31 January, 2019

The year 2018 should be a milestone for Anti-Monopoly Law of the People’s Republic of China (“AML”) enforcement and development in China.

On May 9, 2018, the newly established State Administration for Market Regulation (“SAMR”), as a sole Chinese antitrust and competition authority, has completed unification and reorganization of the three previously separate government agencies. In the second half of 2018, SAMR transited through a series of AML regulations modification and rearrangement of internal enforcement responsibilities, as well as reshuffle of official positions. Public enforcement is active in 2018, although the institutional reform took much time. Private antitrust enforcement has also developments in 2018. For worldwide antitrust policy and enforcement, international cooperation among competition authorities in different jurisdictions is expected to be more frequent.

This article elaborates AML developments and hot-button issues in 2018, and mainly includes four sections, i.e. institutional changes of China’s antitrust enforcement agency, legislation and competition policy, the 10th anniversary of antitrust enforcement, and private antitrust litigations in China.

- Institutional Changes of China’s Antitrust Enforcement Agency

The institutional reform of antitrust enforcement agency is the biggest competition event in China last year. Prior to the administrative structural changes in March 2018, China has three antitrust authorities, with the Ministry of Commerce (“MOFCOM”) being responsible for merger review, the National Development and Reform Commission (“NDRC”) being in charge of price-related antitrust enforcement, and the State Administration for Industry and Commerce (“SAIC”) being responsible for non-price related antitrust enforcement. While after the reform, China realized the “Three Into One”, so to speak, the antitrust function of MOFCOM, NDRC and SAIC are integrated into the newly established SAMR, in which a new Anti-Monopoly Bureau(“AMB”) is established.

The SAMR is a powerful agency. In addition to the responsibility of antitrust and competition enforcement, SAMR undertakes other administrative tasks including comprehensive supervision and regulation of the market, unified registration of market entities and establishment of information publication and sharing mechanism, comprehensive law enforcement in market regulation, standardizing and maintaining market order, implementation of the quality enhancement strategy, industrial product quality and safety supervision, food safety supervision, safety supervision of special equipment, and unified management of measurement standards, inspection and testing, certification and accreditation, etc.

SAMR now has 27 Bureaus with 805 staff members. The minister of SAMR is the ex-SAIC minister, Mr. Zhang Mao. The vice minister in charge of antitrust matters is Ms. Gan Lin, who is also the ex-SAIC vice minister. For the AMB of SAMR, the key officials include Wu Zhenguo, Director of AMB of SAMR, who is ex-director of AMB of MOFCOM, and three Vice Director General of AMB of SAMR, Lu Wanli, Xu Lefu and Yang Wanshan.

There are 10 divisions with around 50 officials within the AMB. Three divisions are for merger control, one for enforcement on gun-jumping and supervision of remedy implementation, one for enforcement on abuse of market dominance, one for monopoly agreement and one for administrative monopoly, which is unique to China. There are also other three divisions, in charge of general matters, legislative works and international exchange, as well as daily affairs of the anti-monopoly commission’s office respectively.

- Legislation and Competition Policy

When a new agency is set up, usually the most importance is legislation and policy making. This also applies to the SAMR, which needs to unify the rules separately and previously issued by MOFCOM, NDRC and SAIC. Therefore, quite a few new rules or draft regulations being publicized in succession in the past months was witnessed. In addition to that the AML’s amendments are under the way, SAMR has published several supplementary antitrust and competition rules.

On December 26, 2018, SAMR announced two regulations, the Interim Provisions on Administrative Penalty Procedures in Market Regulation and the Interim Measures for Administrative Penalty Hearings in Market Regulation. The Penalty Provisions are an elaborate set of 81 articles spread across 7 chapters entitled General Rules, Jurisdiction, Regular Proceedings, Summary Proceedings, Penalty Execution and Closing of Cases, Service of Law Enforcement Documents, and Miscellaneous. These rules are a reflection of the progress that China has made in administrative penalty legislation and law enforcement practice in recent years, as well as an integration of existing procedural rules administered by different regulatory agencies that have been consolidated into the SAMR. The Penalty Provisions also creates an exception for antitrust procedural rules by stating that “administrative penalty proceedings for violations of the AML shall be conducted in accordance with special provisions of the SAMR. Where special provisions are not applicable, these Provisions shall apply”.

On January 3, 2019, SAMR published the Regulations on Prohibition of Monopolistic Conduct (draft version), with 44 articles providing substantive and procedural regulations of enforcement agencies, definition of monopoly agreements, investigation into monopoly agreements, administrative penalty, etc. It mainly includes four aspects:

- Authorization: provincial SAMR branches can be authorized by SAMR to investigate monopolistic conduct;

- Definition of monopolistic conduct: monopoly agreements are not divided into price-related cases and non-price related cases. The listed monopoly agreement conducts are further elaborated, and specific factors to be considered when defining certain conduct as other types of monopoly agreements;

- “Safe Harbor” policy: it is considered that limited prohibitive or restrictive effect on competition would arise where the market share of undertakings involved is not significant in the relevant market, such as 15% for horizontal agreements and 25% for vertical agreements; and

- Suspension of investigation: procedural provisions are further requested.

On January 14, 2019, SAMR published the Regulations on Prohibition of Abuse of Administrative Power Eliminating or Restricting Competition (draft version), with 31 articles providing the purpose of enaction, scope of application, jurisdiction, definition of abuse of administrative power to eliminate or restrict competition, whistle-blowing and investigation, different results of investigation, etc.

In addition to the above rules regarding monopolistic conducts, SAMR issued the Notice on Antitrust Enforcement Authorization on January 3, 2019, which grants blanket authorization to provincial SAMR branches for antitrust enforcement within their respective geographic regions. The move unifies the pre-existing arrangements where the former SAIC authorized provincial branches on a case-by-case basis and the NDRC granted wholesale authorization, which means that local market regulators can perform antitrust investigation with delegated authority.

Regarding antitrust litigations, with the adoption by the Supreme People’s Court of the Provisions on Intellectual Property Tribunal, China’s first national-level appeals mechanism for intellectual property cases went into operation on Jan 1, 2019. As antitrust disputes are tried by IP courts or IP tribunals affiliated with relevant courts, the Provisions also apply to antitrust cases. It means that starting this year, appeals from first-instance civil or administrative judgments and rulings in antitrust cases will be directly heard by the IP Tribunal of the Supreme People’s Court, which is a newly-established affiliate of the Supreme People’s Court. The bench of IP tribunal is composed of 1 Chief Judge, 3 Deputy Chief Judges and 23 Judges.

- The 10th Anniversary of AML Enforcement in China

- Merger Control Filing

Although the institutional reform has been time-consuming, the efficiency of merger control review was not influenced.

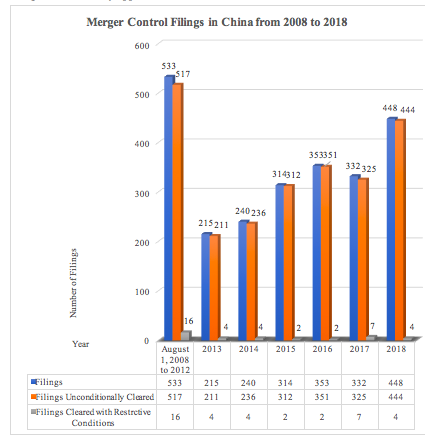

According to the public information (see the Chart below), SAMR reviewed 448 cases in 2018, with 4 conditional approvals and all others being unconditionally approved.

In 2018, MOFCOM/SAMR imposed conditions on 4 merger cases, i.e. Bayer/Monsanto, Essilor/Luxottica, Linde/Praxair, and UTC/Rockwell Collins, with tailored remedies in each transaction to address different competition concerns. Behavioral remedies were imposed only in Essilor/Luxottica, while combination of structural and behavioral remedies was imposed in the other cases. For these complex transactions, MOFCOM/SAMR carried out in-depth review, with an average review time of 373 days. Withdrawal and refile become usual practice for hard cases, which happened in all the four conditional cases (see the Chart below).

Please click on the image to enlarge.

|

Filings Cleared with Restrictive Conditions in 2018 |

||||

|

No. |

Date of Decision |

Case Name |

Filing/Re-filing |

Types of Restrictive Conditions |

|

1 |

Nov 23, 2018 |

UTC/Rockwell Collins |

Initial filing on Nov 16, 2017; re-filling once |

Structural and behavioral conditions |

|

2 |

Sep 30, 2018 |

Linde/Praxair |

Initial filing on Aug 14, 2017; re-filling twice |

Structural and behavioral conditions |

|

3 |

Jul 25, 2018 |

Essilor/Luxottica |

Initiation on Aug 17, 2017; re-filing once |

Behavioral conditions |

|

4 |

Mar 13, 2018 |

Bayer/Monsanto |

Initial filing on Dec 5, 2016; re-filing twice |

Structural and behavioral conditions |

Another case worth mentioning is the Qualcomm/NXP case, which would be viewed by the public as the example that political influence in China’s competition enforcement. This 21-month deal came to an end with MOFCOM holding approval, and Qualcomm paid 2 billion US dollar for breakup fees accordingly.

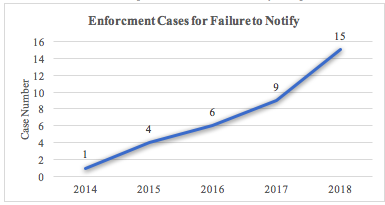

For those cases which failed to notify (i.e. gun-jumping), MOFCOM/SAMR took and will continue to take a harder stance. There are 15 cases in 2018 out of 35 cases in total since the AML was enacted. Generally, it takes MOFCOM/SAMR average 4-9 months for review, and most penalties ranged from RMB 150,000-200,000 yuan; two cases in 2018 incurred penalties of RMB 400,000 yuan. Among these cases, a wide range of companies are involved, such as multinational companies, Chinese SOEs and domestic firms, and a variety of industries including port, steel, chemical, food, paper, real estate, semiconductor, automobile parts, automobile sales, duty-free products and etc.

Please click on the image to enlarge.

- Administrative Enforcement Against Monopolistic Conduct

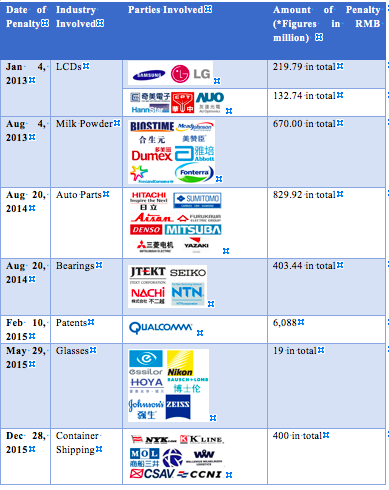

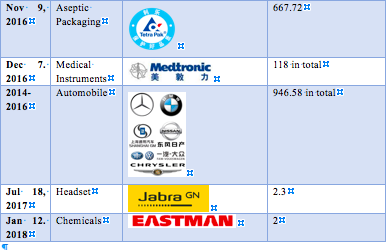

Regarding administrative enforcement against monopolistic conduct in China, there are approximately 220 administrative investigation cases from 2008 to 2018, and 165 of them are monopoly agreement cases and 55 are abuse of market dominance cases. Companies outside mainland China involved in the administrative enforcement against monopolistic conduct are listed below:

Please click on the table below to enlarge.

In 2018, SAMR and local branches initiated 32 investigations into anti-competitive conduct and closed 15 cases. The ongoing cases contained the DRAM case against Micron, Samsung Electronics and SK Hynix (dawn raids on their offices respectively).

- Private Antitrust Litigations in China

The number of private antitrust litigations case in China gradually increased, although China’s private antitrust enforcement is still on the very beginning stage. By the end of 2017, 700 first-instance cases of civil monopoly litigation were accepted and 630 of them were closed. The cases involved various industries, including transportation, insurance, medicine, food, household appliances, power supply, information network and others. Among the 700 cases, those concerning abuse of market dominance accounted for more than 90%.

Meanwhile, legislation of private antitrust litigations in China also had breakthroughs in 2018. According to the Supreme People’s Court of the Provisions on Intellectual Property Tribunal, anti-monopoly appeals would be heard by the Supreme People’s Court since 2019. Guangdong Higher Court also published the Guidelines on Review of SEP Litigations on April 26, 2018. Modification of the Regulations on Law Applications in Civil Monopoly Litigations published by the Supreme Court on May 3, 2012 is under way.

In 2018, there are several hot-button litigation cases in China. For instance, On September 11, 2018, Beijing IP Court announced its acceptance of a private litigation where the plaintiff, Beijing Electric Power Corporation under the State Grid, filed a suit against the South Korean Company, LS, for its horizontal monopoly agreement with 10 other high-voltage cable companies. This is the very first follow-on private antitrust litigation based on foreign antitrust penalty decision. The plaintiff claimed that according to the EU decision made on April 2, 2014, LS and the other cable companies concluded and implemented a price cartel which restricted market competition in the EU and worldwide high-voltage cable product markets, and the plaintiff, an operator of power grid (the downstream customer of high-voltage cable), suffered damages accordingly. The case in Beijing IP Court is still pending. It is said that State Grid brought a follow-on litigation against Viscas in Shanghai IP Court as well.

Looking back to the ten-year private antitrust litigations, it should be recognized, there are a various issues on private enforcement being debated and to be solved in the future in China, for instance, how to coordinate the parallel private antitrust litigation and administrative investigation, whether the evidence collected in administrative investigation, especially in leniency application, should be given to the courts as evidence, how to solve the conflicts between public enforcement agency and Chinese courts towards vertical monopoly agreement, and private antitrust litigations discouraged in China due to low winning rates for plaintiffs, and so on.

In conclusion, following the institutional reform of SAMR in 2018, antirust legislation, administrative antitrust enforcement and private antitrust litigations will face an even more significant challenge in future. The active legislative efforts to unify pre-existing rules offers opportunities to a clearer and more foreseeable future practice, especially when law firms, scholars, trade associations and other relevant agencies are invited to provide public comments. Also, one may also look forward to identifying the new characteristics and focus of the new agency and case handlers, as well as an increase in antitrust investigations in 2019 over 2018. Particularly, given that antitrust appeals are to be heard by the Supreme People’s Court, it is expected that plaintiffs will make more efforts to bring lawsuits and find their way to the supreme court.

For further information, please contact:

Song Ying, Partner, AnJie law firm

songying@anjielaw.com