Introduction

Undeniably, there has been an increase on the level of awareness on how greenhouse gases (“GHG”) emission has significantly affect the world every year. For companies, CSR campaigns were undertaken where pledges were made to help reduce and potentially prevent climate change by taking the initiative to reduce their GHG emission and setting the goal to achieve net zero carbon emission by 2050. Companies such as Petronas declared their Aspiration to achieve net zero carbon emission by 2050.1 One of the potential ways to achieve this net zero emission goal is through the carbon credit market. Carbon credit also gained the attention in ESG investing which contributes to the reduction of carbon.2 This article will focus on explaining how carbon credits work and how it will help to achieve the net zero emission goal. Most importantly, this article will explain how carbon credits can be claimed and traded followed by a further discussion on the initiative taken by Malaysia in promoting the carbon credit market.

What are Carbon Credits?

Carbon credits are certificates or permits that allow the owner to emit a certain amount of carbon dioxide or other GHG3 over a certain period time.4 1 credit permits the emission of 1-ton of carbon dioxide or its equivalent in other GHG.5 Carbon credits are tradeable and only exist in jurisdictions that are governed by a “Cap-and-Trade” system.6

Countries or regions that have already implemented the cap-and-trade system includes the European Union (“EU”), Australia, New Zealand, South Korea, California and Quebec.7 The purpose of carbon credits is to overall lower the amount of GHG released by the buyers. This allows companies and individuals to account for their unavoidable emissions by buying carbon credits.8 This concept also incentivize climate action by enabling parties to trade carbon credits generated by the reduction or removal of GHG from the atmosphere, such as by switching from fossil fuels to renewable energy or by enhancing or conserving carbon stocks in ecosystems such as a forest.9

Carbon trading started as early as 1997 when countries signed the Kyoto Protocol.10 The Kyoto Protocol operationalised the United Nations Framework Convention on Climate Change (UNFCCC) and was adopted on 11 December 1997.11 It commits industrialised countries to limit and/or reduces GHG emissions according to the agreed individual targets.12

This protocol binds 37 industrialised countries and economies in transition as well as the EU.13 To date, there are 192 parties to the Kyoto Protocol including Malaysia14 which signed the Kyoto Protocol on 12 March 1999 and ratified the same on 4 September 2002. Trading of carbon credit is made available under Article 17 of the Kyoto Protocol as it allows countries to sell spare carbon credits to countries that exceeded their targets.

In addition to the above, the Kyoto Protocol became more effective with the coming into force of the Paris Agreement on 4 November 2016, which is a legally binding international treaty on climate change where its goal is to limit global warming to below 2 or ideally, to 1.5 degrees Celsius.15 Article 6 of the Paris Agreement encourages voluntary cooperation between countries to help achieve emissions reduction targets16 and enables countries to trade carbon credits to help other countries to achieve its climate targets.17

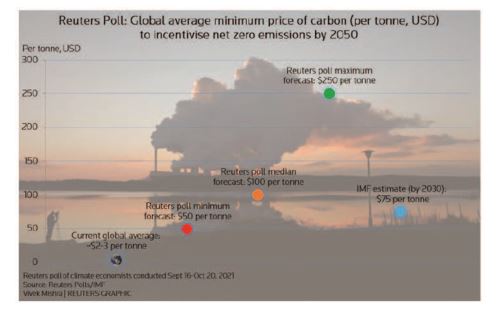

Source: Reuters

How to Claim and Trade Carbon Credits

Carbon credits are a type of permit which allows the company to produce only up to a certain amount of GHG, for example, 1 carbon credit is worth the emission of 1-ton carbon dioxide or its equivalent GHG.18 The amount of carbon credits needed depends on how much GHG are emitted by the company. As a result, companies would take the initiatives to reduce the emission of GHG so that fewer carbon credits are required. Like an allowance, if the company does not use up the carbon credits, they can sell it to other companies. Alternatively, if a company needs more carbon credits, they can purchase it from others that have extra credits. Doing so is known as carbon offset where the credits are purchased to offset the company’s carbon footprint.19 The above is possible via the carbon market where companies can buy and sell carbon credits20.

As Kyoto Protocol allows countries to sell spare carbon credits to countries that exceeded their targets21, carbon credit can be traded in many regional exchanges, for example, Xpansive CBL, AirCarbon Exchange and the Shanghai Environment and Energy Exchange.22 Many countries have implemented the trading system such asthe EU, Canada, China, Japan, New Zealand, South Korea, Switzerland, and the United States.23

Effectiveness of Carbon Credit

Even though the main objective of carbon credit is to encourage the reduction of GHG emission and to achieve a net zero emission by 2050, there are some setbacks. Research showed that a much higher price of carbon credits is required in order to achieve the net zero emission target.24 Currently, the average price of carbon credits is below US$40 to US$80 per metric ton of GHG.25 Report shows that at least US$100 per tonne is necessary in order to achieve the net zero emission by 2050.26 As much as a country wishes to achieve its net zero emission target, a relatively high carbon credit price may potentially drive away some companies from purchasing carbon credits, and this will slow down the process in reaching its 2050 target. If a country wishes to achieve its net zero emission target, more stringent regulation is required.

Carbon Credits in Malaysia

Malaysia too is playing its role in reducing and preventing climate change by progressing rapidly to achieve the nation’s net zero emission by 2050 as compared to the other ASEAN countries.27 For example, Tenaga Nasional Berhad Malaysia aims to cut down carbon emission by 30% in 2024, 45% by 2030 and achieve net zero emission by 2050.28 Malaysia has also recently committed to cut GHG intensity against GDP by 45% by 2030 as compared to 2005 levels.29

Another major step in achieving the net zero emission target is the launching of a voluntary carbon market (“VCM”), an initiative under the purview of the Ministry of Finance (MoF) and Ministry of Environment and Water (KASA), in which Bursa Malaysia Berhad (“Bursa”) has been mandated to implement a VCM Exchange by end of 2022.30 In the VCM exchange, companies can purchase voluntary carbon credits from climate friendly projects and solutions31 to compensate for the emissions and at the same time to finance any carbon mitigation projects.32 The trading of carbon credits in the VCM exchange is similar to those in other jurisdictions in the sense that carbon credits are issued and the owner of the carbon credits can proceed to sell it to others or companies can purchase more from other carbon credits owners.

By the end of 2022, to kick start the process, carbon credits will be sold in auction to interested buyers which would assist in the price discovery for new carbon credit products that will be listed on the VCM exchange.33 Bursa plans to offer standard carbon credit products for trading on a rules-based VCM exchange with product categories for carbon credits originating from nature-based solutions and technologies that reduce and/or remove carbon emissions.34 Bursa further explained that when a developer sets up a project, they can obtain validation and register on a certification standard and a third party will verify the results. Tradeable carbon credits will be issued with a unique serial number on the registry for each ton of GHG produced from the project. The ownership of the credits belongs to the project and the ownership on the registry changes according to the next buyer, if any.

Conclusion

Ideally, the concept carbon credits are effective to reduce GHG if it is done right. As mentioned above, there are setbacks due to the low pricing of carbon credits which may hinder the net zero emission target by 2050 and at the same time there are pros and cons to propose for higher pricing for carbon credits. Ultimately, the government plays an important role not only in regulating and enforcing the carbon trading but also educating and raising awareness on the same. A more stringent enforcement in the purchase of carbon credits pushes the country to achieve its climate targets. Like ESG, Malaysia is fairly new to carbon trading and the VCM is a positive step in introducing carbon trading to companies in Malaysia and it guarantees some, if not a huge impact, in the reduction of GHG emission. At the time of writing, since the VCM has yet to be launched, it is too early to determine its effectiveness as it depends on how the Malaysian Government and Bursa manage the carbon credits, its pricing and trading. Eventually, for a better progress in achieving the net zero target, Malaysia can slowly shift from a voluntary carbon trading to a regulated carbon trading, ensuring companies purchase of the carbon credits and further encouraging the reduction of GHG emission.

- Petronas, ‘PETRONAS Declares Aspiration : To achieve net zero carbon emissions by 2050’ (PETRONAS, n.d.) <https://www.petronas.com/sustainability/net-zero-carbon-emissions accessed 26 October 2022.

- Jennifer L, ‘ESG Investing with Carbon Credits – What Investors Need to Know’, (Carbon Credits.com, n.d.) < accessed 27 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://carboncredits.com/esg-investing-with-carbon-credits-what-investors-need-to-know/> accessed 27 October 2022.

- Will Kenton, ‘Carbon Credits and How They Can Offset Your Carbon Footprint’, (Investopedia, 19 August 2022) < accessed 26 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://www.investopedia.com/terms/c/carbon_credit .asp> accessed 26 October 2022.

- https://submer.com/blog/what-are-carbon-credits/.

- Ibid.

- Kyle Peterdy, ‘Carbon Credits’, (CFI, 19 October 2022), < accessed 26 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://corporatefinanceinstitute.com/resources/esg/carbon-credit/> accessed 26 October 2022.

- Brad Plumer, ‘Around the world, cap-and-trade is still alive and kicking’, (Washington Post, 5 June 2022) < accessed 26 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.washingtonpost.com/blogs/ezra-klein/post/around-the-world-cap-and-trade-is-still-alive-andkicking/2012/06/05/gJQACSKVGV_blog.html> accessed 26 October 2022.

- South Pole, ‘Carbon Offsets Explained’, (South Pole, n.d.), < accessed 26 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.southpole.com/carbon-offsets-explained> accessed 26 October 2022.

- See https://www.worldbank.org/en/news/feature/2022/05/17/what-you-need-to-know-about-article-6-of-theparis-agreement.

- Carbon Market Solution, ‘History of Emissions Trading’, (Carbon Markt Solution, n.d.) < accessed 27 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.carbonmarketsolutions.com/emissions-trading/history-of-emissionstrading/> accessed 27 October 2022.

- UNFCCC, ‘What is the Kyoto Protocol?’, (United Nations Climate Change, n.d.), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://unfccc.int/kyoto_protocol?gclid=Cj0KCQjwteOaBhDuARIsADBqReinIQ-0Q5mJ14Dp1w2DB0td2Q9U-K8_CfjaZZkY-P_YcUA5bjawe6saAjxpEALw_wcB> accessed 27 October 2022.

- Ibid.

- Ibid.

- Ibid.

- United Nations Climate Change, ‘The Paris Agreement’, (UNCC, n.d.), https://unfccc.int/process-and-meetings/the-paris-agreement/the-paris-agreement?gclid=CjwKCAjwh4ObBhAzEiwAHzZYU4fzcPcpQuhuGP-zff2VCqHq0K-EgoArWVWRxW4AtI61C5NKZ67kEBoCYQkQAvD_BwE

- (n 10).

- Ibid.

- Investopedia, ‘Carbon Credits and How They Can Offset Your Carbon Footprint’, (Investopedia, n.d.), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://www.investopedia.com/terms/c/carbon_credit.asp#:~:text=One%20credit%20permits%20the%20emission,limit%2C%20which%20is%20reduced%20periodically.> accessed 27 October 2022.

- Climate Trade, ‘How to buy carbon credits to offset your footprint’, (Climate Trade, n.d.), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://climatetrade.com/how-to-buy-carbon-credits-to-offset-your-footprint/> accessed 27 October 2022.

- Will Kenton, ‘Carbon Credits and How They Can Offset Your Carbon Footprint’, (Investopedia, 19 August 2022), < accessed 27 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.investopedia.com/terms/c/carbon_credit.asp> accessed 27 October 2022.

- United Nations Climate Change, ‘Emission Trading’, (UNFCCC, n.d.), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://unfccc.int/process/the-kyotoprotocol/mechanisms/emissions-trading> accessed 27 October 2022.

- Will Kenton, ‘Carbon Trade: Definition, Purpose, and How Carbon Trading Works’, (Investopedia, 1 September 2022), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://www.investopedia.com/terms/c/carbontrade.asp> accessed 27 October 2022.

- European Comission, ‘International Carbon Market’, (European Commission, n.d.), <https://climate.ec.europa.eu/eu-action/eu-emissions-trading-system-eu-ets/internationalcarbon-market_en#:~:text=The%20number%20of%20emissions%20trading,Switzerland%20and%20the%20United%20States.>

- Samson Opanda, ‘Carbon Credit Pricing Chart : Updated 2022’, (8 Billion Trees, 14 April 2022), < accessed 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://8billiontrees.com/carbon-offsets-credits/new-buyers-market-guide/carboncredit-pricing/> accessed 27 October 2022.

- Ibid.

- Prerena Bhat, ‘Carbon needs to cost at least $100/tonne now to reach net zero by 2050: Reuters poll’, (Reuters, 25 October 2021), < accessed on 27 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://www.reuters.com/business/cop/carbon-needs-cost-least-100tonne-now-reach-net-zero-by-2050-2021-10-25/> accessed on 27 October 2022.

- Yap Leng Kuen, ‘How Malaysia scores on ESG’, (The Star, 2 August 2022), < accessed 28 October 2022″ target=”_blank” rel=”noreferrer noopener”>https://www.thestar.com.my/business/business-news/2022/08/02/how-malaysia-scores-onesg#:~:text=MALAYSIA%20may%20be%20in%20the,relative%20to%20other%20Asean%20countries.> accessed 28 October 2022.

- Fintech News Malaysia, ‘Here’s How Malaysia Is Stepping Up Our ESG Efforts’, (Fintech News, 6 June 2022), < accessed 28 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://fintechnews.my/31329/various/esg-malaysia/> accessed 28 October 2022.

- UNDP, ‘Malaysia’, (UNDP Climate Promise, n.d.), < accessed 28 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://climatepromise.undp.org/what-we-do/where-we-work/malaysia#:~:text=Malaysia%20increased%20its%20mitigation%20ambition,2030%20compared%20to%202005%20levels.> accessed 28 October 2022.

- Dr Wee-nee Chen, ‘Bursa Malaysia Voluntary Carbon Market Exchange’, Bursa Malaysia.

- Bursa Malaysia, ‘Carbon Emission Trading: Bursa’s Voluntary Carbon Market Exchange’, (Bursa, n.d.), https://www.bursamalaysia.com/reference/insights/bursa_broadcast/sectorial_series/carbon-emissions-tradingbursas-voluntarily-carbon-market-exchange

- Jennifer L (n 26).

- Jennifer L (n 26).

- Reuters, ‘Malaysia’s bourse to launch voluntary carbon market by year-end’, (Reuters, 15 August 2022), < accessed 28 October 2022.” target=”_blank” rel=”noreferrer noopener”>https://www.reuters.com/business/malaysias-bourse-launchvoluntary-carbon-market-by-year-end-2022-08-15/> accessed 28 October 2022.