Malaysia – Stamp Duty Redefined: Key Changes And Implications Under The Finance Act 2024.

Introduction

Stamp duty has long been the quiet backdrop of Malaysia’s tax system, often overlooked unless when property transactions occurred, or disputes arose in court. However, the Finance Act 2024 (“Finance Act”) marks a significant turning point. The Inland Revenue Board (“IRB”) is poised to enforce stricter compliance measures, introducing a self-assessment regime that places taxpayers at the centre of a more transparent and demanding system.

Background and the Reason for Amendment

It is pertinent to note that stamp duty is levied on all instruments, including handwritten, printed, or electronic documents that meet the definitions under the Stamp Act 1949 (“Stamp Act”).[1] The liability for duty arises when an instrument falls under the First Schedule of the Act.[2] In simpler terms, these instruments can include agreements, contracts, deeds, licenses, and other written documents specified by law. The purpose of stamp duty is to authenticate and formalize these documents, ensuring their legal validity. Failing to pay the stamp duty or to stamp documents within the specified timeframe can lead to legal repercussions, including penalties or the document being deemed invalid.

On 4 December 2024, a bill to amend the Stamp Act 1949 was tabled for its second reading in the Dewan Rakyat (House of Representatives) of the Malaysian Parliament.[3] This initiative aims to modernise the administrative framework, streamline the stamping process through self-assessment, and enhance efficiency and compliance among taxpayers.[4] The amendment also aligns with the broader adoption of technological and digital solutions, facilitating a transition towards more effective management and administration of the tax collection system.[5] Acknowledging the importance of this bill to the ever evolving taxation system in Malaysia, the Dewan Rakyat passed the bill after its second reading and the bill had been gazetted on 31 December 2024 and came into force on 1 January 2025 as the Finance Act 2024 [Act 862].

Key Changes Introduced by the Finance Act 2024

(i) Introduction of the Self-Assessment Regime

A self-assessment system for stamp duty will be introduced, requiring taxpayers to independently evaluate the stamp duty payable on their instruments. Under this regime, taxpayers will be obligated to electronically submit the relevant returns and instruments, as well as remit payment for the assessed duty in accordance with the deemed assessment. For the avoidance of doubt, Section 2 of the Stamp Act defines ‘instrument’ as “every written document and a written document includes any handwriting, typewriting, printing, electronic record or transmission which is in an electronically readable form.”

Before and after amendments from the Finance Act

Prior to the amendments from the Finance Act, the stamp duty operates under an official assessment system and taxpayers are required to submit their instruments to the IRB for evaluation of the applicable stamp duty. Following the issuance of a Notice of Assessment by the IRB, taxpayers proceed to make payments via the Stamp Assessment and Payment System.

However, under the current self-assessment stamp duty system (“STSDS”) regime, individuals will be required to submit a return in the prescribed format, along with an executed instrument subject to stamp duty, through an electronic medium. The return must specify the description of the instrument, the amount of duty chargeable, and any other particulars as may be required by the Collector.

Upon submission of the return and the accompanying instrument, the Collector will be deemed to have assessed the duty payable based on the information provided. The duty shall become due and payable on the deemed date of assessment. Taxpayers may apply for relief in cases of overpayment by submitting a written application to the Collector within twenty-four (24) months of filing the return.

In other words, under the self-assessment regime, the burden of determining the correct duty will be entirely on the taxpayer and Section 36CA of the Stamp Act empowers the Collector to raise additional assessments for fraud, wilful default, or negligence in relation to the determination of the correct duty effective January 1, 2026.[6] The Collector may issue an assessment or additional assessment where insufficient duty has been paid, within the same year or up to five (5) years after the date the duty was paid or became payable. This reassessment will be based on the Collector’s best judgment of the correct amount of duty ought to be levied.

In cases involving fraud, wilful default, or negligence, the Collector may issue an assessment without time limitation. This provision seeks to recover any loss of duty caused by misconduct or negligence.

The new Section 36CA of the Stamp Act provides as follows:

36CA. Assessment and additional assessment in certain cases[7]

(1) The Collector, where it appears to him that no or no sufficient assessment has been made on an instrument chargeable to duty, may in that year or within five years after the date the duty is paid or would have been paid make an assessment or additional assessment, as the case may be, in respect of that instrument in the amount or additional amount of duty payable or in the additional amount of duty in which, according to the best of the Collector’s judgment, the assessment with respect to that instrument ought to have been made.

(2) The Collector, where it appears to him that-

(a) any form of fraud or wilful default has been committed by or on behalf of any person; or

(b) any person has been negligent,

in connection with or in relation to duty, may at any time make an assessment in respect of that instrument for the purpose of making good any loss of duty attributable to the fraud, wilful default or negligence in question.

Moreover, the newly drafted Section 36CB of the Stamp Act stipulates that, regardless of other provisions in the Act, the minimum duty chargeable on any instrument shall be no less than Ringgit Malaysia (RM10.00) only, excluding cheques and contract notes and it has been provided as follows:

36CB. Minimum amount of duty

Notwithstanding any other provision of this Act, an Amount of ten ringgit shall be imposed as duty for each instrument where the duty is less than ten ringgit except for cheque and contract note.

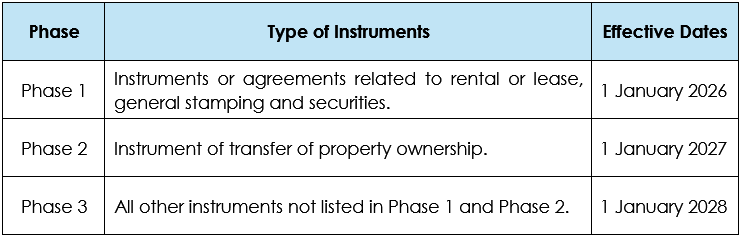

The Self-Assessment System is set to be introduced in three (3) phases:

In a nutshell, taxpayers will now be fully responsible for independently assessing and determining the stamp duty payable on chargeable instruments. If it is incorrect, there will be additional duties and penalties that can range up to 100% of the additional duty. This change minimises dependence on the IRB for initial assessments and simplifies the stamping process.

(ii) Mandatory Stamping for All Instruments

Stamp duties are imposed on instruments and not transactions. An instrument is defined as any written document and in general, stamp duty is levied on legal, commercial and financial instruments. Examples include affidavits, statutory declarations or declarations in writing, lease agreements, deeds, surrenders of charge, transfers, and trusts. (Refer to the First Schedule of the Stamp Act for the complete list.)

Under the revised framework, all dutiable instruments must now be stamped, regardless of the duty amount. In other words, it is pertinent for taxpayers to note that all instruments under the Stamp Act will have to be stamped, and this will include intercompany transactions such as provision of services and financing, sale of business, sale of goods, etc. unless it is specifically exempted by the Act. This measure addresses gaps that may have previously excluded certain transactions, ensuring comprehensive accountability for all chargeable instruments. Notably, the First Schedule has been amended through the Finance Act to provide greater clarity.[8]

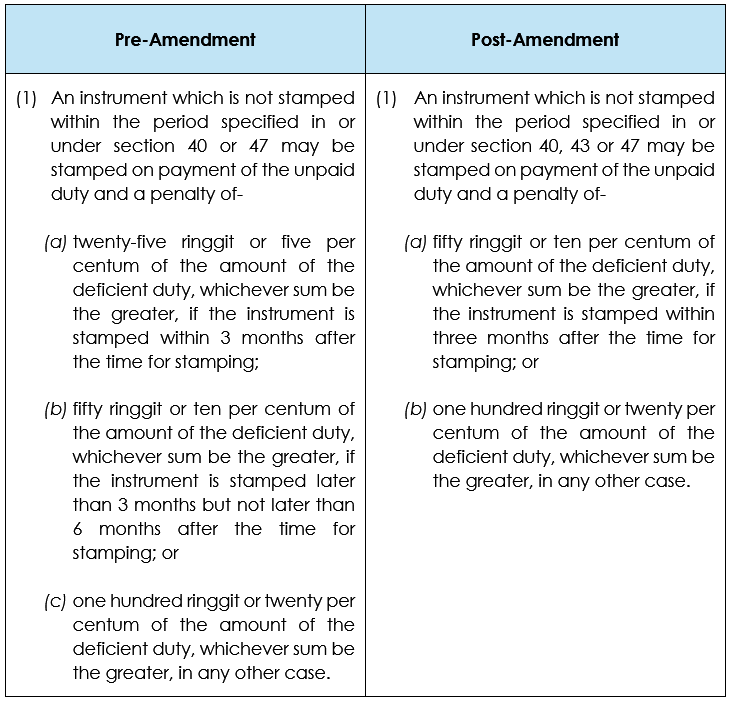

(iii) Penalty for Late Stamping

(iv) Broadened IRB Audit Powers

From 2026 onwards, IRB will have the authority to audit agreements up to five years after the duty is paid or would have been paid.

Taxpayer Liabilities and Legal Safeguards

It is worth noting that countries such as Ireland, Singapore, the United Kingdom, and Australia have long implemented the self-assessment system, providing a proven framework that Malaysian taxpayers can rely on.[9]

The Government, through the IRB, will enhance communication through various mediums, including publishing user guides and educational videos. Additionally, guidelines will be published to clarify the stamping process under the new system.[10]

Subsequently, the IRB will review any mistakes thoroughly and will not impose penalties arbitrarily. In fact, the Government is prepared to consider a transitional period for the imposition of penalties, with discretion granted to the Director General of Inland Revenue.[11]

Conclusion

The Finance Act 2024 represents a pivotal moment in Malaysia’s tax evolution, aiming to modernise stamp duty compliance while enhancing taxpayer accountability by the imposition self-assessment system which makes the payment of stamp duty mandatory. Stamp duty is no longer something that can be ignored as the repercussions of non-compliance can be severe and expensive.

As Malaysia transitions to this enhanced stamp duty regime, the balance between taxpayer empowerment and regulatory oversight will play a key role in determining the system’s success. Taxpayers who prepare early are well-positioned not only to comply but also to thrive in this evolving environment.

For further information, please contact:

Alfred Tan Hsiong Vel, Azmi & Associates

alfred.tan@azmilaw.com

- Section 2, section 4, and section 4A of the Stamp Act 1949 (as at 1 January 2024).

- First Schedule of the Stamp Act 1949 (as at 1 January 2024).

- See page 43 of the Parliament’s Hansard (Bill. 64, 4.12.2024) (“Hansard”).

- See page 84 of the Hansard.

- See page 107 of the Hansard.

- Finance Bill 2024.

- Ibid, section 25.

- (n 8), Section 27.

- See page 108 of the Hansard.

- Ibid.

- See page 107 and 108 of the Hansard.