9 February, 2017

The Indonesian Government last week introduced a new regulation setting the tariff framework for Indonesian renewable energy projects. Regulation of Minister of Energy and Mineral Resources No. 12/2017 on the Utilization of Renewable Energy Resources for Electricity Supply ("MEMR Reg 12") now sets out the tariff framework for the following types of renewable energy projects: solar PV wind hydropower biomass biogas municipal waste geothermal MEMR Reg 12 regulates:

the price at which electricity generated from these renewable energy sources is to be sold to the Indonesian State-owned power utility, PT PLN (Persero) ("PLN") the manner in which PLN is entitled to procure electricity supply from a number of these renewable sources.

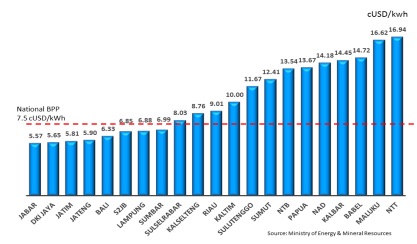

Tariff philosophy The key theme running through MEMR Reg 12 is that the price payable by PLN from renewable energy sources should be aimed at lowering (or at the very least not increasing) the existing average cost of generation (known by its Indonesian acronym, BPP) on the relevant local grid. The audited 2015 BPP numbers published by PLN (at Rp13,300/US$) are set out below:

Whilst the objective is admirable, across an increasing number of grids in Indonesia, coal is becoming the dominant fuel source, and therefore the net result of this new renewables tariff philosophy is that renewable energy is being asked to compete head on with coal fired power generation. With PLN continuing to sign up coal fired power projects at very low tariffs at anywhere between US$0.04 – US$0.07 (depending on coal technology and size), it is expected that BPP will continue to decline over coming years with respect to a number of the grids within Indonesia.

Even with renewable technology prices in areas such as wind and solar PV expected to continue to fall over the coming years, the continued build out of coal projects will put even more pressure on the renewable tariffs, and may result in a number of these renewable projects becoming uneconomical.

There are also the debates as to whether the coal tariffs signed up by PLN under its coal Power Purchase Agreements (PPAs) reflect the true cost of a coal fired project (and therefore whether renewables projects are being asked to compete with an artificially reduced coal price). Secondly, the question arises whether a comparison of renewable energy power prices (where the "fuel cost" is essentially flat (or perhaps with minor CPI-based escalations) over the 20-year life of the project) to coal and diesel fired power prices (where coal and oil prices can move significantly from one month or year to the next) is a true "apples to apples" comparison.

For example, an assessment of the competitiveness of a 20 year hydro power project vs a coal fired project in January 2016 (when the Indonesian coal index price (HBA) was at US$53.20 per tonne) would look very different to an assessment carried out in December 2016 (when the HBA price was US$101.69 per tonne). A tariff policy which allows short term fluctuations in fossil fuel prices to dictate what are often very long term (i.e., 20 – 30 year) investment decisions also raises concerns. It is interesting to note that this is not the first time the government has sought to use BPP pricing as the basis of renewable energy tariff setting.

The smallscale renewable tariffs issued in 2006 and the first geothermal pricing regulations issued in 2008 provided maximum tariffs for geothermal projects based on a percentage of BPP. With the geothermal regulations, as a result of industry backlash, the government quickly moved away from this tariff philosophy and introduced new fixed ceiling pricing in 2009 (with the ceiling not linked to BPP).

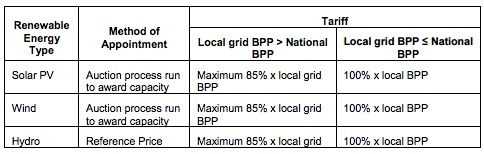

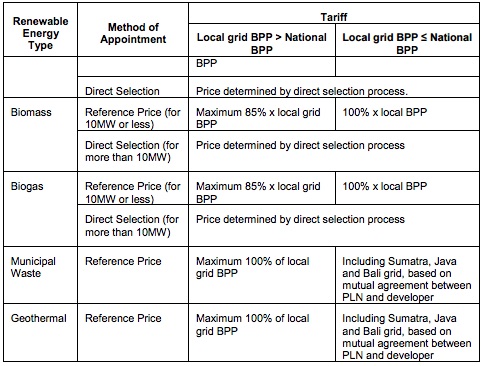

So in a sense, this BPP approach to pricing renewables is turning the clock back a decade. Specific renewable tariffs and method of appointment MEMR Reg 12 sets out the different methods by which PLN can source renewable energy power supplies, and the relevant pricing regime for each:

Please click on the table to enlarge.

Please click on the table to enlarge.

For each of these renewable energy technologies, there are a number of areas where the framework set out in MEMR Reg 12 gives rise to some uncertainties. Solar PV In August last year, the Ministry of Energy and Mineral Resources issued a framework for the award of solar PV projects through a capacity auction system, and set fixed feed in tariffs for the award of the capacity quotas (please see our previous article here).

The regime introduced under these regulations was one where pre-qualified solar PV developers would apply online for the capacity that was being put on offer by the government, and would be awarded this capacity at the fixed feed in tariffs on a "first-come first-served" basis. However, MEMR Reg 12 now provides that the capacity (with capacity quota packages of not less than 15MW in aggregate) will be auctioned off, with solar PV developers apparently competing on price for the award of the capacity.

Where the local BPP is higher than the national BPP, MEMR Reg 12 provides for a "maximum" price equal to 85% of the local BPP (indicating that developers will be engaged in a reverse-auction type bid where the lowest price will win the capacity). What doesn’t not make sense though is where the national BPP is equal to or higher than the local BPP. In this circumstance, the regulation requires the purchase price to be "the same as" 100% of the local BPP. This indicates that there is no bidding war on price – as the price is set precisely at the local BPP. Absent developers competing against each other on a lowest-tariff basis, how will the government or PLN determine which developer is to be awarded the capacity being put on offer? It may therefore be that the "first-come firstserved" system will be applied to award projects where the national BPP is equal to or higher than the local BPP.

In any case, substantial changes to the 2016 solar regulation are going to be needed to ensure that the auction system contemplated by that regulation fits with the pricing regime provided for under MEMR Reg 12. Wind To date, there has been no tariff framework specifically put in place for wind.

The wind projects that have been developed have been awarded based on a direct appointment mechanism – whereby developers carry out feasibility and grid-connection studies, submit a proposal to PLN (which is negotiated between PLN and the developers on a business-to-business basis), and PLN directly appoints the relevant developer and seeks the approval of the Minister to the agreed tariff. MEMR Reg 12 now introduces a regime for wind which is similar to the solar PV regime introduced in August 2016. Essentially, the government will determine quotas of wind capacity to be auctioned off (of not less than 15MW in aggregate).

The same issues arise as with solar PV: for locations where the local BPP is not higher than the national BPP (and therefore the wind tariff is to be set at 100% of the local BPP), how is the capacity to be auctioned off? What are the bidding criteria that the developers are competing against each other on (if it is not price)?

Hydro The regulation provides that hydropower projects can be awarded either (i) on the basis of the "Reference Price", or (ii) through direct selection. "Reference Price" is defined along the same lines as applies for solar PV and wind – namely where the local BPP is less than the national BPP, then the Reference Price is "maximum" 85% of the local BPP, and where the local BPP is not less than the national BPP, the Reference Price is "the same as" 100% of the local BPP.

There is no detail provided around the way in which the "Reference Price" option is used – i.e., is it a direct appointment process (where a developer willing to accept the Reference Price tariff can simply be signed up by PLN directly without any form of competitive process)? Similarly "direct selection" is not specifically defined in the regulation; however, under the applicable government regulations governing the power sector, "direct selection" is defined to mean a selection method by comparing proposals from a minimum of two candidates. There is also no detail provided in respect of when Reference Price should be used versus direct selection. However, our reading of the regulation suggests that:

Where a developer is willing to develop a hydro project within the limits set by the Reference Price, then PLN is able to directly appoint that developer at that price. Where a developer is only able to develop a project above the Reference Price limitations, then the project can be awarded at a tariff higher than the Reference Price would otherwise dictate, but the project must go through a direct selection process (i.e., the developer cannot be directly appointed).

The only distinction drawn between mini-hydro projects (i.e., less than 10MW) and large hydro (10MW or more) is that mini-hydro projects must have a plant capacity factor of at least 65% (whereas the acceptable plant capacity factor for large hydro can be determined based on the relevant system requirements – e.g., this appears to allow for large scale hydro peaking plants). However, as far as the appointment process is concerned, there is no differentiation made between mini-hydro and large hydro. On its face then, this would appear to allow a direct selection process for mini-hydro, which would contradict the existing mini-hydro regulatory regime, which provides for a direct appointment process only.

An additional requirement for hydro projects (both mini-hydro and large hydro) is that they must be contracted on a Build-Own-Operate-Transfer basis. Accordingly, at the end of the term of the PPA, the developer will be required to transfer the project to PLN for a nominal amount. This requirement is in line with other recent regulations issued by the Minister of Energy and Mineral Resources (see here our previous article).

Biomass and Biogas For biomass and biogas projects, MEMR Reg 12 provides that (i) projects for up to 10MW are to be awarded on the basis of the "Reference Price", and (ii) projects above 10MW are to be awarded through direct selection. The determination of the "Reference Price" follows the same model as for solar PV, wind and hydro – again indicating that PLN can require developers to agree to a price lower than 85% of the maximum local BPP price (where the local BPP exceeds the national BPP). As with solar PV, wind and hydro, where the local BPP price is lower than the national BPP, then the Reference Price appears to be fixed (i.e., no higher, no lower) than the local BPP. As with hydro, there is some uncertainty as to how and when the Reference Price is to be used instead of the direct selection process (and vice versa). However, as mentioned above, our best reading of the regulation suggests that PLN is free to directly appoint developers if the Reference Price regime is accepted, but PLN must go through a direct selection process if the tariff exceeds the Reference Price regime requirements.

Municipal Waste

The sole appointment method for municipal waste projects is the Reference Price mechanism. Unlike the Reference Price formulations for the other renewable technologies, the Reference Price for municipal waste is as follows: Where the local BPP exceeds the national BPP, a "maximum" of 100% of (i.e., not 85% of) the local BPP. In Sumatra, Java and Bali or other areas where the local BPP is lower than the national BPP, the price is based on the agreement between PLN and the developers.

The reference to "maximum" again suggests there is room for PLN to seek to negotiate a tariff lower than the local BPP price. The nationwide BPP numbers published by PLN indicate that there are separate BPPs for certain areas of Java and Sumatra, and some of these local BPP numbers vary greatly (e.g., South Sumatra is at US$0.0685/kWh compared to North Sumatra at US$0.1241/kWh). Accordingly, for a project to be developed in North Sumatra, where there may be sufficient flexibility for a developer to implement a municipal waste project at the Reference Price of 100% of local BPP (i.e., US$0.1241), it is not entirely clear how the price is to be set (i.e., using 100% of local BPP or by "mutual agreement" of PLN and the developer).

Geothermal

The pricing regime for geothermal projects follows that of municipal waste, namely where local BPP exceeds the national BPP, then the tariff will be a maximum of 100% of the local BPP, and for Java, Bali and Sumatra (and other local grids where the BPP is not higher than the national BPP, the tariff will be set by negotiation). Accordingly, the same questions arise in relation to the price to be used for development of projects across the different provinces of Sumatra and Java.

As with hydro, the regulation requires all geothermal projects to be awarded on a BOOT basis. One major area of controversy for geothermal projects is the new requirement that PLN is only permitted to purchase electricity from geothermal developers where the exploration reserves have been proven. Given a broad reading, this could mean that PLN is nevertheless free to sign up PPAs with geothermal developers prior to the start of the exploration activity, but the terms of those PPAs provide that PLN is not obliged to purchase any electricity unless and until the reserves are proven. However, in our discussions with the government, the government has indicated that the intent of this provision is to prohibit PLN from signing PPAs with geothermal developers until the exploration reserves are proven.

This poses significant risk for the developers: In view of the substantial investment that is required for exploration drilling, are developers willing to invest that money without having PLN locked in to buy the power if the exploration results prove the reserves? For the purposes of determining the Reference Price based on BPP, is it the BPP at the start of exploration that is to be used?

Or is it BPP at the time of completion of exploration? Clearly if it is the latter, then developers are being asked to take the risk on not only whether PLN will sign a PPA after spending millions of dollars on exploration, but also whether there has been a surge (for example) in cheap coal fired generation on the local grid resulting in a low BPP price.

Other features of MEMR Reg 12 Grandfathering MEMR Reg 12 provides that for PPAs that have already been signed, the new pricing regulations will not apply, and the signed PPA pricing regime will remain in effect. Where PPAs have not been signed, but a developer has been designated by the government or PLN as the project developer through the applicable regulatory regimes (e.g., there is a process laid out in the mini-hydro regulations whereby the government designates a developer as a "hydro power plant developer" to enable that developer to proceed to the next step of signing a PPA with PLN), the pricing regime will follow this new regulation. For geothermal projects where a developer has won the auction for the geothermal concession (which necessarily under the existing regulatory regime involves bidding a tariff to the Government) but no PPA has yet been signed, then the tariff to be applied in the PPA will be the tariff bid by that developer to win the geothermal concession (and these new geothermal pricing arrangements will not apply). Interestingly, MEMR Reg 12 provides that, despite this grandfathering, PLN and developers can elect to follow new pricing arrangements (even where the PPAs have already been signed). Accordingly, this provision leaves open the possibility for projects that have locked in tariffs that are less attractive than those provided for in MEMR Reg 12 to seek PLN's agreement to adopt the MEMR Reg 12 pricing.

That said, one would expect that PLN would be unwilling to agree to a waiver of the grandfathering provisions where the net result would result in a higher tariff.

Conflicts with other regulations

Aside from MEMR Reg 12, there are a number of other regulations that govern the process of appointing developers for renewable energy projects, and the tariffs that apply to those projects. As is not uncommon with Indonesian regulations, MEMR Reg 12 provides that these existing regulations remain valid except to the extent they are inconsistent with MEMR Reg 12.

This adds further uncertainty to the regime generally, as it is not often easy to determine whether or not a particular provision conflicts with the existing regime. For hydropower projects, MEMR Reg 12 does make clear that the previous large hydro ceiling price specified in Minister of Energy and Mineral Resources Regulation No 3/2015 is revoked.

Determination of BPP It is not entirely clear from the regulation how often the local BPP numbers are to be updated.

The regulation provides that the references throughout the regulation to "local BPP" and the "average national BPP" are references to those local BPP and average national BPP numbers for the previous year, as determined by the minister based on the proposal of PLN.

However elsewhere in the regulation, PLN is required to notify the minister of the local BPP numbers on a quarterly basis.

More importantly, there is no reference made in the regulation as to whether the BPP numbers are Rupiah based, or US dollar equivalent. The BPP numbers that were published by the Government as part of its public launch of this new regulation were all provided in US dollar terms.

However, PLN financial reporting is in Rupiah, and to the extent PLN has previously published BPP numbers, these have all been in Rupiah. Absent any express regulatory requirement to the contrary, we would expect that the BPP numbers to be issued will be Rupiah denominated.

Accordingly, there is a mismatch with a number of the renewable feed in tariff regulations passed over the last couple of years, which all provide for US dollar tariffs (and therefore insulate the developers and lenders from movements in the US dollar/Rupiah exchange rate).

The reality for these renewable energy projects is that they are heavily dependent on foreign sourced equipment, and accordingly tariffs need to be either stated in US dollars or indexed to the US dollar to ensure any foreign exchange exposure is minimized.

If developers are now being asked to revert to a system whereby the tariffs must be stated in Rupiah (without any indexation to US dollars), this will certainly negatively impact the appetite of foreign investors to be involved in these projects. If, on the other hand, the government's intention is to allow PPA tariffs to be stated in US dollars (or fully indexed to US dollars), then the government needs to make a clear statement to that effect.

Interconnection costs MEMR Reg 12 provides that for hydropower, biomass, biogas and geothermal projects, PLN and the developer are able to agree on matters relating to the development of the transmission interconnection between the power plant and the PLN grid on a business-to-business basis (indicating that PLN may agree to build, or the developer may agree to build).

The regulation is silent as to transmission responsibility for wind, solar PV and municipal waste. The BPP figures published by PLN are generation costs which exclude transmission and distribution costs. Accordingly, where the regulation calls for tariff to be below (for example) 85% of the local BPP, it is not entirely clear whether the tariff is inclusive or exclusive of transmission costs.

For instance, assume local BPP in a certain area is US$0.10 and a developer is able to develop a hydropower plant in that area for US$0.084 (excluding transmission costs) or US$0.086 (including transmission costs). Which tariff is to be used to determine whether or not the developer can meet the requirement to implement the project at not more than 85% of the local BPP?

Escalation MEMR Reg 12 is silent on escalation. Other renewable type-specific regulations (e.g., regulations on mini-hydro, regulations on geothermal) have made clear whether or not escalation of the tariff (e.g., to keep up with inflationary increases over time) are permitted. However this regulation is silent.

Because, as mentioned above, the existing regulations remain in effect except to the extent they are inconsistent with MEMR Reg 12, this may be one area where the question of whether or not escalation is permitted is determined not by looking at MEMR Reg 12, but instead by referring to these other renewable type-specific regulations.

Small renewable projects are "must run" One of the criticisms of the existing regulatory framework around small scale renewable projects was that there was nothing clear in the regulations, nor in the model PPAs used by PLN for those projects, which made clear that PLN had an obligation to dispatch the projects if those projects were available to produce energy. MEMR Reg 12 now contains a very clear statement that all renewable energy projects with a capacity below 10MW are "must run" projects, meaning that PLN must dispatch those projects (in priority to other base load projects) if they are available to dispatch.

Whilst this is good news, it is not clear how this will flow through to existing PPAs. For these existing PPA, the PLN payment obligations are simply based on energy delivered across the meter, and there are generally no "deemed dispatch" provisions that would catch the "lost kWhs" arising from a situation where PLN has failed to comply with its legal obligations under a regulation (i.e., MEMR Reg 12) to dispatch the plant.

Timing for determining BPP Where MEMR Reg 12 refers to the tariff being based on a percentage of BPP, there are no explicit provisions stating whether or not the tariff under the eventual PPA that will be signed will "float" as BPP changes from year to year, or whether the tariff will be locked in for the full term of the PPA based on the BPP in effect as at the date of signing the PPA.

Whilst the regulation does lack this clarity, we would expect that PLN and the government will adopt the latter approach.

Ability to implement business to business projects with PLN For wind and solar PV projects, MEMR Reg 12 clearly provides that capacity will be allocated through a quota auction system. A question remains whether there is any flexibility in this regulation to allow a developer to promote projects to PLN on a business to business basis (i.e. without having to go through the auction process).

For solar PV projects, Minister of Energy and Mineral Resources Regulation No 19/2016 similarly required solar PV projects to be awarded through a quota allocation system (albeit on a "first-in first-served" basis, rather than a competitive auction). However, that regulation had an express exclusion which provided that where PLN and developers had entered into existing arrangements prior to the introduction of that regulation, then those existing arrangements could continue on a business to business basis (i.e., PLN could continue to negotiate a tariff and finalise and sign a PPA with those developers).

Accordingly, the logical interpretation of this requirement is that all future projects would need to go through the quota allocation system, and no business to business arrangements would be permitted. The wind projects that have been awarded prior to MEMR Reg 12 have all been awarded on a business to business basis, as there was no specific regulatory framework targeted at wind prescribing any particular procurement method by PLN.

Accordingly these wind projects defaulted back to the general exemption found in the electricity regulations which permits PLN to carry out direct appointment for renewable energy projects.

So the question remains – what flexibility is there under MEMR Reg 12 for PLN and developers to engage in business to business transactions?

We believe that with the issuing of MEMR Reg 12, the only way in which renewable projects falling under the scope of that regulation can be awarded by PLN is through the methods prescribed by MEMR Reg 12 (i.e., direct appointment using Reference Price or direct selection), and PLN is not permitted to sign up developers through some other method (e.g., direct appointment without using the Reference Price regime).

However, in our discussions with government officials, they indicated that PLN remains free to engage in business to business transactions, despite MEMR Reg 12. Standardization of PLN procurement documents and PPAs MEMR Reg 12 requires PLN to standardize both its procurement processes and the final form of PPA that renewable energy developers will need to sign.

Similar requirements for standardization have been prescribed in various regulations over the past few years, and it is fair to say that most of the work in this area is still "work in progress".

A form of standard geothermal PPA has been developed over recent years, and PLN has worked on a standard PPA for mini-hydro. However, inevitably both PLN and developers are tempted to suggest changes to these "standard forms" over time, and they quickly move from being standardized documents to "starting points for negotiation".

Additionally, a recent Ministry of Energy and Mineral Resources regulation have now prescribed certain PPA risk allocation concepts that PLN must follow for certain renewable energy projects. So even for those PPA documents that have essentially now evolved into "standard" templates, PLN will now be required to go back and revisit the terms of those PPAs to ensure that they meet with the requirements of the recently passed regulation. Hydropower direct appointment As hydropower projects are often very site specific, there is no practical ability for PLN to carry out competitive processes for the appointment of large scale hydropower developers. As a result, these hydropower projects have traditionally been carried out by PLN on a direct appointment basis. MEMR Reg 12 now provides that hydropower projects are implemented either through "Reference Price" or direct selection.

As mentioned above, our best interpretation of the "Reference Price" option of appointing developers is that it will involve a direct appointment process (i.e., no competitive process involved), and it is only when the tariffs fall outside the "Reference Price" arrangement that a competitive process will be required in the form of a direct selection.

That said, in our discussions with the government, they have indicated that the intent of the regulation is that even where a "Reference Price" is provided as an option for hydropower, the intent is to require a direct selection process to be carried out. In short, the government has indicated that in these situations, PLN will not be permitted to carry out a direct appointment for hydropower developers.

Again, we do not find any support for the government's position in the regulation as drafted. The regulation clearly provides for two bases of appointment for these projects:

Reference Price or direct selection. If the intent was that all projects must go through a direct selection process, then that would have been provided for expressly (and there would be no need to refer to the Reference Price).

Conclusion

Indonesia has adopted very ambitious renewable energy targets, with these ambitions being driven largely by Indonesia's Paris Agreement commitments on climate action.

Whilst sectors such as hydropower and geothermal have been around for a number of years, their potential remains very much underexploited.

For renewable technologies such as wind, solar, biogas, biomass and municipal waste, they are at the very early grass-roots stage of development in Indonesia.

There are real concerns that the tariff pressure that has now been imposed on these technologies is going to make a number of the projects either financially unviable, or marginal at best.

The intention appears clear that the government is telling developers to look at sites other than on Java, Sumatra and Bali, where more expensive renewable technologies can cost compete with expensive diesel plants. The challenge of course is that developing projects in these remote and underdeveloped locations throws up additional project risk – particularly in relation to the ability of often underdeveloped PLN grids in those locations to accept the intermittent renewable power generated. As with its 2008 geothermal tariff predecessor, the industry is likely to send very clear signals to the government as to whether they can make these new tariffs work.

If the clear message to the government is that these tariffs cannot work, it is likely the government will go back to the drawing board.

To the government's credit, it has been openly engaging with industry on these new regulations, holding a public launch event, and following that up with its "coffee morning" events where developers and other stakeholders can engage in a discussion with the government on these areas of concern and uncertainty.

Baker McKenzie is an active participant in this stakeholder engagement process, and as more clarity is provided by the government, we will provide further updates.

.jpg)