30 April, 2015

Executive Summary

Introduction

Historically, private and publicly-listed companies in India have disclosed only as much information as is mandatorily required. The justification and argument for this approach — that the provision of additional information would be of greater interest to competitors rather than investors — has often been repeated by companies. Today, however, increasing regulatory activism and international institutional investors are demanding additional disclosures from India’s 9,000+ listed companies, in the interest of improving corporate governance and removing information asymmetries in the capital markets. Last year, Indian capital market regulator Securities and Exchange Board of India (SEBI) introduced an amended Clause 49 in the Equity Listing Agreement that demands board-level oversight for ‘disclosure and communications,’ while acknowledging weak enforcement of mandatory disclosure standards.

Recognising that raising disclosure standards is an ongoing process that requires a shift in strategic thinking at boardlevels, FTI Consulting reviewed publicly available information disclosed by leading publicly-listed companies in India to ascertain current practice and identify trends that would be helpful to boards of such companies. Combining information parameters that are mandated by law with additional information parameters that are offered voluntarily by publicly-listed companies in the interest of greater transparency, FTI Consulting created a weighted, Composite Disclosure scoring system (more in Methodology section), with six Mandatory Disclosure parameters and five Voluntary Disclosure parameters; and applied it to the Bombay Stock Exchange (BSE) Top 100 index constituents. The report findings, below, reveal current disclosure practices amongst India’s leading 100 companies (by market capitalization).

Report Findings

Composite Disclosure Scores

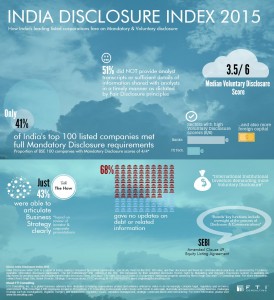

Overall as a group, the BSE 100 index constituents, have an average Composite Disclosure score of 6.7/10, a reflection of low Mandatory and Voluntary Disclosure scores.

- A little over a fourth (27%) have Composite Disclosure scores of 8 or more. This includes three companies which stand out for achieving the maximum score of 10 (Bharti Airtel, ICICI Bank and Infosys).

- About half of all BSE100 index constituent companies have Composite Disclosure scores of more than 5 but less than 8.

- Another fourth of the BSE 100 index constituent companies have low Composite Disclosure Scores of 5 or less. A third of these are government-owned enterprises.

Mandatory Disclosure Scores

Overall as a group, the BSE 100 index constituents have a median Mandatory Disclosure score of 2.5/4 when reviewed against the six basic mandatory disclosure parameters (see Methodology).

- Over half of all BSE 100 index constituent companies have Mandatory Disclosure scores less than 2.5, reflecting a poor level of disclosure for basic mandated information.

- Only 41 of the 100 companies in the BSE 100 Index had a full 4/4 score for Mandatory Disclosure, with the remaining 59 falling short on either one or some of the mandatory disclosure parameters. This is a glaring gap and a telling statistic indicating the unavailability of basic information that is required by law in the Indian capital markets.

- Unavailability of updated analyst transcripts and sufficient public information regarding analyst engagements was the single largest reason for low Mandatory Disclosure scores, with 51% of Indian companies not providing analyst transcripts on their corporate websites. This goes against the principle of Fair Disclosure to all investors and majority and minority shareholders irrespective of class.

Voluntary Disclosure Scores

Overall as a group, the BSE 100 index constituents have a median Voluntary Disclosure score of 3.5/6, when reviewed against five basic mandatory disclosure parameters (see Methodology).

- A third of all BSE 100 index constituent companies have Voluntary Disclosure scores of 3 or less, and 14% have the lowest Voluntary Disclosure score of 1/6. Six of the lowest scorers were government-owned enterprises.

- Only eight of the 100 companies in the BSE 100 Index had a full 6/6 score for Voluntary Disclosure, reflecting the low priority placed on providing additional information in the interest of greater transparency by a majority of the companies. Banks account for six of these eight companies with Voluntary Disclosure scores of 6/6 — Axis Bank, Bank of India, Federal Bank, ICICI Bank, IDBI Bank and IndusInd Bank. Infosys and Bharti Airtel were the only non-bank players in this short list of high Voluntary Disclosure scorers.

- Lack of updated debt-related information was the single largest reason for low Voluntary Disclosure scores, with 68% of Indian companies not providing adequate information on their corporate websites. This was followed by inadequate information pertaining to business strategy with 57% of companies not providing adequate strategy related information on their corporate website.

Conclusion

The low scores for Mandatory Disclosure and Voluntary Disclosure demonstrate the need for a shift in strategic thinking at the board-level and in the senior management teams of publicly-listed Indian companies.

Bridging the gaps in Mandatory Disclosure requires a stricter adherence to Fair Disclosure principles when engaging with the investment community.

While posting online analyst transcripts on the company’s website may seem like an easy fix, changing prevalent practices of selective access to brokerage houses entails a more fundamental shift in the manner that companies engage with the investment community. Companies need to recognize that practices like allowing brokerage houses to host a company’s analyst calls, which happens in many instances every quarter, are telling signals of a permissive culture and rife conflicts of interest.

On Voluntary Disclosure, Indian companies have a lot of work ahead of them to improve the manner in which Management Quality is perceived externally. Scores for Strategy Articulation and Debt-related Information are proxies for an opinion on Management Quality, a significant and subjective filter in the investment decisions of institutional investors. It is surprising that a large majority of BSE 100 index constituents did not articulate corporate strategy in sufficiently clear terms. This is also an indication of the currently-prevalent focus on financial metrics over non-financial ones. This is an area that needs to be revisited by Indian companies and their boards when finalising their disclosure policy.

Additionally, while we noticed many high Voluntary Disclosure scorers enjoying support from a higher proportion of foreign institutional investors in their shareholding structure, but a causal or direct relationship between the two could not be established. This is an area that requires more academic study and attention.

(Click to enlarge)

Methodology

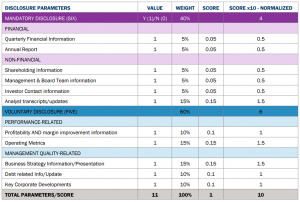

The Mandatory Disclosure weighted score of each company has been calculated on the basis of presence (1) or absence (0) of six mandatory information disclosure parameters, available publicly either on the company's or the BSE’s website. The six parameters are: Quarterly Financial Information, Annual Report, Shareholding, Board and Management Team, Investor Contact and Analyst Transcripts; covering financial and non-financial parameters.

Similarly, the Voluntary Disclosure weighted score has been calculated on basis of presence (1) or absence (0) of five voluntary disclosure parameters – Profit and Margin Improvement Narrative, Operating Metrics, Business Strategy Articulation, Updated Debt Information and Key Corporate Developments. The first two parameters of the Voluntary Disclosure score relate to business performance, while the other three can be taken as proxies for quality of management and business leadership. The Composite Disclosure Score (Composite Disclosure Score = Mandatory Disclosure + Voluntary Disclosure) has been calculated for each company in the BSE 100 Index, with a weight of 40% for Mandatory Disclosure and 60% for Voluntary Disclosure, as observed during period beginning 20 February 2015 to 20 March 2015.

All 11 parameters are combined for a weighted Composite Disclosure score of between 0–10, with a 10 score indicating that all 11 mandatory and voluntary disclosures are publicly and readily available, with diminishing values for companies that score low on overall disclosure.

A separation of Mandatory Disclosure and Voluntary Disclosure scores helps indicate how preferred disclosure philosophies are followed by the leading Indian companies. Technically, all companies should fully adhere to Mandatory Disclosure standards and have varying levels of adherence to Voluntary Disclosure. All parameters are weighted as below, to reflect desirability for more Voluntary Disclosure and transparency. These parameters and the weights assigned to them will be reviewed every year.

Mandatory Disclosure Parameters: Definitions

- Quarterly Financial Information: Updated financial information from the last quarter, i.e. Q3 FY 2014-15.

- Annual Report: Provision of the last Annual Report, i.e. for FY 2013-14.

- Shareholding Information: Details on updated share ownership structure from the previous quarter, i.e. Q3 FY 2014-15.

- Management and Board Team Information: Updated information about board and senior management team.

- Investor Contact Information: Specific contact details of company secretary/CFO/compliance head that investors can write to.

- Analyst Transcripts/Updates: Call transcripts of analyst conference calls from last two quarters, i.e. for Q2 or Q3 FY 2014-15.

(Click to enlarge)

Voluntary Disclosure Parameters: Definitions

- Profitability and margin improvement information: Specific and detailed information pertaining to the profitability of the company on impact on profit margins in the previous three quarters, i.e. Q1/Q2/Q3 of FY 2014- 15.

- Operating Metrics: Specific non-financial information pertaining to the operations of the company in the previous quarter, i.e. Q3 FY 2014-15. • Business Strategy Information: Specific and detailed information on business strategy and how the management intends to deliver growth over the next 12 months at least once in the previous three quarters, i.e. Q1/Q2/Q3 of FY 2014-15.

- Debt-related Information: Updates about debt re-ratings or credit ratings in last three quarters, i.e. Q1/Q2/Q3 of FY 2014-15.

- Key Corporate Developments: Significant or material developments pertaining to the company that may have occurred in the last three quarters, i.e. Q1/Q2/Q3 of FY 2014-15.

Assumptions About Analyst Engagement/ Transcripts & Key Corporate Developments

- It is assumed that BSE 100 constituent companies would have interacted with at least one analyst in the previous four quarters and that there should be at least one public disclosure pertaining to discussions with an analyst or a group of analysts. Failure to record any analyst engagement or transcript in the previous 12 months earns a company an individual score of ‘0’ for the parameter of ‘Analyst Transcripts’ under Mandatory Disclosure.

- It has been assumed that all BSE 100 constituent companies provided full and timely disclosure about key corporate developments within the prescribed time limits defined by SEBI. For this purpose, an individual score of ‘1’ has been assumed for all companies across the board on the parameter of ‘Key Corporate Developments’ under Voluntary Disclosure.

Exhibit A: Composite Disclosure Scores By BSE 100 Index Constituents

(Click to enlarge)

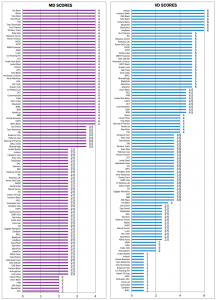

Exhibit B: Mandatory Disclosure & Voluntary Disclosure Scores By BSE 100 Index Constituents

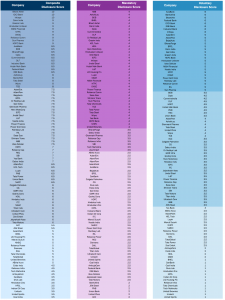

Exhibit C: Categorisation Of BSE 100 Companies By Composite, Mandatory And Voluntary Disclosure Scores

(Click to enlarge)

For further information, please contact:

Amrit Singh Deo, Director, FTI Consulting

amrit.singhdeo@fticonsulting.com