Financial Services

Malaysia – Principles-Based Sustainable And Responsible Investment (“SRI”) Taxonomy For Malaysian Capital Market.

The Securities Commission Malaysia (“SC”) has released a Principles-based SRI Taxonomy for Malaysian Capital Market (“SRI Taxonomy”) on 12 December 2022. The SRI Taxonomy sets out the universal guiding principles for the classification of economic activities that qualify for sustainable investment.

The SRI Taxonomy also seeks to address concerns on the need to mitigate and manage the risks of greenwashing and to define sustainable investments.

In addition to the SRI Taxonomy, the SC also issued a public response paper in response to the feedback it received pursuant to the Public Consultation No. 1/2021 on Principlesbased SRI Taxonomy for Malaysian Capital Market that was issued on 17 December 2021.

9 th Meeting of Joint Committee on Climate Change (JC3) Meeting

Following the 9th meeting of JC3 on 2 December 2022:

- JC3 will publish a Data Catalogue and Accompanying Report, that is intended to serve as a source of reference on the avaiability and accessiblity of of climate and environmental data based on a priority list of financial sector use cases as well as recommendations to bridge data gaps.

- there were discussions on plans to launch several pilot programmes in 2023 to scale up green and sustainable finance.

- there were discussions on plans to launch several pilot programmes in 2023 to scale up green and sustainable finance.

- there were discussions on plans to launch several pilot programmes in 2023 to scale up green and sustainable finance.

- it will align the TCF Application Guide for Malaysian Financial Institutions with the International Sustainability Standards Board’s disclosure requirements upon its finalisation.

- JC3 will support the development of an ESG Disclosure Guide tailored to small and medium enterprises in Malaysia.

- JC3 will develop climate change curriculum for financial institutions which is intended to faciliate the development of structured training pathways for financial institutions to build technical capabilities across all levels in climaterelated topics and developments.

Revision to Guidelines on the Registration of Venture Capital and Private Equity Corporations and Management Corporations

The Securities Commission Malaysia revised its Guidelines on the Registration of Venture Capital and Private Equity Corporations and Management Corporations (the Guidelines) on 28 November 2022.

The revisions made to the Guidelines include:

- expansion on the type of investors eligible to participate in venture capital and private equity funds.

- a venture capital corporation (VCC), private equity corporation (PEC), venture capital management corporation (VCMC) or private equity corporation (PEMC) is now required to be registered with the Securities Commission Malaysia only where it is acting or offering to act as an investment manager or co-investment manager of a venture capital or private equity fund.

- provides guidance on the types of incidental activities which such registered entities may conduct

- streamlining the financial requirements whereby a registered corporation must now maintain at all times a minimum net asset of RM100,000.

Bank Negara Malaysia issues exposure draft on Capital Adequacy Framework (Basel III — Risk Weighted Assets) — Operational Risk

BNM has on 30 November 2022 issued an exposure draft on capital adequacy framework (Basel III — risk-weighted assets) for public feedback by 31 March 2023. This exposure draft sets out the proposed requirements and guidance on the calculation of the capital charge for operational risk under the Basel III capital adequacy framework, which is expected to come into effect in 2025.

Once in effect, these requirements will supersede Part C of the Capital Adequacy Framework (Basel II — Risk-Weighted Assets) and the Capital Adequacy Framework for Islamic Banks (Risk-Weighted Assets), both issued on 3 May 2019.

Bank Negara Malaysia issues policy document on climate risk management and scenario analysis

On 2 December 2022, Bank Negara Malaysia announced the issuance of its policy document on Climate Risk Management and Scenario Analysis (the “PD”).

The PD:

- came into effect on 30 November 2022, subject to the following transitional specifications:

- paragraphs 7 to 11 on governance, strategy, risk appetite and risk management which will come into effect on 31 December 2023;

- paragraphs 9 to 14 on scenario analysis, metrics and targets and disclosure which will come into effect on 31 December 2024.

- Notwithstanding the foregoing, the following paragraphs will come into effect on 31 December 2024:

- Strategy – paragraphs 9.2 and 9.4

- Risk appetite – paragraph 10.3

- Risk management – paragraphs 11.9(a) to (c).

- applies to entities licensed under the Financial Services Act 2013 and Islamic Financial Services Act 2013, the financial holding companies of the foregoing mentioned entities, development financial institutions prescribed under the Development Financial Institutions Act 2002.

- sets out the principles and specific requirements on the management of climate related risks by financial institutions with the aim to enhance the resilience of the financial sector against climate-related risks.

Bank Negara Malaysia has issues policy document on financial reporting for development financial institutions

Bank Negara Malaysia has issued a policy document on financial reporting which is applicable to development financial institutions prescribed under the Development Financial Institutions Act 2002.

The policy document:

- supersedes the Guidelines on Financial Reporting for Development Financial Institutions issued on 28 July 2020.

- clarifies and sets minimum expectations for the application of the Malaysian Financial Reporting Standards to a development financial institution.

- sets out the information to be disclosed in the financial statements including those arising from the Shariah contracts applied in Islamic banking transactions, the application requirements for approval of a dividend payment and the requirements on submission and publication of the financial statements.

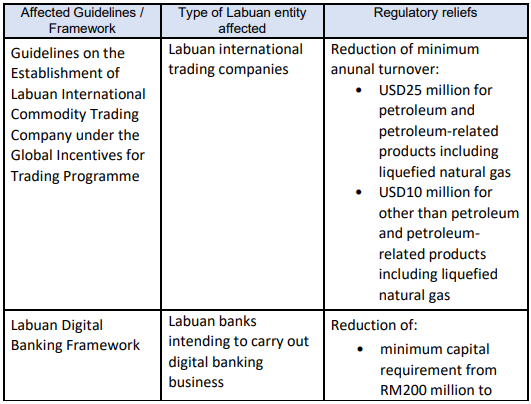

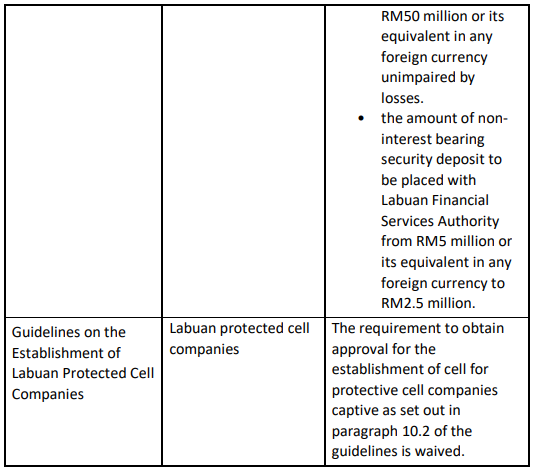

Relaxation of Regulatory and Operational Requirements for Labuan International Trading Companies, Labuan Digital Banks and Labuan Protected Cell Companies

On 28 November 2022, Labuan Financial Services Authority issued a circular on the relaxation of regulatory and operational requirements for Labuan international trading companies, Labuan digital banks and Labuan protected cell companies.

Such regulatory relaxation is extended until 31 December 2023. The table below sets out the affected guidelines/framework and type of reliefs offered by the Labuan Financial Services Authority:

Labuan Financial Services Authority issues Guidelines on Technology Management

The Labuan Financial Services Authority (“LFSA”) has on 14 December 2022 issued a Guidelines on Technology Management (“Guidelines”) which will come into effect on 1 January 2024. The Guidelines provides the minimum requirements to be adhered by financial intermediaries that undertake digital financial services (“DFS”) in Labuan International Business and Financial Centre (“DFI”).

The Guidelines is applicable to any DFI licensed and approved by the LFSA as follows: Labuan money-broking business and Islamic money-broking business licensed under Part VI of the Labuan Financial Services and Securities Act 2010 (“LFSSA”) and Part VI of the Labuan Islamic Financial Services and Securities Act 2010 (“LIFSSA”), respectively;

- Labuan fund managers licensed under Part III of the LFSSA and Part IV of the LIFSSA;

- Labuan securities licensees and Islamic securities licensees licensed under Part IV of the LFSSA and Part V of the LIFSSA, respectively;

- Labuan credit token business and Islamic credit token business licensed under Part VI of the LFSSA and Part VI of the LIFSSA, respectively;

- Labuan exchanges established under Part IX of the LFSSA; and

- Labuan payment system established under Part XI of the LFSSA.

The application and observance of the principles specified under the Guidelines is to be achieved by a DFI through the minimum requirements and to be complemented by the recommended best practices:

minimum requirements must be complied with by all DFIs. For completeness, these applications may refer to relevant regulatory requirements that have been issued by Labuan FSA as set out in Appendix I of the Guidelines; and

Amendment to the Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework

The Securities Commission Malaysia (“SC”) has revised the Guidelines on Unlisted Capital Market Products under the Lodge and Launch Framework (“LOLA Guidelines”) with effect from 28 November 2022. The LOLA Guidelines was revised to reflect changes consequent upon issuance of Guidelines on Islamic Capital Market Products and Services (“ICMPS Guidelines”). The key amendments relate to the removal of the relevant Shariah requirements as these are now provided under the ICMPS Guidelines.

Some of the key amendments to the revised LOLA Guidelines are as follows:

- Deleted definitions on “Islamic Structured Product”, “SAC”, “sukuk bai’ bithaman ajil”, “sukuk ijarah”, “sukuk istisna”, “sukuk mudharabah”, “sukuk murabahah”, “sukuk musharakah”, and “sukuk wakalah bi alistithmar” pursuant to incorporation into ICMPS Guidelines.

- Inserted a new definition of “Shariah Adviser”.

- Deleted Section C (Additional Requirements for Shariah-Compliant Unlisted Capital Market Products under the Lodge and Launch Framework) pursuant to incorporation into the ICMPS Guidelines.