6 January 2021

2020 has been an unprecedented and challenging year. When the Covid-19 virus broke in January in Asia, businesses learned that remote working was no longer an option but a necessity. Companies and employees in the region were adapting in Q1; thus, we monitored a quiet market. China became the first major economy to begin to recover from the covid-19 pandemic in March. Since July, we saw a good level of hiring activity despite the 3rd and 4th wave although Covid-19 did slow lateral hiring in Asia, especially Hong Kong and Singapore. Since Q3, Australia superseded Singapore in legal lateral hiring. Here we look back on the key appointments of the past 12 months in the Asia Pacific region:

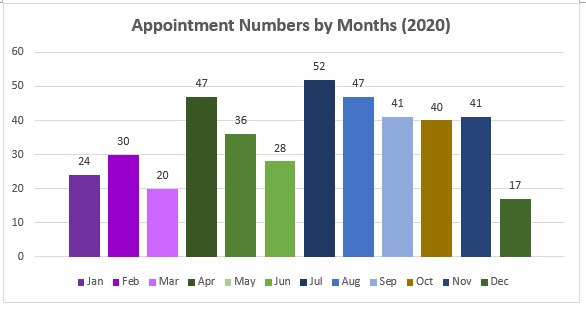

Appointments

-

The numbers of key appointments in Q4 dropped 30% compared to Q3 and 12% to Q2.

-

But, compared to Q1 when the Covid-19 pandemic deeply hit the region, the numbers of key appointments in Q4 still received a 36% rise.

-

The APAC lateral market was very active from July to November when the pandemic showed easing in Asia. Unfortunately, with Covid-19 cases rising again in several regions this winter, governments tightened social-distancing rules in December. In addition to traditional festive holidays, this dramatically slowed the hiring market in December.

-

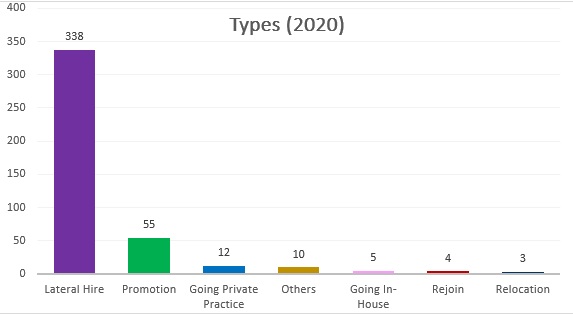

79% of the 427 key appointments in 2020 were lateral hires. 33 out of 55 promotions were senior appointments (Regional Managing Partner, Managing Partner, Executive Member, Head of Office/Practice, etc.)

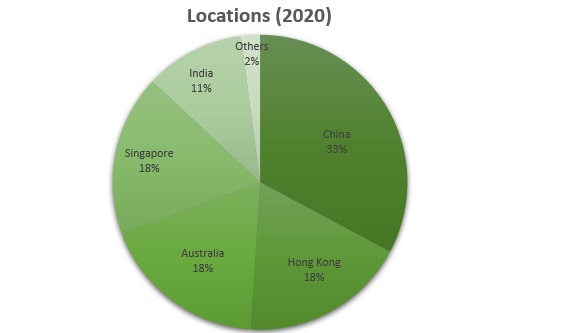

Locations

-

China led the hiring spree with 124 significant hires in 2020, followed by Hong Kong (74), Australia (73) and Singapore (73).

-

China (21), Hong Kong (11) and Singapore (11) all recorded the most key appointments in July.

-

The recurrence of Covid-19 in Singapore from the mid of July to August has a strong impact on their economic activities. As a result, Singapore reported the lowest lateral hires in August of markets surveyed.

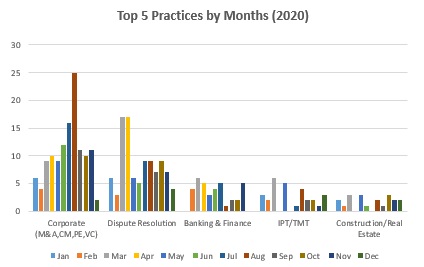

Practices

-

The top 5 practices in 2020 for hiring were Corporate, Dispute Resolution, Banking and Finance, IPT/TMT, and Construction/Real Estate.

-

Corporate/M&A/Capital Markets practices dominated the lateral hires in 2020. In August, these practices saw the highest activity levels

-

Dispute resolutions/Arbitration/Investigations practices saw steady growth from Q1 (17) to Q2 (23) and a stable Q3 and Q4.

-

Construction/Real Estate and Restructuring & Insolvency practices saw the same numbers of key hires in the first half of 2020. Construction/Real Estate practices received an annual record-high of significant appointments in Q4, replacing Restructuring & Insolvency as the 5th most active practice in 2020.

For further information, please contact:

Sam Kenworthy, Director – Head of Private Practice, Hughes-Castell

skenworthy@hughes-castell.com.hk