25 July, 2018

On 16 July 2018, the Minister of Finance announced that SST will be introduced with effect from 1 September 2018. Following the announcement, the Royal Malaysian Customs Department ("RMCD") has published the following details1 on the implementation framework for the SST regime on 19 July 2018:

(a) Proposed Sales Tax Implementation Model;

(b) Frequently Asked Questions (FAQ) – Sales Tax 2018; (c) Proposed Service Tax Implementation Model; and

(d) Frequently Asked Questions (FAQ) – Service Tax 2018,

(collectively referred to as "RMCD Guidance").

This alert provides a general overview of the scope of the proposed SST regime, including details on exempted supplies and registration thresholds, as set out in the RMCD Guidance.

Kindly note that the final SST framework is subject to the legislation that will be tabled before Parliament and published in the Federal Gazette.

Key Features of the SST Regime

Proposed Sales Tax Framework

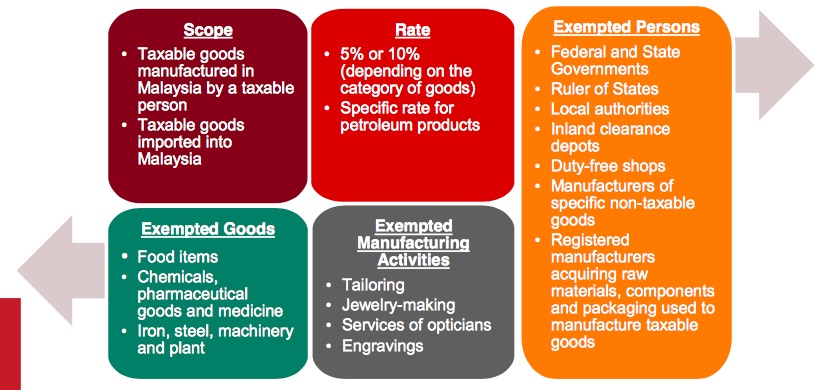

The key features of the proposed sales tax regime are as follows:

Please click on the image to enlarge.

Based on the RMCD Guidance, it is noted that the previous sales tax exemption process (i.e., applications through the Forms CJ5, CJ5A and CJ5B) for raw materials and components acquired by licensed manufacturers will be replaced with a general exemption under the proposed Sales Tax (Persons Exempted From Sales Tax) Order 2018. This change will likely alleviate the historical compliance burdens faced by manufacturers relating to the filing of the exemption application forms, but could result in more RMCD audits to ensure that registered manufacturers have properly utilized the general exemption.

It would also be of interest to note whether a sales tax exemption for low-value goods (not exceeding RM 500) imported into Malaysia will be granted, in line with the import duty exemption granted under the Customs Duties Order 2017.

Proposed Service Tax Framework

The proposed service tax will be chargeable on taxable services made in the course or furtherance of any business by a taxable person in Malaysia. The proposed service tax rate shall be 6%, save for the rate for credit/charge cards which shall be a specific rate of RM 25 for each card.

The scope of taxable services includes the following:

|

TAXABLE SERVICES |

|||

|

|

||

|

Forwarding and courier services |

|

||

|

NON-TAXABLE SERVICES

|

|||

|

Imported Services |

Exported Services |

||

Based on the RMCD Guidance, imported services and exported services will not be subject to the proposed service tax. The exact scope and definition of "imported services" in the proposed Service Tax Act 2018 will be crucial, to determine whether non-resident service providers providing services to Malaysian customers will be impacted by the SST regime. Likewise, the scope of exported services will be important to determine whether the proposed service tax will increase of the cost of services acquired by non-resident customers from Malaysian suppliers.

Registration

Businesses will be required to register for the proposed sales tax or service tax if the value of taxable goods or taxable services exceeds RM 500,000 within a 12- month period. This is in contrast to the previous SST regime, whereby the threshold for sales tax was RM 100,000 and the thresholds for service tax varied between RM 0 to RM 300,000 depending on the category of taxable services and taxable persons.

Registrations will be processed online on the RMCD MySST system. Existing GST-registered businesses that are liable to be registered under the SST framework will be automatically registered under the MySST system.

There is also a voluntary registration regime available under the SST framework, for businesses which do not meet the annual turnover thresholds. There is no group registration under the new SST regime.

Filing and Invoicing Requirements

The filing of the sales tax and service tax returns can be made either manually or through the online MySST portal. The returns are required to be filed on a bi- monthly basis, with the first returns due by 30 November 2018 for the taxable period of September – October 2018.

Registered manufacturers are required to issues invoices which contain the relevant prescribed particulars. At present, the prescribed particulars that are required to be contained in the invoices were not set out in the RMCD Guidance.

Designated Areas and Special Areas

Designated areas (i.e., Labuan, Langkawi and Tioman) and special areas (i.e., free zones, licensed warehouses, licensed manufacturing warehouses and the joint development area) are treated as places outside of Malaysia under the proposed sales tax framework. The RMCD Guidance provides further clarification on the proposed sales tax treatment for manufacturing activities within the designated areas and special areas, as well as the removal of goods between these areas and the principal customs area.

In contrast, designated areas and special areas are not deemed as places outside Malaysia for service tax purposes. Notwithstanding that, the RMCD Guidance indicates that services provided within / between designated areas and special areas will not be subject to the proposed service tax, unless specifically prescribed to be taxable. The RMCD Guidance also provides further clarification on the proposed service tax treatment between the special areas / designated areas and the principal customs area.

Transitional Rules

Final GST Returns

Based on the RMCD Guidance, it is noted that the final GST returns should be filed within 120 days from the date on which the Goods and Services Tax Act 2014 is repealed (which is anticipated to be 1 September 2018). Businesses should ensure that all input tax claims are included in the final GST return.

The RMCD Guidance indicates that GST audits will be conducted from 1 September 2018 for the closure of GST files. Businesses are therefore advised to carry out a GST review or health check to determine any potential non- compliance or audit issues, in advance of the RMCD audits.

Supplies Spanning 1 September 2018

For supplies spanning the proposed effective SST date of 1 September 2018, it appears from the RMCD Guidance that SST will be applied for goods made available and services rendered from 1 September 2018 onwards, regardless of the timing of the payment or the issuance of the invoices.

In instances where prepayments or advance billing arrangements have been effected, revisions to the invoices may be required to take into account these transitional provisions. Businesses may also need to consider the use of separate GST invoices and SST invoices for supplies spanning the effective date, given that there may be different particulars which are required to be set out in the invoices depending on which tax is applicable.

Further, businesses should also carry out a legal review of all on-going contracts with vendors and customers, to determine the implications of the SST on the purchase prices.

Ongoing contracts with existing indirect tax clauses may impact the ability to charge SST and pass on the SST burden to customers.

What should Businesses Do?

Given the very short timeframe until 1 September 2018, businesses should immediately start preparing for SST implementation. Amongst the first steps includes ascertaining whether SST would be applicable to their business operations. Price adjustments may need to be made with the introduction of SST and this should be done carefully to ensure that anti-profiteering laws are adhered to. It is expected that anti-profiteering enforcement will increase with the implementation of SST, as the public will be more vigilant in relation to prices of goods and services.

There may be impact to supply chain compliance and structuring moving forward especially for companies located in designated areas and special areas. Legal

advice should be sought to ensure that the existing supply chain structure is efficient and that the appropriate SST treatment is applied.

Contracts that will be signed will need to be considered and drafted carefully, to ensure that issues relating to the transition from GST to SST are adequately addressed and that prices take into account the change from GST to SST.

Training for employees will also be key to ensure that the SST is implemented correctly in the company's systems and also in pricing decisions to be made.

1 The publications can be obtained from the RMCD website at www.gst.customs.gov.my.

For further information, please contact:

Adeline Wong, Partner, Wong & Partners

adeline.wong@wongpartners.com