In the Indian Union Budget speech for F.Y. 2022-23, the Honourable Finance Minister had announced that a battery swapping policy will be introduced, which will help build and improve the efficiency of battery swapping ecosystem to encourage faster adoption of electric vehicles (“EV”).

In line with this announcement, the Indian government’s public policy think tank – “NITI Aayog” has published the draft battery swapping policy (“Draft Policy”) (read the draft policy here). A summary of this Draft Policy is encapsulated below for your reference:

I. Background

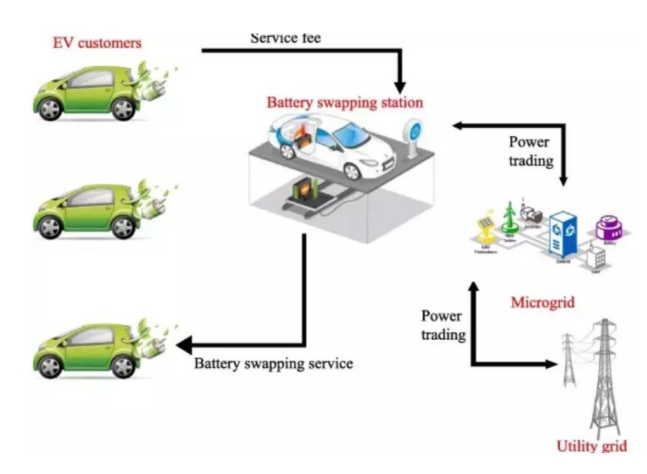

Traditionally, EVs are sold by Original Equipment Manufacturers (“OEMs”) with fixed batteries, and such fixed batteries are required to be charged while the same are within the EV i.e., without detaching the battery from the EV. Battery swapping is an alternative which involves exchanging discharged batteries for charged ones and also provides flexibility to charge such batteries separately. This de-links charging and battery usage and also keeps the vehicle in operational mode with negligible downtime.

Battery swapping falls under the broader umbrella of the Battery as a Service (“BaaS”) business model which involves users purchasing an EV without the battery, which significantly lowers upfront costs. For usage of the battery, the EV owner can pay a regular subscription fee (daily, weekly, monthly, etc.) to service providers for battery services throughout the vehicle lifetime; business models will keep on emerging/ improvising, as the

ecosystem expands.

To support this initiative, the Ministry of Road Transport and Highways has also allowed the registration of electric vehicles without pre-fitted batteries (read the official press release here).

II. Scope

The Draft Policy is currently meant to support adoption of battery-swapping for light electric power train vehicles (LEV) of category L, and E-Rickshaw / E-Cart. However, it has been indicated that the Government may extend the coverage to other EV segments in the future.

III. Rollout of Battery Swapping

The target vehicle segments for battery swapping are electric 2-wheelers and electric 3-wheelers, which are heavily concentrated in urban areas. The roadmap for the rollout of battery swapping stations will be phased in the following manner:

A. Phase 1 (Years 1-2): All metropolitan cities with a population greater than 4 million (as per Census 2011) will be prioritized for development of battery swapping networks.

B. Phase 2 (Years 2-3): All major cities such as state capitals, union territories headquarters and cities with population greater than 500,000 (as per Census 2011) will be covered.

IV. Business Models

Under the umbrella of the BaaS business model that is currently being employed by battery providers, there exist different business models, depending on the services that are integrated or kept separate. Typically, battery providers will work with battery OEMs to develop smart, swappable batteries, and provide them to the end users, and also operate charging facilities or BCSii / BSSiii. Each of these roles can be separated, whereby the batteries manufactured by an OEM are purchased by a battery provider, which then partners with relevant entities that deliver customer facing facilities such as BCSs/BSSs.

As battery swapping is still nascent in India, keeping in view that further business models will emerge as the market matures, the Draft Policy is business model agnostic and seeks to even the playing field for different models.

The Draft Policy recommends the following measures to support the development of such business models:

➢ Encourage collaboration among stakeholders to form battery swapping ecosystems that are sustainable, scalable and leverage the strengths of each party by:

a. Allowing for multiple distinct interoperable solutions to arise from the market.

b. Requiring ecosystems to be “open” to allow participation from other market players to be considered for support under the Policy.

➢ Battery providers to play a key role in managing the above-mentioned partnerships to ensure key requirements related to safety, and performance are met. Further, the battery provider would also be the potential point of contact representing the ecosystem for any coordination with external stakeholders including EV users, and government agencies.

➢ Provide flexibility to end users (personal and business) to have different arrangements with battery providers with the option of switching operators in the future.

➢ Support enabling technologies, which promote standardization, interoperability, safety and improve communication among stakeholders (including EV users where applicable). This would include providingaccess to real-time data on battery statistics like charge levels and range, discovery of nearest swapping stations as well as seamless options to book and pay for the services.

➢ The Draft Policy will allow for multiple distinct interoperable solutions to evolve in the market.

V. General Requirements

Some of the eligibility standards as per the Draft Policy are as under:

(i) The Draft Policy will only support batteries using ‘Advanced Chemistry Cells’, with performance that is equivalent to or superior to EV batteries supported under the FAME II Scheme.

(ii) Battery providers must demonstrate end-to-end compatibility between batteries and other components of the swapping ecosystem, all of which must be certified under appropriate processes.

(iii) For efficient battery monitoring, data analysis, and safety, batteries covered under this policy are required to be BMS-enabled. The manufacturer shall ensure that appropriate BMS is in place to protect the battery from conditions such as thermal runaway.

(iv) To ensure battery safety and security of assets, swappable batteries will be equipped with advanced features like internet of things-based battery monitoring systems, remote monitoring & immobilization capabilities, and other required control features.

(v) Additional standards and specifications for batteries regarding battery pack dimensions, charging connectors, etc. will be notified over time with adequate notice to, and consultation with, industry stakeholders, to support a phased transition to interoperability between ecosystems.

VI. Battery and Swapping Station Unique Identification Number

To implement unique traceability across the battery lifecycle, a unique identification number (“UIN”) will be assigned at the manufacturing stage for tracking and monitoring EV batteries. It is also proposed that a standard or generic methodology and the detailed definition of the UIN system for EV batteries will be developed since various tracking solutions are used in different industry sectors, and an appropriate system may be applied for EV batteries that are tamper-proof and allows centralized monitoring.

Further, required technical data of the battery will be mapped by the OEMs with UIN of the battery pack at the manufacturing stage. The battery swapping operator must store the usage history and required performance data of battery with UIN during EV application, and data must be maintained to facilitate the traceability of EV batteries during the entire lifecycle. Similarly, an UIN number will be assigned to each battery swapping station.

VII. Testing & Certification for Battery Swapping Components

Batteries will be tested and certified as per AIS 156 (2020) and AIS 038 Rev 2 (2020) standards. Additional tests may be prescribed for swappable batteries which are subject to multiple coupling / decoupling processes at the connectors.

VIII. Battery Charging and Swapping Infrastructure

To ensure safe and cost-effective infrastructure for charging and swapping of EV batteries, standards for BCS and BSS will be developed or approved by BIS / Ministry of Power or other competent authorities. The EV supply equipment used at the swapping station must be tested and approved by the National Accreditation Board for Testing and Calibration Laboratories or agency appointed by the central nodal agency for battery swapping.

IX. Fiscal Support

Demand side incentives offered under existing or new schemes for EV purchase should be made available to EVs with swappable batteries eligible under this Draft Policy. Quantum of the incentive could be determined based on the kWh rating of the battery and compatible EV. An appropriate multiplier may be applied to the subsidy allocated to battery providers to account for the float battery requirements for battery swapping stations in different battery swapping ecosystems. It is also proposed that a seamless mechanism for the disbursement

of subsidies shall be worked out by the concerned ministry or department. Further, an appropriate ongoing scheme may be revised, or a new scheme may be launched.

X. Applicable Rates of Goods & Services Tax

Currently, under the Goods and Services Tax (“GST”) regime, the tax rates on Lithium-ion batteries and Electric Vehicle Supply Equipment are 18% and 5% respectively. It is proposed that the GST Council, which is the decision-making body on GST provisions, may consider aligning the GST rates.

Our Thoughts

Announcement of the Draft Policy is a welcome move to enable faster adoption of EVs in India. At one end, the Draft Policy lays down standards for safety and improvements, and on the other, it also paves the way for easier collaboration between various players in the battery swapping ecosystem. Introduction of UIN for batteries is a good idea, especially to drive accountability. Successful implementation of battery swapping models will require close and cohesive coordination between the Central and State Government ministries.