4 September, 2019

SFC licensing can be a dangerous area for the unwary to navigate because of the misinformation which abounds in the market. In this article we have sought to identify the various questions people have and to provide short clear answers.

1. Do PE managers operating in Hong Kong need SFC licences?

This simply depends on what people will do when they are in Hong Kong. There is no private equity- specific licence in Hong Kong so in each case you need to analyse what the individuals will do here, against the various activities regulated under the Securities and Futures Ordinance (SFO), and then consider whether any of the (limited scope) exemptions apply.

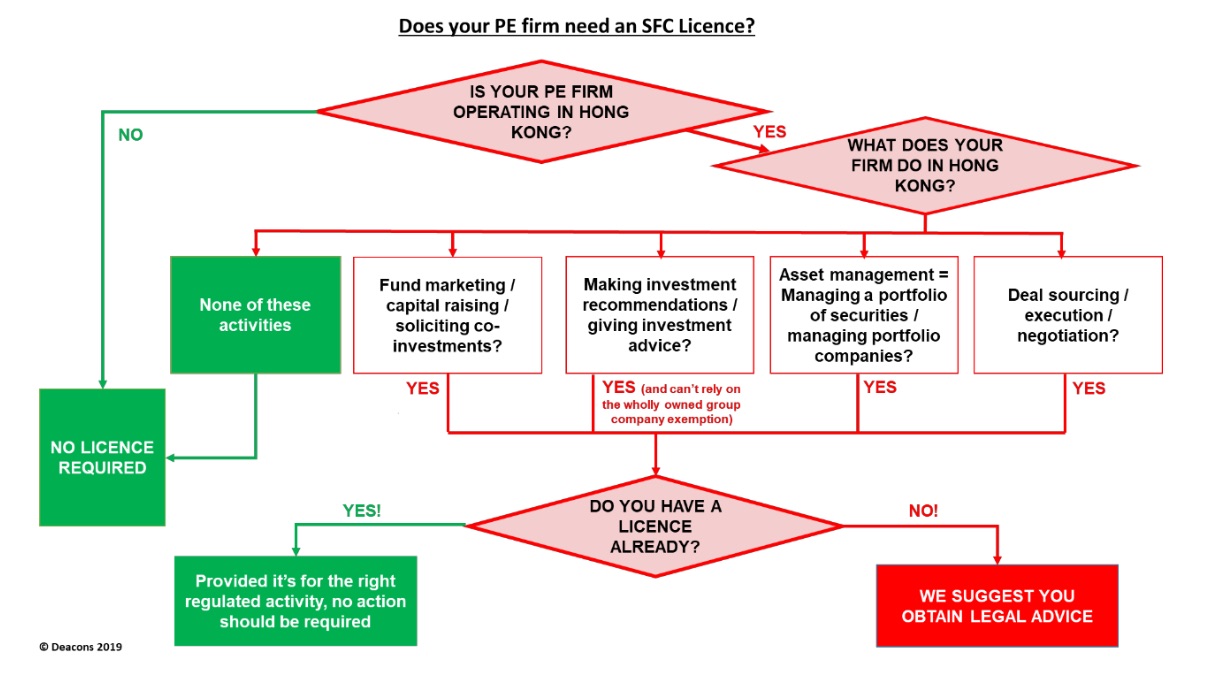

This diagram summarises when a PE manager needs an SFC licence to operate in HK:

Please click on the image to enlarge.

2. But PE managers only invest into private companies; aren’t private companies exempted?

No, there is no such exemption. The definition of securities in the SFO certainly carves out private companies which are incorporated in Hong Kong; but most PE managers tend not to invest exclusively into Hong Kong incorporated companies.

3. But PE funds are not SFC authorised; doesn’t this mean they can be managed and sold to professional investors (PIs) in Hong Kong without having to get an SFC licence?

No, that's not what this means. Certainly, the funds themselves do not need to be authorised by the SFC’s Investment Products Department (under s103 of the SFO) if they will only be marketed to PIs but under the SFC’s conduct regime (i.e. under s114 of the SFO), the acts of managing, advising and marketing all require SFC licences (unless there is a relevant licensing exemption).

4. What licence type does a PE manager need then?

Most PE managers which are licensed in Hong Kong have a type 1, 4 and/or 9 licence. Before submitting a new corporate licence application however, the firm needs to take legal advice as to the type of licence they need; and firms which do not apply for the right licence the first time may need to resubmit their applications which means an even longer wait before business can commence.

This table shows which activity requires which licence:

|

Activity |

Licence type |

Legal notes |

|

Investment decision making |

Type 9 |

|

|

Capital raising |

Type 1 – but if firm has a Type 9, it will not need a Type 1 as well provided the firm is also making investment decisions for the fund (this is referred to as the “incidental” exemption) |

See: exemptions – in relation to advisory activities – in this link. |

|

Soliciting co- investments |

Type 1/9 (unless portfolio company is a HK incorporated company) |

The definition of “Asset Management” in a securities context is “securities management” which is separately defined in the SFO as “providing a service of managing a portfolio of securities for another person” so in our view co-investment activity in a PE context should also be considered as asset management. |

|

Advising on a proposed investment / divestment or recommending an investment / divestment |

Type 4 – but no licence is required where the recipient of the advice is a wholly-owned group company which makes the advice its own before making the investment decision (this is referred to as the “wholly-owned group company exemption” and it only applies to Type 9 activity in very limited circumstances) |

|

Investment sourcing, negotiation, execution etc. |

Type 1 or 9 |

In the hedge fund world these activities would typically be classified as Type 1 but in the PE fund world, it can be difficult to separate these activities from the investment decision making function so can be considered as Type 9 activity. |

|

Management of the portfolio companies |

Type 9 |

The definition of “Asset Management” in a securities context is “securities management” which is separately defined under the SFO as “providing a service of managing a portfolio of securities for another person” so in our view this can also be considered as asset management. |

Type 1 – Dealing in Securities Type 4 – Advising on Securities Type 9 – Asset Management

5. But aren’t there PE firms operating in Hong Kong without SFC licences?

Some PE firms are certainly operating in Hong Kong without licences. Although some of these firms may be operating lawfully under a licensing exemption (for example the “wholly-owned group company exemption”), others may be breaching s114 of the SFO (which is a criminal offence).

It would seem that the SFC wants to “regularise” this situation so we expect that PE firms which have been operating in Hong Kong under the misapprehension that they do not need to be licensed, will still be able to become licensed in the ordinary course provided they do not delay unduly in proceeding to apply for licences. Skill and delicacy will be required in handling these applications though, and in particular in relation to demonstrating the competency of the responsible officer (RO) applicants.

6. How difficult is it for PE managers to get SFC licences?

If a PE manager is applying for an SFC licence at the same time as it is setting up the business in Hong Kong, the process will be straight-forward, and the SFC’s 15-week performance pledge should apply. Any SFC licence application must however be comprehensive and the proposed ROs must be able to demonstrate that they have enough relevant experience. Where a firm has already been operating in Hong Kong however, a more “strategic” than usual approach may be required.

7. What are the capital requirements for a PE manager?

The minimum paid-up share capital and liquid capital requirement for a PE firm will depend on the type of licence granted and nature of the conditions imposed on the licence. Once an appropriate amount of share capital has been injected into the company, provided the company does not do a capital reduction, the company will continue to be in compliance even after the share capital amount has been used up. The minimum liquid capital requirement however is more difficult because firms need to be constantly recalculating their liquid assets and adjusted liabilities to determine their liquid capital at any one time.

|

Licence type |

Minimum paid- up share capital amount |

Minimum liquid capital amount (including mandatory 20% buffer) |

|

Type 1 |

HK$5 million |

HK$3 million* (HK$3.6 million) |

|

Types 4 and / or 9 (if subject to the “no holding client assets” licensing condition) |

NA |

HK$100,000* (HK$120,000) |

|

Types 4 and / or 9 (if not subject to the “no holding client assets” licensing condition) |

HK$5 million |

HK$3 million* (HK$3.6 million) |

*or 5% of its “adjusted liabilities” if higher

For further information, please contact:

Jane McBride, Partner, Deacons

jane.mcbride@deacons.com.hk

.jpg)

.jpg)