16 June, 2017

Acquirers wishing to buy control of, or merge with, a company with a Singapore primary listing (“Target”) should first evaluate a potential Target through due diligence, the process of obtaining and studying information on the Target and its business. Analysing publicly available information avoids legal problems. By contrast, private information from a Target to an acquirer, whilst useful, could trigger legal problems (including insider trading risks). This presents an acquirer with two choices: bid for the Target on the basis of publicly available information only, or do so on the basis of both publicly available information and private information.

Bidding on the Basis of Publicly Available Information Only

Publicly available information on a Target includes:

- The Target’s and its subsidiaries’ audited accounts

- Annual reports and annual return

- Half-yearly or quarterly financial results (the frequency of such results reporting depends on the Target’s market capitalization

- The Target’s constitution (formerly known as memorandum and articles of association)

- Details on Target’s share capital

- Details on Target’s directors

- Target’s announcements made on the Singapore Exchange’s website

- News articles written about the Target

- Stockbrokers’ research reports on the Target

This information, studied from the different standpoints of finance, tax, accounting and legal, will help an acquirer in two ways. First, the acquirer will be able to value the Target. A Target’s title to assets and also productivity in using resources will be important considerations. Second, the acquirer will be able to plan its takeover strategy using a general offer or scheme of arrangement, form of consideration to be offered, amount of first offer, etc.

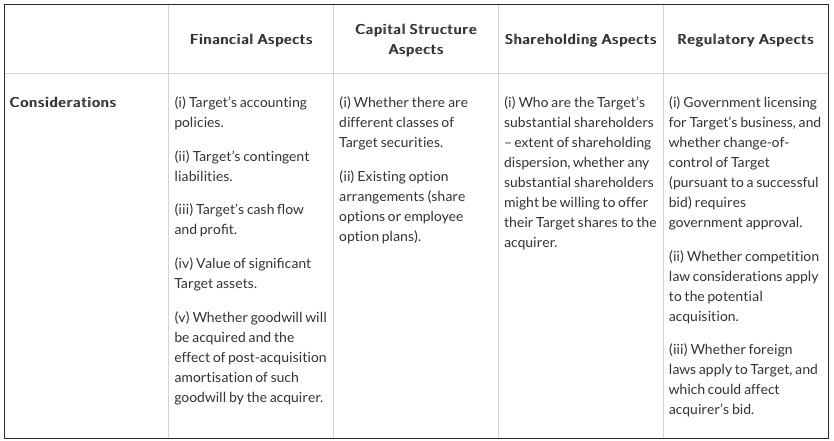

For example, publicly available information allows such areas to be considered:

Please click on the table to enlarge.

Bidding on the Basis of Both Publicly Available Information and Private Information

If there is ample public information available already, why bother with private information? After all, a Target is likely to tell inquisitive acquirers that it has already publicly announced all material information relating to it and its business, in compliance with the Singapore Exchange’s continuing disclosure requirements.

The answer is that information helps acquirers. The more information that an acquirer has before making a bid for the Target, the better it can evaluate the Target and plan its acquisition strategy.

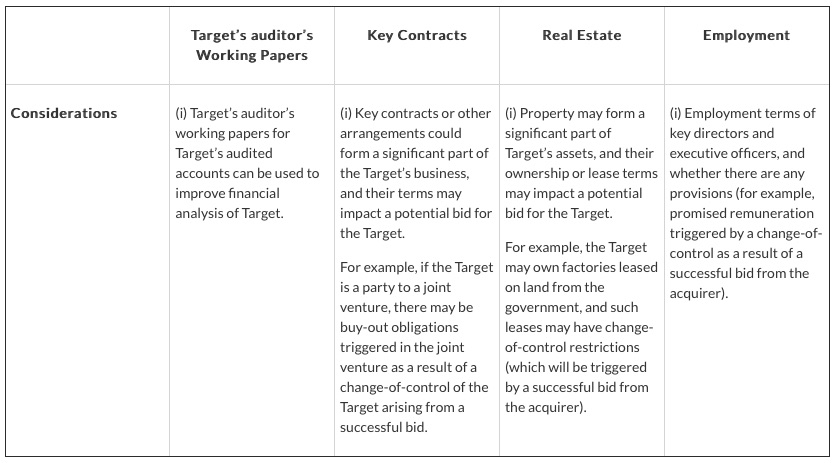

For example, apart from the areas set out in the table above, private information allows such areas to be considered:

Please click on the table to enlarge.

An expansive due diligence investigation can therefore offer two advantages for an acquirer.

First, the exercise will help the acquirer to validate various assumptions of the Target and its prospects. These could be strategic, financial, commercial, operational, or technological in nature.

Second, the exercise will help the acquirer to improve the terms of its planned bid. It minimises overpayment and also synergy risk.

In friendly takeovers, an acquirer can ask the Target for additional (private) information, while in hostile takeovers, it has to rely on public information for its assessment as the Target will not be likely to cooperate on information requests.

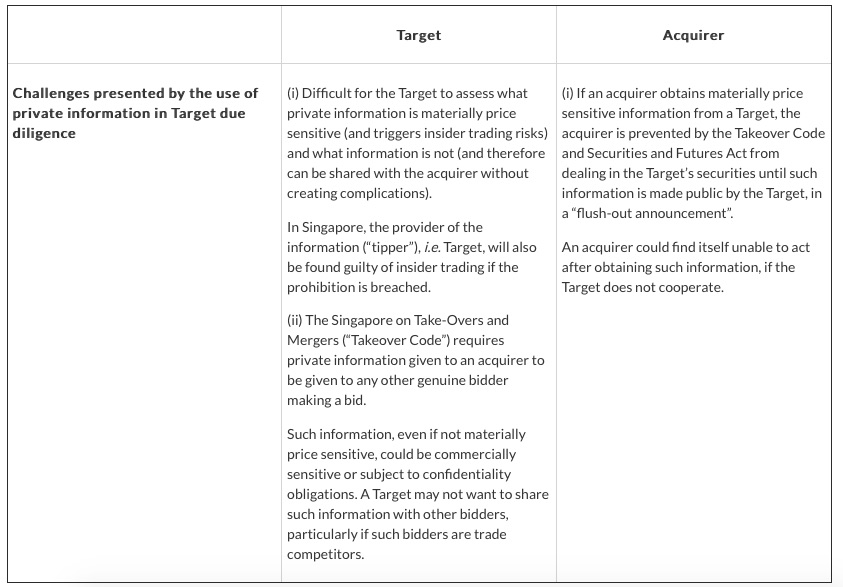

If the Target provides private information to an acquirer, both parties will have to consider if the benefit of this course of action outweighs the costs.

Please click on the table to enlarge.

If a Target provides private information which is not materially price sensitive to an acquirer, the acquirer must nonetheless ensure that proper disclosure is made in the takeover documentation. This is to comply with statutory and Singapore Code on Take-overs and Mergers disclosure requirements and to avoid challenges on the basis that the acquirer has materially price sensitive information which is not publically available.

Should Private Information Ever Be Used in a Public Takeover?

An acquirer, in deciding the relative importance of private information to its potential bid for a Target, should consider its specific goals for the acquisition.

For example, an acquirer looking to enter a new product market through acquiring control of a Target and its product lines, may not consider the Target’s profitability to be of great importance for the purpose of due diligence. By contrast, profitability could be of great importance if the acquirer is looking to merge with a Target of similar size, as this affects the combined entity’s post-acquisition value.

In some cases, private information may be very useful for a bid, and in others, acquirers will be content to bid on the basis of publicly available information only.

For further information, please contact:

Mark See, Director, Duane Morris & Selvam

msee@duanemorrisselvam.com

.jpg)