26 February, 2019

The consumer goods and retail (CG&R) sector had a strong year for M&A in 2018, up 25% from 2017. Megadeals, such as the eye-watering EUR 50 billion Essilor-Luxottica pairing, played a part, but strong consumer markets around the world also supported dealmaking, as well as upticks in three “millennial consumer” trends which show no sign of abating: a desire for personalization, provenance and luxury – including one-of-a-kind experiences.

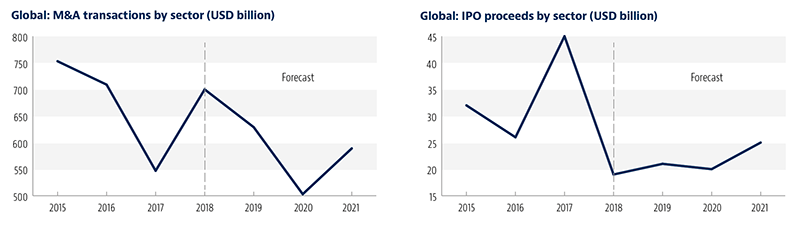

Our Global Transactions Forecast, issued with Oxford Economics, predicts that while global consumer M&A will decrease from USD 700 billion in 2018 to USD 629 billion in 2019, the sector is still significantly more buoyant than any other – including finance, tech and healthcare.

Please click on the image to enlarge.

Alyssa Auberger, Consumer Goods & Retail Industry Group Chair, says the sector trends witnessed in 2018 will continue, with an increased focus on personalization and the consumer's desire to share values and "brand affinity" with the goods they are buying in a way we haven't seen before.

"To remain competitive, retailers need to get a better grasp on what makes shoppers tick. The increased consumer desire for personalization – whether around a product or an experience – is one aspect brands need to be sensitive to, as is the desire to share values with a brand – to trust a product and feel a connection, and those are both likely to be drivers in M&A in the sector.

"For companies to respond to the demand for personalization and trust, technology is key – and that makes the companies that make that technology very valuable to brands. There's a growing sense that the more personalized a product can be, the more unique and 'better' it is for me; whatever technology enables the use of data that allows a sales associate to know green is your favorite color, makes product recommendations just for you, or permits one-of-a-kind customization, transforming shopping into a bespoke experience, is probably a hot bed for acquisition. Similarly, technology that allows brands to demonstrate the origin of their products and enhanced traceability throughout the supply chain will also be in demand.

And just as we saw in 2018, consumers care what a product says about them – they crave sustainable and ethical products and do not only expect, but demand, traceability and a sense of provenance.

Clearly, while companies are all seeking growth, their deals reflect an array of strategies. Some are investing in digitization to adjust to consumers' craving for a bespoke experience. Others are buying companies in faster-growing regions, like the emerging markets, or within on-trend categories, like organic food and drink (Nestle's alliance with Danone and Origin Materials in 2018 to create a PET plastic bottle that hopes to be entirely bio-based is a good example) or sustainable beauty products.

And some are consolidating, in particular in the luxury and fashion sub-sector. The most recent of these massive deals is Capri Holdings' (Michael Kors) acquisition of Versace, which saw the American fashion label pay USD 2.1 billion in a bid to expand into the European fashion space. Richemont’s USD 3.2 billion buyout of the remaining shares it did not own in Yoox Net-A-Porter is another example of where, to coin fashionspeak, consolidation is “the new black.”

In the sector more generally, accelerating wage growth in advanced economies will boost household spending in 2019, and we expect a rise in e-commerce activity as a result, as Capital Markets Partner Adam Farlow explains:

"Rising e-commerce IPO valuations have been a key trend within the CG&R sector with significant amounts of capital raised in 2018, as companies seek funds to drive expansion into new markets, develop new tech platforms, and roll-out new products and services. Emerging markets will be key to future growth of e-commerce with traditional retailers developing online capabilities, greater adoption of mobile payments, and increased demand for goods via online channels."

This was evident during the USD 4.9 billion listing of China food delivery service platform Meituan Dianping in 2018, which helped the company fortify itself against stiff competition from its main competitor, food-delivery platform Ele.me which is backed by China’s biggest e-commerce company Alibaba Group Holding. Both parties, in a bruising battle for market share, are offering heavy discounts to attract bnew customers.

We expect this trend to continue into 2019. With the backlog of IPO candidates increasing and capital becoming more widely available, the IPO outlook remains optimistic – set to rise from USD 19 billion in 2018 to USD 21 billion in 2019.

Key sub-sectors: Food for thought?

"Food and beverage (F&B) related businesses, both through the eco chain upstream (manufacturing) and downstream (retail), will always be a popular target" says Brian Chia, an M&A Partner. Alyssa agrees: "There will be continued activity in F&B, both from the product side and on the development side, as consumers care more and more about ingredients and how they are brought to market. As we see in other subsectors, the desire for traceability goes hand in hand with tech in F&B as well. Consumers want to know what they’re eating – they want to know where the ingredients come from.

Otherwise, changes in diet, say animal-free or glutenfree, or the desire for ‘farm to table’ are forcing the F&B conglomerates to rethink their product offering, which means that smaller producers responding to these dietary changes are also ripe for M&A."

That desire to feel that a product is “experiential” can also be seen in the luxury market, says Stéphane Davin, M&A partner.

"Despite geopolitical shifts, uncertainty and all the factors that seem to affect almost every other sector, the luxury sub-sector is less sensitive to external fluctuations and remains not only buoyant but, in some instances, broadening. The recent LVMH acquisition of hotelier group Belmond is a good example of this: a significant diversification of their holdings and a move into areas which promise the extension of the experience their coveted brand is known for."

US and Asia are dominating deal activity

America's IPO momentum is building, despite an uncertain forecast around GDP growth in light of moves such as the recent Federal shutdown. Broadly speaking, across Asia, access to growing and deepening markets, new geographical footprints, a younger consumer demographic and increasing income disposal all bode well for M&A. However, Brian Chia adds: “Brands may become more selective and strategic in their choice of targets and be circumspect about new opportunities."

Elsewhere, Europe witnessed significant IPO activity in 2018, with a number of listings by companies including Bygghemma Group on NASDAQ Stockholm at USD 171 million.

Adam Farlow comments that, "The group has established a leading Nordic platform and has great potential for both substantial organic and acquisition-driven growth and improved results in the coming years."

Challenges facing CG&R transactions

Like many other sectors, for CG&R, regulation, tariffs, NAFTA and Brexit all nurture a sense of uncertainty, and while companies aren’t necessarily leaving the deal table, some are pausing between courses and assessing their appetite. The tension between online retail versus bricks and mortar has made for winners and losers, and while digitization opens a whole new world for retailers and their ability to personalize their products, the Internet of Things has had a negative impact on over-the-counter retail as shoppers enjoy the experience of wandering around a shopping mall – but don’t necessarily splash the cash there.

For further information, please contact: