The European Commission has adopted its revised Implementing Regulation (including new Form CO, Short Form CO, Form RM and Form RS templates) and Notice on using the Simplified Procedure. This so-called “simplification package” will enter into force on 1 September 2023.

The simplification package introduces some welcome changes designed to expedite the process for non-problematic merger control cases and to give the EC more flexibility to apply the benefits of the simplified procedure.

Noteworthy procedural changes

Amongst the changes we think the following procedural improvements are worth highlighting:

- A codification of the “super-simplified” treatment for joint ventures not active in the EEA and for transactions where there are neither horizontal overlaps, nor vertical relationships between the parties. Notifying parties are exempted from submitting information on section 8 (horizontal overlaps), section 9 (vertical overlaps) and section 11 (safeguards and exclusions). These filings can also proceed without (recommended) pre-notification. Case allocation requests still need to be submitted at least one week before the expected date of notification.

- A new “tick-the-box” Short Form CO. While the format is simplified, the level of information required has increased with new requirements to provide information on non-controlling shareholdings above 10% and cross-directorships. Time will tell if this information (when disclosed during pre-notification) could lead the EC to refuse the simplified procedure.

- Further digitalisation of the merger control proceeding with all documents, including powers of attorney, to be submitted electronically. Only EU-recognised Qualified Electronic Signatures (QES) will be accepted by the EC.

New categories of simplified cases

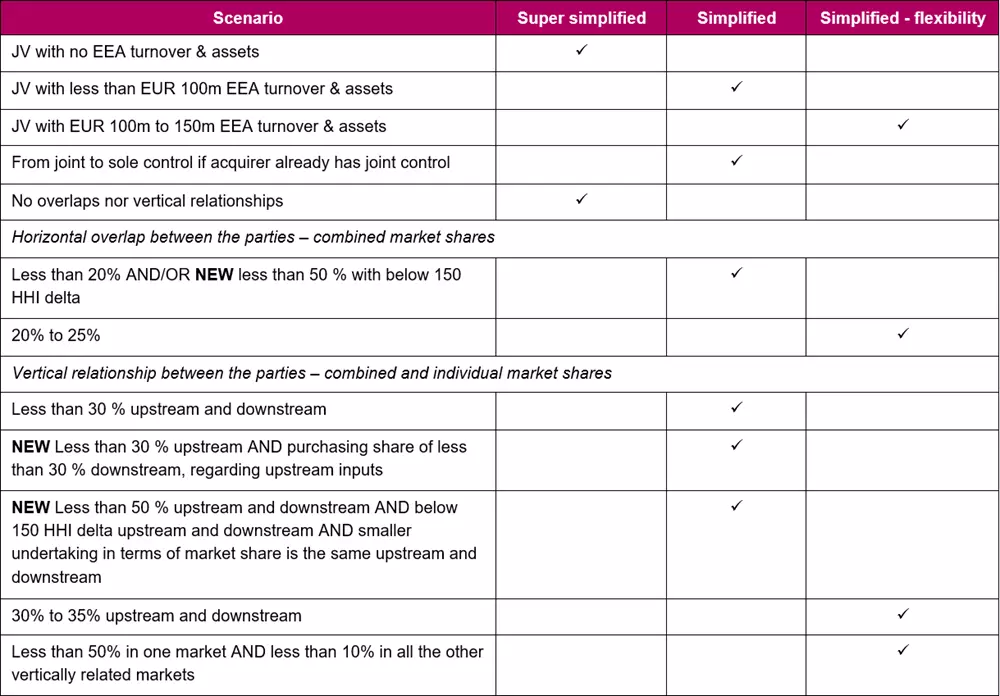

The simplification package comes with three types of simplified cases and a “light” version of the normal procedure, allowing some markets to be treated in a simplified manner within the normal procedure (see table below this blog post).

- Super simplified cases (as above – covers non-EEA joint ventures and no horizontal/vertical overlap transactions).

- Simplified cases. Two new categories of vertical relationships and one amended horizontal category can benefit from simplified treatment. The four previously applicable categories remain.

- Simplified cases under the “flexibility clause”. Although these cases would appear to be outside the scope of simplified treatment, the EC has the discretion to treat them as simplified upon request where the simplified procedure thresholds are modestly exceeded.

- Simplified sections within the normal procedure where the parties’ shares for a specific market fall below the simplified procedure thresholds (see table below), while others do not. This was previously handled through non-affected markets or ad hoc waiver requests. The revised rules should allow the notifying parties and the EC to focus on fewer markets where concerns may be more likely. The EC has discretion to exclude markets from simplified treatment if they fall under the extended list of safeguards and exclusions.

On a more critical note, the flexibility clause may blur the lines between what used to be a clear division and thereby bring more delays due to protracted discussions on eligibility. To benefit from the flexibility clause, notifying parties will need to contact the EC (either through a briefing paper or an early pre-notification) to confirm that the simplified procedure can be applied.

In practice, this will involve proving that the relevant market share thresholds are not exceeded “under all plausible market definitions” and that none of the extended list of exclusion grounds apply. This may result in longer pre-notification, including discussions on whether simplified treatment is warranted, possibly coupled with jurisdictional and market definition issues. After discussion with the EC – and only if the EC (including potentially the Legal Service) agrees to a simplified treatment – the notifying parties would be allowed to submit the Short Form CO.

It is not known how many more cases will qualify for further simplified treatment under the new package. The EC seems optimistic that it may capture a non-trivial number of cases. Some parties may opt to avoid requesting a simplified procedure, especially if the timeline to close the deal is tight. This is not only a theoretical risk, as shown by the EC’s 2021 Staff working document evaluation: “some merging parties decided to follow normal procedure even though the case was potentially eligible for notification under the simplified procedure”.

Conclusions

The simplification package brings several positive changes to the merger control procedure, including a welcome extension of the cases that can (potentially) benefit from simplified treatment. The EC anticipates that approximately 10% of normal procedure cases would be eligible for simplified treatment under the new flexibility rules. Whether the simplification package will achieve its intended goal will largely depend on how the EC will approach the new rules in practice.

Summary of the simplification package

For further information, please contact:

Gerwin Van Gerven, Partner, Linklaters

gerwin.vangerven@linklaters.com