4 September, 2018

The Amendment to the PRC Individual Income Tax (“IIT”) Law containing significant changes to Chinese IIT system was issued on August 31, 2018, which will be effective from January 1, 2019 (the “Amendment”). The key changes are listed as below:

Definition of Chinese tax resident

The current applicable rule is that an individual non-domiciled in China will become taxable on worldwide income only when he/she has been a Chinese tax resident for five consecutive years. Having said that, an individual will be considered as a Chinese resident for tax purposes only if during a calendar year he/she does not leave China for more than 30 days in a single trip or for more than 90 days cumulatively. Currently, individuals who are not Chinese tax residents are subject to Chinese IIT only on their China- sourced income, regardless of where the income is paid.

The Amendment introduces the internationally recognized “183-day” criterion for determining whether an individual is a Chinese tax resident. The new 183-day threshold is aligned with international common practice, which would facilitate the connection between Chinese domestic law and the tax treaties. With the new criterion, an individual non-domiciled in China should be considered as a Chinese tax resident as long as he/she has lived more than 183 days in China during a given calendar year.

However, it remains unclear whether the abovementioned five-year rule, which is currently applied to individuals non-domiciled in China, will be abolished or not. If such rule is abolished, an individual non- domiciled in China will become Chinese tax resident as long as he/she has lived in China for more than 183 days in a calendar year, and will thus be subject to Chinese IIT on worldwide income, and not only on China-sourced income. The impact on the expatriates working in China will be particularly important.

Thus, the expatriates are recommended to review their tax residence status, by taking into account, if applicable, the provisions of the double tax treaty between China and their country of origin, in order to reduce or avoid any risk of double taxation.

Aggregate taxation and tax rates

Based on the current IIT law, all taxable income of individuals is classified into 11 categories and taxed separately according to different tax rates and brackets.

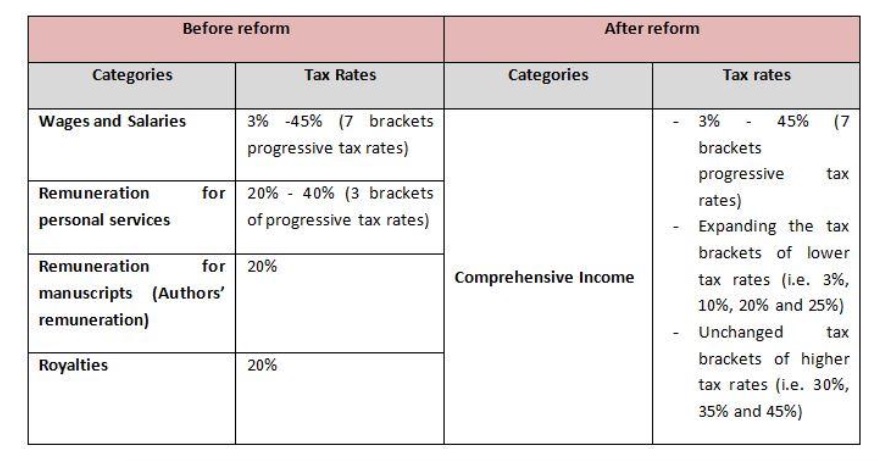

In the Amendment, four types of labor income (i.e. salaries and wages, remuneration for (independent) services, authors' remuneration, and royalties) are now combined into a single new tax category called “comprehensive income" (“Comprehensive Income”).

Salaries and wages are currently subject to progressive tax rates ranging from 3% to 45%, with seven tax brackets. The tax rates and seven brackets will remain and be applied to compute tax on Comprehensive Income.

Nevertheless, the lowest three brackets (i.e. 3%, 10%, and 20%) would be broadened considerably to benefit middle-/low-wage earners.

Below please find the comparisons chart:

Please click on the table to enlarge.

Below please find the comparison of the detailed tax rates:

Please click on the table to enlarge.

The Amendment specifies that the Comprehensive Income shall be assessed on an annual basis for resident individuals. As such, resident individuals need to perform a final settlement at the time the annual return is filed (the annual return is due between March 1st and June 30th of the year following the calendar year in which the income is received). Having said that, the employer would still be required to withhold IIT on salaries and wages received by these individuals on a monthly or transactional basis. For nonresidents, the Comprehensive Income shall be assessed on a monthly or transactional basis.

Standard basic deductions

The current IIT law provide for a standard basic deduction for the calculation of IIT on salaries and wages. According to the Amendment, such deduction regime will apply to Comprehensive Income and will be increased from RMB 3,500 per month to RMB 5,000 per month (i.e., RMB 60,000 per year). Meanwhile, the Amendment abolishes the additional standard deduction of RMB 1,300 per month that currently applies to foreign individuals working in China.

Additional specific deductions

The existing IIT law allows only a few specific deductions that are normally limited to statutory social security contributions for Chinese taxpayers. The Amendment introduces the principal of additional specific deductions, without specifying the condition relating to taxpayer’s nationality, such as deductions for children’s education and continuing education expenses, medical expenses for critical illnesses, housing mortgage interest, and housing rent, etc., without however giving more details on the extent of these deductions and the criteria to be met to benefit from them. The measures shall be further detailed in a later stage through issuance of implementing rules or special circulars. The upcoming texts are also expected to make clear whether the taxpayers with foreign nationality can continue to benefit from the current additional specific deductions, or in the contrary all taxpayers shall be subject to the same deduction rules. In the meantime, we suggest that all taxpayers collect and keep all pieces of information and documents that may be requested in order to benefit from the said additional specific deductions, such as the official invoices (fapiao), the lease agreement, etc.

The Amendment also provides that if a taxpayer submits information relating to additional specific deductions to his/her employer (who is responsible for withholding taxes at source) and requests the latter to deduct the relevant items of costs from the IIT computation basis, the employer should not refuse the request. However, the Amendment did not specify whether the employer has the obligation to verify the authenticity of the documents submitted or not, nor the responsibility of the employer in case the amounts deducted are found later to be non-deductible.

Tax compliance and social credit

The Amendment introduces new rules relating to tax compliance obligations. The key point is “one taxpayer, one tax ID number”, which will be the ID Card number for Chinese citizens, and a special number for other taxpayers, it being specified that such special number can already be found on the IIT declaration return of the latter. Such measure should allow for a better control over the social credit of each of citizens, with probably an impact on their daily life in the future, for example the conditions to obtain bank loans.

Anti-avoidance rules

The Amendment introduces anti-avoidance rules which allow the Chinese tax authorities to initiate tax adjustments and collect underpaid tax with late-payment interest in the following situations:

- When transactions between an individual and his or her related parties do not comply with the arm’s length principle and are performed without bona fide commercial purposes;

- When a resident individual controls (or jointly controls with other resident individuals/companies) an enterprise established in a jurisdiction where the effective tax rate is significantly low and the enterprise does not distribute profits or distributes less profits than it should without a reasonable business justification; and

- When an individual obtains improper tax benefits through an arrangement that lacks a reasonable business purpose.

Effective date of the Amendment

Phase 1 – the new tax brackets and new standard basic deduction will start to apply to the employment

income as from October 1, 2018,

Phase 2 – the overall amendment would be effective from January 1, 2019.

For further information, please contact:

Olivier Monange, Partner, DS Avocats

monange@dsavocats.com