4 December, 2016

On 21 October 2016, the Prime Minister and Minister of Finance, YAB Dato’ Sri Mohd Najib Tun Haji Abdul Razak unveiled the Malaysian Budget for the year 2017 (Budget).

Following the Budget announcement, the Malaysian Finance Bill 2016 (Finance Bill) was tabled before the Lower House of Parliament on 25 October 2016, and has been passed by the Lower House on 23 November 2016. The Finance Bill is now pending debate and approval before the Upper House. The Finance Bill sets forth some of the proposed amendments announced in the Budget, as well as some further amendments to the Malaysian tax legislation which were not included in the Budget.

We have outlined below some of key amendments to the Malaysian Income Tax Act 1967 (ITA) that have been proposed in the Finance Bill:

I. Expansion of the Definition of "Royalties"

It is proposed that the definition of "royalty" under ITA be expanded to also specifically include, amongst others, any sums paid as consideration for, or derived from:

(a) the use of, or the right to use in respect any software or other like property or rights;

(b) the reception of, or the right to receive, visual images or sounds, or both, transmitted to the public by satellite, cable, fibre optic or other similar technology;

(c) the use of, or the right to use, some or all of the part of the radiofrequency spectrum specified in a relevant licence; and

(d) a total or partial forbearance in respect of the use of or the granting of the right to use, amongst others, copyrights, software, patents, tapes for radio or television broadcasting, know-how or information concerning technical, industrial, commercial or scientific knowledge, reception of visual images or sounds, and the use of radio frequency spectrum.

A preliminary review of the proposed amendment raises a number of issues, such as the inconsistency of this position with the Guidelines on Taxation of E-Commerce published by the Malaysian Inland Revenue Board (MIRB), which provides guidance that a payment for the purchase of a software product would not be regarded as royalty income.

Further, the term “software” has not been defined in the proposed amendments, and it remains to be seen whether the term would also include software-as-a-service (SaaS) products. Separately, based on a plain reading of the proposed language regarding the "reception of, or the right to receive, visual images or sounds or both", it is likely that payments for music / video streaming services would be caught by the amended royalty definition.

Based on the Finance Bill, the proposed amendment will be effective from the coming into operation of the Finance Act.

II. Amendments of Deemed Derivation Rules for Section 4A Income

At current time, Section 4A of the ITA (which includes "amounts paid in consideration of technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme”) would be subject to withholding tax under Section 109B of the

ITA, only if the income is deemed to be derived in Malaysia.

The derivation rules set out in Section 15A as currently drafted provides that Section 4A income shall be deemed to be derived from Malaysia if (i) responsibility for the payment lies with the government, state government, local authority or a person who is resident in Malaysia; or (ii) the payment is charged as an outgoing payment or expense in the accounts of a business carried on in Malaysia, provided that this section shall apply to the amount attributable to services which are performed in Malaysia.

However, the Finance Bill proposes to amend Section 15A of the ITA by deleting the clause which limits the deemed derivation provisions to only services which are performed in Malaysia. Based on the proposed amendment, service fees paid by a Malaysian resident to a non-resident would be deemed to be derived from Malaysia, even if the services are performed by the non-resident wholly outside Malaysia.

Accordingly, such service fees paid to non-residents would be subject to Malaysian withholding tax under Section 109B of the ITA, even though the services are performed outside Malaysia. The proposed amendment will be effective from the coming into operation of the Finance Act.

III. Implementation of the Base Erosion and Profit Shifting (BEPS) Initiatives

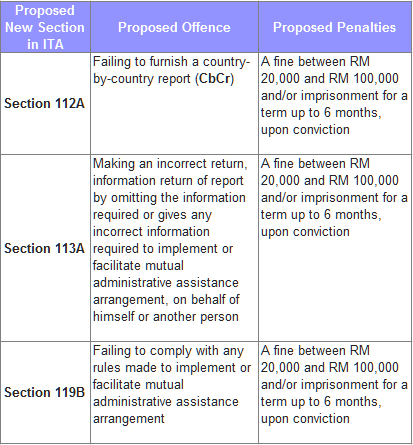

In conjunction with Malaysia's commitment in implementing the BEPS initiatives as well as the Automatic Exchange of Information for Tax Purposes (AEOI) and Common Reporting System (CRS), the Finance Bill has proposed the introduction of three new penalty provisions relating to non-compliance with country-by-country reporting, AEOI and CRS rules (which have yet to be put in place):

Please click on the image to enlarge.

The introduction of the new penalty provisions signifies that Malaysia will be introducing measures to implement the CbCr, AEOI and CRS obligations soon and development in this regard should be monitored closely.

IV. Removal / Limitation of Scope of Certain Types of Income Currently Exempted from Tax

Under the Finance Bill, it is proposed that the exemption for the following types of income will be removed:

(a) income derived by non-resident from trading in Malaysia through consignees in any kind of commodity produced outside Malaysia; and

(b) income derived from non-resident in respect of interest derived from Malaysia on an approved loan.

Further, there are proposals to amend the existing exemption on interest paid or credited to any company not resident in Malaysia in respect of securities issued by the Malaysian government or Islamic securities / debentures issued in Ringgit Malaysia approved by the Securities Commission (SC), such that the exemption will no longer apply to such interest paid or credited to a non-resident company in the same group of companies.

In addition, it is further proposed that the scope of the income tax exemption on interest paid or credited in respect of Islamic securities originating from Malaysia issued in a currency other than Ringgit Malaysia and approved by SC or the Labuan Financial Services Authority be limited, such that the exemption would not apply to interest paid or credited to:

(a) a company in the same group; or

(b) a bank licensed under the Financial Services Act 2013, an Islamic bank licensed under the Islamic Financial Services Act 2013 or a development financial institution under the Development Financial Institution Act 2002.

The proposed removal or limitation of the income tax exemptions will result in additional tax costs for certain financing structures which may need to be reconsidered.

For further information, please contact:

Yvonne Beh, Partner, Wong & Partners

yvonne.beh@wongpartners.com