The International Financial Services Centres Authority (IFSCA) had notified its Fintech Incentive Scheme on February 2, 2022 (Scheme), setting up a framework to provide six grants to eligible applicants. The six grants, thematically, are for ESG financing (Green FinTech Grant), meant to provide early-stage capital for scaling up (FinTech Start-up Grant, Proof-of-Concept Grant, Sandbox Grant, Listing Support Grant), and aimed at supporting third-party incubation (Accelerator Grant), with the common thread among all being an intent to facilitate market access.

This new channel of funding will help in ensuring early-stage capital flow into fintech entities domiciled in GIFT City – while adding to the gains from the recent robust fintech-focused fund activity in the Indian mainland. In the recent past, several initiatives have been undertaken by the IFSCA to promote the fintech hub, including the introduction of a regulatory sandbox in October 2020, for entities operating in specified financial services, including capital markets, banking, pensions, and insurance. Following that, the Central Government has supported several IFSCA measures, including a global fintech hackathon (October 2021) and a fintech thought-leadership forum (December 2021). The IFSCA’s supply-side measures can act as a catalyst in aiding a diverse pool of beneficiaries in the GIFT City fintech ecosystem through benign eligibility requirements. Now, structural, non-financial policies are needed to leverage the Scheme and gain mileage in delivering fintech-led innovation to the markets.

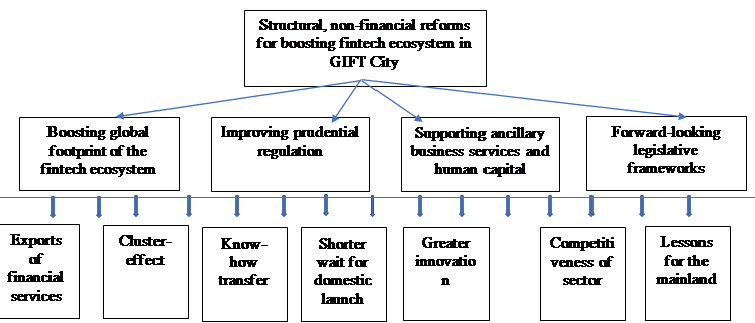

In our view, the IFSCA must aim towards four fundamental medium-term targets for the fintech hub in GIFT City: (i) boosting the global footprint of the fintech ecosystem in GIFT City; (ii) improving the robustness of prudential regulations and supervision of entities domiciled within GIFT City; (iii) supporting the development of ancillary business services and human capital; and (iv) implementing forward-looking financial sector legislations (which may involve elements of deregulation and liberalisation). Short-term supply-side measures by the IFSCA (such as the Scheme) and other smaller steps must align themselves and be guided by these targets. Early-stage and maturing fintech firms are likely to benefit strongly from a regulatory framework that promotes various aspects of ease of doing business – including incorporation of the corporate entity/ registration of business, receiving the necessary regulatory authorisations from the relevant regulator to commence its business operations, and assistance from state authorities in complying with the relevant local, regional and national laws. Regulatory frameworks that are risk-based, proportional, and subject to effective enforcement and consistent judicial interpretations are especially relevant for emerging financial services that may not have a clear regulatory or legal backing at present. Fintech firms are also likely to accord high priority to access to domestic markets and linkages with other markets, and rely on cluster effect – where a dense network of investors, competitors, and business support services help a fintech firm in benchmarking its performance and gaining market access. For Indian start-ups, Singapore has especially emerged as an attractive destination for setting up operations because of these reasons.

Boosting the global footprint of the fintech ecosystem

Fintech firms domiciled in GIFT City tend to focus on expanding their business operations outward to other jurisdictions to capitalise on opportunities in other financial markets – partly on account of tax treatment that is moving towards global best practices, complemented by relatively economical local operational costs. This places them at the vanguard of any effort towards (i) boosting exports of services from India – particularly financial services; and (ii) connecting the Indian market to global financial markets. GIFT City units already contributed to ~10% of the financial services exports from the country in FY19-20.

IFSCA made telling contributions towards this cause in 2021 – through discussions with more than 10 of its counterparts in other jurisdictions on bilateral agreements. This must now translate to cross-border fintech corridors, where the IFSCA and an offshore regulator can agree on a common framework to grant incumbents in each market access to the other. The framework will include provisions on eligibility/ entry conditions, areas for mutual cooperation, joint-regulation, funding, ongoing supervision, etc. The cross-border fintech corridor may give rise to cross-border regulatory sandboxes, such as the one between China and Hong Kong, where two jurisdictions set out a common framework for a jointly supervised and managed regulatory sandbox, which has the distinct benefit of allowing early-stage incumbents with a cross-border focus to test their products under controlled regulatory environments. A cross-border regulatory sandbox facilitates easier exchange of information between regulators on innovations and emerging developments. Fintech firms are also encouraged to test viability and push the scope of innovation without the risks associated with a broader market launch. For a relatively new regulator like the IFSCA, these opportunities present the potential to scale supervisory capacity to meet global standards. While the IFSCA relies on the experience of officials from domestic regulators on deputation, given that the IFSCA exercises powers of the Reserve Bank of India (RBI), the Securities and Exchange Board of India, the Insurance Regulatory and Development Authority of India (IRDAI) and the Pension Fund Regulatory and Development Authority (PFRDA), its unique objectives vis-à-vis GIFT City and other IFSCs remain priority, which may vary from the objectives of domestic regulators.

In the Indian mainland, the RBI has so far launched thematic regulatory sandboxes for retail payments, cross-border payments, MSME lending, and financial frauds. Other financial sector regulators, including the IRDAI have also notified regulatory sandboxes. However, there are inherent limitations to the domestic regulator-led approaches towards regulatory sandboxes, which have the potential to be addressed in GIFT City:

(i) sectoral regulators cannot offer regulatory sandboxes for entities that undertake activities that are cross-cutting in nature or that do not fall under the defined supervisory boundaries of a particular regulator – for example, digital gold or cryptocurrencies. IFSCA, being a unified regulator, will be able to allow regulatory sandboxes for cross-cutting financial services and products more directly;

(ii) the principal objective of India’s financial sector regulators is to address points of market failure, while promoting innovation is not expressly a codified objective. The IFSCA’s role is broader, with a focus on overall development.

This makes the framework that will govern the regulatory sandbox in GIFT City potentially more robust and capable of fostering more innovative products.

Improving prudential regulation and supervision

The development of a fintech hub in GIFT City requires a pipeline of investments at all stages of a company’s expansion and growth. Towards that, there is a need to bring regulatory certainty and global best practices to prudential regulation of capital sources in GIFT City. To sustain and attract a large pool of institutional investors comprising pension funds, insurance companies, portfolio investors and other funds, there is a need to move away from legacy rule-based quantitative investment limits (that restrict exposures to specific kinds of assets) to one that follows a prudential investor framework (where the fund is allowed to independently make investment decisions in relation to its assets under management, subject to certain principles). This specifically involves phasing out of domestic regulations that continue to apply within GIFT City, such as the Insurance (Investment) Regulations, 2016, that may follow legacy approaches towards regulation of investments than global standards.

The IFSCA also needs to focus specifically on risk-based supervision of fintech incumbents that is commensurate with the risks associated with the activity that will be undertaken by the fintech entity. This means adopting a light-touch approach towards regulation, where the scope for harm remains low or remote – in such instances, there is also scope for policies driven by self-regulation to take the lead.

Supporting the growth of ancillary business services

As the fintech hub continues to develop, a greater volume of sophisticated deal-activity will require a network of ancillary business services professionals, including lawyers, chartered accountants, tax advisors, merchant bankers etc., to sustain robust financial activity. This requires thinking on growing the domestic pool of such professionals by offering relevant training and certifications to be obtained within the GIFT IFSC. The recent Union Budget announcement on the entry of foreign universities in GIFT IFSC could provide a significant boost in this regard. The DIFC Academy in the Dubai International Finance Centre, which has entered into collaborative arrangements with leading universities to offer executive training programmes and degrees in relevant disciplines, provides another model.

There is also scope for further supply-side measures to incentivise the growth of ancillary business services professionals through tax benefits on personal and professional income, provided that challenges arising out of differential taxation regimes within a country are adequately addressed.

Deregulation and liberalisation

Although there is a strong outward focus in the activities of fintech firms domiciled in GIFT IFSC, innovative products that offer solutions to problems existing in the domestic mainland – including financial inclusion, delivery of micro-savings and social security covers, may offer great benefits. However, Indian laws and financial sector regulations may sometimes not expressly allow for a product to be introduced in the domestic market, even if the product solves an acute consumer problem on account of risks that the regulator may feel has not been adequately addressed. For example, the lack of a defined regulatory treatment in respect of digital assets hinders products like the XRP token (native to the Ripple blockchain), although it may greatly boost convenience around cross-border remittances.

While domestic financial regulators must exercise caution, keeping in mind the profile of the large Indian demographic that will ultimately hold and use a financial service or product, the IFSCA is better placed to introduce a regulatory framework to govern an innovative product or service relatively earlier, banking on the greater sophistication of its investor pool and given it is global in nature. This gives a chance to domestic financial sector regulators to observe a product and make an informed decision before its introduction in the domestic mainland. In the future, it is not entirely inconceivable that deregulation and liberalisation efforts towards financial sector regulations within GIFT IFSC will provide a blueprint for the mainland. The challenge for the IFSCA, however, in effectively balancing liberalisation efforts against its supervisory roles is that this requires a constant stream of feedback from the fintech industry led market leaders in their respective segments. For the incumbents, liberalised regimes offer greater space for innovation and ease of operational and compliance burdens.

The IFSCA-led efforts, such as the recent Scheme, and the government support including by way of recent Union Budget announcements regarding GIFT IFSC (like the plans to establish an arbitral institution) are laudable, and rightly place the needs of the industry as priority. There is now a responsibility on policymakers, the industry, and experts to drive forward this intent by working on various financial sector policies for GIFT IFSC, leading towards necessary and desirable reforms. For starters, the four areas highlighted in this article could act as a guide towards that.

Boosting short-term supply side measures towards the fintech ecosystem in GIFT City

For further information, please contact:

Arjun Goswami, Partner, Cyril Amarchand Mangaldas

arjun.goswami@cyrilshroff.com