New Developments In The EU’s Mandatory Reporting And Due Diligence Regimes On Human Rights, The Environment And Good Governance.

Article providing an overview of recent developments affecting the EU’s ESG reporting and due diligence regimes, their impact on companies and the EU’s trading partners. This article is an update on an article on the EU’s ESG legislative framework published on 13 August 2021: https://www.azmilaw.com/insights/new-eu-mandatory-due-diligence-regime-on-human-rights-the-environment-and-good-governance/

On 8 November 2024, three days after the election of Donald Trump in the US, the President of the European Commission gave a press conference urging the EU to regain competitiveness and reduce red tape[1]. This was largely inspired by M. Draghi’s report on EU competitiveness a couple of months earlier. In her speech, Ms von der Leyen repeated her call for a new Clean Industrial Deal to rebalance the goal of decarbonisation with competitiveness, which means that the EU is preparing to revisit its ESG legislation[2]. In practice, it is now expected that the Corporate Sustainability Reporting Directive (CSRD) and the Corporate Sustainability Due Diligence Directive (CS3D)[3] will be amended after barely a couple of years on the statute books.[4]

Green Deal and Competitiveness

Undeniably, this is a welcome change of stance for Europe and it carries the hope of much-needed mitigation to the drastic goals of the European Green Deal. But this is also a change that throws many companies and trading partners of the EU into the unknown.

As we write, in-scope companies[5] have already spent considerable time and resources to ready themselves to comply with the CSRD’s reporting regime for their 2025 annual reports[6] and it is unlikely to the EU legislative process will bring any clarity on the reforms in time for them: it will take years to take shape. Although the more recent CS3D’s due diligence, mitigation and sanction regime has a longer timeline of implementation[7], many in-scope companies[8] have already initiated the transformations which it requires, internally as well as within their upstream and downstream chains.

Beyond Europe, many trading partners have also embarked on regulatory reforms to ‘green’ their national frameworks with the EU’s ESG regulations in mind. This is the case of Malaysia among others, where last September the Securities Commission published its National Sustainability Reporting Framework (NSRF) for sustainability reporting by Malaysian listed companies and non-listed in-scope companies[9], starting from 2025. Although the NSRF and CSRD regimes draw their source from different standards[10], it is undeniable that national efforts are consented with a view to permit more fluidity with EU businesses.

The Burden of a Late Shift

We see here the EU acting as recklessly in seeking to alleviate the much-contested regulatory burden that it has imposed as in the past it did in imposing its unilateral vision of human rights, environmental and ethical goals. For many companies in the EU and worldwide, relief will come too late as they will have lost valuable business opportunities to competition. For many directors whose responsibility is at stake, the uncertainty is a source of grave concern. And for many non-EU countries, this is an unprecedented economic and diplomatic about-turn.

In January, the new EU Commission unveiled its Competitiveness Compass which builds on the Draghi report mentioned earlier. For ESG, it points to simplification of reporting and due diligence and greater proportionality of regulation to spare the lower end of in-scope companies from its burden. In a few weeks, the European Commission is expected to publish an Omnibus Simplification Package which will affect the CSRD and CS3D (and the EU taxonomy). It is currently not clear what changes will be proposed.

To Recap

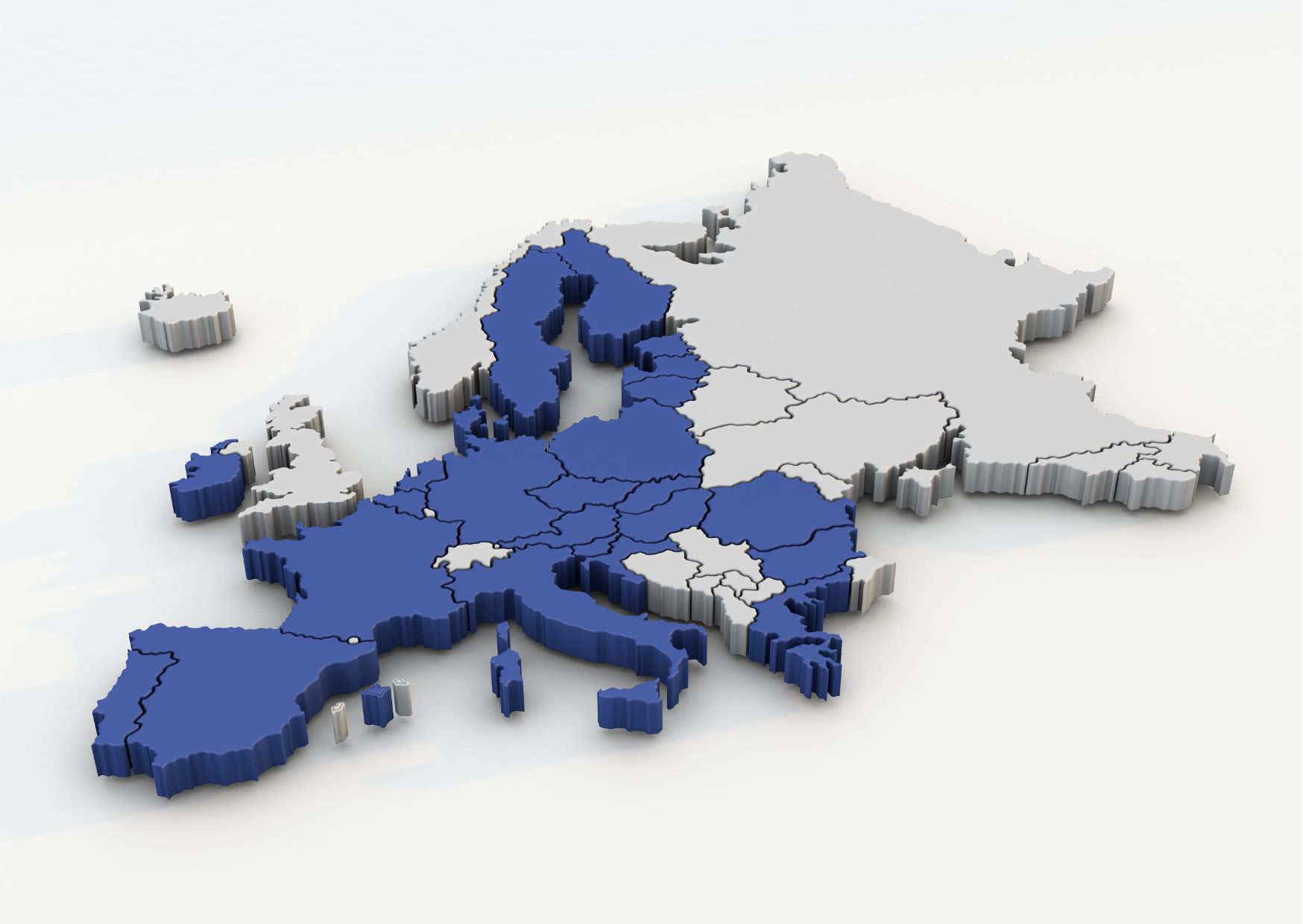

The CSRD[11] created a reporting regime which requires in-scope companies to include extensive ESG disclosures on virtually all of their activities (their impact on, as well as how they are impacted by, sustainability factors) in their annual reports. The CS3D requires in-scope companies to monitor, change (to avoid penalties) and report the ESG impact of their operations as well as those of their business partners, both upstream and downstream, in the EU and globally. The EU taxonomy is a classification system that defines criteria for economic activities compliant with the EU’s climate and other environmental goals. As such, the combined effects of CSRD, CS3D and EU Taxonomy impact global trade and the trading partners of EU companies everywhere.

If you would like to discuss how EU’s ESG compliance might apply to your business, please contact Pierre Brochet.

For further information, please contact:

Pierre Brochet, Azmi & Associates

pierre.brochet@azmilaw.com

- Other priorities: bridging the innovation gap with the US and China and reducing dependencies.

- Environmental, Social and Governance.

- And the EU Taxonomy Regulation.

- CSRD Directive 2022/2464 of 14 December 2022 came into force on 5 January 2023; CS3D Directive 2024/1760 of 13 June 2024 came into force on 25 July 2024; Taxonomy Regulation 2020/852 of 18 June 2020 came into force on 12 July 2020.

- It is estimated that the CSRD affects approximately 50,000 companies: initially, those satisfying at least two of the following three criteria: more than 500 employees, net turnover of more than €40 million and assets of more than €20 million.

- For 2024 financial year.

- From 2027 to 2029.

- It is estimated that the CS3D affects approximately 5,500 EU and non-EU companies: primarily those with more than 1,000 employees and a turnover of more than €450 million, but it extends beyond these as it impacts suppliers of in-scope companies.

- Companies with turnover of more than RM2 billion (approx. €430 million).

- The International Sustainability Standards Board (ISSB) for the NSRF, the European Sustainability Reporting Standards for the CSRD.

- Replacing and expanding on the Non-financial Reporting Directive (NFRD) 2014/95.