2022 was a tragic year for cryptocurrencies. Molly White, an affiliate of the Berkman Klein Center for Internet and Society at Harvard University, identified January and February 2022 as the key inflection points where the crypto industry achieved “peak hype”[1]. Instead of “going to the moon”, investors “crash landed” into financial entanglement.

Subsequently, waves of scandals shocked investors, for instance the collapse of the Terra LUNA crypto, the FTX collapse, and the liquidation of Three Arrows Capital [2]. Participants in the crypto ecosystem recoiled, tightening their crypto belts and diversifying their portfolios into traditional investments like gold, stocks, and real estate[3]. The overall confidence in the crypto market was rudely shaken and plunged the crypto market into a “crypto winter”. Some said this was only to be expected as part of the normal cyclical rise and fall in any market – others called this the end of the crypto hype, while yet others called for more regulation of the wild west that the crypto market often is.

A crypto winter[4] is characterised by a significant and prolonged decrease in the prices of cryptocurrencies and an overall reduction in market capitalisation. This development is often brought by a decline in cryptocurrency prices and decreased trading volume. Consequently, the market experiences increased volatility due to the loss in confidence and increased skepticism of investors. With the frequent fluctuations in cryptocurrency prices, investors rein in new crypto investments and liquidate existing ones, triggering a downward spiral in the crypto market. Crypto winters can experience significant dive in valuation and last for a prolonged period of a few months or years. In November 2022, CNBC reported that crypto investors had lost a whooping estimated 2 trillion dollars[5]. Some investors lost their homes, became bankrupt, and lost their lives when they were unable to withstand the blow of their crypto-related losses[6], further lending a sense of tragedy to the entire situation.

The crypto winter that rippled through the global economy was understandably stressful for cryptocurrency investors. The volatility in the crypto markets drove many investors into alternating spasms of greed and fear, leading them to become careless with their decisions. Combined with the proliferation of remote transactions across all sectors precipitated by the global Covid-19 pandemic, the crypto markets became fertile ground for fraud.

What are some common crypto scams?

Crypto scams come in various forms, and seem generally to fall into the following categories.

Phishing Hacks

Much like the notorious Nigerian prince scams received in spam mails, hackers send fake emails or website links that resemble legitimate cryptocurrency exchanges or wallets. This lowers the guard of investors, making it easier for hackers to steal login credentials and other personal information when the victim accesses the link.

Example of a phishing scam via email. Image source: Mail Guard

Ponzi Schemes

Another traditional scam is a Ponzi scheme or a pyramid scheme where investors are promised high returns on investment. Instead of any genuine underlying investment, funds from new investors are used to pay off earlier investors. FTX was embroiled in a legal suit that accused it of running a Ponzi scheme siphoning customer funds to line the coffers of cofounder Sam Bankman-Fried’s trading firm Alameda Research.[7]

Rug Pulls / Pump-and-Dump

Other frauds are more sophisticated, drawing in even sophisticated investors. As we touched on in our rug pull scam article, rug pulls and pump-and-dump schemes are insidiously constructed to take advantage of investors’ pursuit of quick returns. The cryptocurrency price is artificially inflated through false or misleading information or trading manipulation, creating a “Fear Of Missing Out” enthusiasm amongst investors. Once the price peaks, the fraudsters sell their holdings aggressively, causing a price crash and leaving the rest of investors with assets of little value. While it is not always easy to identify such scams, investors must do their due diligence and rein in their fear of missing out.

Fake Investment Platforms

Here, crypto syndicates[8] create fake investment platforms to attract investors and their funds. While appearing legitimate, complete with professional-looking websites, mobile apps and customer service hotlines, funds sent to such platforms instead go directly into the scammers’ pockets and are quickly sent out elsewhere beyond the reach of legal recourse. The Financial Times highlighted a case of Londoner “Lili” whose “friends” convinced her to part with US$300,000 [9] by using spoof trading apps.

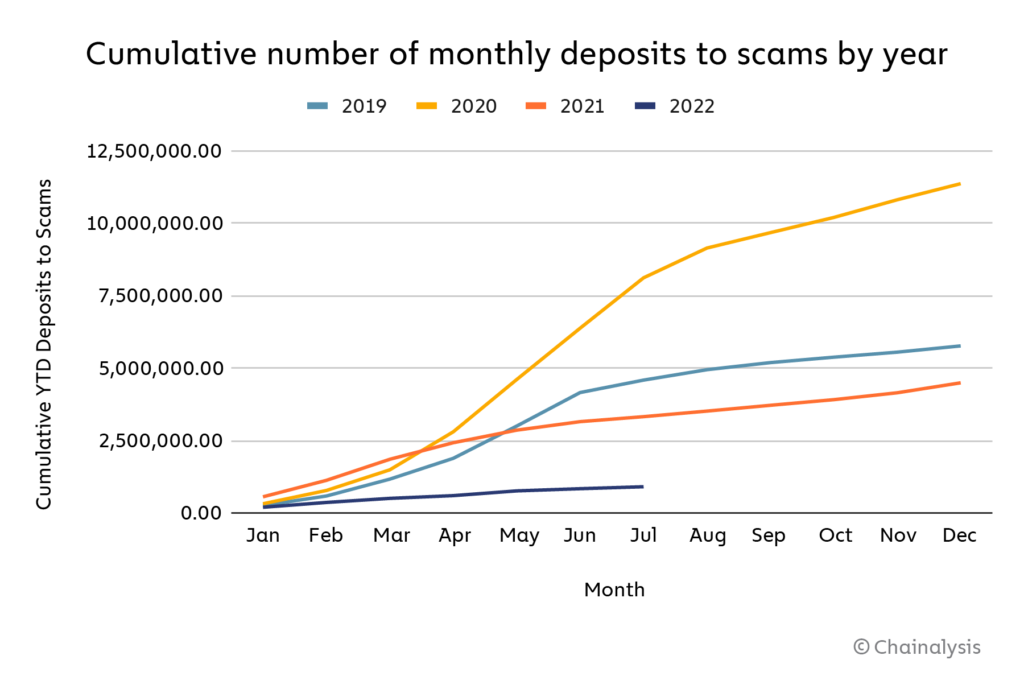

Year by year illicit cryptocurrency transaction. Image Source : Chain Analysis

Fake Initial Coin Offerings (ICO) are another way which investors may be scammed.

Social Engineering Scams

Social engineering scams are sophisticated schemes run by criminal syndicates targeting vulnerable individuals. The fraudsters will have done fairly extensive research on the victim through his or her social media content, and adjust their approach to the victim based on their personality and preferences. The victim may be contacted on social media or instant messaging, with the scammer claiming to have been introduced by a friend, or else claiming they had the wrong number but continuing with “why don’t we get to know each other better anyway?”. Victims are drawn in by the promise of attractive returns, and often also with the hope of a romantic relationship.

Is it difficult to recover stolen cryptocurrency?

Most cryptocurrencies are decentralised in nature, which often means no central body monitors or controls the cryptocurrency[10]. Instead, crypto asset registers are usually dispersed among numerous nodes to prevent tampering or corruption of the registers. In an ideal world, a decentralised crypto exchange is a peer-to-peer marketplace where cryptocurrencies are traded in a non-custodial manner without the use of intermediaries such as banks, brokers or payment processors. In addition, each person’s cryptocurrency holdings are “held” in an address that is represented by an anonymous string of characters. As scammers also receive ill-gotten cryptocurrency in anonymous address, sent through a decentralized network of anonymous nodes, it is no wonder that victims and the authorities often have a difficult time finding the perpetrators behind crypto fraud.

In addition, many crypto figures are shrouded in anonymity – crypto founders can raise funds without revealing their real names. Take the case of world’s most famous cryptocurrency, Bitcoin – it has been 15 years since Bitcoin’s inception but to date no one knows the real identity of Bitcoin’s inventor ”Satoshi Nakamoto”.[11] The culture of anonymity is a fundamental aspect of the cryptocurrency universe, and valued by many of its participants.

By removing any association with their real-life identity[12], crypto criminals can evade the authorities and victims by simply terminating their online presence. These criminals often proliferate the dark web and are hard, or even impossible, to trace as they cover their tracks through the use of Virtual Private Networks (VPNs), masking their IP addresses or using encrypted communication methods to avoid detection by law enforcement.

Unfortunately for many victims, the sheer overwhelming number of crypto scams has overstretched the resources of authorities to seek justice for each and every victim[13]. For some victims, the costs of recovering their losses far exceed the losses themselves. Action in the courts is almost always necessary for recovery, in conjunction with assistance from law enforcement, and it is costly to hire lawyers and consultants to pursue losses. As a rule of thumb, unless the loss is more than USD500,000, victims often find that the costs of recovery exceed what they can recover. Law enforcement also generally tends to prioritise victims who have lost larger sums.

Furthermore, global regulation still lags the breakneck development of cryptocurrencies (and the fintech and defi ecosystems in general). Regulators are still grappling with understanding how crypto technology works. The cryptocurrency ecosystem operates virtually on a global scale, and is not limited by geographical boundaries. A victim may be scammed in Hong Kong by a mastermind in Canada. Much more needs to be done to develop local regulations sensibly, and enhance global cooperation amongst authorities, for a safer cryptocurrency market to emerge.

How can investors protect themselves?

There is much debate over whether the crypto winter is over. In the meantime, investors around the world expectantly await the return of a crypto bull market in order to jump back in.

Getting good advice early in the game is important. Be suspicious of any opportunity that seems too good to be true, and do your research carefully. If you are investing a significant amount in cryptocurrency, it may make sense to hire experts to help with due diligence on who you’re dealing with, and seek legal advice from an experienced cryptocurrency lawyer. When dealing with a crypto platform or buying a crypto product, a lawyer can alert you to any suspicious or ambiguous clause that could harm you. Together with a lawyer, crypto advisers can also help you do proper due diligence before you commit to a transaction.

In the event of a cryptocurrency dispute or fraud, your lawyer can also engage with law enforcement and pursue litigation to seek recourse. When trader Ahmed was unable to exit his position on cryptocurrency exchange Binance, he initiated arbitration proceedings against Binance for the HKD 47 million damages he suffered[14].

Hauzen LLP is an internationally-recognized law firm with its expertise in financial regulation and cryptocurrency laws in Hong Kong. We offer the following:

- Pre-transaction review and due diligence

- Litigation and enforcement of loss recovery

- Cryptocurrency insolvencies

- Regulatory advice

Contact us today to find out more.

[1] How Molly White became a crypto critic – Protocol

[2] 13 Biggest Crypto Scandals and Controversial Stories of 2022 (cryptopotato.com)

[3] Can staking still beat inflation during a crypto winter? (theedgesingapore.com)

[4] What is a crypto winter and are we still experiencing one? | FinTech Magazine

[5] Crypto peaked in Nov. 2021: Investors lost more than $2 trillion since (cnbc.com)

[6] Are Crypto-Related Suicides A Real Problem? | Js Magazine (jumpstartmag.com)

[7] FTX scam explained: Everything you need to know (techtarget.com)

[8] A List of Fake Crypto Websites & Trading Platforms 2022 | Trend Micro News

[9] The lawless world of crypto scams | Financial Times (ft.com)

[10] What is Decentralization in Blockchain? (blockchain-council.org)

[11] Anonymity in Crypto Raises Alarm – The New York Times (nytimes.com)

[12] Shifting crypto landscape threatens crime investigations and sanctions (brookings.edu)

[13] The lawless world of crypto scams | Financial Times (ft.com)

[14] Cryptocurrency traders seek damages from Binance after major outage (cnbc.com)