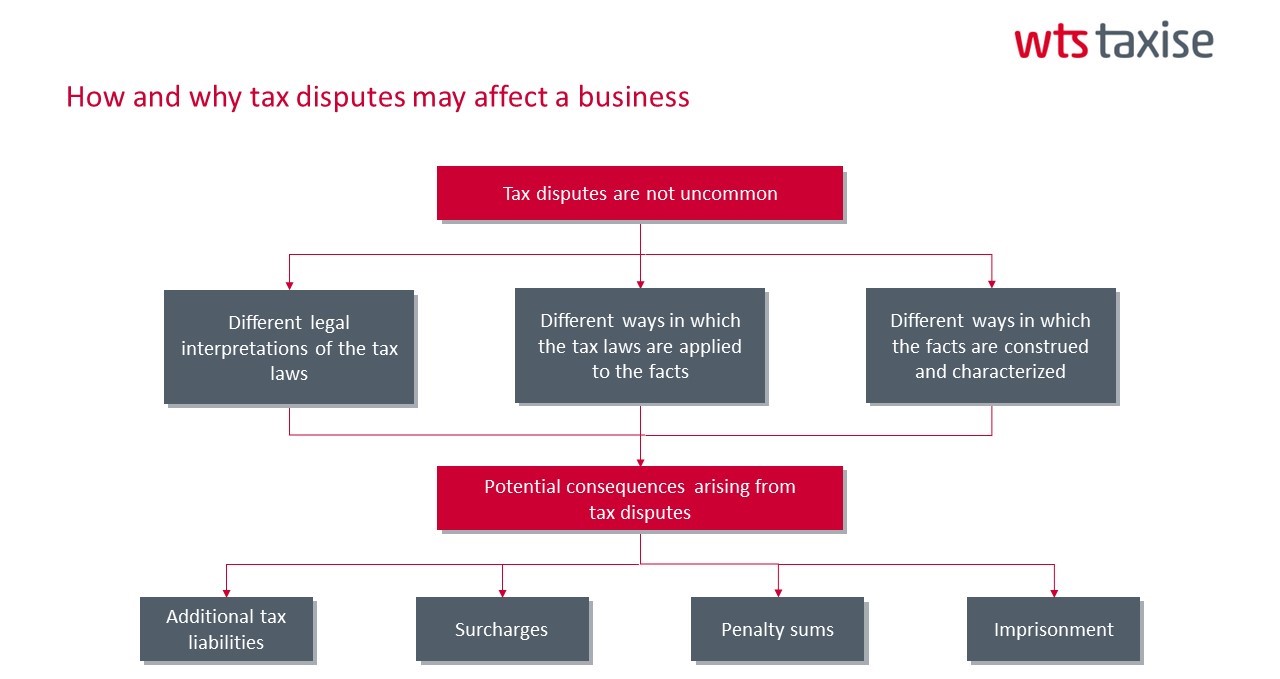

Broadly speaking, there are three main ways in which a tax dispute can arise. First, there may be different interpretations of the tax laws in question. Second, there may be disagreement in terms of how the tax laws are applied to the facts of the case. Third, there is disagreement on how the facts are construed and characterized. Due to these uncertainties in the area of tax, it is not uncommon for tax disputes to arise between a company and the tax regulator. If not managed properly, a tax dispute may lead to serious consequences for both the company and the key personnel involved.

At different stages of the life cycle of a tax dispute, there are actions which you can take to prevent or resolve a tax conflict. For instance, you may consider seeking an Advance Ruling. Or you can make a voluntary disclosure if there are errors in the tax returns. For audits and investigations, one need not be a passive participant. Instead, we should aim to use this period to shape the narrative and convince the tax regulator of our position.

When navigating tax disputes, it is not sufficient to merely understand what your own position is. It is crucial to also have a firm appreciation and understanding of the tax regulator’s position. Because only then one can define what a “successful” resolution of a tax dispute is and thereafter, calibrate your approach towards a tax dispute. If you have a strong case, then you are in a position to hold firm and proceed to litigate the case if necessary. However, if you have a weak case, you may wish to consider resolving the dispute using methods other than litigation.

Download a copy of the presentation slides here.

For further information, please contact:

HanFeng Ma, Taxise Asia LLC

hanfeng.ma@TaxiseAsia.com