Our Vietnam Legal Update #207 would lead you on 03 legal issues:

I. New minimum wage for employees working under labor contracts

On 12 June 2022, the Government issued Decree No. 38/2022/ND-CP to issue regulations on the minimum wage for employees working under labor contracts. The notable content includes:

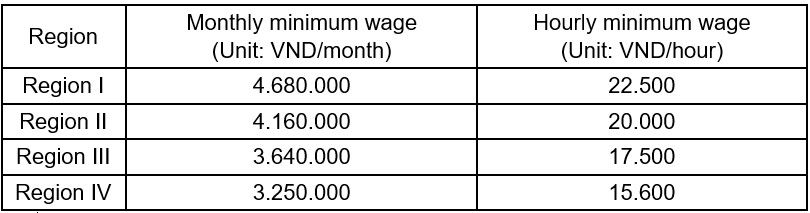

- The new minimum wage is regulated as follows:

- The list of geographical areas in Region I, Region II, Region III, and Region IV is specified in the Appendix attached to this Decree.

- The Decree provides guidance on converting weekly or daily wages, wages by-product, or package wages for employees to monthly or hourly wages to ensure the application of the minimum wage for these groups of employees.

- There is no longer a regulation on a higher minimum wage for employees who have undergone vocational training or vocational training.

- This Decree takes effect from 01 July 2022.

II. Strengthening the review and inspection to detect taxpayers having signs of risks on invoices, combating VAT refund fraud

The General Department of Taxation has issued Official Letter 1873/TCT-TTKT dated 01 June 2022 to strengthen the review and inspection to detect taxpayers having signs of risk on invoices, combating VAT refund fraud. The notable content includes:

- The General Department of Taxation requires tax authorities at all levels:

- Implementing synchronous measures to spread and exchange experiences on signs and violations in invoice management: Illegal issuance, use, purchase, and sale of invoices.

- Organizing the review, assessment, and classification of enterprises having signs of risks on invoices through suspicious signs.

- Some typical signs and violations in the Appendix attached to this Official Letter include:

- Enterprises have large turnover and input and output VAT but do not generate payable tax amounts and have negative VAT for many periods;

- Enterprises have no fixed assets, or the value of fixed assets is very low;

- Enterprises have suspicious transactions via banks (money being transferred or withdrawn on the same day);

- Enterprises employ workers that are inconsistent with their size and industry;

- An individual in his name (the legal representative) establishes and operates many enterprises; etc.

- Other signs and violations are specified in this Official Letter.

III. Summary of articles published in June 2022

Below are the articles that were published on BLawyers Vietnam’s website this month. Please click on the links below to see more.

1. Commercial agencies and 03 notes under Vietnamese laws:

Commercial agency is one of 04 commercial intermediary activities of a trader regulated by Vietnamese laws (along with trader representative, commercial brokerage, purchase, and sale of goods by mandated dealers). BLawyers Vietnam would like to explain this definition and 03 notes under Vietnamese laws.

During business operations, an enterprise may fall into a status of a crisis affecting its solvency. BLawyers Vietnam would like to present to you information on this issue.

3. Tax obligation imposed to asset selling of a Vietnam-based enterprise

A Vietnam-based enterprise that sold its assets shall obligate to declare and pay the value-added tax (“VAT”) and the corporate income tax (“CIT”) to State. BLawyers Vietnam would like to briefly raise 2 issues regarding tax obligation imposed on asset selling of a Vietnam-based enterprise.

4. Is Vietnam tightening the recruitment and employment of foreign workers?

The recruitment and employment of foreign workers in Vietnam are clearly regulated in the prevailing Labor Code and guiding documents. So, is Vietnam tightening the use of foreign workers, and to what extent? BLawyers Vietnam will analyze accordingly.

5. How can Vietnam-based enterprises prevent the risk of being disclosed trade secrets by employees?

Trade secret (“TS”) is especially important in determining the success of an enterprise. Therefore, along with the development, enterprises must find ways to prevent competitors from accessing their TS. One of the subjects that can disclose TS is employees because they are the ones accessing TS directly. So how can enterprises prevent the risk of being disclosed TS by employees?

Currently, the non-disclosed information and non-compete agreement to the employees give many enterprises concerns, especially the enterprises specializing in information technology. So, which regulations of Vietnam that the enterprise must consider developing such agreements?

Corporate income tax (“CIT”) directly affects the business of an enterprise, thus knowing which incomes shall be entitled to CTI exemption o plays an important role. BLawyers Vietnam would like to which incomes are entitled to CIT exemption and application dossiers and orders to request a CIT exemption.

During the resolution of lawsuits under civil procedures, provisional emergency measures (also called interim injunctive relief/ interim relief orders) may be a “turning point”. Such a “turning point” may speed up or suspend/ prolong the case settlement. Thus, how can involved parties apply provisional emergency measures?

For further information, please contact:

Minh Ngo Nhat, Partner, BLawyers

minh.ngo@blawyersvn.com