9 November 2021

Stamp duty is a form of tax imposed on documents that are created as a tool to explain an event of a civil nature and documents to be used as evidence in a court of law. Civil documents include:

-

Memorandums of Understanding (MoU), letters of reference, statement letters, or other related documents and its copies;

-

Notarial deeds and grosse (the first copy of an original deed), including its copies and excerpts;

-

Land Deed Officer’s deeds and its copies;

-

Commercial papers in any name or form;

-

Commercial paper transaction documents including futures contract transactions in any name and form;

-

Tender documents in the form of excerpts, minutes, copies and grosse;

-

Documents stating a sum of money above IDR5 million, that: (i) describes the receipt of money or (ii) contains an acknowledgment of debt payment or settlement, either entirely or partially; and

-

Other documents as stipulated under Law 10 of 2020 on Stamp Duty (“Stamp Duty Law”).

As a means to provide convenience and simplicity in using the stamp duty, the Minister of Finance (“Minister”) of the Republic of Indonesia has officially launched and enforced the use of e-stamp with the issuance of Minister Regulation No. 134/PMK.03/2021 on Payments of Stamp Duty, General Characteristics and Special Characteristics of Stamps, Unique Codes and Certain Information on Electronic Stamps, Stamps in Other Forms, Determinations of the Validity of Stamps and Paid Post-Dated Stamps (“Regulation 134/2021”) as the implementing regulation of Stamp Duty Law.

What is the rate of the new stamp duty?

Before the enactment of Stamp Duty Law earlier this year, the stamp duty was offered at three different rates, IDR3,000, IDR6,000, or a combination of these rates (“Old Stamp Duties”). Under Stamp Duty Law, the new stamp duty is set at a flat rate of IDR10,000. The Old Stamp Duties will remain valid and the affixation of multiple stamps which amounts to at least IDR9,000 can be used instead of one IDR 10,000 stamp duty. In other words, the Old Stamp Duties can be used until 31 December 2021 in either of the following combinations:

-

three IDR3,000 stamps;

-

one IDR3,000 stamp and one IDR6,000 stamp; or

-

two IDR6,000 stamps.

What is e-stamp?

Stamp Duty Law recognises the following types of stamp duty:

|

Affixed stamp duty |

A new valid stamp duty is affixed to a Document. The stamp must not be damaged and must be signed. |

|

e-stamp |

As outlined above, this type of stamp involves the use of the e-stamp System (“System”) in relation to Documents by taking account of the utilisation guidelines which are an integral part of the System itself. |

|

Other forms of stamp duty |

The following stamps, among others, are categorised as other forms of stamps:

|

The manufacture and distribution of e-stamp is handled by a state-owned enterprise called “Perusahaan Umum Percetakan Uang Republik Indonesia” (“Peruri”), which is directly appointed by the Indonesian government. Peruri may cooperate with other parties through a transparent and accountable process for the distribution of the e-stamp. On the other hand, the distribution and sale of affixed stamp duties are carried out by another state-owned enterprise, i.e. PT Pos Indonesia.

Purchase and affixation of e-stamp through System

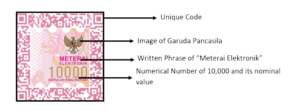

The e-stamp can be purchased from the System, state-owned banks and private banks and/or PT Telkom Indonesia (Persero) Tbk as the distributor. However, it must be affixed through the System. An e-stamp contains a unique code in the form of a 22-digit serial number and certain information, specifically:

-

an image of Garuda Pancasila;

-

the written phrase (tulisan) “Meterai Elektronik”; and

-

numbers and words that indicate the nominal value of the rate as seen below.

It is worth noting that Regulation 134/2021 expressly stipulates that the absence of any of the above mentioned elements will deem the relevant stamp duty invalid albeit paid, and the documents affixed with the defective e-stamp will be considered as not stamped.

Below are the steps to purchase the e-stamp from the System:

-

Open the web page of the System at https://pos.e-meterai.co.id and click the “Buy e-Meterai” menu;

-

Login to your account by entering your email address and password, or, click “Register here” to create an account by filling in your data and uploading the relevant documents to create the account;

-

Enter the One Time Password (OTP) code sent via SMS and/or email to complete the validation process;

-

After the validation process has been completed, log into your account. You will be presented with two menu options, “Purchase” and “Affixation”. If you don’t have an e-stamp yet, select “Purchase”;

-

After purchasing the e-stamp, you can proceed to affix the e-stamp to the uploaded documents. The additions of information such as date, document number, and document type are possible at this stage;

-

After the document has been uploaded and the detailed document information has been added, you may position the e-stamp in accordance with the applicable regulations by clicking ”Apply Stamp Duty” for the affixation;

-

You will be asked to enter the PIN at the next stage. The affixation process will be completed after the PIN information has been filled in; and

-

The electronically stamped PDF files can be directly downloaded or sent to the registered email.

For further information, please contact:

Andina Sitoresmi, Roosdiono & Partners

andina.sitoresmi@zicolaw.com