type of license for all types of geothermal activities – the Geothermal Mining Business License (Izin Usaha Pertambangan) (“IUP”). There are now two different licenses depending on the type of utilization activities conducted by the permit holder (“Permit Holder”) – a Direct Utilization License (Izin Permanfaatan Langsung) for direct utilization activities and a Geothermal License (Izin Panas Bumi) for indirect utilization activities.

Direct Utilization

Direct utilization under the 2014 Geothermal Law refers to activities that utilize geothermal resources for purposes other than generating electricity, for example tourism and agribusiness. The relevant approving authority may be the MEMR, the provincial government or the municipal government depending on where the direct utilization activities are carried out at.

| MEMR | Cross regions |

| Conservation forest area | |

| Protected water areas | |

| Sea areas more than 12 miles from coastline | |

| Provincial government | Within the region (crossing municipalities) |

| Sea areas within12 miles from the coastline | |

| Municipal government | Within one municipality |

| Marine areas within one-third of the provincial jurisdiction |

Failure to obtain a Direct Utilization License or to comply with the terms and conditions of the Direct Utilization License may result in the below penalties. Fines will be further increased by 1/3 if the violations are committed by a business entity.

| Activity | Penalty |

| Conducts direct utilization activities without a Direct Utilization License | Maximum imprisonment of 2 years or a maximum fine of IDR6.000.000.000,00 |

| Conducts direct utilization activities at a location not permitted by the Direct Utilization License | Maximum imprisonment of 2 years and 6 months or a maximum fine of IDR7.000.000.000,00 |

| Conducts direct utilization activities in a manner not permitted by the Direct Utilization License | Maximum imprisonment of 3 years or a maximum fine of IDR10.000.000.000,00 |

Indirect Utilization

In contrast, indirect utilization under the 2014 Geothermal Law refers to activities that harvest geothermal resources for generating energy (such as electricity or steam power). They are managed by the Indonesian government through the MEMR.

Work Areas are determined based on preliminary surveys. The MEMR will then auction the Work Areas to businesses via public tender. Bidders have to demonstrate that they fulfil the administrative, technical and financial requirements, including provision of feasibility study results, a work program and a financing plan. It should also be noted that an Indonesian special purpose vehicle must be incorporated if the bid is successful, and that current negative list rules require that an Indonesian entity must hold at least 5% shareholding in a company participating in the power sector. The selected tenderer will be issued a Geothermal License which will allow it to conduct exploration and exploitation activities in the Work Area for a total period of 37 years (with a possible further extension of 20 years).

Failure to obtain a Geothermal License or to comply with the terms and conditions of the Geothermal License by the Permit Holder may result in the below penalties. Assets and revenues of any business entity committing the violation that have been obtained from conducting illegal indirect utilization activities may also be confiscated by the Indonesian government.

| Activity | Penalty |

| Conducts indirect utilization activities without a Geothermal License | Maximum imprisonment of 6 years or a maximum fine of IDR,50.000.000.000,00 |

| Conducts indirect utilization activities at a location that is not the designated Work Area | Maximum imprisonment of 7 years or a maximum fine of IDR 70.000.000.000,00 |

| Conducts indirect utilization activities in a manner not permitted by the Geothermal License | Maximum imprisonment of 10 years or a maximum fine of IDR 100.000.000.000,00 |

Please note that under the 2014 Geothermal Law, the MEMR has the authority to issue Work Area Determinations (Penetapan Wilayah Usaha) and Geothermal Licenses. However, the recent MEMR Regulation No. 35/2014 has changed the authorizing agency to the Indonesia Investment Coordinating Board (“BKPM”) with effect from 26 January 2015.

Licenses

Apart from obtaining a Direct Utilization License or Geothermal License, the Permit Holder may also be required to acquire one or more of the following licenses in respect of the relevant utilization activities.

Environmental License

An Environmental License must be acquired for both direct utilization activities and indirect utilization activities. Further, in order to obtain the Environmental License, the applicant must either go through the Environmental Impact Analysis (“AMDAL”) or Environmental Management Efforts and Environment Monitoring Efforts (“UKL-UPL”) process.

The AMDAL process applies for geothermal exploitation activities which are conducted in a Work Area of and greater than 200 hectares, or are conducted in an open area designated for geothermal business activities of and greater than 50 hectares, or are conducted for the purposes of developing a geothermal steam and/or power plant with a capacity of and greater than 55 MW. An AMDAL consists of a Terms of Reference, an Environmental Impact Statement (ANDAL) and an Environmental Management Plan and Environmental Monitoring Plan (RKL-RPL), which must be prepared by a certified AMDAL consultant.

The UKL-UPL process applies to geothermal exploration activities that are not required to undergo the AMDAL process. A UKL-UPL consists of a prescribed form which the applicant has to fill in, describing its activities, the environmental impact and its proposed environmental program.

In addition, an Environmental Services Utilization License (Izin Pemanfaatan Jasa Lingkungan) (“IUPJL”) must be acquired if indirect utilization activities are carried out in a conservation forest area.

MEMR License

If direct utilization activities are conducted in a Work Area for indirect utilization, the governor or mayor/ regent must obtain an approval from the MEMR prior to issuing a Direct Utilization License.

If indirect utilization activities are conducted, an MEMR Feasibility Approval (persetujuan Menteri ESDM atas Studi Kelayakan) must be acquired before conducting any exploitation activities.

Forestry License And BUP

Current forestry regulations distinguish between conservation forest areas (no mining activities are allowed), protected forest areas (no open cut mining activities are allowed) and production forest areas (mining activities are generally allowed subject to obtaining the necessary approvals).

(a) Forestry License

A Forestry License from the Ministry of Environment and Forestry (“MEF”) is required for both direct utilization activities and indirect utilization activities that are performed in a conservation forest area.

(b) Borrow-To-Use Permit (Izin Pinjam Pakai) (“BUP”)

A BUP is required for the conduct of indirect utilization activities in protected and production forest areas. An in-principle approval must first be obtained from the MEF before the BUP is issued.An applicant for a BUP is generally required to provide compensation to the MEF in the form of land or Non Tax State Revenue (Penerimaan Negara Bukan Pajak) payment.

At present, there is a moratorium till 13 May 2015 on the issue of BUPs for any areas designated as “primary forests” or “peatland areas”, however geothermal areas are exempted from this moratorium.

Marine Affairs License

A Marine Affairs License from the Minister of Marine Affairs and Fisheries must be acquired for indirect utilization activities that are performed in a conservation water area.

Land Issues

There are several types of registered land rights in Indonesia including:

(a) Ownership rights (Hak Milik);

(b) Cultivation (eg using land for farming, fishery and livestock) rights (Hak Guna Usaha);

(c) Building rights (Hak Guna Bangunan); and

(d) Use rights (Hak Pakai).

Apart from Hak Milik, the other land rights are specific and temporary and need to be periodically renewed. Indonesian citizens and corporate bodies that are established under Indonesian law and are based in Indonesia (such as a PT PMA) can potentially hold of all the above rights, but foreign individuals and foreign representative offices may only hold Hak Pakai. Apart from the above registered land rights, there may also be unregistered land rights such as native title (adat ) rights.

The Permit Holder has the responsibility to settle land use issues with the relevant land owners (and if any, other land users/license holders). The Permit Holder must show them the Direct Utilization License or Geothermal License, notify them of its intention and the activities to be carried out and conduct settlement by consensus and proper compensation.

Provided that the Permit Holder has complied with all applicable requirements, the Permit Holder shall be allowed use of the land in respect of the utilization. There are penalties (imprisonment or a fine) against individuals who obstruct Permit Holders that are legally and properly conducting their utilization activities.

It should be noted that in Indonesia, acquisition of the necessary land rights is often a lengthy process and this should be factored into the timetable of any project.

Schedule 2 – Key Changes To The 2003 Geothermal Law

Please see the below table for a summary of the key amendments to the 2003 Geothermal Law. Evidently, the principal changes to the geothermal legislation are meant to address the regulation of the indirect utilization regime as opposed to the direct utilization regime.

| 2003 Geothermal Law | 2014 Geothermal Law | |

| Nature of geothermal resources | Considered mining activities | No longer considered mining activities |

| Size of geothermal concession | Capped at 200,000 hectares | No cap – depends on the geothermal system |

| Authority to organize and manage indirect utilization (eg. call tenders, issue permits) | Provincial/municipal governments | Central government |

| License period for indirect utilization activities | 35 years (can be extended but the possible period of extension is not stated) | 37 years (possible further extension of 20 years) |

| Production bonuses in respect of indirect utilization | Businesses to give bonuses which will be shared 20% for the central government and 80% for provincial/municipal government | Businesses to give a production bonus only to the provincial/municipa l government |

| Transfer of Geothermal License | Permitted | Prohibited |

Nature Of Geothermal Resources

This is an extremely significant change. As geothermal activities were classified as “mining activities” under the 2003 Geothermal Law, it was not possible to harvest geothermal resources in conservation forest areas pursuant to Law No 41/1999 regarding Forestry (as amended by Law No 19/2004). This was a significant problem as much of Indonesia’s geothermal area is located in forested areas. As geothermal activities are no longer classified as “mining activities” under the 2014 Geothermal Law, it is now possible to carry out geothermal activities in conservation forest areas so long as the relevant licenses are obtained.

Size Of Geothermal Concession

Previously there was a cap of 200,000 hectares on the size of geothermal concession. Such a cap did not always make geographical sense as exploitation depends on how the geothermal system is actually laid out. By determining the concession size based on the existing geothermal system, the 2014 Geothermal Law is a practical step forward.

Authority

As part of Indonesia’s decentralization efforts, Law No 22/1999 (as amended by Law No 32/2004) was promulgated, providing a general legal framework and guidelines for devolution of central government authority to regional governments. However, in recent years, the trend in respect of matters of infrastructure and natural resources has been towards centralization and reducing the regulatory authority of the regencies/ cities.

This has been true of the geothermal regime. Under the 2003 Geothermal Law, managing powers were largely placed in the hands of the provincial and municipal governments who had the authority to issue licenses and local regulations and organize tenders for the Work Areas. Such powers have now been transferred to the central government under the 2014 Geothermal Law, in hope of cutting down excessive bureaucracy and increasing efficiency.

License Period

The license period has been slightly extended, and clarity has also been given in respect of the maximum extension period of the Geothermal License.

Production Bonuses

Under the 2014 Geothermal Law, holders of a Geothermal License are required to pay a production bonus to the provincial/municipal governments. This production bonus is seen as a compromise for the provincial/municipal governments relinquishing their previous powers under the 2003 Geothermal Law, and hence is not payable to the central government.

The production bonus is intended to be based on a percentage of gross income after first commercial production – detailed regulation on the same is currently being formulated. It is also anticipated that there will be a new pricing regime formulated to partially alleviate the high development costs of geothermal power.

It should be noted that the production bonus is payable in respect of all geothermal concessions, even those existing prior to the 2014 Geothermal Law.

Transfer Of Geothermal License

Under the 2003 Geothermal Law, an IUP could be transferred to a company that holds at least 25% of shares (with voting rights) in the IUP holder, so long as the approval of the IUP issuer is obtained. However, there are now new provisions aimed at preventing the sale and purchase of a Geothermal License.

Under the 2014 Geothermal Law, the Geothermal License cannot be transferred. However, subject to the MEMR’s approval, shareholdings in a Permit Holder may be transferred on the Indonesia Stock Exchange after exploration has concluded. This would effectively require the Permit Holder to be a public listed company, for the share transfer to take place.

Schedule 3 – Transitional Provisions

Existing IUP holders should take note of the transitional provisions under the 2014 Geothermal Law.

Direct Utilization

All existing IUPs for direct utilization activities must be converted into Direct Utilization Licenses within 3 years from the promulgation date of the 2014 Geothermal Law (ie. 17 September 2014) (“Promulgation Date”).

Indirect Utilization

Provided that exploitation has commenced by 31 December 2014:

(a) Geothermal business proxy rights remain valid for another 30 years from the Promulgation Date;

(b) Joint operation contracts existing prior to the promulgation of the 2014 Geothermal Law remain valid according to their terms; and

(c) IUPs existing prior to the Promulgation Date remain valid according to their terms, but must be converted into a Geothermal License pursuant to the 2014 Geothermal Law. The provincial/municipal governments must transfer relevant data and documents to the MEMR for the purposes of license conversion within 6 months from the Promulgation Date.

Existing IUP holders who have entered into PPAs/ESCs prior to the 2014 Geothermal Law may renegotiate such contract in a mutually beneficial manner, and in accordance with “customary business”.

Existing IUP holders are not exempted from the production bonus requirement in the 2014 Geothermal Law. They must give such bonus to the provincial/ municipal governments effective from 1 January 2015 or upon commencement of commercial production (whichever the later date).

Any application for a new Geothermal License or extension of an existing IUP must follow the process under the 2014 Geothermal Law. This includes companies who have been declared winning bidders of Work Area tenders but have not been issued with a Geothermal License.

Schedule 4 – Commercial Issues

Standardised Contractual Forms

Although the PPAs issued by PLN during the tenders tend to be fairly similar, there is in fact no formal standard PLN PPA. PLN is under regulatory mandate to develop a standard PPA, and the Bahasa Indonesia draft template of PLN’s standard PPA (specifically drafted for geothermal projects) has been recently made available and can be accessed through PLN’s official website.15 The terms in the draft PLN PPA are fairly typical and include terms such as provision of two performance bonds, price escalation and environmental requirements. We anticipate that development of a standard PLN PPA will make the tender process more efficient.

Government Initiatives

Geothermal projects are costly long-term projects. In Indonesia, this is aggravated by the fact that the tendering process is done before exploration, and the exact amount of geothermal resources available is an unknown until exploration is conducted. The Indonesian government generally expects the Permit Holder to shoulder the risks. However, the Indonesian government has also introduced various incentives and schemes to help mitigate the risks, in hope that they will make geothermal projects more attractive to the private sector.

Geothermal Fund Facility

The GFF is a facility provided by the Indonesian government to minimize risks on geothermal projects in Indonesia. It was set up by the Indonesian government pursuant to MOF Decree No. 3 Year 2012. It is administered by PIP and has about IDR3 trillion as of 2013.

The GFF offers support to government agencies seeking to obtain data from reputable geothermal consulting companies pertaining to tendered Work Areas, as well as a loan facility to IUP or Pertamina (which has been granted a geothermal concession through President Decree No 22/1981 as amended by President Decree No 45/1991). There are two primary forms of support available under the GFF:

- The PIP acquires data from detailed geoscience

- studies, magnetotelluric surveying, thermal gradient drilling, and exploration drilling. The data and information acquired will then be handed over to the central government to be used for public-private partnership tender of the Work Area. The winning bidder of the tender pays back the cost to the PIP with a 5% margin.

- The GFF provides a loan for exploration activities to the IUP Holder and Pertamina who must repay the loan within:

- for an IUP holder, 48 months or at the financial closing date of the geothermal plant, whichever is the earlier date. The financial closing date refers to the date on which the first utilization for the development of the geothermal plant is disbursed from the bank/financial institution to the IUP holder; and

- for Pertamina, 5 years from the commencement of the commercial operation date of the geothermal plant.

Interest will be set at the Bank Indonesia rate prevailing at the time the loan agreement is signed. A collateral is required and this may prove to be a challenge to the Permit Holder which is likely to have limited assets prior to the exploration phase.

Business Viability Guarantee Letter

The BVGL is a government guarantee by which the Indonesian government guarantees that PLN will meet its long-term payment obligations under the PPA. It is primarily targeted towards geothermal projects developed, financed and operated by the private sector which require guarantees backing the financial credibility of PLN. The BVGL becomes ineffective if the Permit Holder fails to reach the financial closing date within 48 months of the issuance of the BVGL.

Indonesia Infrastructure Guarantee Fund

The IIGF was set up in 2009 to provide a “single window” for providing government guarantees for PPP projects (including geothermal PPP projects). The IIGF guarantees the financial obligations of the relevant government contracting agency entering into a PPP contract, thus enhancing the creditworthiness andbankability of the relevant project. As a “single window” any claims from the investor based on government guarantees (whether to the IIGF or the Indonesian government) will be processed through the IIGF.

Tariff Regime

The Indonesian geothermal tariff regime has fluctuated wildly. At present, the tariff system is governed by MEMR Regulation No 17/2014 (“Regulation 17”). Regulation 17 represents a geographically based tariff regime moderated by the commercial operation date.

The three geographical regions for the purposes of the tariff are as follows:

| Region | Location |

| Region I: | Bali, Java, Sumatra |

| Region II: | Halmahera, Irian Jaya, Kalimantan, Maluku, Nusa Tenggara Barat, Nusa Tenggara Timur, Sulawesi |

| Region III: | Locations in Region I and Region II that are (i) isolated and (ii) where power is largely produced from fuel-oil plants |

The tariff ceilings are stated below in USD cents per kWh. They increase (i) in order from Region I to Region III and (ii) the further away the commercial operation date is. The tariff ceilings represent the maximum electricity tariffs that bidders are allowed to put forth in the tender for a Work Area.

|

Commercial Operation Date |

||||||

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

| Region I | 11.8 | 12.2 | 12.6 | 13.0 | 13.4 | 13.8 |

| Region II | 17.0 | 17.6 | 18.2 | 18.8 | 19.4 | 20.0 |

| Region III | 25.4 | 25.8 | 26.2 | 26.6 | 27.0 | 27.4 |

|

Commercial Operation Date |

|||||

| 2021 | 2022 | 2023 | 2024 | 2025 | |

| Region I | 14.2 | 14.6 | 15.0 | 15.5 | 15.9 |

| Region II | 20.6 | 21.3 | 21.9 | 22.6 | 23.3 |

| Region III | 27.8 | 28.3 | 28.7 | 29.2 | 29.6 |

It should be noted that no tariff escalation is permitted until the commercial operation date and in order to alleviate inflation risks prior to the commercial operation date, the relevant tariff ceilings increase the further the commercial operation date is. Regulation 17 does not prescribe a permissible escalation rate but in practice, PLN typically allows a 25% escalation rate (tied to the US Consumer Price Index).

Whilst Regulation 17 represents the current tariff regime, it should be noted that the 2014 Geothermal Law states that the price to be paid for geothermal energy generated from indirect utilization activities shall be determined with consideration given to “economic cost”. This provision appears to give formal recognition to the high costs of developing geothermal energy and directs the Indonesian government to set the tariff ceilings with such considerations in mind. The mechanism for determining such price is to be spelled out in subsequent regulation and may have the possible effect of increasing the internal rate of return.

Tax Incentives

There are tax incentives available for renewable energy projects (including geothermal energy). Under Ministry of Finance Regulation No 21/2010 (“Regulation 21”), the following tax incentives are offered:

(a) income tax and import duty exemption on machinery and capital used for the development of power plants (so long as the goods are not available in Indonesia, or that their Indonesian equivalents have unsuitable specifications or are available in insufficient quantity);

(b) net income tax reduction of 5% of the investment value for each year over a six-year period;

(c) accelerated depreciation and amortization, in accordance with the terms and formula as provided in Regulation 21;

(d) income tax application on dividends to foreign investors of 10% or at a lower rate under an applicable double tax treaty; and

(e) compensation for losses incurred over a five-year period. Such period may be extended by an additional year, subject to the conditions stated in Regulation 21.

Annex 1 – List Of Accelerated Projects Of The Power Generation Development Using Renewable Energy, Coal, And Gas and Related Transmission

(Click to enlarge)

End Notes:

1 Indonesia Investment Coordinating Board, “Investment opportunities – Key sectoral opportunities – Energy”, retrieved 17 February 2015 − http://www.bkpm.go.id/contents/general/22/energy

2 Indonesia Investment Coordinating Board, “Investment opportunities – Key sectoral opportunities – Energy”, retrieved 17 February 2015 − http://www.bkpm.go.id/contents/general/22/energy

3 The Business Times, 21 November 2014, “Indonesia clears path for geothermal energy as power needs rise”, retrieved 17 February 2015 − http://www.businesstimes.com.sg/energy-commodities/indonesia-clearspath-for-geothermal-energy-as-power-needs-rise

4 Ministry of Energy and Mineral Resources of the Republic of Indonesia, 17 April 2012, “The Signing of Indonesia-New Zealand Geothermal Cooperation”, retrieved 10 March 2015 − http://www2.esdm.go.id/pressrelease/53-pressrelease/5649-the-signing-of-indonesia-new-zealandgeothermal-cooperation-.html

5 The Jakarta Post, 13 November 2014, “RI, NZ to forge investment deal on geothermal”, retrieved 17 February 2015 − http://www.thejakartapost.com/news/2014/11/13/ri-nz-forge-investmentdeal-geothermal.html

6 Millennium Challenge Corporation United States of America, 12 June 2012, “Green Prosperity: Reducing Poverty by Supporting Indonesia’s Commitment to Low-Carbon Economic Growth”, retrieved 10 March 2015 – https://assets.mcc.gov/press/factsheet-2012002110501- greenprosperity.pdf

7 Oxford Policy Management, “Low carbon development in Indonesia”, retrieved 10 March 2015 – http://www.opml.co.uk/projects/low-carbondevelopment-indonesia

8 Reuters, 28 May 2014, “Indonesia to start work on worldʼs biggest geothermal plant in June”, retrieved 10 March 2015 – http://www.reuters.com/article/2014/05/28/indonesia-geothermal-sarullaidUSL3N0OE26F20140528

9 Moody’s Investors Service, 12 December 2014, “Moody’s affirms PLN’s ratings”, retrieved 9 March 2015 − https://www.moodys.com/research/Moodys-affirms-PLNs-ratings– PR_303016

10 Tempo, 13 February 2015, “House Approves Rp5t Capital Injection for PLN”, retrieved 10 March 2015 – xhttp://en.tempo.co/read/news/2015/02/13/056642314/House-ApprovesRp5t-Capital-Injection-for-PLN

11 Nikkei Asian Review, 12 December 2014, “Sumitomo to build power plant in North Sulawesi”, retrieved 17 February 2015 − http://asia.nikkei.com/Business/Deals/Sumitomo-to-build-power-plant-inNorth-Sulawesi

12 Alstom Press Centre, 11 February 2015, “Alstom to build a turnkey geothermal plant in Indonesia”, retrieved 17 February 2015 − http://www.alstom.com/press-centre/2015/2/alstom-to-build-a-turnkeygeothermal-plant-in-indonesia/

13 DG NREEC News Release, 23 January 2015, “Pertamina Geothermal to Invest US$432 Million”, retrieved 27 February 2015 − http://www.ebtke.esdm.go.id/post/2015/01/23/765/pertamina.geothermal.ku curkan.investasi.us432.juta?lang=en

14 Infrastructure Journal and Project Finance Magazine, 25 February 2015, “ADB funding for geothermal exploration to expand”, retrieved 26 February 2015 − https://ijglobal.com/articles/95332/adb-funding-for-geothermalexploration-to-expand

15 PT PLN (Persero), “Draft Energy Sales Contract”, retrieved 27 February 2015 – http://www.pln.co.id/eng/?p=69