8 February, 2018

What is BEPS?

Base Erosion & Profit Shifting (BEPS) refers to tax planning strategies taken by multinational enterprises to exploit gaps and mismatches in tax rules worldwide, reducing tax payable by shifting their profits to jurisdictions with lower tax rates.

The BEPS project was initiated by the OECD and G20 countries in 2013. In October 2015, a comprehensive 15-point Action Plan was released in response to growing concerns about the inability of the international tax system to keep up with globalisation. The BEPS package sets out 15 actions along the key pillars of (i) improving coherence of corporate income taxation to reduce loopholes in the interaction of countries’ domestic tax laws, (ii) establishing substance requirements in international standards, and (iii) ensuring a transparent tax environment as well as certainty. It is expected that once implemented, measures recommended under the BEPS package will result in the taxation of profits where the economic activities that generate them take place and where value is created.

The OECD established the Inclusive Framework (IF) in January 2016 so that countries and jurisdictions can collaborate on the implementation of the BEPS package. At the IF meeting on 25 – 27 January 2017 in Paris, Malaysia announced its intention to join the IF. In March 2017, the OECD welcomed Malaysia officially as a BEPS Associate. As such, Malaysia now has a voice in the development of standard setting and BEPS implementation monitoring.

1. BEPS Action 1 – Addressing the Tax Challenges of the Digital Economy

Overview

In September 2013, the Task Force on the Digital Economy (TFDE), a subsidiary body of the Committee on Fiscal Affairs, was established with the objective of developing a report to identify issues raised by the digital economy and propose detailed options to address these concerns. The Action 1 Final Report contains the TFDE's conclusions regarding the broader tax challenges posed by the digital economy, and the recommended next steps.

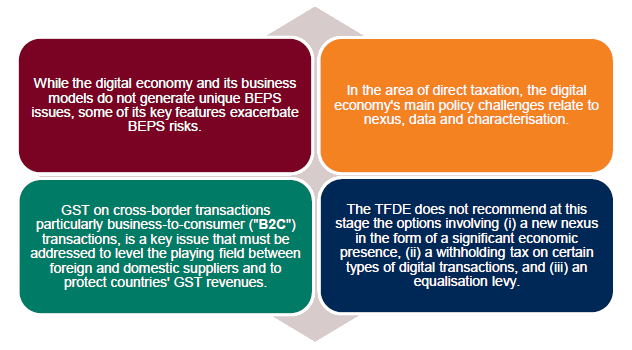

Some of the key conclusions reached in the Action 1 Final Report include:

Please click on the image to enlarge.

Recommendations in the Action 1 Final Report

A. Direct Tax

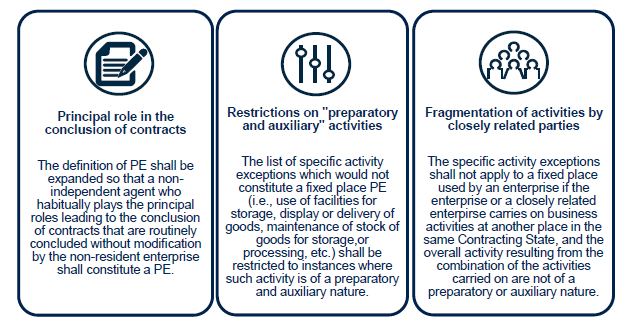

To address the BEPS risks exacerbated by the digital economy, it was agreed that changes should be made to the current permanent establishment (PE) standards:

Please click on the image to enlarge.

Separately, the current transfer pricing guidance will be revised in accordance with the recommendations under Actions 8 – 10 to clearly stipulate that legal ownership of intangibles alone does not entitle the owner to premium profits. Group companies performing key functions, contributing assets or assuming risks related to the development, enhancement, maintenance, protection and exploitation of intangibles should receive an appropriate return.

B. Indirect Tax

The Action 1 Final Report recognises that the main GST challenges in the digital economy relate to (i) imports of low value goods from online sales which are exempted from GST in many jurisdictions; and (ii) the complexity in enforcement of GST collection on the supplies of digital services and intangibles, particularly for cross-border B2C transactions.

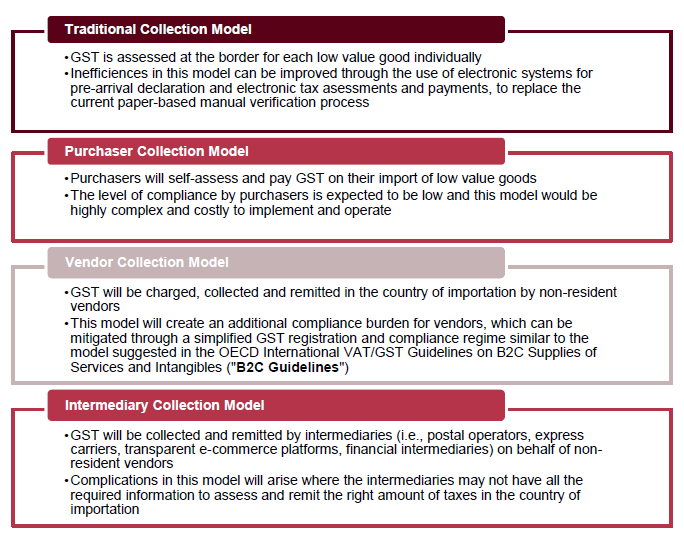

With respect to the collection of GST on low value goods, a Low Value Imports Report was prepared by the Working Party No. 9 of the OECD Committee on Fiscal Affairs to identify and assess the models for collecting GST on low value imports. The Low Value Imports Report focuses on the collection of GST on imports of low value goods. The Action 1 Final Report does not endorse any specific model as being the preferred model, but concludes that there are a range of possible approaches available for jurisdictions to consider. The four collection models considered are as follows:

Please click on the image to enlarge.

Further, the recommended approach in the B2C Guidelines for addressing the challenge of collecting GST on the cross-border sales of digital products to private consumers by non-resident suppliers is to grant the jurisdiction of the usual residence of the customers the right to levy GST on the supply of digital content. Therefore, non-resident suppliers would be required to register and account for GST in the jurisdiction of taxation. It is further recommended that jurisdictions consider establishing a simplified registration and compliance regime for non-resident suppliers to facilitate compliance. Importantly, the B2C Guidelines clarified that registration for GST purposes is independent from the determination of whether there is PE for income tax purposes.

C. Next Steps

These conclusions may evolve as the digital economy continues to develop. As such, continued work will be undertaken to monitor developments in the digital economy over time. In July 2017, the G20 requested that the TFDE deliver an interim report on the implications for taxation of digitalisation in April 2018. The final report reflecting the outcome of the continued work in relation to the digital economy is to be produced by 2020.

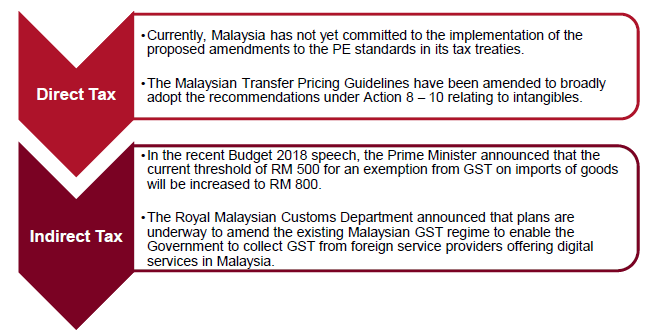

Malaysia – Response and Implementation

Whilst the recommendations under Action 1 are not mandatory for Malaysia as a BEPS Associate1, the Malaysian government has demonstrated a keen interest in the taxation issues affecting the digital economy. The Malaysian Inland Revenue Board (MIRB) has been tasked with monitoring the development of the digital economy and the taxation of digital businesses.

Please click on the image to enlarge.

The CEO of the MIRB has stated that Malaysia is waiting for further guidance and recommendations. Although the report on the outcome of the continued work in relation to the digital economy is due to be published by 2020, developing countries such as Malaysia have requested that this timeline be accelerated. Malaysia currently participates in the TFDE and is a member of the TFDE Bureau.

In recent tax audits and investigations, the MIRB has been examining PE issues and transfer pricing issues. This appears to be a signal that the MIRB will be taking a more vigilant stance. Given that there are ongoing developments in the taxation of the digital sector in Malaysia, it would be prudent for companies operating within this space to re-evaluate their current business models to address any potential direct tax concerns.

Additionally, the proposed amendments to introduce GST registration and collection requirements for non-resident suppliers will impose a compliance burden on non-resident businesses operating in Malaysia. It is hoped that the Malaysian government will implement the recommendations provided in the B2C Guidelines, as well as the recent report on "Mechanisms for the Effective Collection of VAT/GST When the Supplier is Not Located In the Jurisdiction of Taxation" published by the OECD in late October 2017.

1 BEPS Associates are required to commit to the implementation of four minimum standards under the BEPS Package, namely Action 5 (Countering Harmful Tax Practices), Action 6 (Preventing Treaty Abuse), Action 13 (Country-by-Country Reporting), and Action 14 (Enhancing Dispute Resolution Mechanisms)

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com